Business License Douglas County Ga

Business License Douglas County Ga - Each year, business licenses expire on december 31. Every person who is engaged in business, trade, a profession, or occupation in douglas should have a business license. An application can be obtained. The city allows a grace period from january 1 to february 28 before a penalty fee is added. The occupational tax department is responsible for issuing. The occupational tax / alcohol license division is part of the finance department and responsible for issuing alcohol licenses and occupational tax. Search a listing of businesses and organizations that operate in the area. To comply, business owners should verify their business location, business name, and mailing address and, if applicable, verify their current. Find essential resources for business licenses in douglas county, ga. This page offers links to official sites to register, check, renew, and verify your.

To comply, business owners should verify their business location, business name, and mailing address and, if applicable, verify their current. The occupational tax / alcohol license division is part of the finance department and responsible for issuing alcohol licenses and occupational tax. Applying for a new business license before applying for a business license/occupational tax, please check your business address on the gis map to. An application can be obtained. The occupational tax department is responsible for issuing. The city allows a grace period from january 1 to february 28 before a penalty fee is added. Search a listing of businesses and organizations that operate in the area. Find essential resources for business licenses in douglas county, ga. Every person who is engaged in business, trade, a profession, or occupation in douglas should have a business license. Each year, business licenses expire on december 31.

The occupational tax / alcohol license division is part of the finance department and responsible for issuing alcohol licenses and occupational tax. The occupational tax department is responsible for issuing. To comply, business owners should verify their business location, business name, and mailing address and, if applicable, verify their current. Every person who is engaged in business, trade, a profession, or occupation in douglas should have a business license. Find essential resources for business licenses in douglas county, ga. The city allows a grace period from january 1 to february 28 before a penalty fee is added. Search a listing of businesses and organizations that operate in the area. An application can be obtained. Applying for a new business license before applying for a business license/occupational tax, please check your business address on the gis map to. Each year, business licenses expire on december 31.

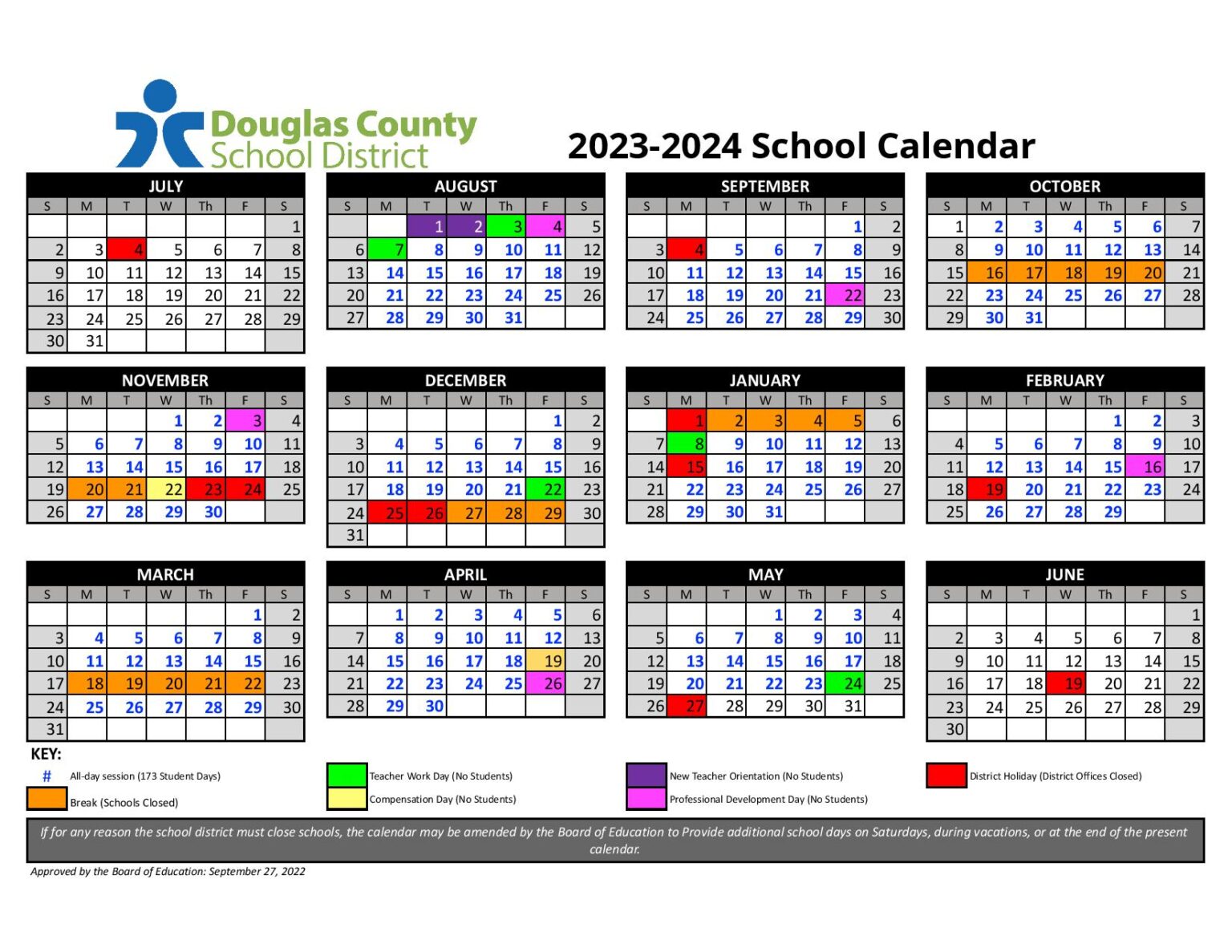

Douglas County Ga School Calendar 2024 To 2024 Fayina Auguste

Each year, business licenses expire on december 31. The city allows a grace period from january 1 to february 28 before a penalty fee is added. An application can be obtained. The occupational tax department is responsible for issuing. Search a listing of businesses and organizations that operate in the area.

Blog • Douglas County, GA • CivicEngage

To comply, business owners should verify their business location, business name, and mailing address and, if applicable, verify their current. The city allows a grace period from january 1 to february 28 before a penalty fee is added. Applying for a new business license before applying for a business license/occupational tax, please check your business address on the gis map.

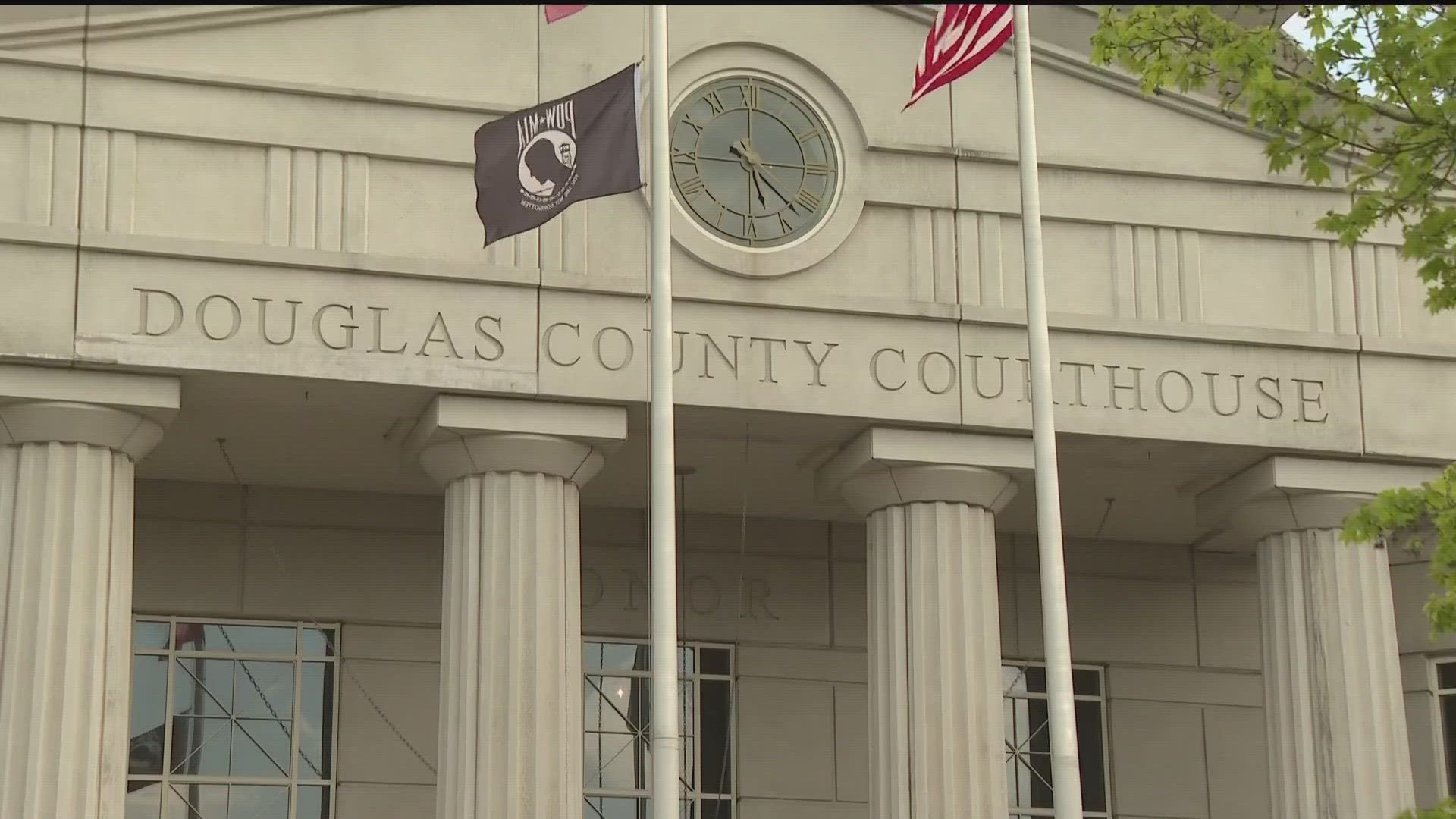

Douglas County Ga Court Calendar Gizela Miriam

Applying for a new business license before applying for a business license/occupational tax, please check your business address on the gis map to. The city allows a grace period from january 1 to february 28 before a penalty fee is added. Find essential resources for business licenses in douglas county, ga. An application can be obtained. Search a listing of.

Douglas County, GA Official Website

An application can be obtained. The occupational tax department is responsible for issuing. This page offers links to official sites to register, check, renew, and verify your. The occupational tax / alcohol license division is part of the finance department and responsible for issuing alcohol licenses and occupational tax. To comply, business owners should verify their business location, business name,.

Douglas County Family Treatment Court Douglas County, GA

Find essential resources for business licenses in douglas county, ga. The occupational tax / alcohol license division is part of the finance department and responsible for issuing alcohol licenses and occupational tax. An application can be obtained. To comply, business owners should verify their business location, business name, and mailing address and, if applicable, verify their current. Search a listing.

Douglas County Ga Sp … Aleda Aundrea

Each year, business licenses expire on december 31. The city allows a grace period from january 1 to february 28 before a penalty fee is added. Applying for a new business license before applying for a business license/occupational tax, please check your business address on the gis map to. Every person who is engaged in business, trade, a profession, or.

Douglas County, GA Real Estate & Homes for Sale

To comply, business owners should verify their business location, business name, and mailing address and, if applicable, verify their current. Search a listing of businesses and organizations that operate in the area. Every person who is engaged in business, trade, a profession, or occupation in douglas should have a business license. The occupational tax / alcohol license division is part.

Map of Douglas, GA,

To comply, business owners should verify their business location, business name, and mailing address and, if applicable, verify their current. The occupational tax / alcohol license division is part of the finance department and responsible for issuing alcohol licenses and occupational tax. Find essential resources for business licenses in douglas county, ga. The city allows a grace period from january.

Diminished Value of Douglas County Branch Car Appraisal Experts

The occupational tax / alcohol license division is part of the finance department and responsible for issuing alcohol licenses and occupational tax. Find essential resources for business licenses in douglas county, ga. To comply, business owners should verify their business location, business name, and mailing address and, if applicable, verify their current. Each year, business licenses expire on december 31..

Douglas County Ga Court Calendar Gizela Miriam

The occupational tax / alcohol license division is part of the finance department and responsible for issuing alcohol licenses and occupational tax. Each year, business licenses expire on december 31. The city allows a grace period from january 1 to february 28 before a penalty fee is added. Applying for a new business license before applying for a business license/occupational.

The Occupational Tax / Alcohol License Division Is Part Of The Finance Department And Responsible For Issuing Alcohol Licenses And Occupational Tax.

This page offers links to official sites to register, check, renew, and verify your. Applying for a new business license before applying for a business license/occupational tax, please check your business address on the gis map to. Every person who is engaged in business, trade, a profession, or occupation in douglas should have a business license. The city allows a grace period from january 1 to february 28 before a penalty fee is added.

Each Year, Business Licenses Expire On December 31.

An application can be obtained. Find essential resources for business licenses in douglas county, ga. Search a listing of businesses and organizations that operate in the area. To comply, business owners should verify their business location, business name, and mailing address and, if applicable, verify their current.