Foreclosure And Tax Liens

Foreclosure And Tax Liens - A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other being a. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. Understanding the priority of claims between tax liens and mortgage liens is crucial in the event of a foreclosure. The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how they lead to foreclosure. In such cases, the government.

In such cases, the government. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other being a. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how they lead to foreclosure. Understanding the priority of claims between tax liens and mortgage liens is crucial in the event of a foreclosure.

Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. Understanding the priority of claims between tax liens and mortgage liens is crucial in the event of a foreclosure. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other being a. The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how they lead to foreclosure. In such cases, the government.

Foreclosure of Association’s Assessment Lien and Tax Liens HOA Lawyer

Understanding the priority of claims between tax liens and mortgage liens is crucial in the event of a foreclosure. In such cases, the government. The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how they lead to foreclosure. Tax lien foreclosure is a legal process that occurs when a property owner fails to.

Tax Liens An Overview CheckBook IRA LLC

The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how they lead to foreclosure. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other.

How Do I Investigate Foreclosure Liens?

The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how they lead to foreclosure. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other being a. In such cases, the government. Tax lien foreclosure is a legal process that occurs when a property.

Do missouri state tax liens survive foreclosure lknmgift

The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how they lead to foreclosure. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other.

Tax Lien Foreclosure Attorney In Ohio?

The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how they lead to foreclosure. Understanding the priority of claims between tax liens and mortgage liens is crucial in the event of a foreclosure. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other.

Judgment Liens and Foreclosure The Fullman Firm

Understanding the priority of claims between tax liens and mortgage liens is crucial in the event of a foreclosure. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other being a. The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how they lead.

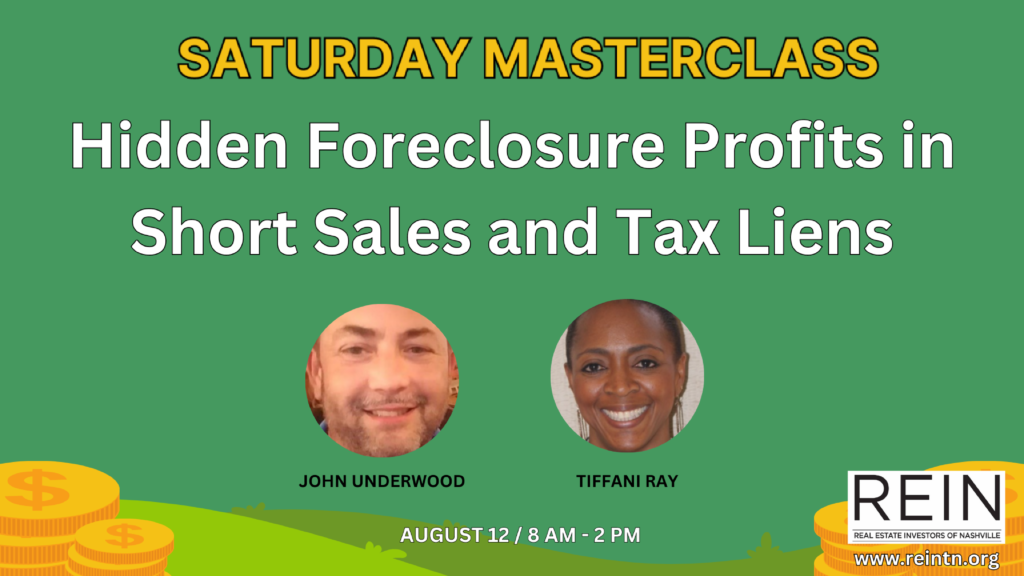

AllDay Online Intensive Hidden Foreclosure Profits in Short Sales and

Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other being a. In such cases, the government. The auction process for tax lien foreclosures is a critical aspect of understanding tax.

Investing In Tax Liens Alts.co

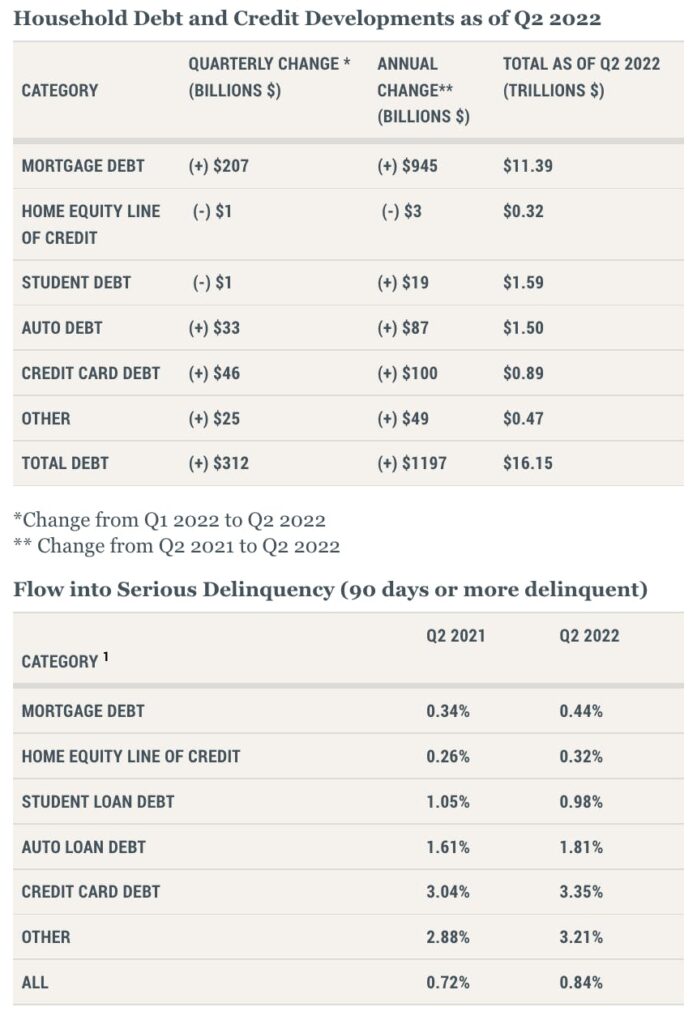

The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how they lead to foreclosure. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. Understanding the priority of claims between tax liens and mortgage liens is crucial in the event of a foreclosure. In.

Protect Your Home From Tax Liens and Foreclosure in Texas

Understanding the priority of claims between tax liens and mortgage liens is crucial in the event of a foreclosure. In such cases, the government. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how.

What is a property Tax Lien? Real Estate Articles by

Understanding the priority of claims between tax liens and mortgage liens is crucial in the event of a foreclosure. Tax lien foreclosure is a legal process that occurs when a property owner fails to pay their property taxes. In such cases, the government. The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how.

Tax Lien Foreclosure Is A Legal Process That Occurs When A Property Owner Fails To Pay Their Property Taxes.

A tax lien foreclosure is one of two methods employed by government authorities to tackle delinquent property taxes, the other being a. Understanding the priority of claims between tax liens and mortgage liens is crucial in the event of a foreclosure. In such cases, the government. The auction process for tax lien foreclosures is a critical aspect of understanding tax liens and how they lead to foreclosure.