Florida State Tax Lien

Florida State Tax Lien - Enter a stipulated payment agreement. Florida's taxpayers' right advocate assists with protecting taxpayer rights by ensuring a taxpayer's privacy and assets are protected during tax. When florida property owners neglect to pay their property tax, a course of action is instigated by the county issuing a tax lien against the property. Pay the amount in full. This auction is called a tax lien sale. then, if. To resolve your tax liability, you must do one of the following: Once there's a tax lien on your home, the tax collector may sell that lien at an auction. A tax lien certificate, or tax certificate is not a purchase of property; Rather, it is a lien imposed on the property by payment of the delinquent taxes. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june.

Once there's a tax lien on your home, the tax collector may sell that lien at an auction. A tax lien certificate, or tax certificate is not a purchase of property; Florida's taxpayers' right advocate assists with protecting taxpayer rights by ensuring a taxpayer's privacy and assets are protected during tax. When florida property owners neglect to pay their property tax, a course of action is instigated by the county issuing a tax lien against the property. To resolve your tax liability, you must do one of the following: Pay the amount in full. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. Rather, it is a lien imposed on the property by payment of the delinquent taxes. Enter a stipulated payment agreement. This auction is called a tax lien sale. then, if.

Once there's a tax lien on your home, the tax collector may sell that lien at an auction. To resolve your tax liability, you must do one of the following: A tax lien certificate, or tax certificate is not a purchase of property; Florida's taxpayers' right advocate assists with protecting taxpayer rights by ensuring a taxpayer's privacy and assets are protected during tax. When florida property owners neglect to pay their property tax, a course of action is instigated by the county issuing a tax lien against the property. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. Enter a stipulated payment agreement. This auction is called a tax lien sale. then, if. Pay the amount in full. Rather, it is a lien imposed on the property by payment of the delinquent taxes.

Tax Lien Mailing List Spectrum Mailing Lists

When florida property owners neglect to pay their property tax, a course of action is instigated by the county issuing a tax lien against the property. Pay the amount in full. Rather, it is a lien imposed on the property by payment of the delinquent taxes. Florida's taxpayers' right advocate assists with protecting taxpayer rights by ensuring a taxpayer's privacy.

Florida County Held Tax Lien Certificates Tax Lien Foreclosure

In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. Pay the amount in full. When florida property owners neglect to pay their property tax, a course of action is instigated by the county issuing a tax lien against the property. Enter a stipulated payment agreement. To resolve your.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

A tax lien certificate, or tax certificate is not a purchase of property; Pay the amount in full. Rather, it is a lien imposed on the property by payment of the delinquent taxes. When florida property owners neglect to pay their property tax, a course of action is instigated by the county issuing a tax lien against the property. To.

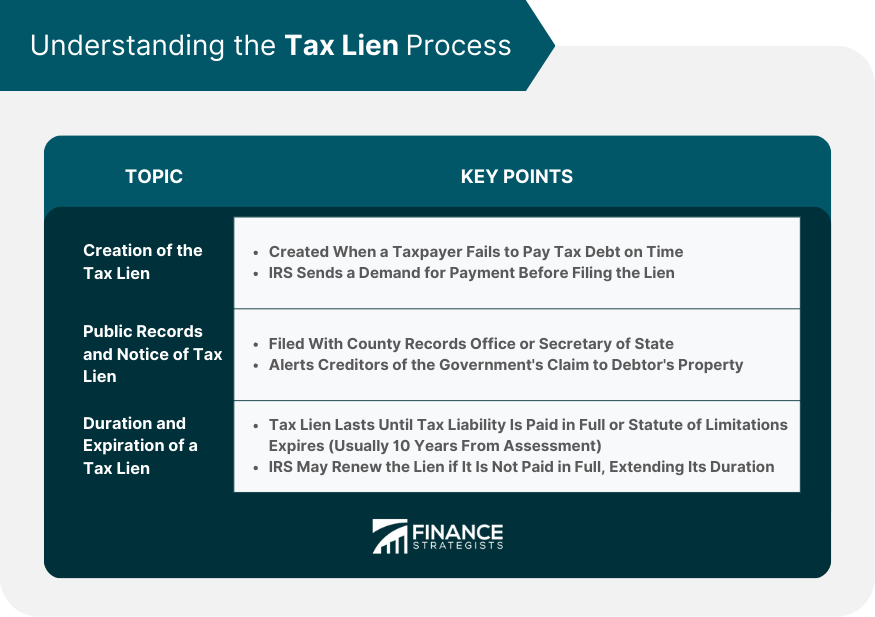

Tax Lien Definition, Process, Consequences, How to Handle

To resolve your tax liability, you must do one of the following: Florida's taxpayers' right advocate assists with protecting taxpayer rights by ensuring a taxpayer's privacy and assets are protected during tax. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. When florida property owners neglect to pay.

EasytoUnderstand Tax Lien Code Certificates Posteezy

Pay the amount in full. Enter a stipulated payment agreement. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. Florida's taxpayers' right advocate assists with protecting taxpayer rights by ensuring a taxpayer's privacy and assets are protected during tax. To resolve your tax liability, you must do one.

State Tax Lien vs. Federal Tax Lien How to Remove Them

Enter a stipulated payment agreement. To resolve your tax liability, you must do one of the following: Pay the amount in full. Rather, it is a lien imposed on the property by payment of the delinquent taxes. This auction is called a tax lien sale. then, if.

Property Tax Lien Certificates Florida PRORFETY

Pay the amount in full. A tax lien certificate, or tax certificate is not a purchase of property; To resolve your tax liability, you must do one of the following: Florida's taxpayers' right advocate assists with protecting taxpayer rights by ensuring a taxpayer's privacy and assets are protected during tax. When florida property owners neglect to pay their property tax,.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

Pay the amount in full. When florida property owners neglect to pay their property tax, a course of action is instigated by the county issuing a tax lien against the property. Enter a stipulated payment agreement. A tax lien certificate, or tax certificate is not a purchase of property; To resolve your tax liability, you must do one of the.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

Once there's a tax lien on your home, the tax collector may sell that lien at an auction. Florida's taxpayers' right advocate assists with protecting taxpayer rights by ensuring a taxpayer's privacy and assets are protected during tax. Pay the amount in full. Enter a stipulated payment agreement. Rather, it is a lien imposed on the property by payment of.

Tax Lien Sale PDF Tax Lien Taxes

Florida's taxpayers' right advocate assists with protecting taxpayer rights by ensuring a taxpayer's privacy and assets are protected during tax. To resolve your tax liability, you must do one of the following: In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. Rather, it is a lien imposed on.

A Tax Lien Certificate, Or Tax Certificate Is Not A Purchase Of Property;

To resolve your tax liability, you must do one of the following: This auction is called a tax lien sale. then, if. In florida, acquiring a tax lien begins with the annual tax certificate sale, typically held in late may or early june. Enter a stipulated payment agreement.

Pay The Amount In Full.

When florida property owners neglect to pay their property tax, a course of action is instigated by the county issuing a tax lien against the property. Rather, it is a lien imposed on the property by payment of the delinquent taxes. Florida's taxpayers' right advocate assists with protecting taxpayer rights by ensuring a taxpayer's privacy and assets are protected during tax. Once there's a tax lien on your home, the tax collector may sell that lien at an auction.