Federal Tax Lien Database

Federal Tax Lien Database - Search by name, document number, or assessor’s parcel number (apn). You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. The government also may file a notice of. See sources to check your lien. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. It is also possible to search for a federal tax lien on your secretary.

See sources to check your lien. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. It is also possible to search for a federal tax lien on your secretary. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. Search by name, document number, or assessor’s parcel number (apn). If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. The government also may file a notice of.

See sources to check your lien. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. The government also may file a notice of. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. Search by name, document number, or assessor’s parcel number (apn). Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. It is also possible to search for a federal tax lien on your secretary. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill.

Federal Tax Lien Steps to Eliminate a Tax Lien Legal Tax Defense

You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. It is also possible to search for a federal tax lien on your secretary. Search by name, document number, or assessor’s parcel number (apn). See sources to check your lien. A federal tax lien arises.

Title Basics of the Federal Tax Lien SnapClose

Search by name, document number, or assessor’s parcel number (apn). Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. The government also may file a notice of. If.

State Tax Lien vs. Federal Tax Lien How to Remove Them

It is also possible to search for a federal tax lien on your secretary. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. Search by name, document number, or assessor’s parcel number (apn). If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien.

Federal Tax Lien Federal Tax Lien Payment

Search by name, document number, or assessor’s parcel number (apn). See sources to check your lien. The government also may file a notice of. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. You can search for a federal tax lien at the recorder's office in.

Federal Tax Lien Federal Tax Lien On Foreclosed Property

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. Search by name, document number, or assessor’s parcel number.

State Tax Lien vs. Federal Tax Lien How to Remove Them

Search by name, document number, or assessor’s parcel number (apn). The government also may file a notice of. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. It is also possible to search for a federal tax lien on your secretary. See sources to check your lien.

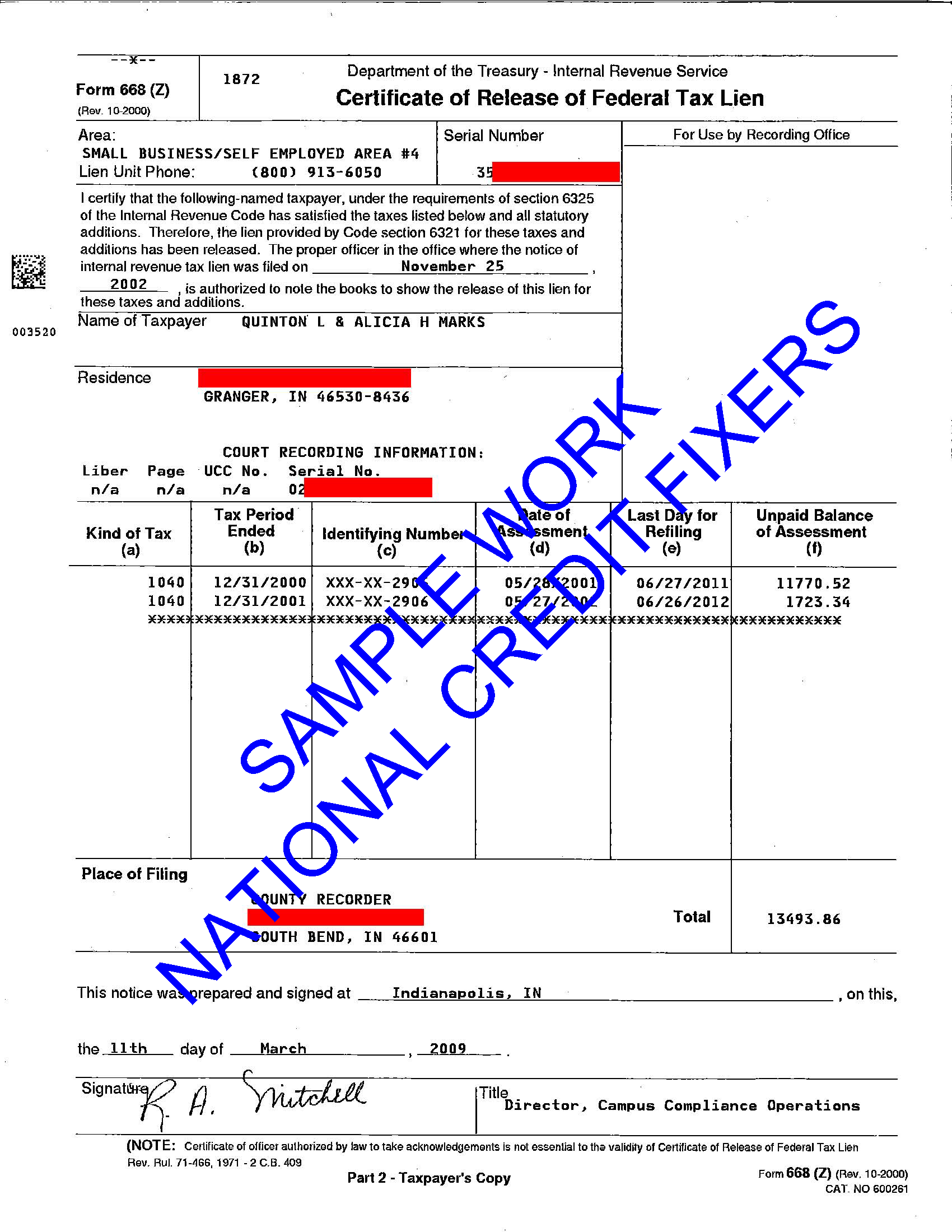

Understanding a Federal Tax Lien Release Traxion Tax

See sources to check your lien. It is also possible to search for a federal tax lien on your secretary. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can.

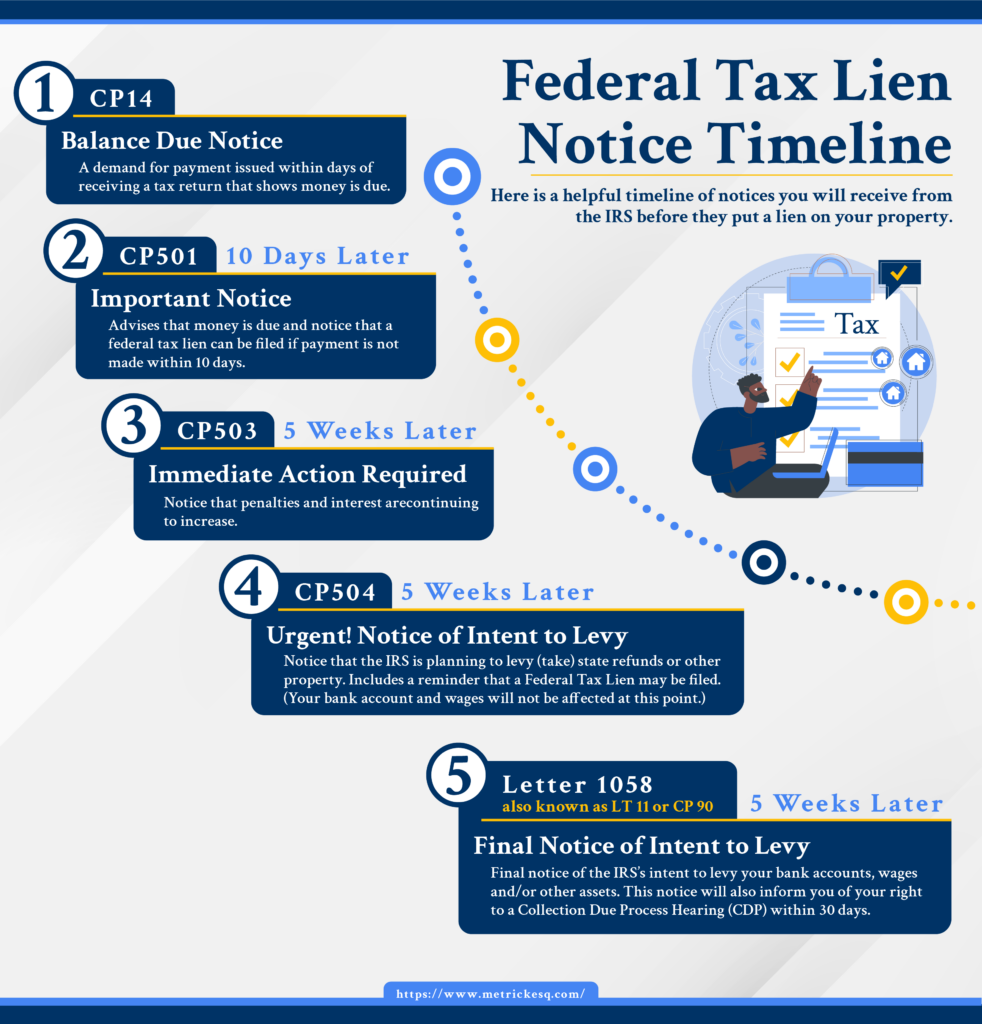

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. It is also possible to search for a federal tax lien on your secretary. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. See sources to.

Tax Lien Sale PDF Tax Lien Taxes

You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. See sources to check your lien. Search by name, document number, or assessor’s parcel number (apn). Learn.

Federal tax lien on foreclosed property laderdriver

The government also may file a notice of. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Search by name, document number, or assessor’s parcel number (apn). A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. If.

It Is Also Possible To Search For A Federal Tax Lien On Your Secretary.

Search by name, document number, or assessor’s parcel number (apn). You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. The government also may file a notice of.

If A Property Owner Fails To Pay Federal Taxes, The Irs Files A Notice Of Federal Tax Lien With The State Recorder's Office To Secure The Debt And.

See sources to check your lien. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill.