Arizona Tax Lien Sales 2024

Arizona Tax Lien Sales 2024 - In accordance with federal and state public record laws, any lien holder's name and. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). The treasurer’s tax lien auction web site will be. The 2024 tax lien sale has concluded. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale. Outstanding liens have not yet been redeemed. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. The next tax lien sale will be on february 13, 2024 online through realauction.

The treasurer’s tax lien auction web site will be. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. The 2024 tax lien sale has concluded. Outstanding liens have not yet been redeemed. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale. In accordance with federal and state public record laws, any lien holder's name and. The next tax lien sale will be on february 13, 2024 online through realauction. The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst).

The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). The next tax lien sale will be on february 13, 2024 online through realauction. Outstanding liens have not yet been redeemed. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. The treasurer’s tax lien auction web site will be. The 2024 tax lien sale has concluded. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale. In accordance with federal and state public record laws, any lien holder's name and.

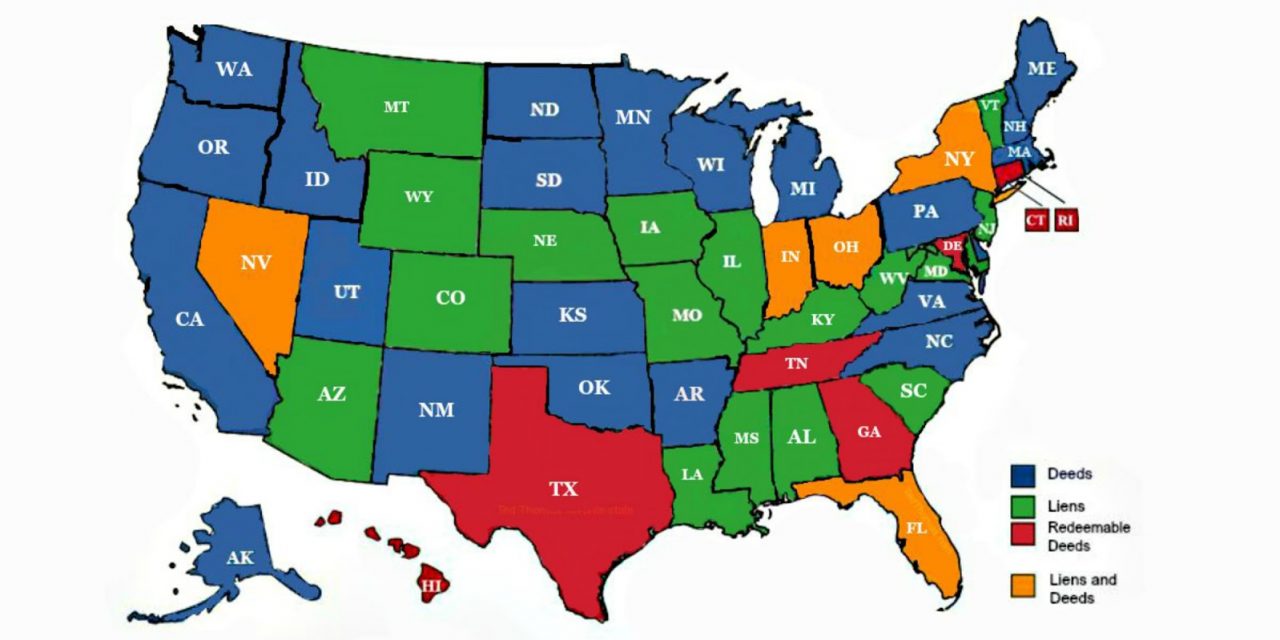

Tax Lien States Map 2024 Wilow Kaitlynn

The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. The 2024 tax lien sale has concluded. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. The next tax lien sale will be on february 13,.

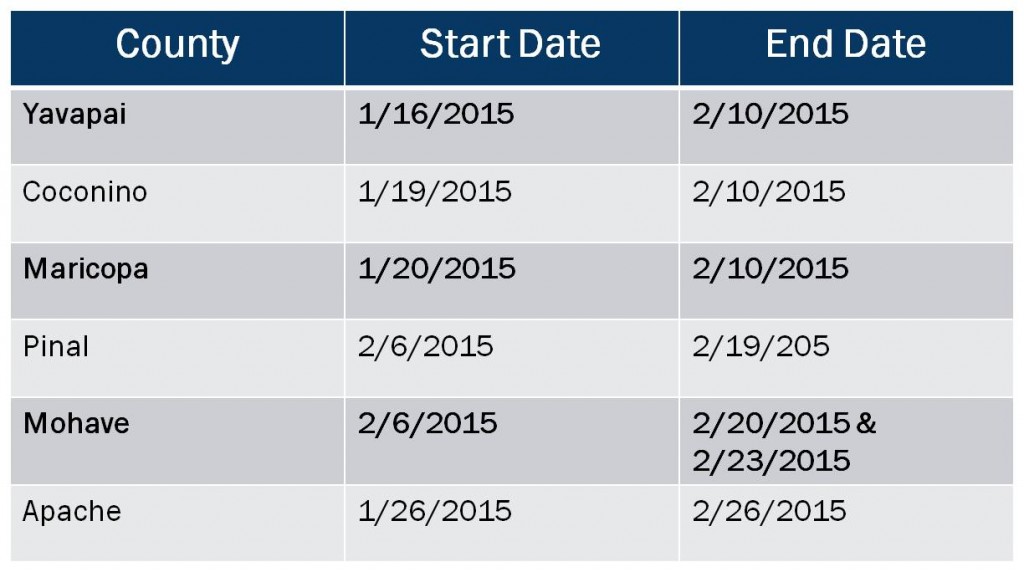

Arizona PDF Lien Sales

The treasurer’s tax lien auction web site will be. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. Outstanding liens have not yet been redeemed. In accordance with federal and state public record laws, any lien holder's name and. The 2024 tax lien sale has concluded.

Arizona Tax Form 2024 Wilie Julianna

The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). The 2024 tax lien sale has concluded. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. The treasurer’s tax lien auction web site will be..

The Complete Guide to Arizona Lien & Notice Deadlines National Lien

The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). The 2024 tax lien sale has concluded. The next tax lien sale will be on february 13, 2024 online through realauction. Outstanding liens have not yet been redeemed. 29 rows sold liens includes liens sold at the tax.

Arizona Tax Day 2024 Audrey Kelcie

The treasurer’s tax lien auction web site will be. The next tax lien sale will be on february 13, 2024 online through realauction. Outstanding liens have not yet been redeemed. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. 29 rows sold liens includes liens sold at the.

Arizona Tax Lien Sales Tax Lien Investing Tips

Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale. The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). 29 rows sold liens includes liens sold at the tax sale, subtax and.

Colorado Tax Lien Sales 2024 Carla Cosette

29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. The 2024 tax lien sale has concluded. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. Property taxes that are delinquent at the end of december are added to any previously uncollected.

Tax Lien States Map 2024 Wilow Kaitlynn

In accordance with federal and state public record laws, any lien holder's name and. The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025. The 2024 tax lien sale has concluded. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on.

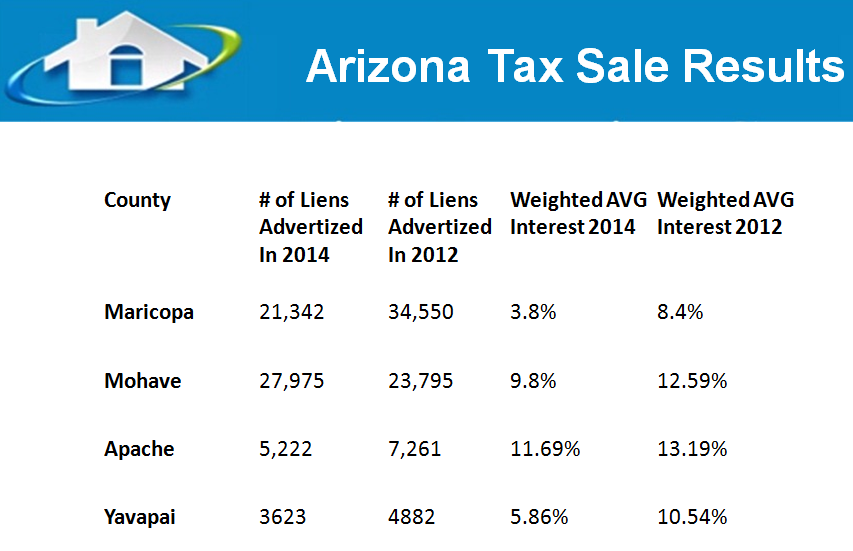

Results From The Arizona Online Tax Lien Sales Tax Lien Investing Tips

The next tax lien sale will be on february 13, 2024 online through realauction. 29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. Outstanding liens have not yet been redeemed. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. In accordance.

Arizona Tax Liens Primer PDF Foreclosure Tax Lien

29 rows sold liens includes liens sold at the tax sale, subtax and assignment liens. The properties subject to the 2024 tax lien sale of delinquent 2022 and prior years will be published in the nogales international. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax.

29 Rows Sold Liens Includes Liens Sold At The Tax Sale, Subtax And Assignment Liens.

In accordance with federal and state public record laws, any lien holder's name and. The 2024 tax lien sale has concluded. The cochise county treasurer's tax lien sale will be held through govease starting on tuesday, february 13, 2024 at 8:30 am (mst). The tax lien sale of unpaid 2023 real property taxes will be held on and will close on february 4, 2025.

The Properties Subject To The 2024 Tax Lien Sale Of Delinquent 2022 And Prior Years Will Be Published In The Nogales International.

The treasurer’s tax lien auction web site will be. The next tax lien sale will be on february 13, 2024 online through realauction. Property taxes that are delinquent at the end of december are added to any previously uncollected taxes on a parcel for the tax lien sale. Outstanding liens have not yet been redeemed.