Cook County Tax Liens

Cook County Tax Liens - With the case number search, you may use either the. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. Use your property index number to see if your property has any sold, forfeited or open taxes. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Search >> what if i don't have my pin? To search for a certificate of tax lien, you may search by case number or debtor name.

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. Search >> what if i don't have my pin? Use your property index number to see if your property has any sold, forfeited or open taxes. With the case number search, you may use either the. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. To search for a certificate of tax lien, you may search by case number or debtor name.

With the case number search, you may use either the. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. Search >> what if i don't have my pin? Use your property index number to see if your property has any sold, forfeited or open taxes. To search for a certificate of tax lien, you may search by case number or debtor name. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois.

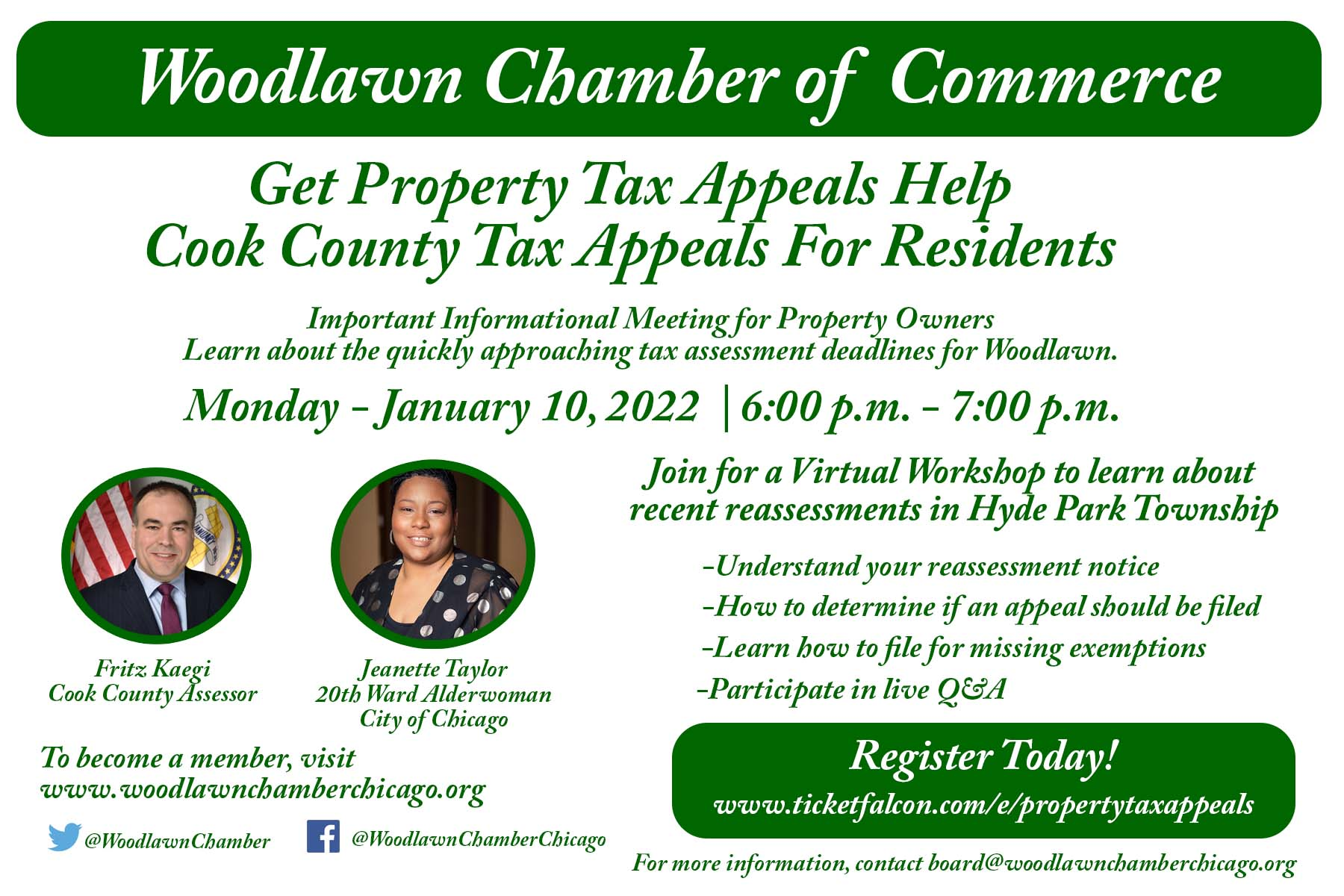

How to file your Cook County Tax appeal online! How to appeal your Cook

Search >> what if i don't have my pin? The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. With.

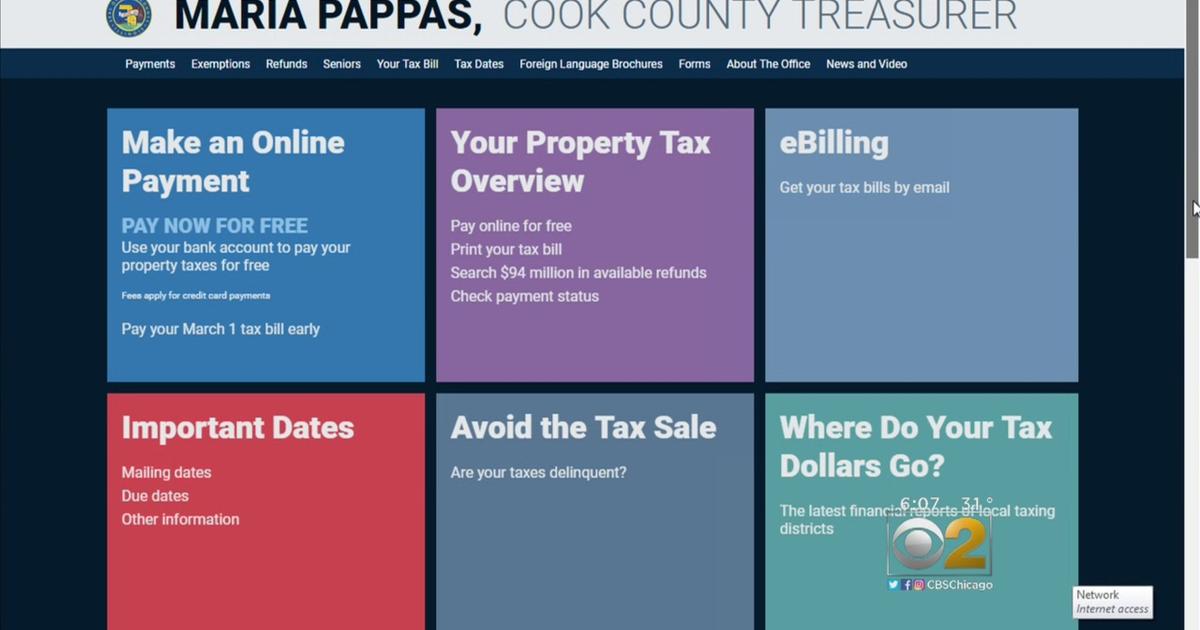

Cook County property tax bills have arrived. You’ve got questions. We

To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Use your property index number to see if your property.

Tax Lien Certificates and Tax Deeds How Tax Lien Auctions Work in Cook

To search for a certificate of tax lien, you may search by case number or debtor name. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for.

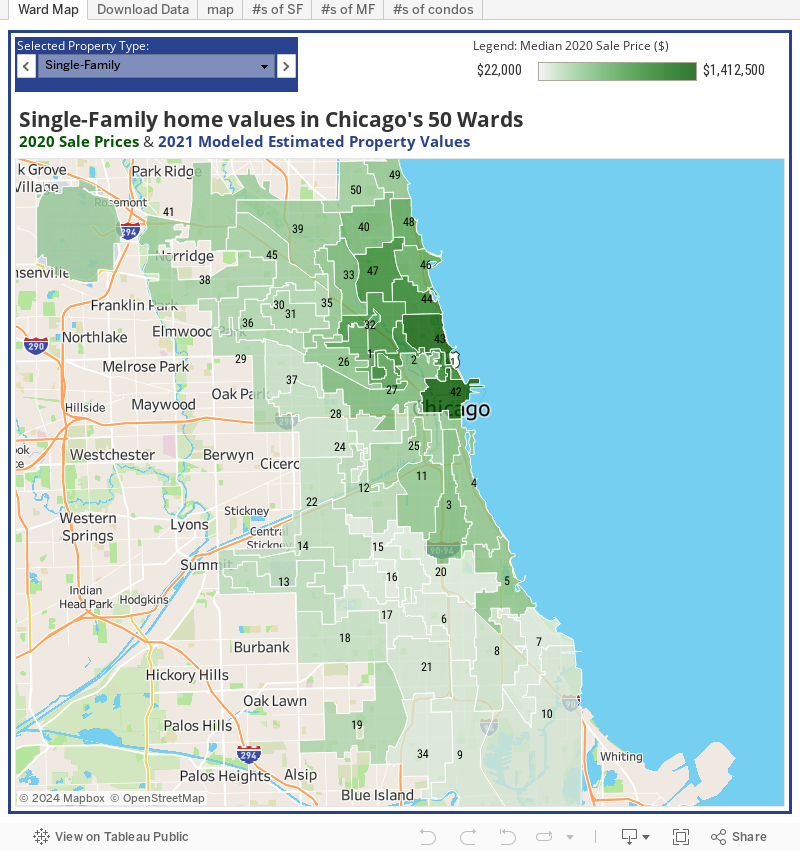

cook county tax portal map Claudio Lawton

Use your property index number to see if your property has any sold, forfeited or open taxes. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all.

Your 2020 Cook County tax bill questions answered Medium

Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. With the case number search, you may use either the. Search >> what.

Cook County Chicago Property Taxes — HermosaChi

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. To see if your taxes have been sold, forfeited or open, for prior.

Cook County Tax Sale 2024 Gusta Katrina

Search >> what if i don't have my pin? Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. With the case.

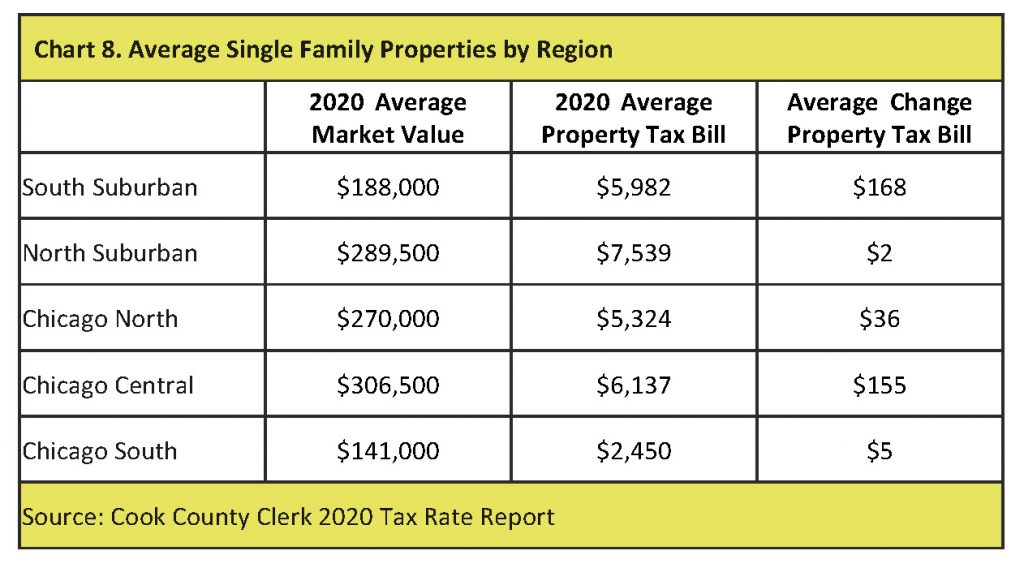

Taxpayers' Federation of Illinois Cook County Property Taxation The

To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. With the case number search, you may use either the. Use your property index number to see if your property has any sold, forfeited or open taxes. Search >> what if i don't have my.

2023 Cook County Tax Bills FITZGERALD LAW GROUP, P.C.

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Tax extension and rates the clerk's tax extension unit is responsible for calculating property tax rates for all local taxing districts in. Under illinois law, there are two types of tax sales to sell delinquent.

Get Cook County Property Tax Appeals Help Tickets Powered by Ticket

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Search >> what if i don't have my pin? Use your property index number to see if your property has any sold, forfeited or open taxes. To see if your taxes have been sold, forfeited.

With The Case Number Search, You May Use Either The.

Search >> what if i don't have my pin? Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. To see if your taxes have been sold, forfeited or open, for prior years (currently defined as 2021 and earlier), please enter your property index. To search for a certificate of tax lien, you may search by case number or debtor name.

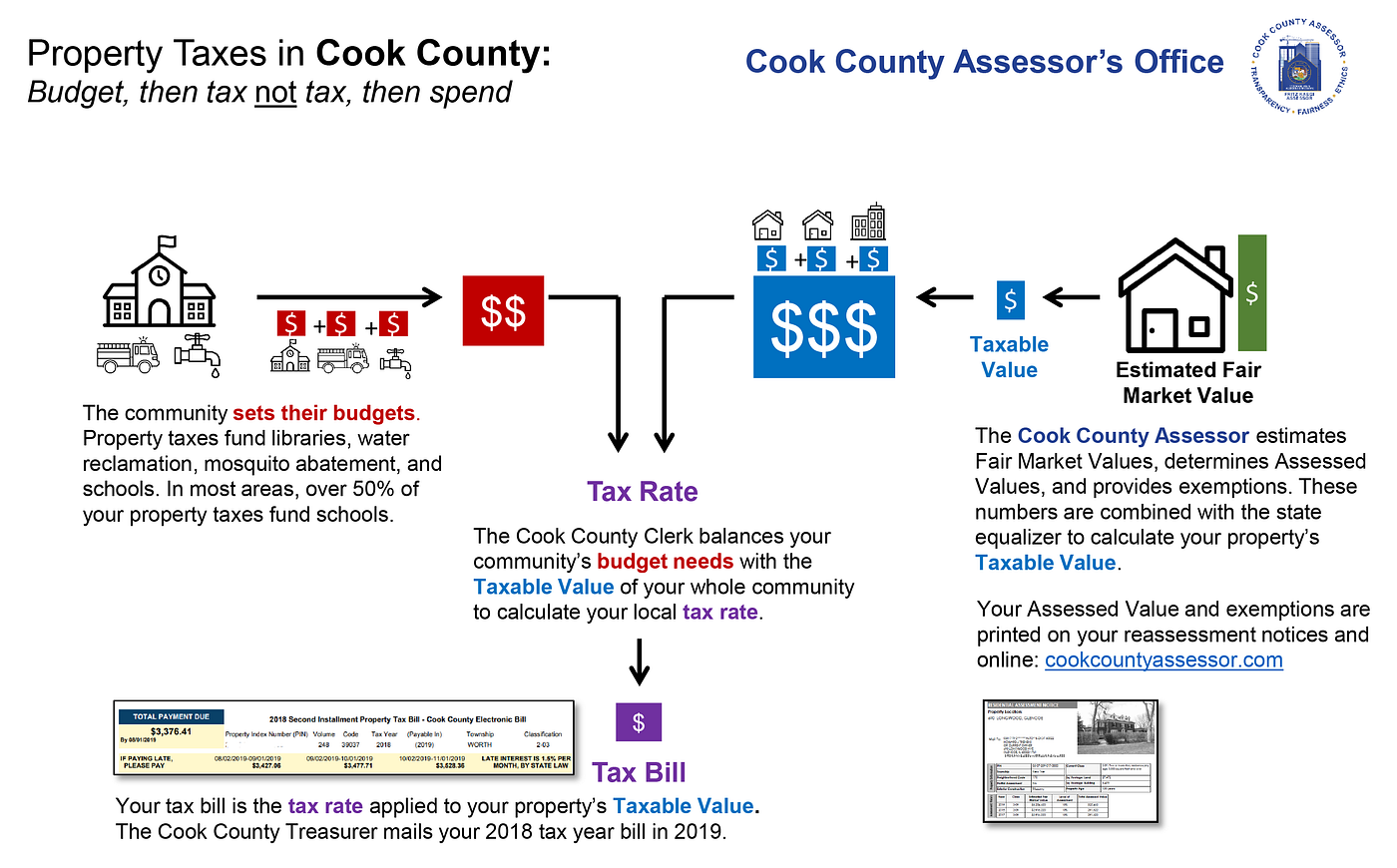

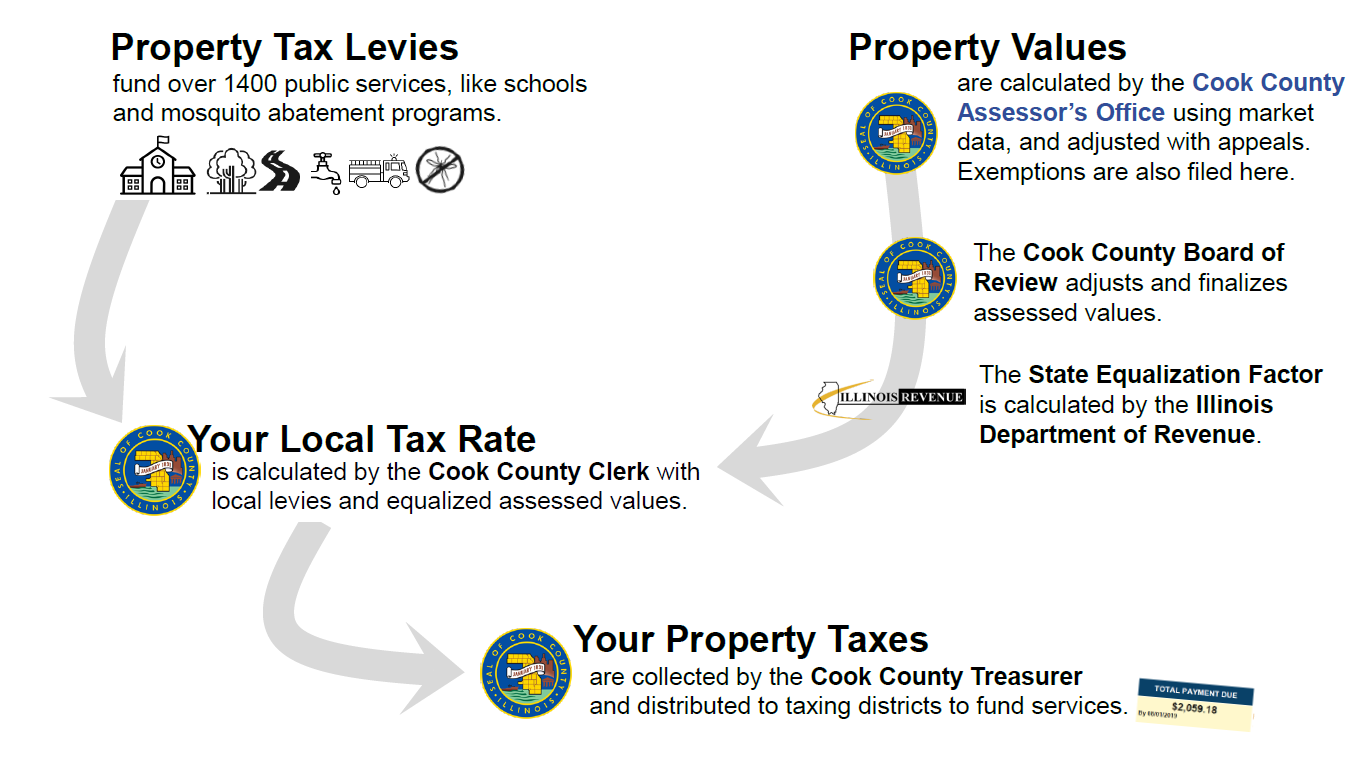

Tax Extension And Rates The Clerk's Tax Extension Unit Is Responsible For Calculating Property Tax Rates For All Local Taxing Districts In.

Use your property index number to see if your property has any sold, forfeited or open taxes. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois.