Does A Tax Lien Affect Credit Score

Does A Tax Lien Affect Credit Score - The good news is that since 2018, federal and state tax liens no longer appear on your credit report. Does a tax lien hurt your credit score? Learn more here about what. And because your credit score is. A tax lien is a legal claim by the government on your property due to unpaid taxes. While tax liens may have several negative financial implications, they won’t impact your credit score. Since the three major credit bureaus no longer include tax liens on your credit reports, a tax lien is no longer. A tax lien once caused your credit score to take a dive, but according to an experian report, “a tax lien or outstanding debt you owe the irs, no longer. What is a tax lien, and how does it affect my credit score?

A tax lien once caused your credit score to take a dive, but according to an experian report, “a tax lien or outstanding debt you owe the irs, no longer. Learn more here about what. And because your credit score is. Since the three major credit bureaus no longer include tax liens on your credit reports, a tax lien is no longer. A tax lien is a legal claim by the government on your property due to unpaid taxes. While tax liens may have several negative financial implications, they won’t impact your credit score. Does a tax lien hurt your credit score? The good news is that since 2018, federal and state tax liens no longer appear on your credit report. What is a tax lien, and how does it affect my credit score?

Does a tax lien hurt your credit score? A tax lien once caused your credit score to take a dive, but according to an experian report, “a tax lien or outstanding debt you owe the irs, no longer. What is a tax lien, and how does it affect my credit score? The good news is that since 2018, federal and state tax liens no longer appear on your credit report. A tax lien is a legal claim by the government on your property due to unpaid taxes. And because your credit score is. Learn more here about what. While tax liens may have several negative financial implications, they won’t impact your credit score. Since the three major credit bureaus no longer include tax liens on your credit reports, a tax lien is no longer.

Credit Line iQ

The good news is that since 2018, federal and state tax liens no longer appear on your credit report. A tax lien is a legal claim by the government on your property due to unpaid taxes. What is a tax lien, and how does it affect my credit score? Since the three major credit bureaus no longer include tax liens.

How many points does a lien affect your credit score? Leia aqui Do

Learn more here about what. And because your credit score is. The good news is that since 2018, federal and state tax liens no longer appear on your credit report. While tax liens may have several negative financial implications, they won’t impact your credit score. Does a tax lien hurt your credit score?

How many points does a lien affect your credit score? Leia aqui Do

And because your credit score is. A tax lien once caused your credit score to take a dive, but according to an experian report, “a tax lien or outstanding debt you owe the irs, no longer. While tax liens may have several negative financial implications, they won’t impact your credit score. Since the three major credit bureaus no longer include.

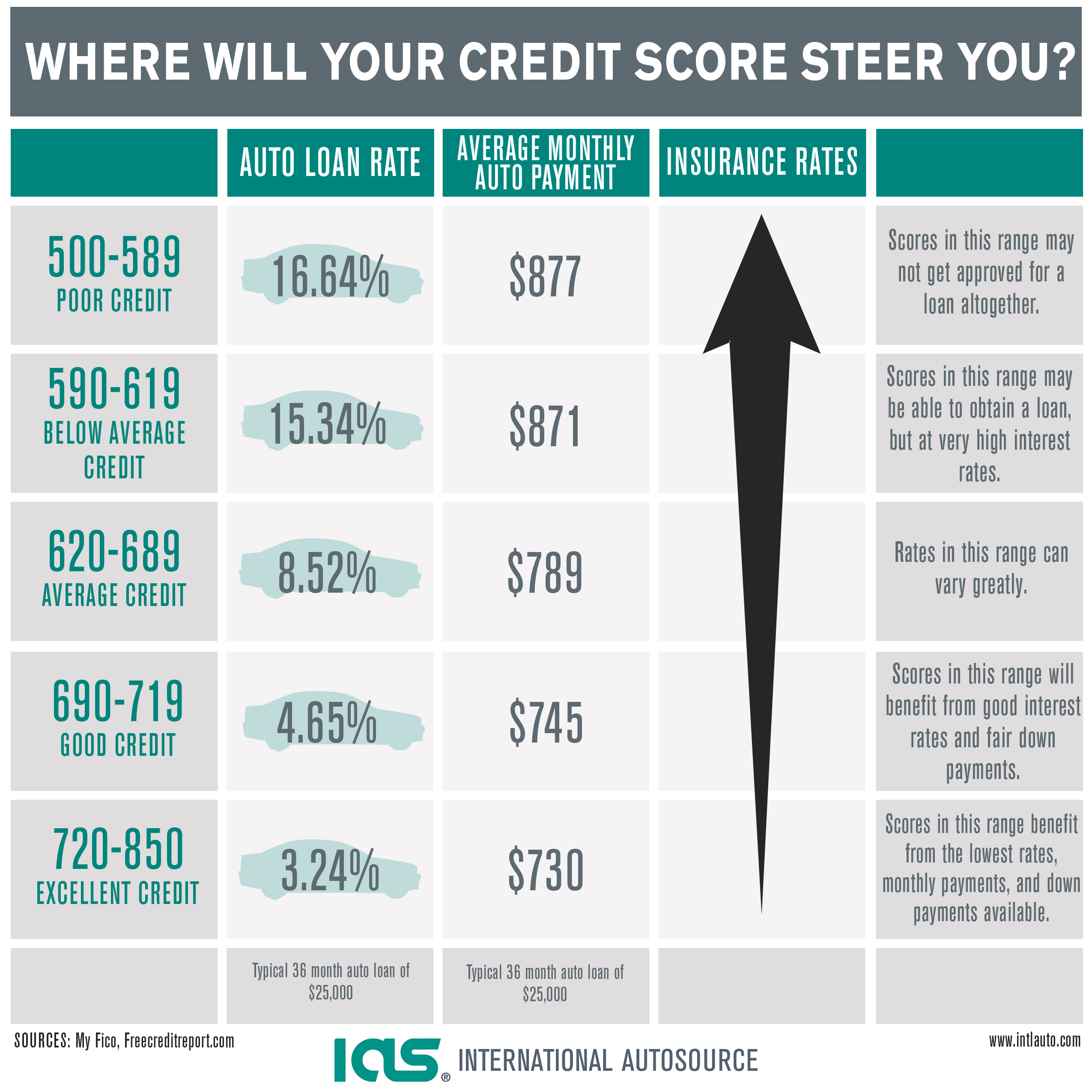

How Does A Car Loan Affect Credit Score Credit Walls

While tax liens may have several negative financial implications, they won’t impact your credit score. Does a tax lien hurt your credit score? Learn more here about what. A tax lien is a legal claim by the government on your property due to unpaid taxes. And because your credit score is.

Does Council Tax Affect Your Credit Score? Creditspring

The good news is that since 2018, federal and state tax liens no longer appear on your credit report. A tax lien once caused your credit score to take a dive, but according to an experian report, “a tax lien or outstanding debt you owe the irs, no longer. Learn more here about what. Does a tax lien hurt your.

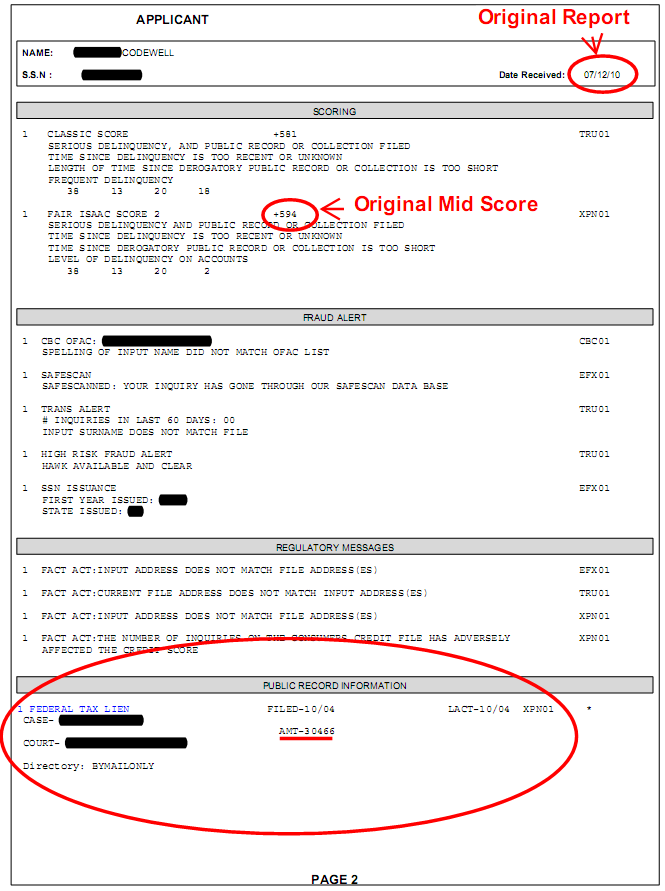

Credit Score Lowered by a Tax Lien? Not Anymore!

And because your credit score is. Since the three major credit bureaus no longer include tax liens on your credit reports, a tax lien is no longer. What is a tax lien, and how does it affect my credit score? The good news is that since 2018, federal and state tax liens no longer appear on your credit report. A.

Video How a Tax Lien Can Affect Your Credit Score TurboTax Tax Tips

Does a tax lien hurt your credit score? The good news is that since 2018, federal and state tax liens no longer appear on your credit report. Since the three major credit bureaus no longer include tax liens on your credit reports, a tax lien is no longer. A tax lien once caused your credit score to take a dive,.

Can Tax Liens Make my Credit Score worse? Credit Reporting Lawyers in

The good news is that since 2018, federal and state tax liens no longer appear on your credit report. While tax liens may have several negative financial implications, they won’t impact your credit score. Does a tax lien hurt your credit score? A tax lien is a legal claim by the government on your property due to unpaid taxes. Since.

Video Tax Liens & Your Credit

A tax lien is a legal claim by the government on your property due to unpaid taxes. A tax lien once caused your credit score to take a dive, but according to an experian report, “a tax lien or outstanding debt you owe the irs, no longer. Does a tax lien hurt your credit score? While tax liens may have.

Does Owing the IRS Affect Your Credit Score? Tax Network USA

Learn more here about what. Does a tax lien hurt your credit score? A tax lien is a legal claim by the government on your property due to unpaid taxes. And because your credit score is. Since the three major credit bureaus no longer include tax liens on your credit reports, a tax lien is no longer.

Since The Three Major Credit Bureaus No Longer Include Tax Liens On Your Credit Reports, A Tax Lien Is No Longer.

The good news is that since 2018, federal and state tax liens no longer appear on your credit report. While tax liens may have several negative financial implications, they won’t impact your credit score. Learn more here about what. What is a tax lien, and how does it affect my credit score?

Does A Tax Lien Hurt Your Credit Score?

A tax lien is a legal claim by the government on your property due to unpaid taxes. And because your credit score is. A tax lien once caused your credit score to take a dive, but according to an experian report, “a tax lien or outstanding debt you owe the irs, no longer.