Colorado Tax Lien Sales 2023

Colorado Tax Lien Sales 2023 - The 2023 tax lien sale will be held november 02, 2023 online. Buyers pay the total advertised price consisting of tax, interest to the date of public auction and an advertising fee. The 2023 real estate delinquent. Annually, unpaid taxes are available for purchase at the tax lien sale. They also pay a $4.00. At the county treasurer’s discretion, the method of the sale may change. Here are some facts to help you understand what a tax lien. County officials and employees may not acquire a tax lien or property by sale of a tax lien Interest begins on the date of sale in november and thereafter on the date of endorsements. Interested in property in costilla county?

At the county treasurer’s discretion, the method of the sale may change. The 2023 real estate delinquent. The 2023 tax lien sale will be held november 02, 2023 online. 1.1 the dates and time for the 2023 tax lien sale will be 8:00 am mdt, november 3, 2023 through 4:00 pm mst, november 6, 2023. Here are some facts to help you understand what a tax lien. County officials and employees may not acquire a tax lien or property by sale of a tax lien Contact treasurer for information on tax lien sale list! Interest begins on the date of sale in november and thereafter on the date of endorsements. Buyers pay the total advertised price consisting of tax, interest to the date of public auction and an advertising fee. Annually, unpaid taxes are available for purchase at the tax lien sale.

The internet auction website will be open for registration and. Contact treasurer for information on tax lien sale list! Buyers pay the total advertised price consisting of tax, interest to the date of public auction and an advertising fee. Annually, unpaid taxes are available for purchase at the tax lien sale. They also pay a $4.00. Interest begins on the date of sale in november and thereafter on the date of endorsements. At the county treasurer’s discretion, the method of the sale may change. The 2023 real estate delinquent. 1.1 the dates and time for the 2023 tax lien sale will be 8:00 am mdt, november 3, 2023 through 4:00 pm mst, november 6, 2023. Here are some facts to help you understand what a tax lien.

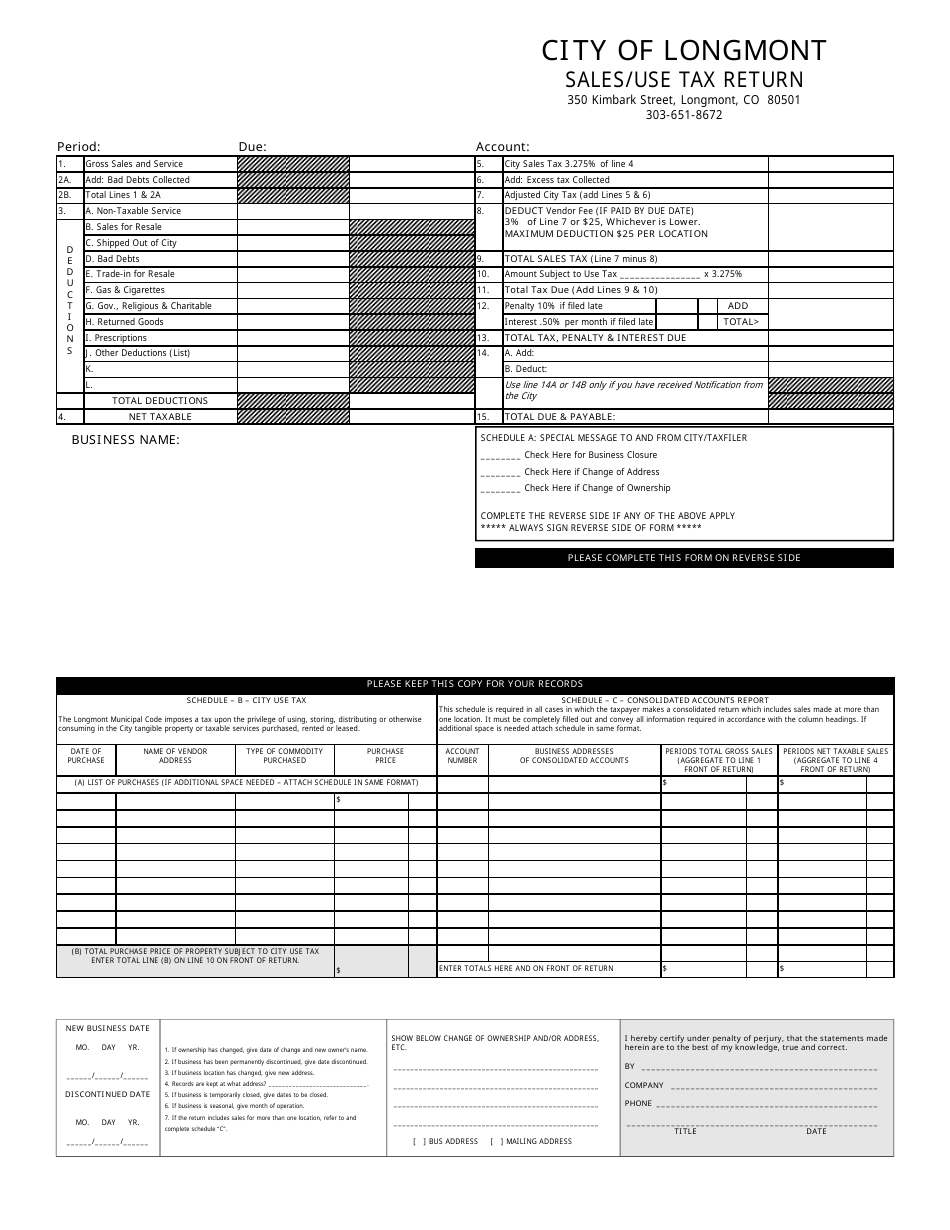

LONGMONT, Colorado Sales/Use Tax Return Form Fill Out, Sign Online

County officials and employees may not acquire a tax lien or property by sale of a tax lien Interest begins on the date of sale in november and thereafter on the date of endorsements. The 2023 tax lien sale will be held november 02, 2023 online. At the county treasurer’s discretion, the method of the sale may change. They also.

Colorado 2023 Sales Tax Guide

The internet auction website will be open for registration and. The 2023 tax lien sale will be held november 02, 2023 online. At the county treasurer’s discretion, the method of the sale may change. They also pay a $4.00. County officials and employees may not acquire a tax lien or property by sale of a tax lien

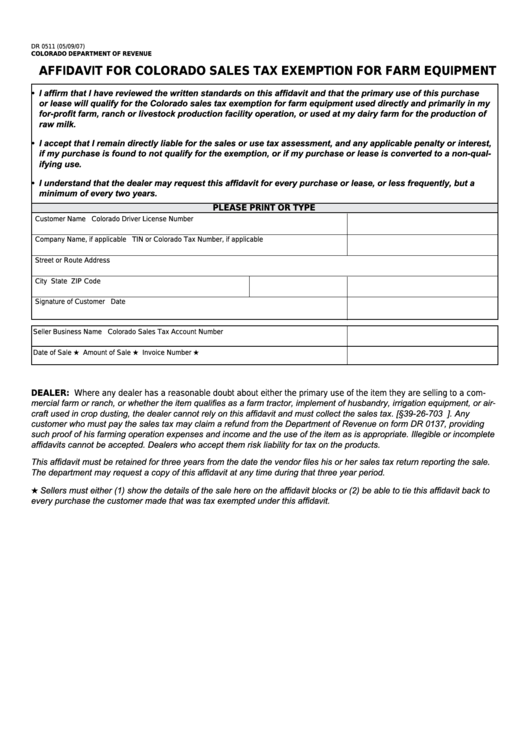

Form Dr 0511 Affidavit For Colorado Sales Tax Exemption For Farm

Annually, unpaid taxes are available for purchase at the tax lien sale. Buyers pay the total advertised price consisting of tax, interest to the date of public auction and an advertising fee. At the county treasurer’s discretion, the method of the sale may change. Here are some facts to help you understand what a tax lien. County officials and employees.

Colorado Tax Lien Sales 2024 Carla Cosette

Interested in property in costilla county? The 2023 tax lien sale will be held november 02, 2023 online. The 2023 real estate delinquent. The internet auction website will be open for registration and. Annually, unpaid taxes are available for purchase at the tax lien sale.

Federal tax lien on foreclosed property laderdriver

County officials and employees may not acquire a tax lien or property by sale of a tax lien They also pay a $4.00. The 2023 tax lien sale will be held november 02, 2023 online. 1.1 the dates and time for the 2023 tax lien sale will be 8:00 am mdt, november 3, 2023 through 4:00 pm mst, november 6,.

Colorado Tax Lien Sales 2024 Carla Cosette

Contact treasurer for information on tax lien sale list! Buyers pay the total advertised price consisting of tax, interest to the date of public auction and an advertising fee. Interested in property in costilla county? At the county treasurer’s discretion, the method of the sale may change. The internet auction website will be open for registration and.

NYC Tax Lien Sale Information Session Jamaica311

They also pay a $4.00. Interested in property in costilla county? County officials and employees may not acquire a tax lien or property by sale of a tax lien The 2023 tax lien sale will be held november 02, 2023 online. The rate of interest for the 2023.

Tax Lien Certificate Sales

1.1 the dates and time for the 2023 tax lien sale will be 8:00 am mdt, november 3, 2023 through 4:00 pm mst, november 6, 2023. The rate of interest for the 2023. Contact treasurer for information on tax lien sale list! The 2023 tax lien sale will be held november 02, 2023 online. County officials and employees may not.

tax lien investing colorado Now YouVe Figured It Out Record Pictures

County officials and employees may not acquire a tax lien or property by sale of a tax lien Buyers pay the total advertised price consisting of tax, interest to the date of public auction and an advertising fee. The internet auction website will be open for registration and. Interested in property in costilla county? They also pay a $4.00.

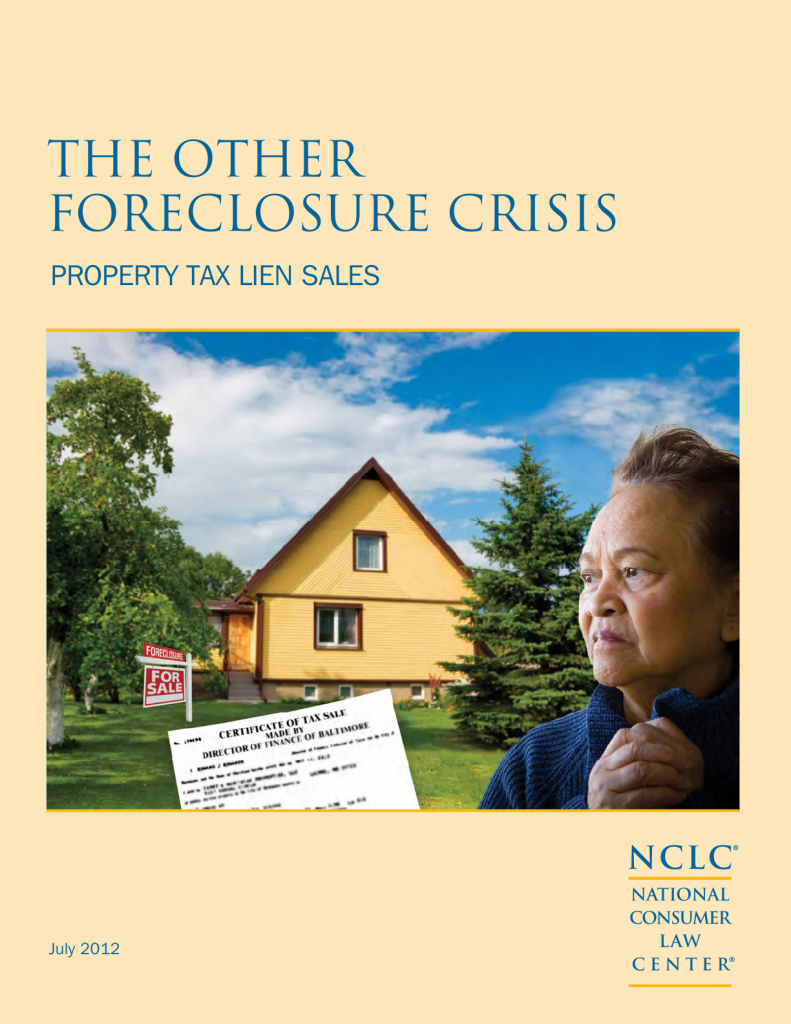

The Other Foreclosure Crisis Property Tax Lien Sales FORECLOSURE FRAUD

The internet auction website will be open for registration and. The 2023 real estate delinquent. At the county treasurer’s discretion, the method of the sale may change. County officials and employees may not acquire a tax lien or property by sale of a tax lien Here are some facts to help you understand what a tax lien.

Contact Treasurer For Information On Tax Lien Sale List!

The internet auction website will be open for registration and. Interested in property in costilla county? The 2023 real estate delinquent. The 2023 tax lien sale will be held november 02, 2023 online.

Buyers Pay The Total Advertised Price Consisting Of Tax, Interest To The Date Of Public Auction And An Advertising Fee.

Interest begins on the date of sale in november and thereafter on the date of endorsements. At the county treasurer’s discretion, the method of the sale may change. The rate of interest for the 2023. 1.1 the dates and time for the 2023 tax lien sale will be 8:00 am mdt, november 3, 2023 through 4:00 pm mst, november 6, 2023.

Annually, Unpaid Taxes Are Available For Purchase At The Tax Lien Sale.

They also pay a $4.00. Here are some facts to help you understand what a tax lien. County officials and employees may not acquire a tax lien or property by sale of a tax lien