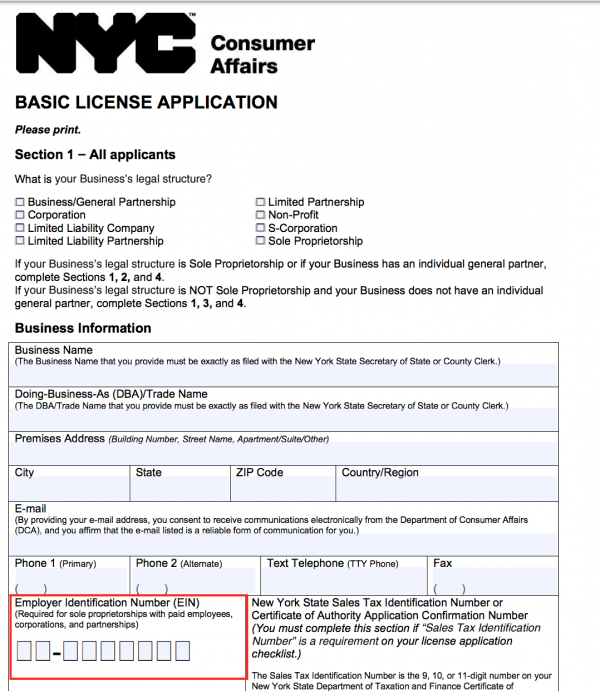

Can I Change My Business Name On My Ein

Can I Change My Business Name On My Ein - Report income tax as a branch or division of another entity and you. Change your name or locations; When you change your business name, you generally do not have to file for a new ein. In some situations a name change may require a new employer identification number (ein) or a final return. Instead, you submit an ein name change. You don’t need a new ein to change your business name ,. See publication 1635, understanding your. You don’t need a new ein if you: You need a new ein, in general, when you change your entity’s ownership or structure.

Instead, you submit an ein name change. Report income tax as a branch or division of another entity and you. You don’t need a new ein to change your business name ,. You don’t need a new ein if you: You need a new ein, in general, when you change your entity’s ownership or structure. See publication 1635, understanding your. When you change your business name, you generally do not have to file for a new ein. In some situations a name change may require a new employer identification number (ein) or a final return. Change your name or locations;

Instead, you submit an ein name change. You don’t need a new ein if you: You don’t need a new ein to change your business name ,. See publication 1635, understanding your. Change your name or locations; When you change your business name, you generally do not have to file for a new ein. You need a new ein, in general, when you change your entity’s ownership or structure. In some situations a name change may require a new employer identification number (ein) or a final return. Report income tax as a branch or division of another entity and you.

Business Name Change Letter Gotilo

Report income tax as a branch or division of another entity and you. See publication 1635, understanding your. Change your name or locations; You don’t need a new ein to change your business name ,. Instead, you submit an ein name change.

Can I Change My Business Name on Google? Reviewgrower

You need a new ein, in general, when you change your entity’s ownership or structure. See publication 1635, understanding your. Report income tax as a branch or division of another entity and you. You don’t need a new ein if you: In some situations a name change may require a new employer identification number (ein) or a final return.

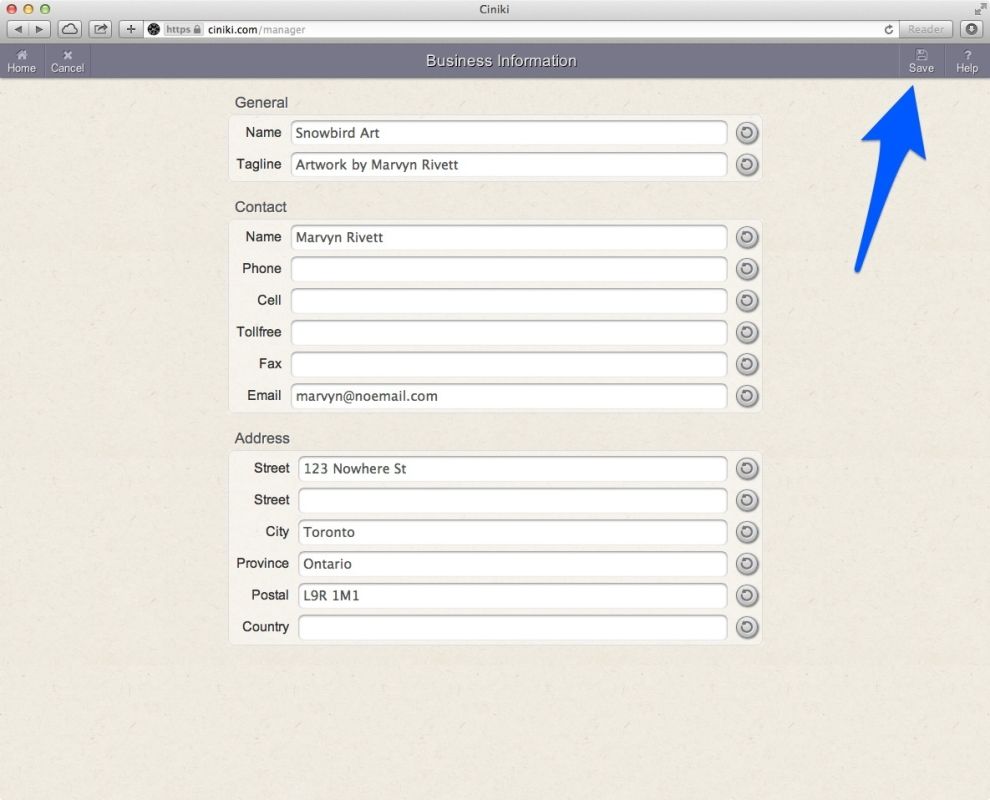

How do I change my Business Name? Paystack Support

Change your name or locations; When you change your business name, you generally do not have to file for a new ein. See publication 1635, understanding your. Report income tax as a branch or division of another entity and you. Instead, you submit an ein name change.

How To Change Owner Name On Ein

Change your name or locations; You don’t need a new ein to change your business name ,. Instead, you submit an ein name change. When you change your business name, you generally do not have to file for a new ein. Report income tax as a branch or division of another entity and you.

Ciniki How do I change my business name?

You need a new ein, in general, when you change your entity’s ownership or structure. See publication 1635, understanding your. Report income tax as a branch or division of another entity and you. When you change your business name, you generally do not have to file for a new ein. Change your name or locations;

Should I use my SSN or EIN for business credit? Leia aqui Can I use my

Report income tax as a branch or division of another entity and you. In some situations a name change may require a new employer identification number (ein) or a final return. Instead, you submit an ein name change. You don’t need a new ein if you: You need a new ein, in general, when you change your entity’s ownership or.

You can easily change your name on Google Business Profile

In some situations a name change may require a new employer identification number (ein) or a final return. Instead, you submit an ein name change. Report income tax as a branch or division of another entity and you. See publication 1635, understanding your. You need a new ein, in general, when you change your entity’s ownership or structure.

Business Name Change Letter Template To Irs

Change your name or locations; You don’t need a new ein if you: You don’t need a new ein to change your business name ,. Report income tax as a branch or division of another entity and you. In some situations a name change may require a new employer identification number (ein) or a final return.

How To Change The Address Of My Ein Number

Report income tax as a branch or division of another entity and you. Change your name or locations; When you change your business name, you generally do not have to file for a new ein. You don’t need a new ein if you: You need a new ein, in general, when you change your entity’s ownership or structure.

Can I Get A Business Loan With My Ein Number

Instead, you submit an ein name change. You don’t need a new ein to change your business name ,. In some situations a name change may require a new employer identification number (ein) or a final return. When you change your business name, you generally do not have to file for a new ein. Report income tax as a branch.

Instead, You Submit An Ein Name Change.

Report income tax as a branch or division of another entity and you. When you change your business name, you generally do not have to file for a new ein. See publication 1635, understanding your. You don’t need a new ein to change your business name ,.

You Need A New Ein, In General, When You Change Your Entity’s Ownership Or Structure.

Change your name or locations; In some situations a name change may require a new employer identification number (ein) or a final return. You don’t need a new ein if you: