Disability Life And Property Insurance Quick Check

Disability Life And Property Insurance Quick Check - Quizlet has study tools to help you learn anything. It is often sponsored by the employer and provides income protection to an employee while they cannot work for a temporary period. Disability coverage that pays a portion of a person's income for up to three months. It is a contract purchased by the policyholder that commits the insurance company, in exchange for premiums paid, to pay a specified amount of. Disability insurance pays the insured person a percentage of their normal income in the event of a major illness or injury that prevents them. List some of the important questions to ask when buying disability insurance. What is the main difference between term life insurance and.

List some of the important questions to ask when buying disability insurance. What is the main difference between term life insurance and. It is a contract purchased by the policyholder that commits the insurance company, in exchange for premiums paid, to pay a specified amount of. It is often sponsored by the employer and provides income protection to an employee while they cannot work for a temporary period. Disability coverage that pays a portion of a person's income for up to three months. Quizlet has study tools to help you learn anything. Disability insurance pays the insured person a percentage of their normal income in the event of a major illness or injury that prevents them.

It is a contract purchased by the policyholder that commits the insurance company, in exchange for premiums paid, to pay a specified amount of. It is often sponsored by the employer and provides income protection to an employee while they cannot work for a temporary period. Quizlet has study tools to help you learn anything. List some of the important questions to ask when buying disability insurance. Disability coverage that pays a portion of a person's income for up to three months. Disability insurance pays the insured person a percentage of their normal income in the event of a major illness or injury that prevents them. What is the main difference between term life insurance and.

Disability Insurance for Individuals in United States (USA)

Quizlet has study tools to help you learn anything. Disability coverage that pays a portion of a person's income for up to three months. It is a contract purchased by the policyholder that commits the insurance company, in exchange for premiums paid, to pay a specified amount of. Disability insurance pays the insured person a percentage of their normal income.

Best business long term disability insurance Arlington USA Virginia

Disability coverage that pays a portion of a person's income for up to three months. What is the main difference between term life insurance and. List some of the important questions to ask when buying disability insurance. Quizlet has study tools to help you learn anything. It is a contract purchased by the policyholder that commits the insurance company, in.

disability insurance SecurePlan Insurance Solutions

Disability insurance pays the insured person a percentage of their normal income in the event of a major illness or injury that prevents them. It is a contract purchased by the policyholder that commits the insurance company, in exchange for premiums paid, to pay a specified amount of. Disability coverage that pays a portion of a person's income for up.

The Importance of Disability Insurance for Working Professionals Your

Disability coverage that pays a portion of a person's income for up to three months. Quizlet has study tools to help you learn anything. It is a contract purchased by the policyholder that commits the insurance company, in exchange for premiums paid, to pay a specified amount of. Disability insurance pays the insured person a percentage of their normal income.

Disability Care Nannysure by Finsura

List some of the important questions to ask when buying disability insurance. It is often sponsored by the employer and provides income protection to an employee while they cannot work for a temporary period. It is a contract purchased by the policyholder that commits the insurance company, in exchange for premiums paid, to pay a specified amount of. Disability coverage.

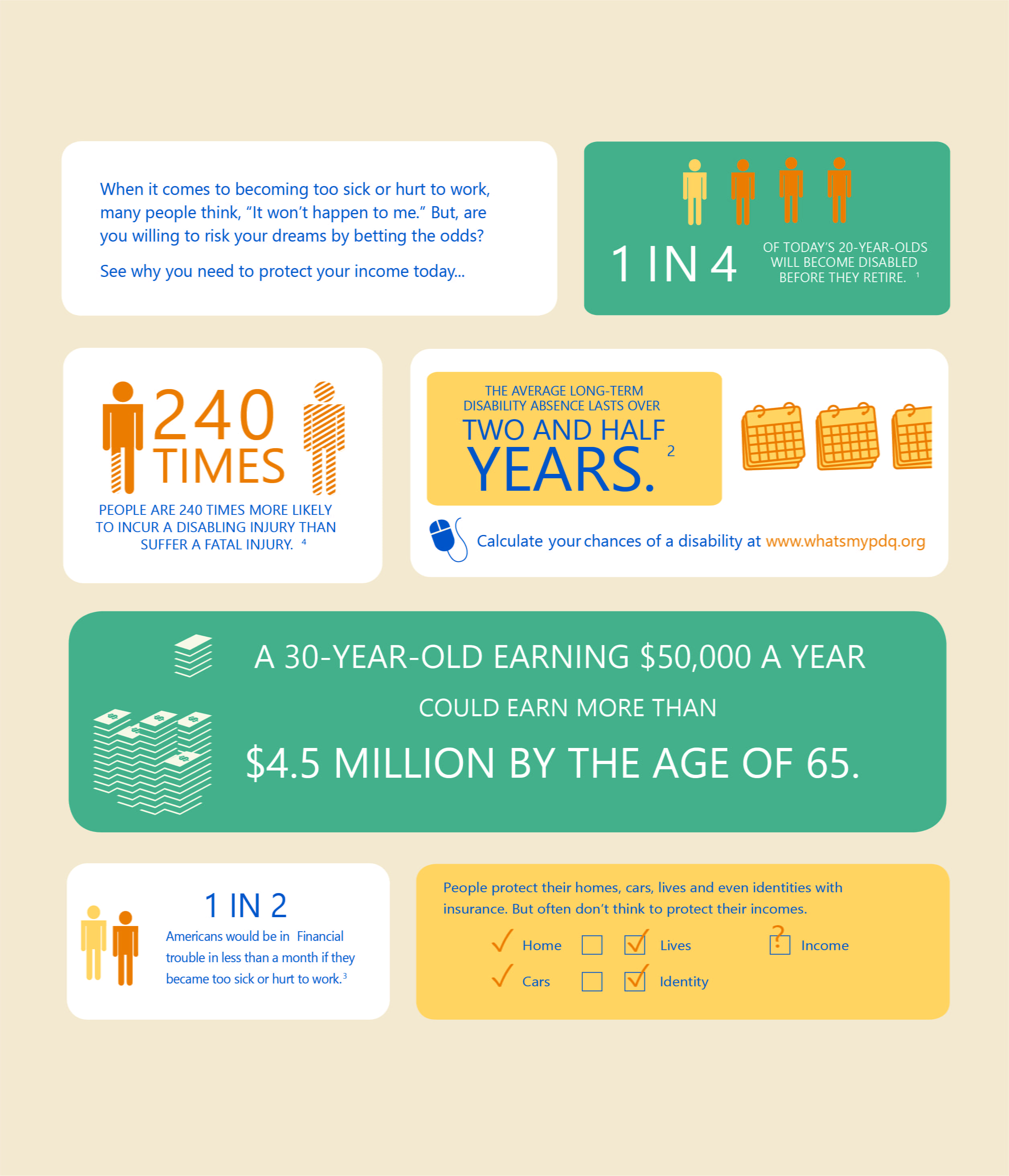

Disability Insurance A Benefit for All

It is a contract purchased by the policyholder that commits the insurance company, in exchange for premiums paid, to pay a specified amount of. Disability insurance pays the insured person a percentage of their normal income in the event of a major illness or injury that prevents them. What is the main difference between term life insurance and. Disability coverage.

Disability Insurance Solutions from Canada Life Life Insurance Canada

Disability coverage that pays a portion of a person's income for up to three months. Disability insurance pays the insured person a percentage of their normal income in the event of a major illness or injury that prevents them. What is the main difference between term life insurance and. It is a contract purchased by the policyholder that commits the.

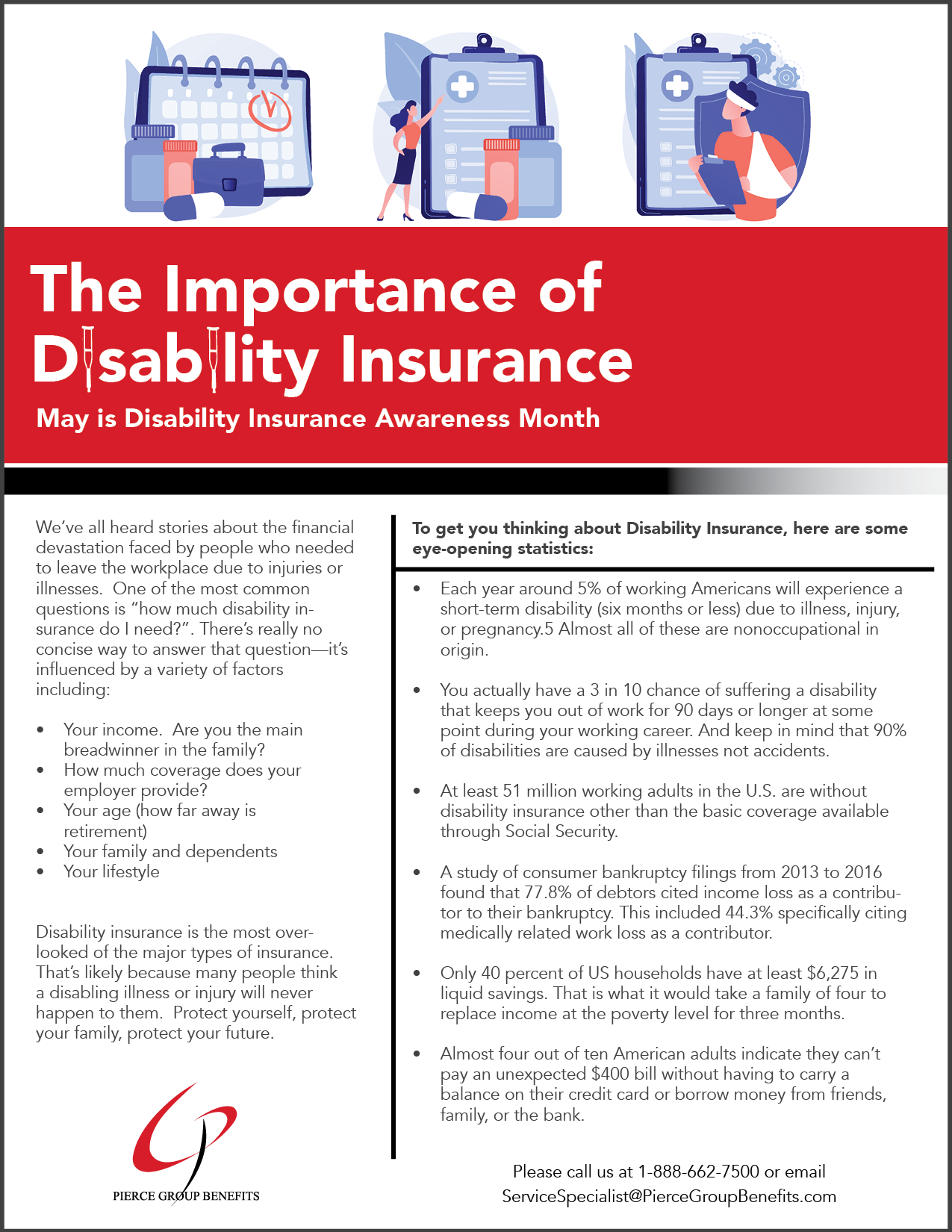

The Importance of Disability Insurance • Pierce Group Benefits

It is often sponsored by the employer and provides income protection to an employee while they cannot work for a temporary period. Disability coverage that pays a portion of a person's income for up to three months. Quizlet has study tools to help you learn anything. Disability insurance pays the insured person a percentage of their normal income in the.

Get Affordable and Best Disability Insurance Quotes

What is the main difference between term life insurance and. Disability coverage that pays a portion of a person's income for up to three months. Quizlet has study tools to help you learn anything. It is often sponsored by the employer and provides income protection to an employee while they cannot work for a temporary period. Disability insurance pays the.

Disability Insurance Inszone Insurance

What is the main difference between term life insurance and. Quizlet has study tools to help you learn anything. List some of the important questions to ask when buying disability insurance. Disability insurance pays the insured person a percentage of their normal income in the event of a major illness or injury that prevents them. It is a contract purchased.

List Some Of The Important Questions To Ask When Buying Disability Insurance.

Quizlet has study tools to help you learn anything. It is often sponsored by the employer and provides income protection to an employee while they cannot work for a temporary period. Disability coverage that pays a portion of a person's income for up to three months. It is a contract purchased by the policyholder that commits the insurance company, in exchange for premiums paid, to pay a specified amount of.

What Is The Main Difference Between Term Life Insurance And.

Disability insurance pays the insured person a percentage of their normal income in the event of a major illness or injury that prevents them.