Does Paying Property Tax Give Ownership In Michigan

Does Paying Property Tax Give Ownership In Michigan - In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of the. Individual properties will have their property taxes evaluated by the municipality. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of. In michigan, property taxes are handled by each town or city. The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. Property tax uncapping occurs as a result of a change in ownership of a property. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. The sale “uncaps” the taxable value. In michigan, the taxable value can only increase by. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no.

In michigan, property taxes are handled by each town or city. Individual properties will have their property taxes evaluated by the municipality. The sale “uncaps” the taxable value. In michigan, the taxable value can only increase by. Property tax uncapping occurs as a result of a change in ownership of a property. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of the. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of. The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no.

Individual properties will have their property taxes evaluated by the municipality. In michigan, property taxes are handled by each town or city. Property tax uncapping occurs as a result of a change in ownership of a property. In michigan, the taxable value can only increase by. The sale “uncaps” the taxable value. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of the. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate.

Does Paying Property Tax Give Ownership? ThinkGlink

Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of. Property tax uncapping occurs as a result of a change in ownership of a property. In michigan, property taxes are handled by each town or city. Individual properties will have their property taxes evaluated by the.

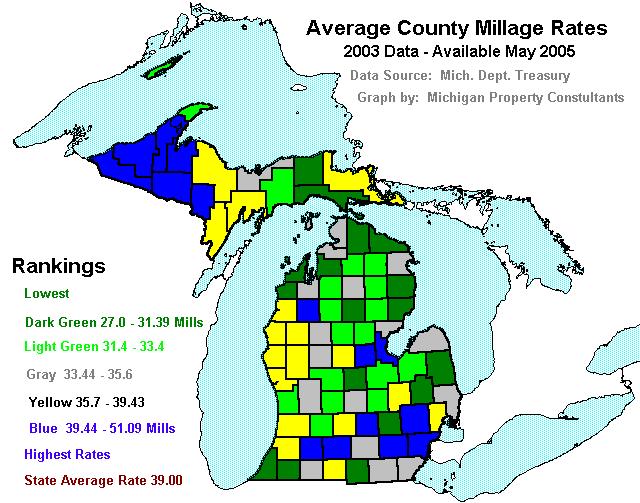

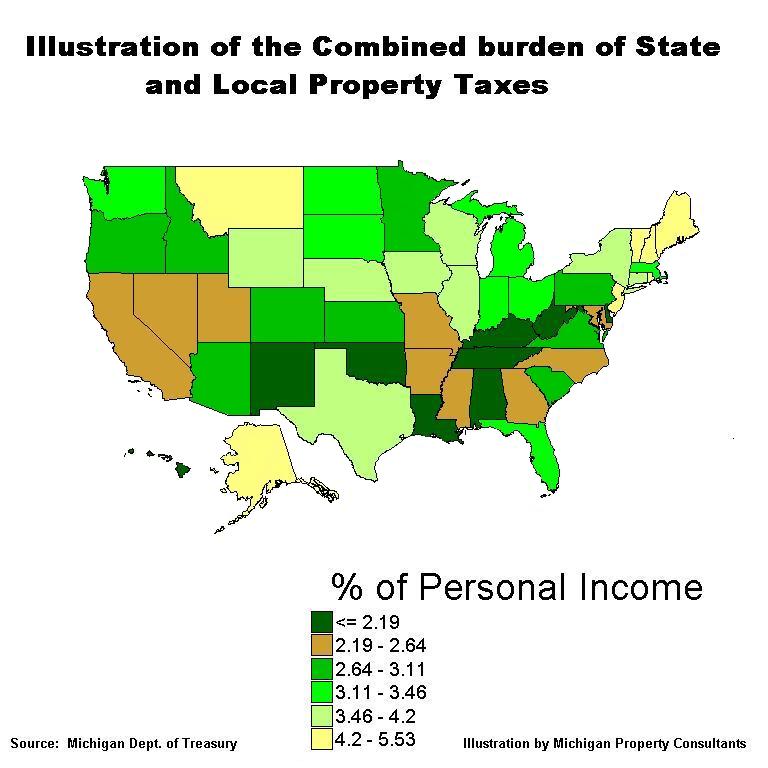

Michigan SEV Values, Tax Burdens and other Charts, Maps and Statistics

Property tax uncapping occurs as a result of a change in ownership of a property. The sale “uncaps” the taxable value. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. In michigan, the taxable value.

Does Paying Property Tax Give Ownership? ThinkGlink

The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. In michigan, property taxes are handled by each town or city. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest.

Michigan Property Tax

The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. In michigan, the taxable value can only increase by. The sale “uncaps” the taxable value. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. Property tax uncapping occurs as a result of a change in.

Michigan SEV Values, Tax Burdens and other Charts, Maps and Statistics

Individual properties will have their property taxes evaluated by the municipality. In michigan, property taxes are handled by each town or city. Property tax uncapping occurs as a result of a change in ownership of a property. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of.

Does Paying Property Tax Give Ownership? ThinkGlink

The sale “uncaps” the taxable value. The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. Property tax uncapping occurs as a result of a change in ownership of a property. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of.

Does Paying Property Tax Give Ownership? ThinkGlink

The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. Individual properties will have their property taxes evaluated by the municipality. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer.

17++ Does paying property tax give ownership in india information

In michigan, the taxable value can only increase by. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. In michigan, property taxes are handled by each town or city. Individual properties will have their property taxes evaluated by the municipality. In accordance with the michigan constitution as amended by proposal a of 1994,.

Does Paying Property Tax Give Ownership? ThinkGlink

The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. In michigan, the taxable value can only increase by. The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. Michigan.

Does Paying Property Tax Give Ownership In Florida? Eye And Pen

In michigan, property taxes are handled by each town or city. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of. The straightforward answer to whether paying someone else's property taxes gives you ownership of their property is no. Individual properties will have their property taxes.

The Straightforward Answer To Whether Paying Someone Else's Property Taxes Gives You Ownership Of Their Property Is No.

In michigan, property taxes are handled by each town or city. So, to answer the initial question, paying property tax in michigan does not automatically confer ownership. Property tax uncapping occurs as a result of a change in ownership of a property. Michigan statute defines “transfer of ownership” generally as the conveyance of title to or a present interest in property, including the beneficial use of.

Individual Properties Will Have Their Property Taxes Evaluated By The Municipality.

In michigan, the taxable value can only increase by. In accordance with the michigan constitution as amended by proposal a of 1994, a transfer of ownership will cause the taxable value of the. The owner pays property taxes in 2021 based on $80,000.00 multiplied by the local millage rate. The sale “uncaps” the taxable value.