Delinquent Tax Liens

Delinquent Tax Liens - Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

(1) the full amount of tax finalized by filing a. Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows:

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

Everything You Need To Know About Getting Your County's "Delinquent Tax

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

How She Got A List Of 25,000 Delinquent Tax Liens in Saint Louis

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

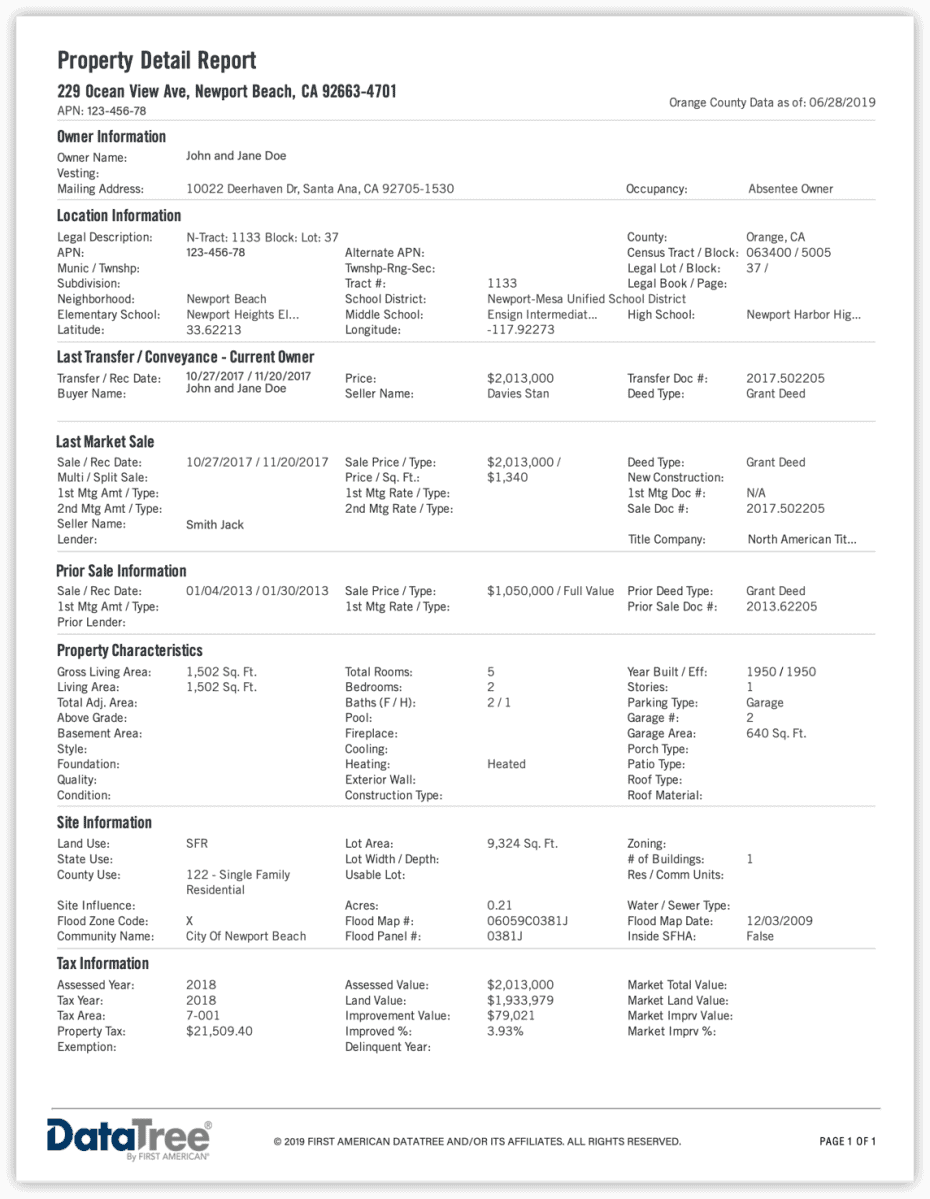

Solved Research Case—Delinquent Taxes and Tax Liens. (L041

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

How to make money on Delinquent Taxes thru Tax Deeds, Liens & Tax Deed

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

Delinquent property taxes/vacant residential and nontax liens by

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

County Corner Delinquent property taxes, Tax Lien Sale Kingman

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

How To Find Tax Lien Properties An Investor’s Guide

(1) the full amount of tax finalized by filing a. Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows:

How the Entire Tax Delinquent & Lien Process Works Wholesaling Real

(1) the full amount of tax finalized by filing a. Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows:

Delinquent Tax Lien Raises Questions About County Judge Candidate

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: (1) the full amount of tax finalized by filing a.

(1) The Full Amount Of Tax Finalized By Filing A.

Delinquent tax will be imposed if your payment of the principal amount of tax is overdue as follows: