City Of Pittsburgh Local Tax Rate

City Of Pittsburgh Local Tax Rate - View and sort psd codes & eit rates by county, municipality, and school district. The 2022 carnegie library real. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. All owners of real estate located within the city and school district. The market value of the. Real estate tax is tax collected by the city. If the employer does not withhold the proper amount. The 2022 city real estate tax rate is 8.06 mills. The first two (2) digits of a psd code.

The 2022 school district real estate tax rate is 10.25 mills. Real estate tax is tax collected by the city. Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. If the employer does not withhold the proper amount. View and sort psd codes & eit rates by county, municipality, and school district. The market value of the. The first two (2) digits of a psd code. All owners of real estate located within the city and school district. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. The 2022 carnegie library real.

The 2022 city real estate tax rate is 8.06 mills. All owners of real estate located within the city and school district. Real estate tax is tax collected by the city. The 2022 school district real estate tax rate is 10.25 mills. The market value of the. Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. The first two (2) digits of a psd code. The 2022 carnegie library real. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. If the employer does not withhold the proper amount.

Fill Free fillable forms City of Pittsburgh

Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. Real estate tax is tax collected by the city. View and sort psd codes & eit rates by county, municipality, and school district. The local services tax of $52 is.

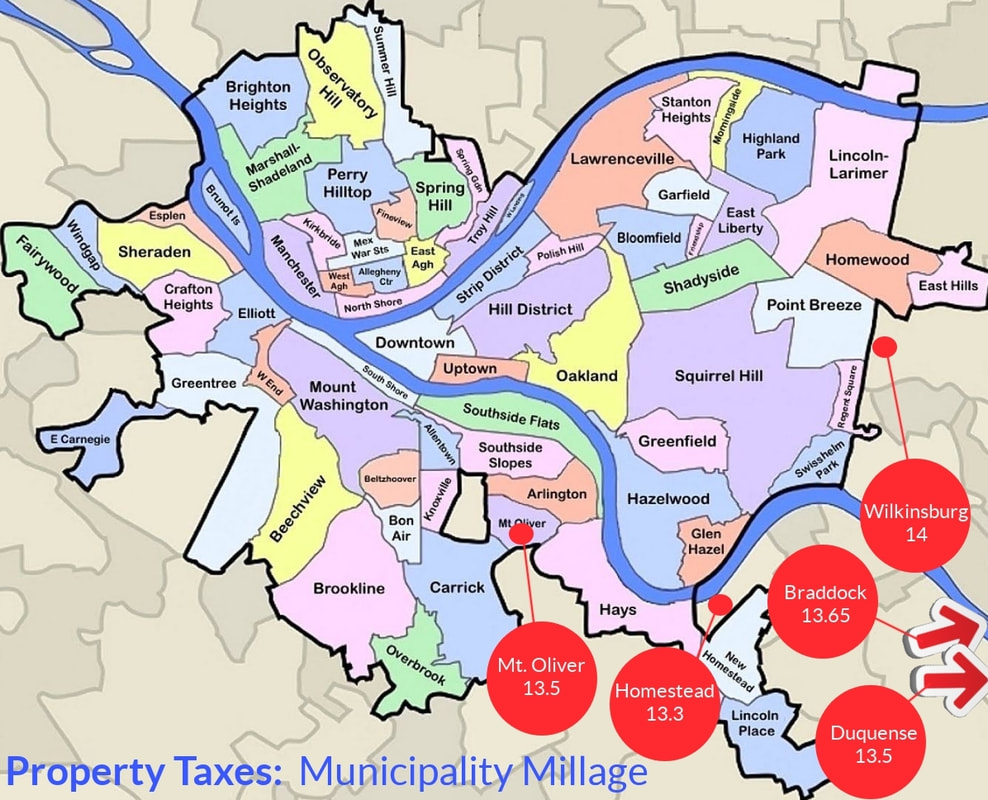

Where are the highest property tax rates in central Pa.?

Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. The first two (2) digits of a psd code. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. The market value of.

TRENDING

If the employer does not withhold the proper amount. Real estate tax is tax collected by the city. The market value of the. Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. The 2022 city real estate tax rate.

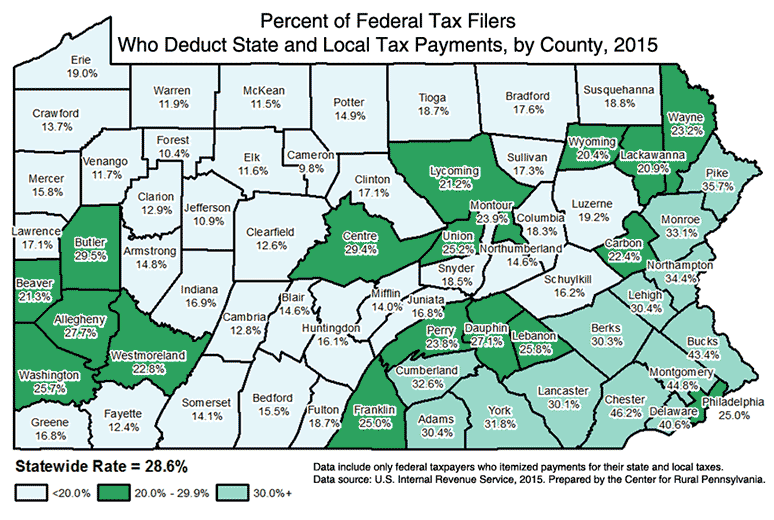

DataGrams Center for Rural PA

All owners of real estate located within the city and school district. The first two (2) digits of a psd code. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. Real estate tax is tax collected by the city. View and sort psd codes & eit rates by county, municipality, and school.

Taxes Per Capita, By State, 2021 Tax Foundation

The 2022 school district real estate tax rate is 10.25 mills. The local services tax of $52 is to be deducted evenly from pay checks throughout the year. The 2022 carnegie library real. The 2022 city real estate tax rate is 8.06 mills. All owners of real estate located within the city and school district.

Policy Property Tax Assessments — ProHousing Pittsburgh

Real estate tax is tax collected by the city. Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. The first two (2) digits of a psd code. View and sort psd codes & eit rates by county, municipality, and.

City of Pittsburgh launches interactive tool to show residents where

The local services tax of $52 is to be deducted evenly from pay checks throughout the year. All owners of real estate located within the city and school district. Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. The.

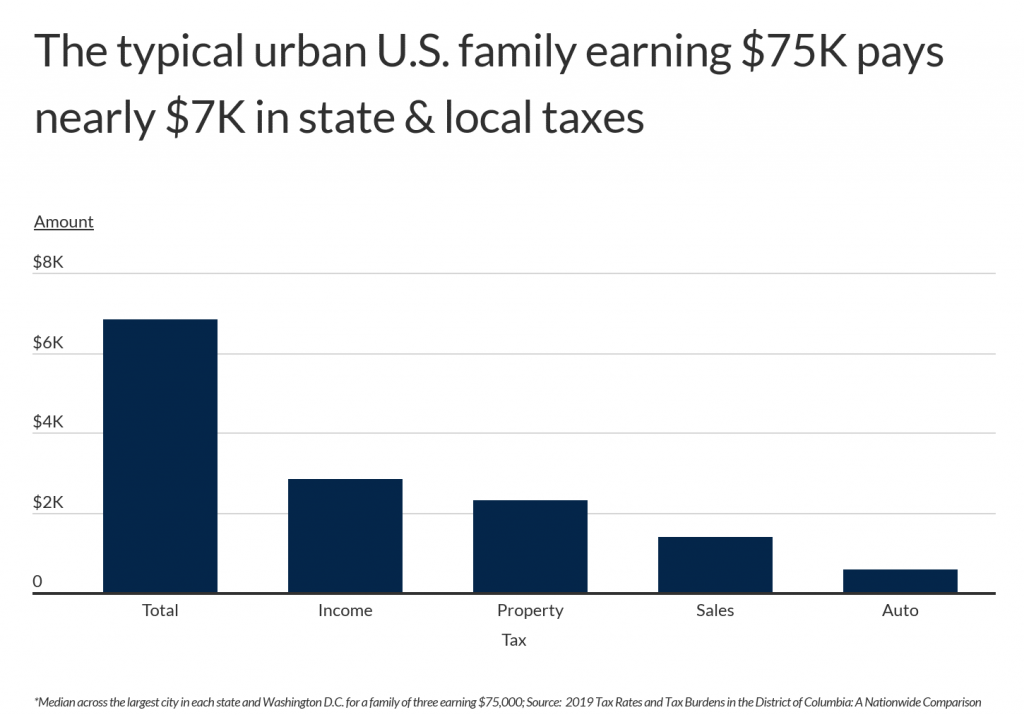

Local Taxes in 2019 Local Tax City & County Level

The local services tax of $52 is to be deducted evenly from pay checks throughout the year. If the employer does not withhold the proper amount. The market value of the. Real estate tax is tax collected by the city. The 2022 school district real estate tax rate is 10.25 mills.

Pitt Study Pa. municipalities in line to lose 3.4B in tax revenue in

All owners of real estate located within the city and school district. The first two (2) digits of a psd code. If the employer does not withhold the proper amount. View and sort psd codes & eit rates by county, municipality, and school district. The local services tax of $52 is to be deducted evenly from pay checks throughout the.

doSh Relocating to Pittsburgh Pittsburgh Taxes doSh

All owners of real estate located within the city and school district. If the employer does not withhold the proper amount. View and sort psd codes & eit rates by county, municipality, and school district. The 2022 city real estate tax rate is 8.06 mills. The first two (2) digits of a psd code.

The 2022 City Real Estate Tax Rate Is 8.06 Mills.

The 2022 school district real estate tax rate is 10.25 mills. The 2022 carnegie library real. Pittsburgh pa 15219 tax rate by tax type for tax year 20 20 tax type city rate school rate city p & i total school p & i total at. View and sort psd codes & eit rates by county, municipality, and school district.

If The Employer Does Not Withhold The Proper Amount.

Real estate tax is tax collected by the city. The market value of the. All owners of real estate located within the city and school district. The first two (2) digits of a psd code.