95757 Local Sales Tax Rate

95757 Local Sales Tax Rate - The 95757, elk grove, california, general sales tax rate is 8.75%. The current sales tax rate in elk grove, ca is 7.75%. The combined rate used in this calculator (8.75%) is the result of the california. An alternative sales tax rate of. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: The minimum combined 2025 sales tax rate for 95757, california is 8.75%. The current sales tax rate in 95757, ca is 8.75%. The december 2020 total local sales tax rate was also 7.750%. Click for sales tax rates, elk grove sales tax calculator, and printable sales tax table from. Click for sales tax rates, 95757 sales tax calculator, and printable sales tax table from sales.

The current total local sales tax rate in elk grove, ca is 7.750%. The 95757, elk grove, california, general sales tax rate is 8.75%. The combined rate used in this calculator (8.75%) is the result of the california. Elk grove's sales tax rates can differ depending on your zip code and district, reflecting the specific needs and funding requirements of each area. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: Understanding elk grove's combined sales. The current sales tax rate in 95757, ca is 8.75%. The december 2020 total local sales tax rate was also 7.750%. Click for sales tax rates, 95757 sales tax calculator, and printable sales tax table from sales. In elk grove the total sales tax rate, including county and city taxes, is consistently 8.75% throughout the city.

The current sales tax rate in 95757, ca is 8.75%. The current sales tax rate in elk grove, ca is 7.75%. The december 2020 total local sales tax rate was also 7.750%. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: In elk grove the total sales tax rate, including county and city taxes, is consistently 8.75% throughout the city. The minimum combined 2025 sales tax rate for 95757, california is 8.75%. The 95757, elk grove, california, general sales tax rate is 8.75%. This is the total of state, county, and city sales tax rates. Click for sales tax rates, 95757 sales tax calculator, and printable sales tax table from sales. Click for sales tax rates, elk grove sales tax calculator, and printable sales tax table from.

Utah Sales Tax Rate 2024 Salli Consuela

The current total local sales tax rate in elk grove, ca is 7.750%. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: Understanding elk grove's combined sales. This is the total of state, county, and city sales tax rates. Elk grove's sales tax rates can differ depending on your zip code and district,.

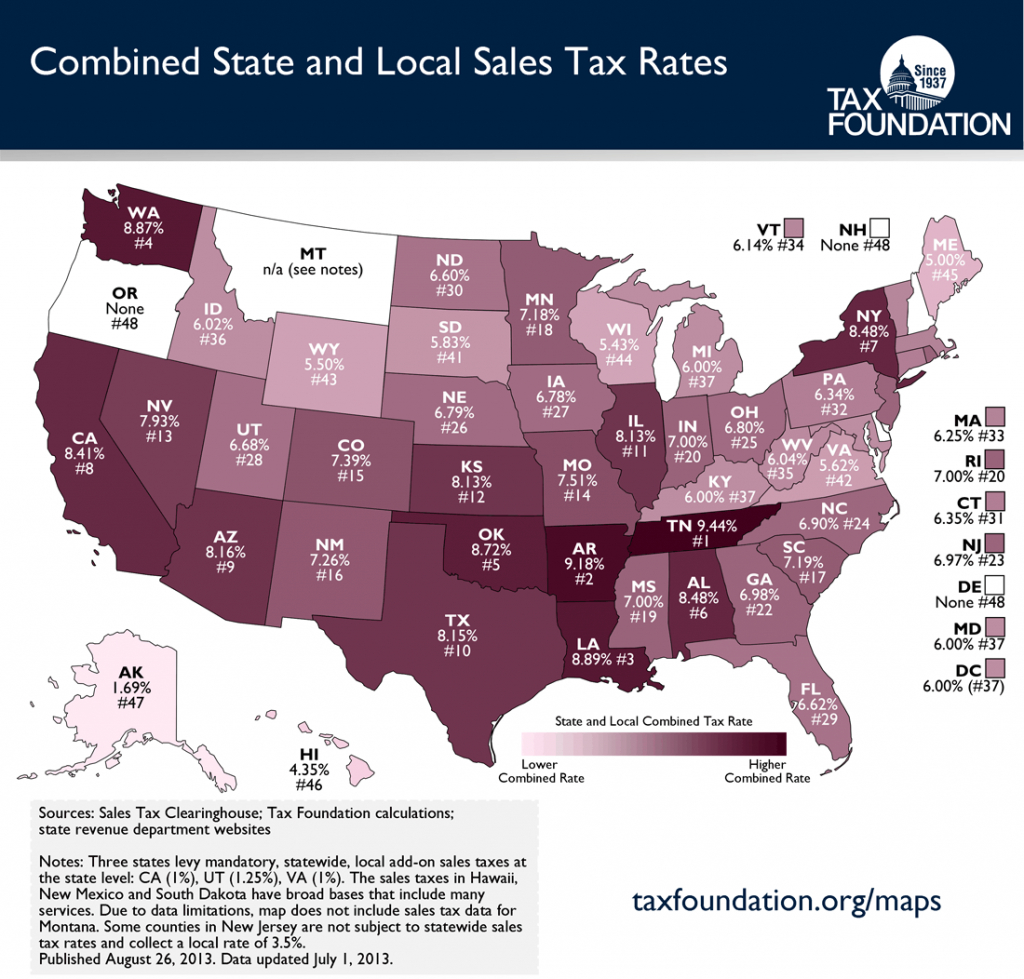

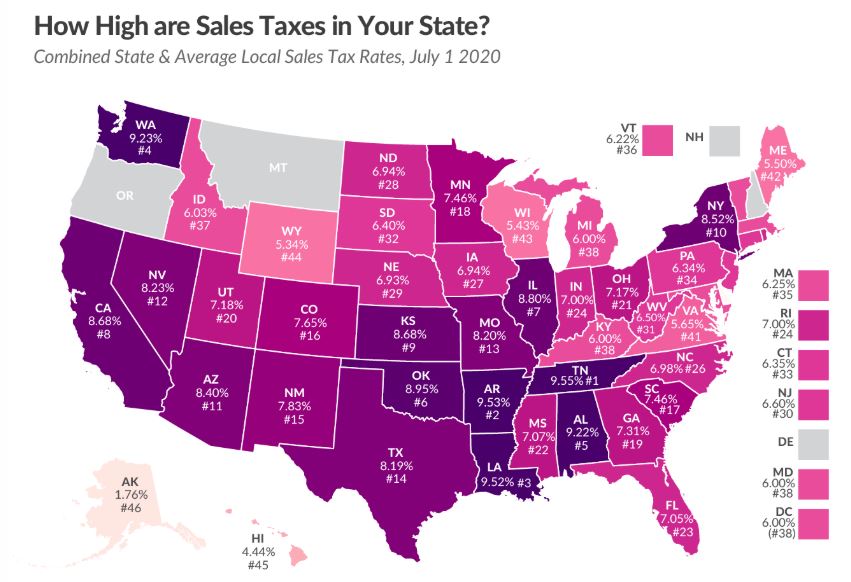

Combined State and Average Local Sales Tax Rates Tax Foundation

Understanding elk grove's combined sales. The current total local sales tax rate in elk grove, ca is 7.750%. Click for sales tax rates, elk grove sales tax calculator, and printable sales tax table from. Elk grove's sales tax rates can differ depending on your zip code and district, reflecting the specific needs and funding requirements of each area. The current.

Record Taxable Sales with GST

This is the total of state, county, and city sales tax rates. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: The current total local sales tax rate in elk grove, ca is 7.750%. The combined rate used in this calculator (8.75%) is the result of the california. The december 2020 total local.

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

The current total local sales tax rate in elk grove, ca is 7.750%. The december 2020 total local sales tax rate was also 7.750%. Elk grove's sales tax rates can differ depending on your zip code and district, reflecting the specific needs and funding requirements of each area. An alternative sales tax rate of. The current sales tax rate in.

Nc State Sales Tax Rate 2024 Caryn Cthrine

Understanding elk grove's combined sales. The combined rate used in this calculator (8.75%) is the result of the california. The december 2020 total local sales tax rate was also 7.750%. The minimum combined 2025 sales tax rate for 95757, california is 8.75%. The 95757, elk grove, california, general sales tax rate is 8.75%.

State and Local Sales Tax Rates Sales Taxes Tax Foundation

Click for sales tax rates, elk grove sales tax calculator, and printable sales tax table from. In elk grove the total sales tax rate, including county and city taxes, is consistently 8.75% throughout the city. The current sales tax rate in 95757, ca is 8.75%. The december 2020 total local sales tax rate was also 7.750%. An alternative sales tax.

Sales Tax Rate Chart 2012 Rating Log

In elk grove the total sales tax rate, including county and city taxes, is consistently 8.75% throughout the city. The combined rate used in this calculator (8.75%) is the result of the california. The current total local sales tax rate in elk grove, ca is 7.750%. The minimum combined 2025 sales tax rate for 95757, california is 8.75%. An alternative.

Kansas has 9th highest state and local sales tax rate The Sentinel

Click for sales tax rates, 95757 sales tax calculator, and printable sales tax table from sales. This is the total of state, county, and city sales tax rates. The combined rate used in this calculator (8.75%) is the result of the california. The current sales tax rate in 95757, ca is 8.75%. In elk grove the total sales tax rate,.

Sales Tax Rate Texas 2024 Margaret Hendren

This is the total of state, county, and city sales tax rates. Click for sales tax rates, elk grove sales tax calculator, and printable sales tax table from. The december 2020 total local sales tax rate was also 7.750%. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: The current total local sales.

NY Sales Tax Chart

Elk grove's sales tax rates can differ depending on your zip code and district, reflecting the specific needs and funding requirements of each area. The combined rate used in this calculator (8.75%) is the result of the california. An alternative sales tax rate of. Click for sales tax rates, elk grove sales tax calculator, and printable sales tax table from..

The Current Sales Tax Rate In Elk Grove, Ca Is 7.75%.

In elk grove the total sales tax rate, including county and city taxes, is consistently 8.75% throughout the city. Click for sales tax rates, 95757 sales tax calculator, and printable sales tax table from sales. The combined rate used in this calculator (8.75%) is the result of the california. The current total local sales tax rate in elk grove, ca is 7.750%.

The December 2020 Total Local Sales Tax Rate Was Also 7.750%.

Click for sales tax rates, elk grove sales tax calculator, and printable sales tax table from. This is the total of state, county, and city sales tax rates. The elk grove, california sales tax rate of 8.75% applies to the following three zip codes: An alternative sales tax rate of.

Understanding Elk Grove's Combined Sales.

Elk grove's sales tax rates can differ depending on your zip code and district, reflecting the specific needs and funding requirements of each area. The current sales tax rate in 95757, ca is 8.75%. The 95757, elk grove, california, general sales tax rate is 8.75%. The minimum combined 2025 sales tax rate for 95757, california is 8.75%.

.png)