Does Lexington Kentucky Charge Additional Local Tax

Does Lexington Kentucky Charge Additional Local Tax - On top of kentucky's state flat income tax rate of 4.0 in 2024, some of its counties and cities also impose an additional local tax. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically exempted by. Residents of lexington fayette urban county pay a flat county income tax of 2.25% on earned income, in addition to the kentucky income tax and the. The division of revenue collects taxes and fees for the government. The lexington, kentucky sales tax is 6.00%, the same as the kentucky state sales tax. Businesses submit license fees and taxes to our division. You can click on any city or county for more details, including the. We have information on the local income tax rates in 218 localities in kentucky. While many other states allow counties and other localities to.

Businesses submit license fees and taxes to our division. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically exempted by. On top of kentucky's state flat income tax rate of 4.0 in 2024, some of its counties and cities also impose an additional local tax. The lexington, kentucky sales tax is 6.00%, the same as the kentucky state sales tax. You can click on any city or county for more details, including the. While many other states allow counties and other localities to. We have information on the local income tax rates in 218 localities in kentucky. The division of revenue collects taxes and fees for the government. Residents of lexington fayette urban county pay a flat county income tax of 2.25% on earned income, in addition to the kentucky income tax and the.

The division of revenue collects taxes and fees for the government. The lexington, kentucky sales tax is 6.00%, the same as the kentucky state sales tax. You can click on any city or county for more details, including the. Residents of lexington fayette urban county pay a flat county income tax of 2.25% on earned income, in addition to the kentucky income tax and the. On top of kentucky's state flat income tax rate of 4.0 in 2024, some of its counties and cities also impose an additional local tax. We have information on the local income tax rates in 218 localities in kentucky. Businesses submit license fees and taxes to our division. While many other states allow counties and other localities to. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically exempted by.

Ultimate Kentucky Sales Tax Guide Zamp

The division of revenue collects taxes and fees for the government. We have information on the local income tax rates in 218 localities in kentucky. Businesses submit license fees and taxes to our division. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically exempted by. The lexington, kentucky.

KY woman charged in husband’s death indicted on new arson charge

Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically exempted by. We have information on the local income tax rates in 218 localities in kentucky. On top of kentucky's state flat income tax rate of 4.0 in 2024, some of its counties and cities also impose an additional.

Lexington, KY City Guide ClassPass Blog

The division of revenue collects taxes and fees for the government. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically exempted by. While many other states allow counties and other localities to. Businesses submit license fees and taxes to our division. The lexington, kentucky sales tax is 6.00%,.

Man charged with murder in 2015 Lexington shooting pleads guilty to

While many other states allow counties and other localities to. We have information on the local income tax rates in 218 localities in kentucky. Residents of lexington fayette urban county pay a flat county income tax of 2.25% on earned income, in addition to the kentucky income tax and the. The division of revenue collects taxes and fees for the.

The Our Common Purpose Communities Project launches Lexington, Kentucky

The division of revenue collects taxes and fees for the government. On top of kentucky's state flat income tax rate of 4.0 in 2024, some of its counties and cities also impose an additional local tax. While many other states allow counties and other localities to. We have information on the local income tax rates in 218 localities in kentucky..

Map Kentucky Lexington Share Map

Residents of lexington fayette urban county pay a flat county income tax of 2.25% on earned income, in addition to the kentucky income tax and the. We have information on the local income tax rates in 218 localities in kentucky. Businesses submit license fees and taxes to our division. On top of kentucky's state flat income tax rate of 4.0.

Downtown Lexington KY hotel near Rupp Arena Hyatt Regency Lexington

Residents of lexington fayette urban county pay a flat county income tax of 2.25% on earned income, in addition to the kentucky income tax and the. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically exempted by. We have information on the local income tax rates in 218.

Cityscape of Lexington, Kentucky Wikiwand

Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically exempted by. On top of kentucky's state flat income tax rate of 4.0 in 2024, some of its counties and cities also impose an additional local tax. You can click on any city or county for more details, including.

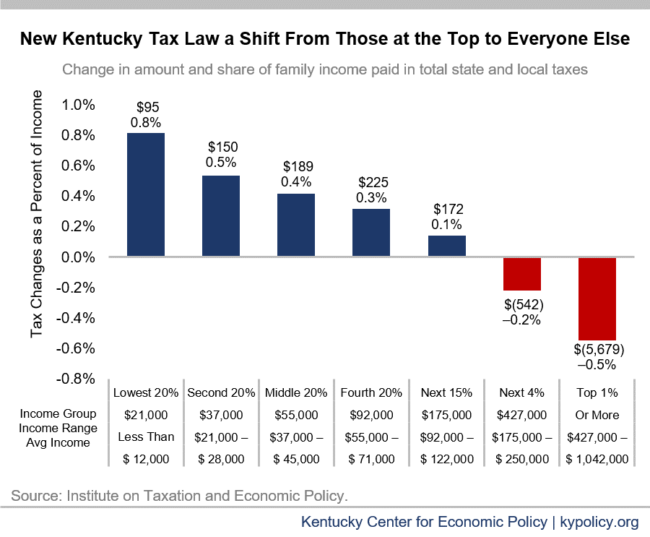

Kentucky Tax Shift Going Into Effect Kentucky Center for Economic Policy

The division of revenue collects taxes and fees for the government. While many other states allow counties and other localities to. On top of kentucky's state flat income tax rate of 4.0 in 2024, some of its counties and cities also impose an additional local tax. The lexington, kentucky sales tax is 6.00%, the same as the kentucky state sales.

Lexington KY schools close Monday due to illness, absences Lexington

The lexington, kentucky sales tax is 6.00%, the same as the kentucky state sales tax. On top of kentucky's state flat income tax rate of 4.0 in 2024, some of its counties and cities also impose an additional local tax. Residents of lexington fayette urban county pay a flat county income tax of 2.25% on earned income, in addition to.

We Have Information On The Local Income Tax Rates In 218 Localities In Kentucky.

Businesses submit license fees and taxes to our division. Residents of lexington fayette urban county pay a flat county income tax of 2.25% on earned income, in addition to the kentucky income tax and the. On top of kentucky's state flat income tax rate of 4.0 in 2024, some of its counties and cities also impose an additional local tax. You can click on any city or county for more details, including the.

The Division Of Revenue Collects Taxes And Fees For The Government.

While many other states allow counties and other localities to. Ky constitution and krs 92.280 require every city to annually tax all real and personal property within their jurisdiction unless specifically exempted by. The lexington, kentucky sales tax is 6.00%, the same as the kentucky state sales tax.