Berkheimer Local Earned Income Tax

Berkheimer Local Earned Income Tax - Berkheimer tax administration collects the following taxes for butler township: An earned income tax of 1.06% on gross earnings and net profits from businesses is paid by everyone living or working in the township. If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be filed annually. To connect with the governor’s center for local government services (gclgs) by. Berkheimer tax administration contact information: You are eligible to file your local return online via select forms if you lived in an area that we served for that tax year and you: 71 rows download the list of local income tax collector into excel. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence.

An earned income tax of 1.06% on gross earnings and net profits from businesses is paid by everyone living or working in the township. Berkheimer tax administration contact information: You are eligible to file your local return online via select forms if you lived in an area that we served for that tax year and you: If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be filed annually. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Berkheimer tax administration collects the following taxes for butler township: To connect with the governor’s center for local government services (gclgs) by. 71 rows download the list of local income tax collector into excel.

An earned income tax of 1.06% on gross earnings and net profits from businesses is paid by everyone living or working in the township. You are eligible to file your local return online via select forms if you lived in an area that we served for that tax year and you: 71 rows download the list of local income tax collector into excel. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Berkheimer tax administration contact information: Berkheimer tax administration collects the following taxes for butler township: If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be filed annually. To connect with the governor’s center for local government services (gclgs) by.

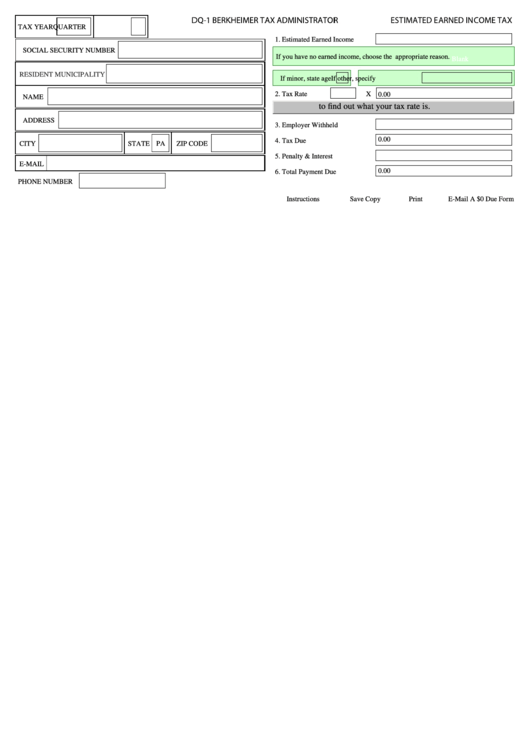

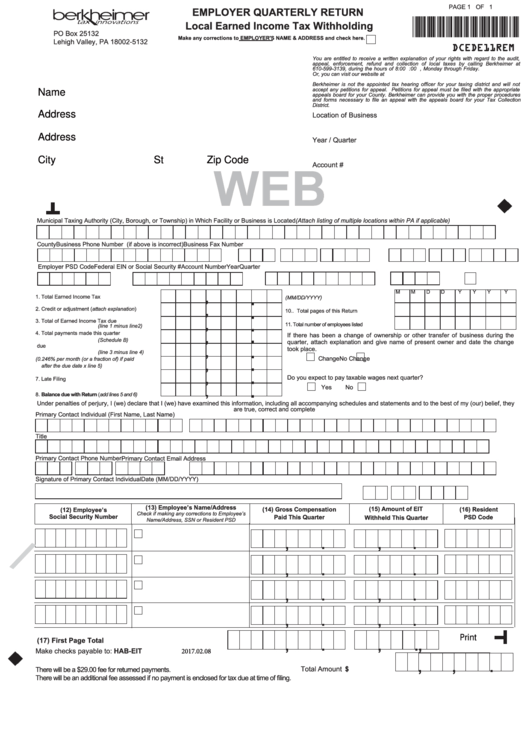

Fillable Berkheimer Estimated Earned Tax Form printable pdf download

To connect with the governor’s center for local government services (gclgs) by. If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be filed annually. You are eligible to file your local return online via select forms if you lived in an area.

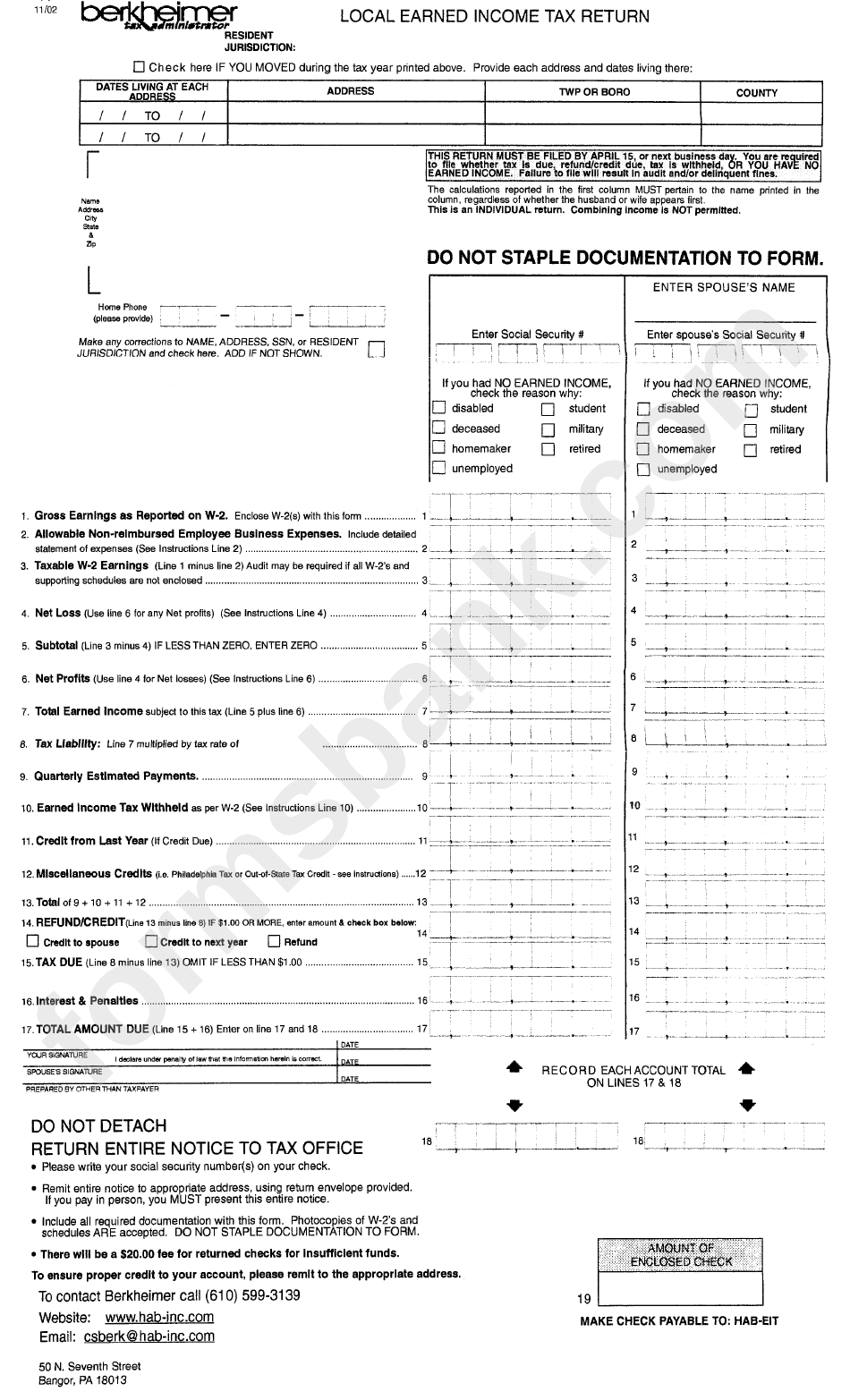

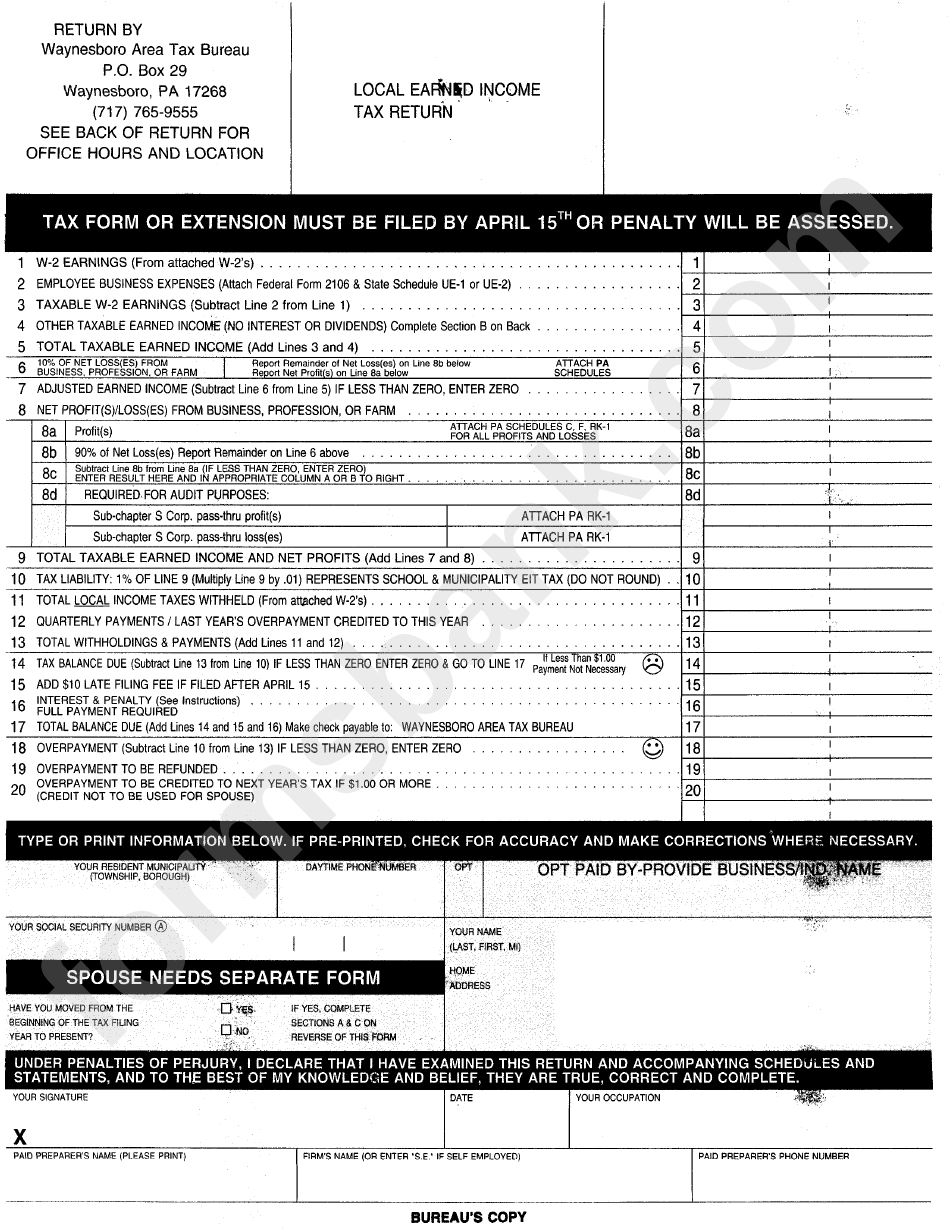

Local Earned Tax Return Form Berkheimer Tax Administrator

To connect with the governor’s center for local government services (gclgs) by. An earned income tax of 1.06% on gross earnings and net profits from businesses is paid by everyone living or working in the township. If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned.

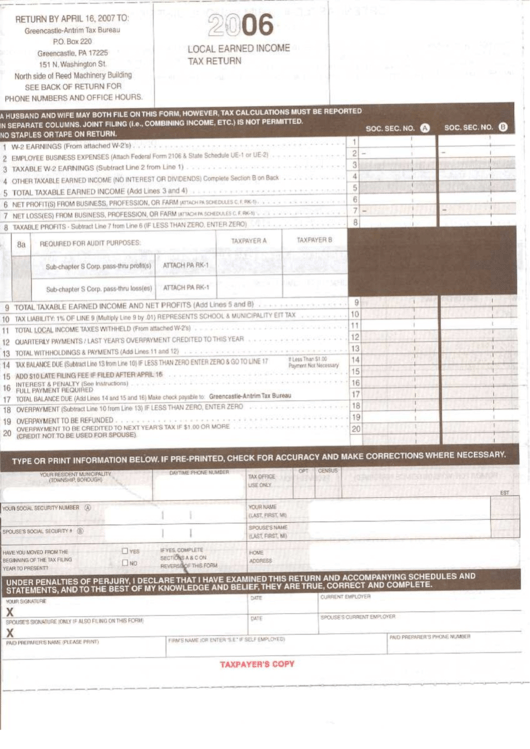

Local Earned Tax Return Form printable pdf download

An earned income tax of 1.06% on gross earnings and net profits from businesses is paid by everyone living or working in the township. If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be filed annually. Part year resident eit worksheet use.

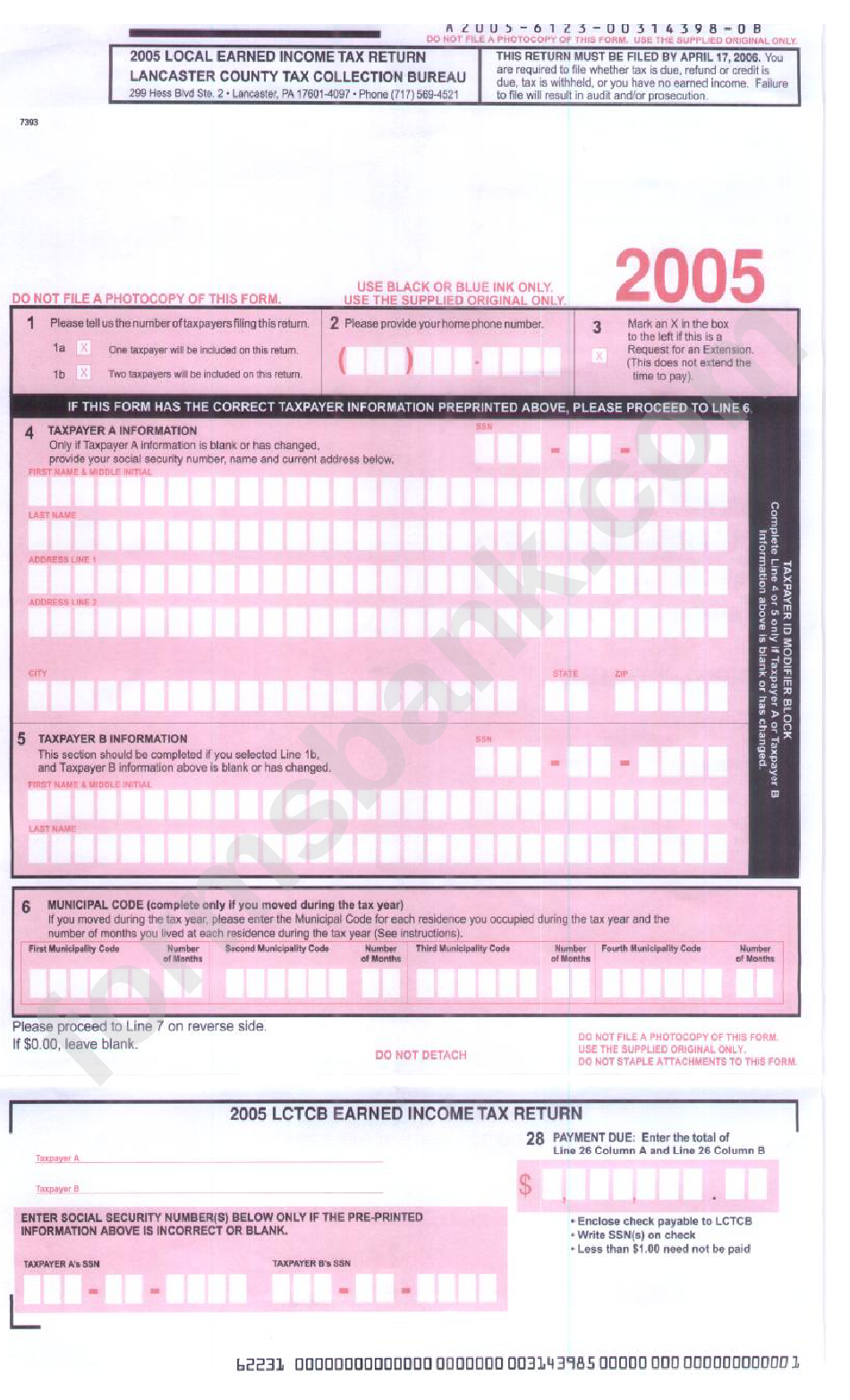

Local Earned Tax Return Form Lancaster County 2005 printable

Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Berkheimer tax administration collects the following taxes for butler township: If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be.

Is Berkheimer Tax Innovations Legit Tax Preparation Classes

Berkheimer tax administration collects the following taxes for butler township: 71 rows download the list of local income tax collector into excel. If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be filed annually. Part year resident eit worksheet use this form.

Fill Free fillable Berkheimer Tax Innovations PDF forms

You are eligible to file your local return online via select forms if you lived in an area that we served for that tax year and you: An earned income tax of 1.06% on gross earnings and net profits from businesses is paid by everyone living or working in the township. To connect with the governor’s center for local government.

Local Earned Tax Return Form printable pdf download

You are eligible to file your local return online via select forms if you lived in an area that we served for that tax year and you: Berkheimer tax administration contact information: To connect with the governor’s center for local government services (gclgs) by. An earned income tax of 1.06% on gross earnings and net profits from businesses is paid.

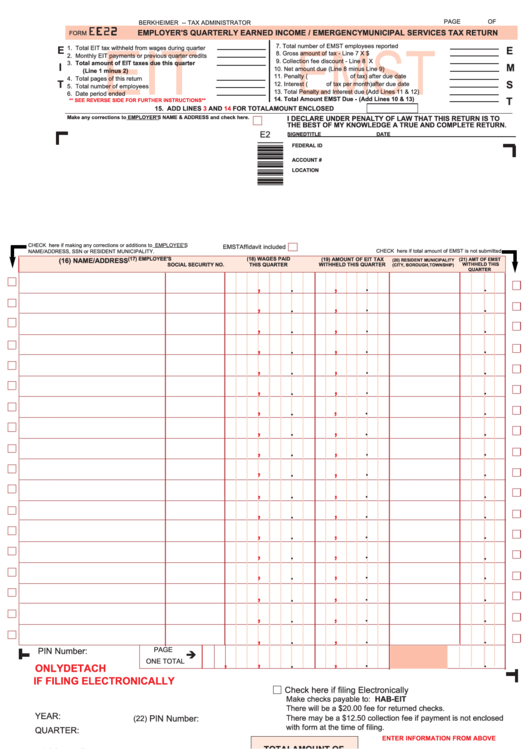

Form E2 Employer'S Quarterly Earned / Emergency Municipal

Berkheimer tax administration collects the following taxes for butler township: Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Berkheimer tax administration contact information: 71 rows download the list of local income tax collector into excel. To connect with the governor’s center for local government services (gclgs).

Top 21 Berkheimer Tax Forms And Templates free to download in PDF format

An earned income tax of 1.06% on gross earnings and net profits from businesses is paid by everyone living or working in the township. 71 rows download the list of local income tax collector into excel. You are eligible to file your local return online via select forms if you lived in an area that we served for that tax.

Fill Free fillable Berkheimer Tax Innovations PDF forms

To connect with the governor’s center for local government services (gclgs) by. Berkheimer tax administration collects the following taxes for butler township: An earned income tax of 1.06% on gross earnings and net profits from businesses is paid by everyone living or working in the township. Part year resident eit worksheet use this form if you have moved during the.

Berkheimer Tax Administration Contact Information:

You are eligible to file your local return online via select forms if you lived in an area that we served for that tax year and you: Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. If you live in a jurisdiction with an earned income tax in place and had wages for the year in question, a local earned income return must be filed annually. To connect with the governor’s center for local government services (gclgs) by.

Berkheimer Tax Administration Collects The Following Taxes For Butler Township:

An earned income tax of 1.06% on gross earnings and net profits from businesses is paid by everyone living or working in the township. 71 rows download the list of local income tax collector into excel.