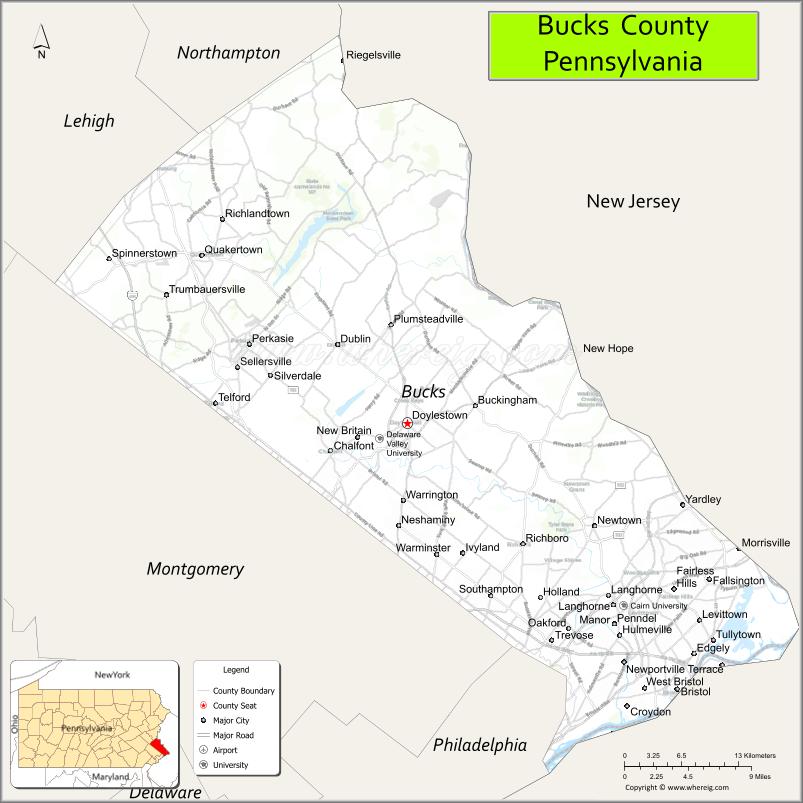

Bucks County Pa Local Income Tax

Bucks County Pa Local Income Tax - Residential owners are eligible for one annual. These bills are mailed either. To connect with the governor’s center for local government services (gclgs) by. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. Employers with worksites located in pennsylvania are required to withhold and remit. 71 rows download the list of local income tax collector into excel. Check the website for appropriate mailing addresses. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. Payment is accepted via check or credit card via mail, phone, or online. The tax claim bureau no longer accepts cash payments.

Residential owners are eligible for one annual. 71 rows download the list of local income tax collector into excel. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. Employers with worksites located in pennsylvania are required to withhold and remit. The tax claim bureau no longer accepts cash payments. Check the website for appropriate mailing addresses. Payment is accepted via check or credit card via mail, phone, or online. These bills are mailed either. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. To connect with the governor’s center for local government services (gclgs) by.

71 rows download the list of local income tax collector into excel. Employers with worksites located in pennsylvania are required to withhold and remit. These bills are mailed either. To connect with the governor’s center for local government services (gclgs) by. The tax claim bureau no longer accepts cash payments. Residential owners are eligible for one annual. Check the website for appropriate mailing addresses. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. Payment is accepted via check or credit card via mail, phone, or online. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills.

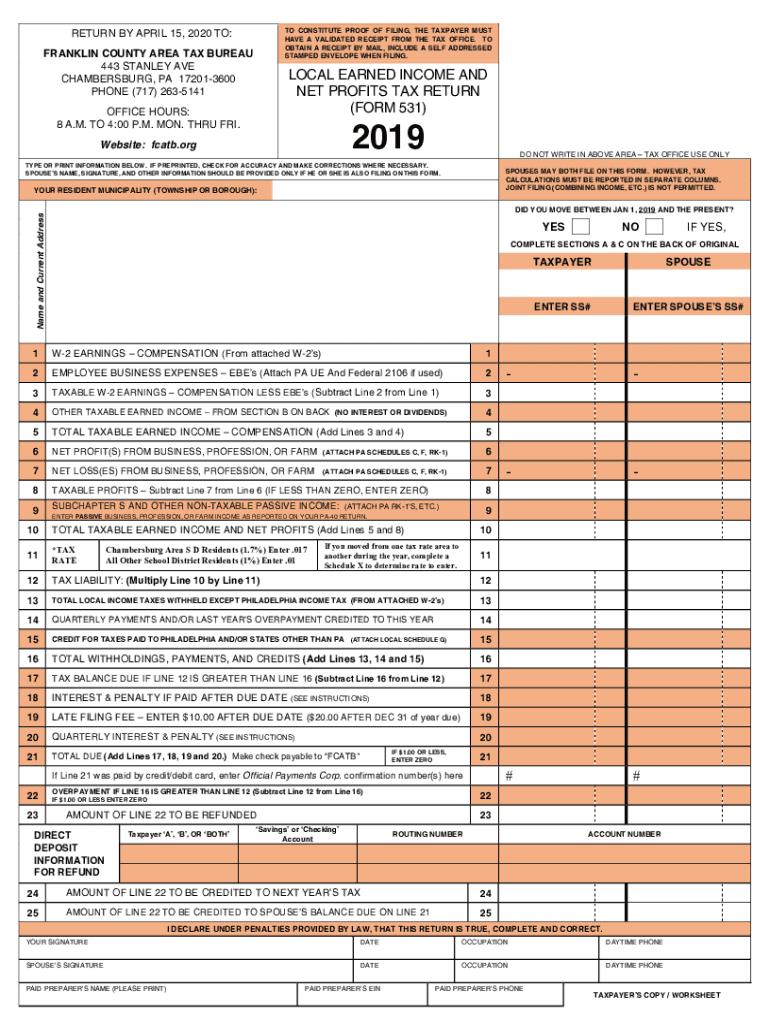

Cumberland County Pa Local Earned Tax Return

All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. Check the website for appropriate mailing addresses. 71 rows download the list of local income tax collector into excel. Residential owners are eligible for one annual. Payment is accepted via check or.

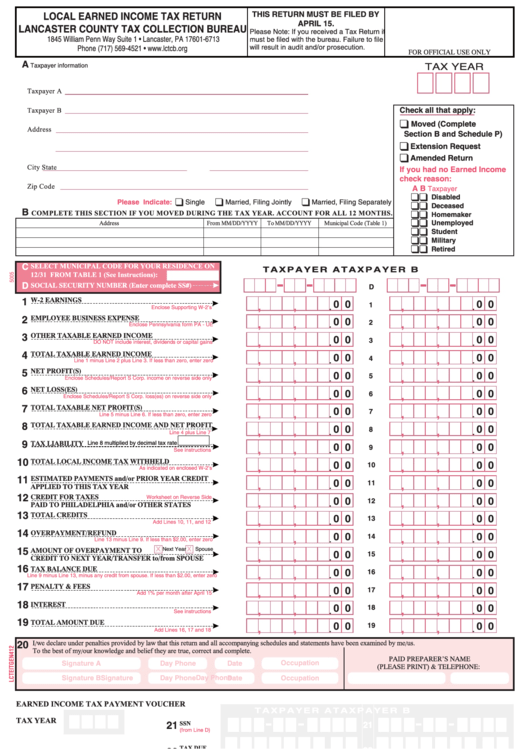

Local Earned Tax Return Form Lancaster County 2005 Printable

On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. To connect with the governor’s center for local government services (gclgs) by. The tax claim bureau no longer accepts cash payments. Check the website for appropriate mailing addresses. These bills are mailed either.

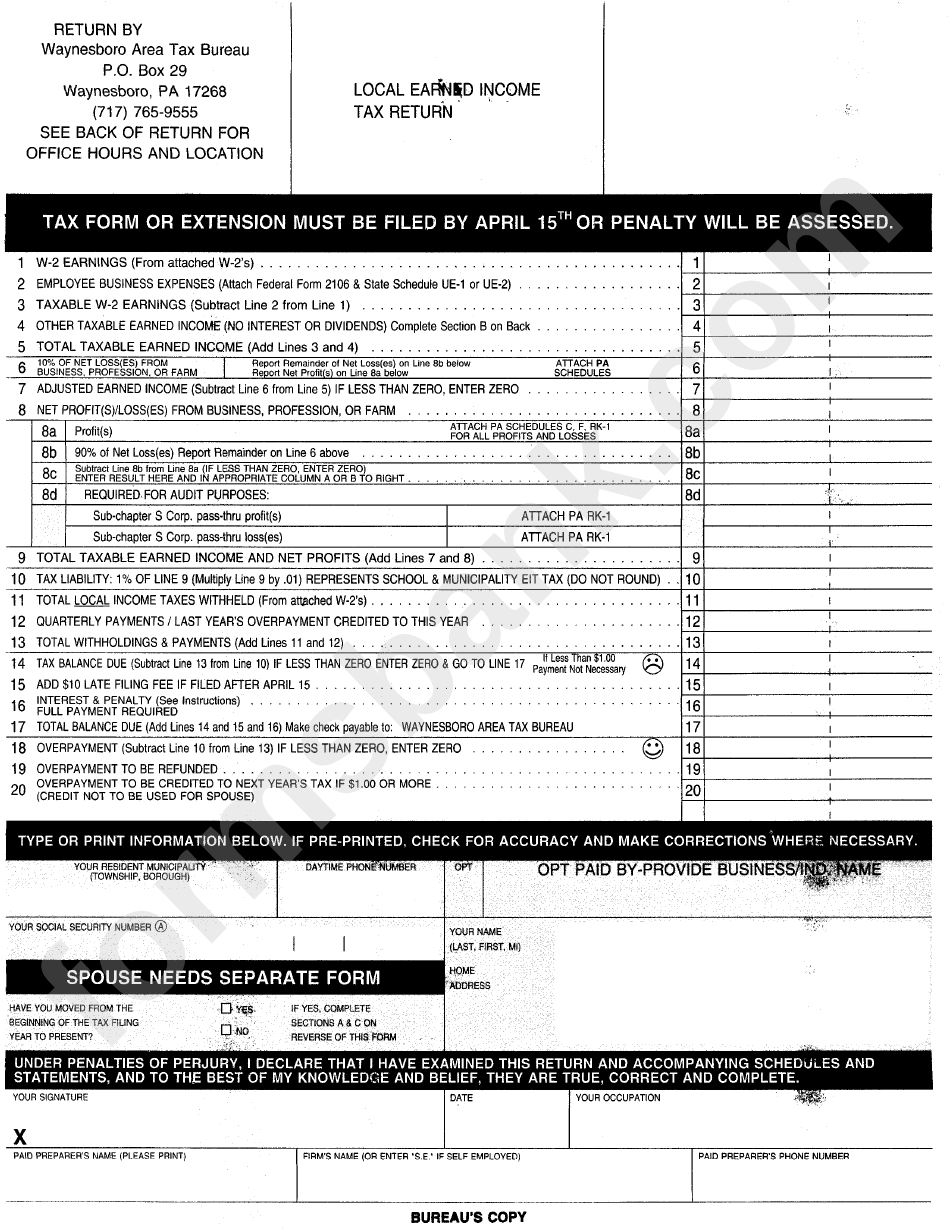

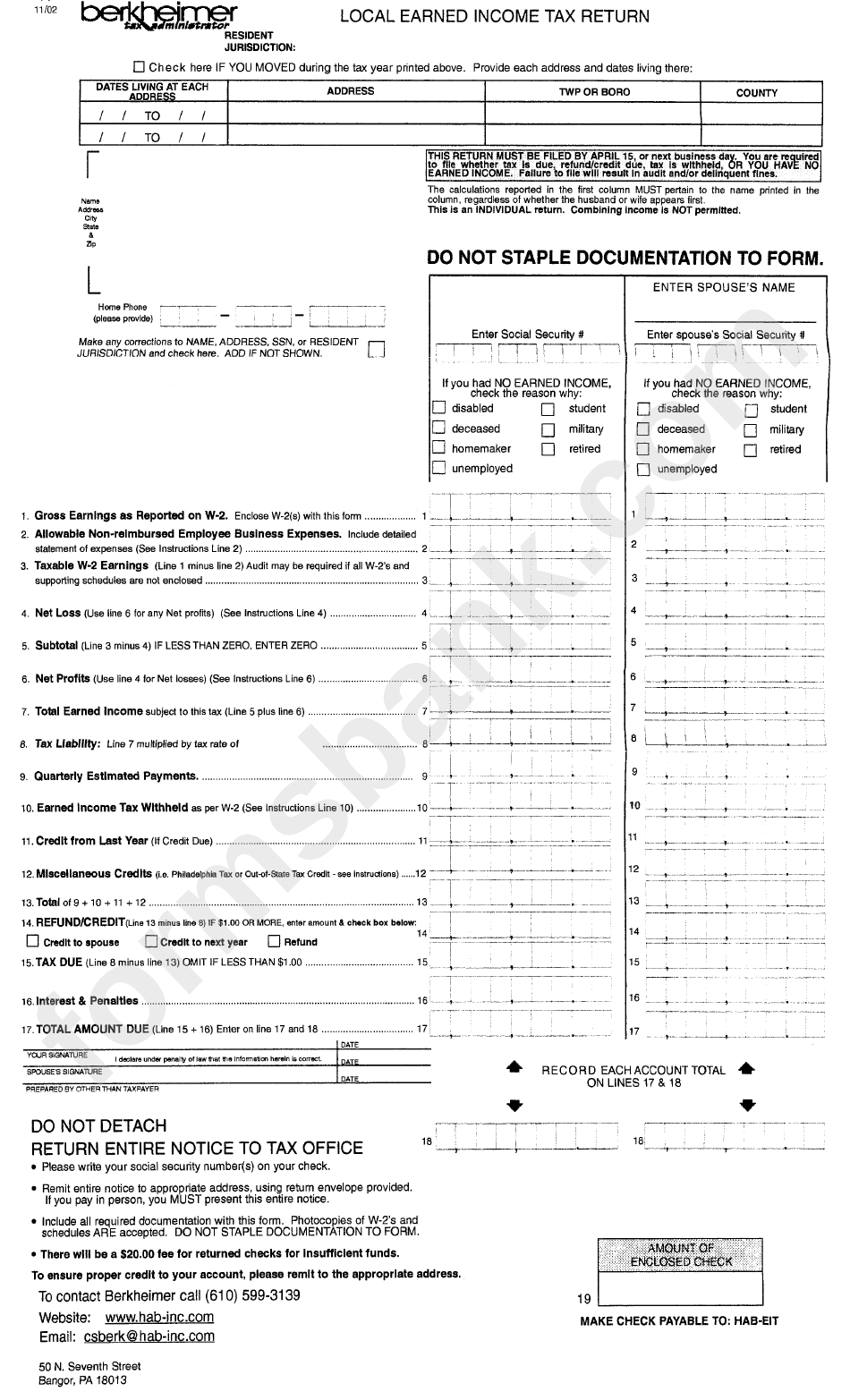

Local Earned Tax Return Form printable pdf download

Payment is accepted via check or credit card via mail, phone, or online. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. To connect with the governor’s center for local government services (gclgs) by. 71 rows download the list of local income tax collector into excel. Residential owners are eligible.

Printable Pa Local Tax Return Form Printable Forms Free Online

All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. The tax claim bureau no longer accepts cash payments. Employers with worksites located.

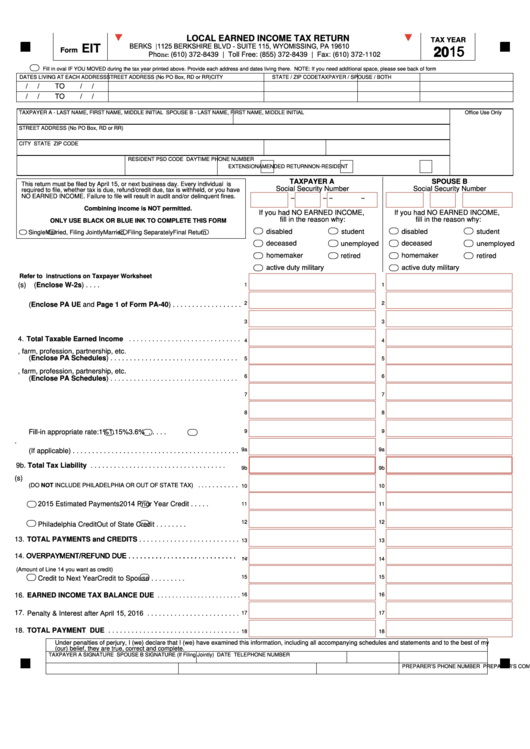

Fillable Local Earned Tax Return Pa Eit 2015 printable pdf download

Check the website for appropriate mailing addresses. 71 rows download the list of local income tax collector into excel. To connect with the governor’s center for local government services (gclgs) by. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. Payment.

Printable Pa Local Tax Return Form Printable Forms Free Online

71 rows download the list of local income tax collector into excel. To connect with the governor’s center for local government services (gclgs) by. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. These bills are mailed either. Payment is accepted via check or credit card via mail, phone, or.

PA FCATB 531 Franklin County 20192021 Fill out Tax Template Online

On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. These bills are mailed either. Residential owners are eligible for one annual. 71 rows download the list of local income tax collector into excel. To connect with the governor’s center for local government services (gclgs) by.

Map of Bucks County, Pennsylvania

Check the website for appropriate mailing addresses. To connect with the governor’s center for local government services (gclgs) by. Residential owners are eligible for one annual. The tax claim bureau no longer accepts cash payments. Payment is accepted via check or credit card via mail, phone, or online.

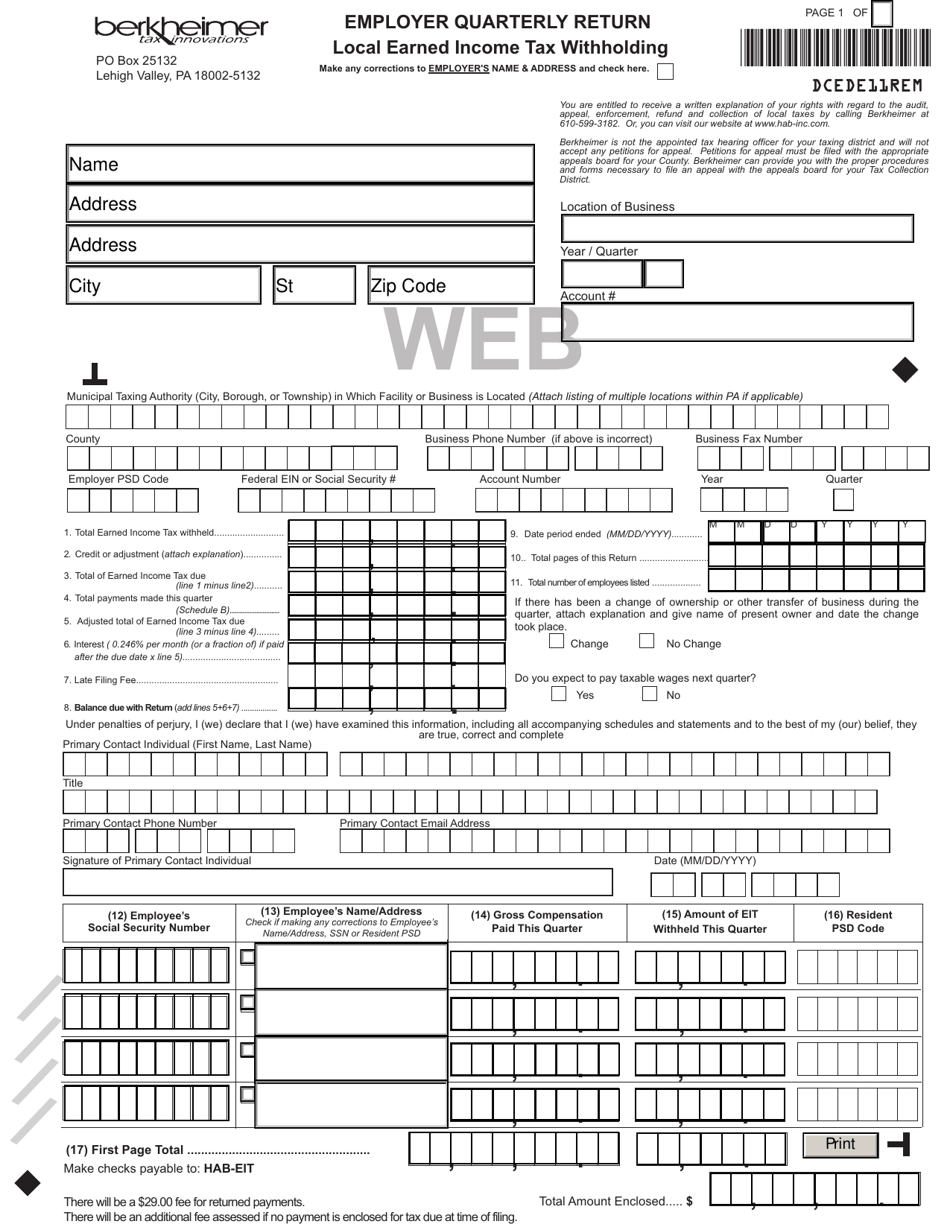

Local Earned Tax Return Form Berkheimer Tax Administrator

On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. The tax claim bureau no longer accepts cash payments. Check the website for.

Municipalities Bucks County, PA

71 rows download the list of local income tax collector into excel. To connect with the governor’s center for local government services (gclgs) by. Employers with worksites located in pennsylvania are required to withhold and remit. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. All resident taxpayers must file.

Check The Website For Appropriate Mailing Addresses.

Payment is accepted via check or credit card via mail, phone, or online. 71 rows download the list of local income tax collector into excel. To connect with the governor’s center for local government services (gclgs) by. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not.

Residential Owners Are Eligible For One Annual.

On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. Employers with worksites located in pennsylvania are required to withhold and remit. The tax claim bureau no longer accepts cash payments. These bills are mailed either.