Company Owned Vehicle

Company Owned Vehicle - The auto must be owned or leased by the employer and provided for use in the employer’s trade or business; There’s also a tax credit. To claim any vehicle expenses as a tax deduction, you must use the vehicle for business purposes. (1) the vehicle must be owned or leased by the employer and provided to one or more employees for use in connection with the employer’s trade. If you or anyone else in your company travels in a.

The auto must be owned or leased by the employer and provided for use in the employer’s trade or business; To claim any vehicle expenses as a tax deduction, you must use the vehicle for business purposes. If you or anyone else in your company travels in a. There’s also a tax credit. (1) the vehicle must be owned or leased by the employer and provided to one or more employees for use in connection with the employer’s trade.

There’s also a tax credit. If you or anyone else in your company travels in a. To claim any vehicle expenses as a tax deduction, you must use the vehicle for business purposes. (1) the vehicle must be owned or leased by the employer and provided to one or more employees for use in connection with the employer’s trade. The auto must be owned or leased by the employer and provided for use in the employer’s trade or business;

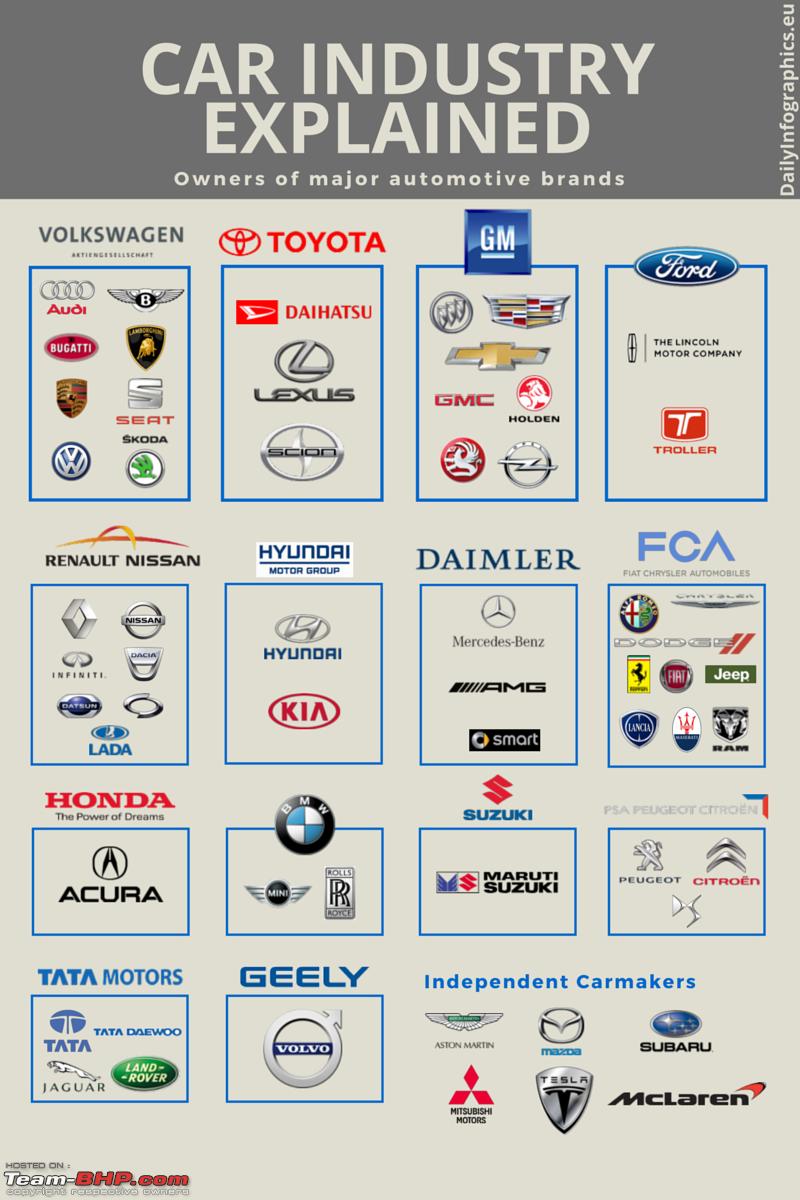

Who owns whom (Car Companies) Page 4 TeamBHP

To claim any vehicle expenses as a tax deduction, you must use the vehicle for business purposes. (1) the vehicle must be owned or leased by the employer and provided to one or more employees for use in connection with the employer’s trade. The auto must be owned or leased by the employer and provided for use in the employer’s.

GM to sell 30,000 companyowned used cars online

If you or anyone else in your company travels in a. There’s also a tax credit. To claim any vehicle expenses as a tax deduction, you must use the vehicle for business purposes. (1) the vehicle must be owned or leased by the employer and provided to one or more employees for use in connection with the employer’s trade. The.

Company owned vehicles chalk white icon on dark background 3414882

If you or anyone else in your company travels in a. The auto must be owned or leased by the employer and provided for use in the employer’s trade or business; There’s also a tax credit. (1) the vehicle must be owned or leased by the employer and provided to one or more employees for use in connection with the.

CompanyOwned Vehicles 3 Disposition Challenges Motorlease Fleet

If you or anyone else in your company travels in a. The auto must be owned or leased by the employer and provided for use in the employer’s trade or business; There’s also a tax credit. To claim any vehicle expenses as a tax deduction, you must use the vehicle for business purposes. (1) the vehicle must be owned or.

Infographic These 14 Companies Control the Entire Auto Industry

(1) the vehicle must be owned or leased by the employer and provided to one or more employees for use in connection with the employer’s trade. There’s also a tax credit. The auto must be owned or leased by the employer and provided for use in the employer’s trade or business; To claim any vehicle expenses as a tax deduction,.

Automotive Tree Which Company owns which Car Brand; Complete Guide

There’s also a tax credit. The auto must be owned or leased by the employer and provided for use in the employer’s trade or business; To claim any vehicle expenses as a tax deduction, you must use the vehicle for business purposes. If you or anyone else in your company travels in a. (1) the vehicle must be owned or.

The biggest car companies in the world Details, graphic Business Insider

The auto must be owned or leased by the employer and provided for use in the employer’s trade or business; (1) the vehicle must be owned or leased by the employer and provided to one or more employees for use in connection with the employer’s trade. If you or anyone else in your company travels in a. There’s also a.

Company owned vehicles RGB color icon Stock Vector Image & Art Alamy

To claim any vehicle expenses as a tax deduction, you must use the vehicle for business purposes. The auto must be owned or leased by the employer and provided for use in the employer’s trade or business; If you or anyone else in your company travels in a. There’s also a tax credit. (1) the vehicle must be owned or.

Understanding the Differences Between CompanyOwned and PrivatelyOwned

There’s also a tax credit. The auto must be owned or leased by the employer and provided for use in the employer’s trade or business; (1) the vehicle must be owned or leased by the employer and provided to one or more employees for use in connection with the employer’s trade. If you or anyone else in your company travels.

Giant Car Corporations Dominating Auto Industry Who Owns Who

(1) the vehicle must be owned or leased by the employer and provided to one or more employees for use in connection with the employer’s trade. The auto must be owned or leased by the employer and provided for use in the employer’s trade or business; There’s also a tax credit. If you or anyone else in your company travels.

There’s Also A Tax Credit.

(1) the vehicle must be owned or leased by the employer and provided to one or more employees for use in connection with the employer’s trade. If you or anyone else in your company travels in a. The auto must be owned or leased by the employer and provided for use in the employer’s trade or business; To claim any vehicle expenses as a tax deduction, you must use the vehicle for business purposes.