Judicial Vs Nonjudicial Foreclosure

Judicial Vs Nonjudicial Foreclosure - In others, it can foreclose without going through the court system, using a nonjudicial foreclosure. In some states, foreclosures are exclusively judicial. Foreclosure works differently in different states. Depending on your state’s laws and the terms of your mortgage, your lender may have the option to pursue a nonjudicial foreclosure or a judicial foreclosure. In others, the lender can proceed using either a judicial or nonjudicial process. In some states, the lender will use a judicial procedure. In states where home loans are secured by a mortgage, the process tends to take the judicial route, whereas states where they are secured by a deed of trust follow a nonjudicial process. A judicial foreclosure involves the court. A judicial sale is the result of a lawsuit and a court order, while a nonjudicial sale. In these states, lenders usually select the nonjudicial process because it's faster and cheaper than.

In states where home loans are secured by a mortgage, the process tends to take the judicial route, whereas states where they are secured by a deed of trust follow a nonjudicial process. Foreclosure works differently in different states. In some states, the lender will use a judicial procedure. A judicial sale is the result of a lawsuit and a court order, while a nonjudicial sale. Depending on your state’s laws and the terms of your mortgage, your lender may have the option to pursue a nonjudicial foreclosure or a judicial foreclosure. In others, the lender can proceed using either a judicial or nonjudicial process. In others, it can foreclose without going through the court system, using a nonjudicial foreclosure. In these states, lenders usually select the nonjudicial process because it's faster and cheaper than. In some states, foreclosures are exclusively judicial. A judicial foreclosure involves the court.

Depending on your state’s laws and the terms of your mortgage, your lender may have the option to pursue a nonjudicial foreclosure or a judicial foreclosure. In others, it can foreclose without going through the court system, using a nonjudicial foreclosure. In some states, the lender will use a judicial procedure. A judicial sale is the result of a lawsuit and a court order, while a nonjudicial sale. A judicial foreclosure involves the court. In states where home loans are secured by a mortgage, the process tends to take the judicial route, whereas states where they are secured by a deed of trust follow a nonjudicial process. In some states, foreclosures are exclusively judicial. In others, the lender can proceed using either a judicial or nonjudicial process. In these states, lenders usually select the nonjudicial process because it's faster and cheaper than. Foreclosure works differently in different states.

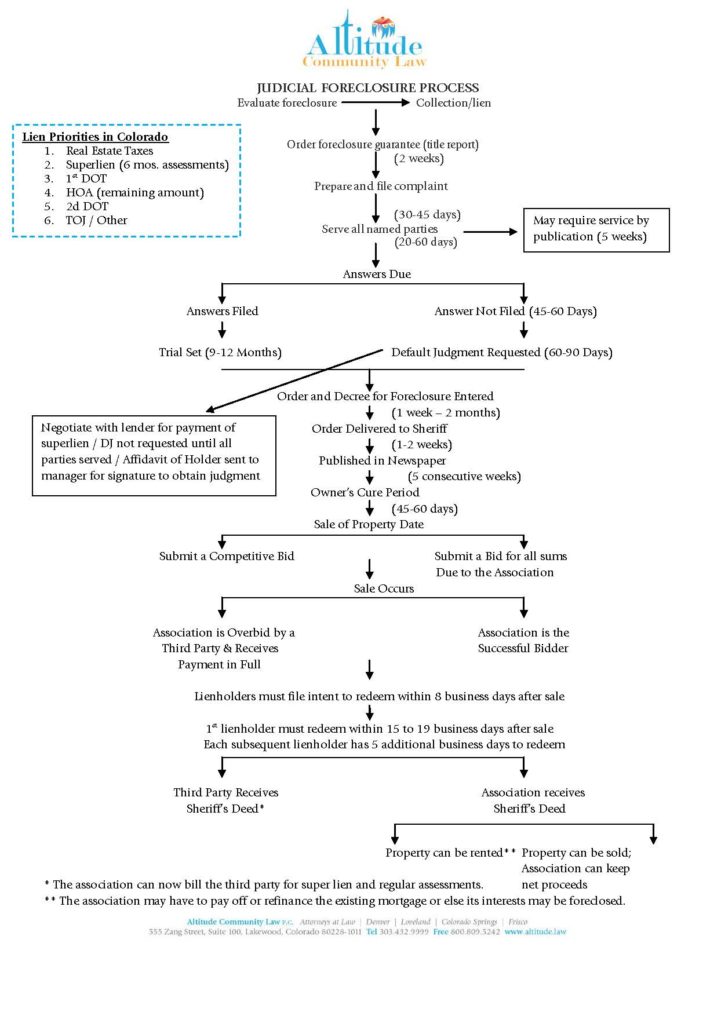

Judicial Foreclosure Flowchart

A judicial sale is the result of a lawsuit and a court order, while a nonjudicial sale. In states where home loans are secured by a mortgage, the process tends to take the judicial route, whereas states where they are secured by a deed of trust follow a nonjudicial process. In some states, the lender will use a judicial procedure..

What's the Difference Between Judicial and NonJudicial Foreclosure?

A judicial sale is the result of a lawsuit and a court order, while a nonjudicial sale. In some states, foreclosures are exclusively judicial. Depending on your state’s laws and the terms of your mortgage, your lender may have the option to pursue a nonjudicial foreclosure or a judicial foreclosure. In these states, lenders usually select the nonjudicial process because.

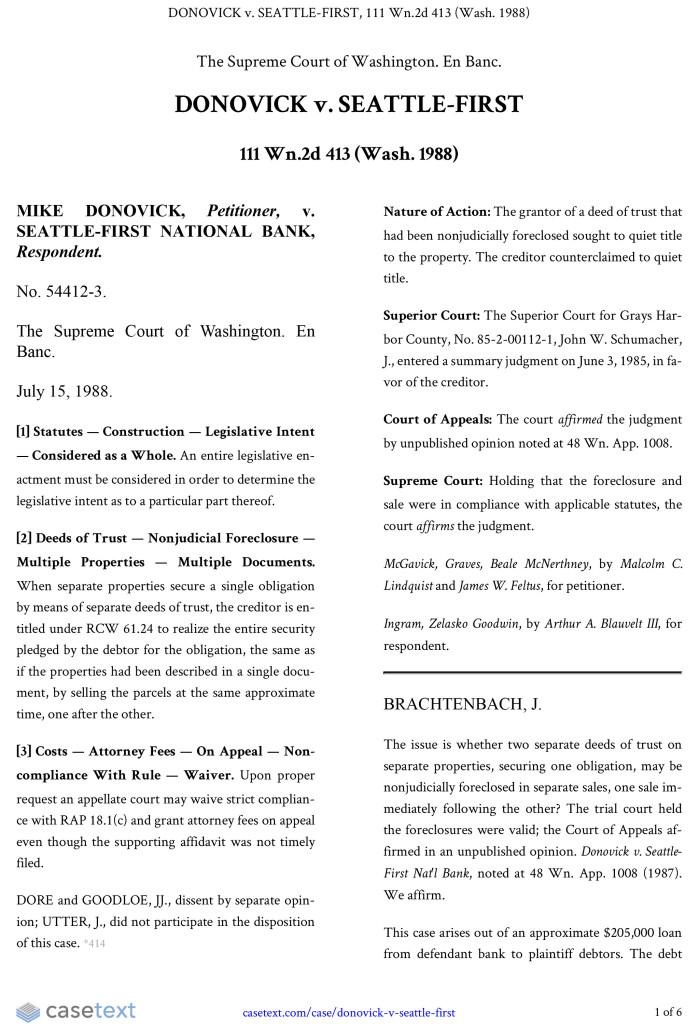

The GREAT DIVIDE . . . Judicial vs. NonJudicial Foreclosure, PART I

A judicial sale is the result of a lawsuit and a court order, while a nonjudicial sale. In these states, lenders usually select the nonjudicial process because it's faster and cheaper than. Foreclosure works differently in different states. In others, it can foreclose without going through the court system, using a nonjudicial foreclosure. In some states, the lender will use.

Judicial Vs NonJudicial Foreclosure Steve Novak

In others, the lender can proceed using either a judicial or nonjudicial process. Depending on your state’s laws and the terms of your mortgage, your lender may have the option to pursue a nonjudicial foreclosure or a judicial foreclosure. In others, it can foreclose without going through the court system, using a nonjudicial foreclosure. Foreclosure works differently in different states..

"Judicial Vs. Nonjudicial Foreclosure" Key Differences Explained

A judicial foreclosure involves the court. Foreclosure works differently in different states. In states where home loans are secured by a mortgage, the process tends to take the judicial route, whereas states where they are secured by a deed of trust follow a nonjudicial process. In others, the lender can proceed using either a judicial or nonjudicial process. In some.

What's the Difference Between Judicial and NonJudicial Foreclosure?

In some states, foreclosures are exclusively judicial. In others, it can foreclose without going through the court system, using a nonjudicial foreclosure. In others, the lender can proceed using either a judicial or nonjudicial process. In these states, lenders usually select the nonjudicial process because it's faster and cheaper than. A judicial foreclosure involves the court.

How States Can Help Police Mortgagelending Practices Knowledge at

In these states, lenders usually select the nonjudicial process because it's faster and cheaper than. In some states, foreclosures are exclusively judicial. Foreclosure works differently in different states. A judicial sale is the result of a lawsuit and a court order, while a nonjudicial sale. Depending on your state’s laws and the terms of your mortgage, your lender may have.

Judicial Foreclosure Process Flowchart Altitude Community Law

Foreclosure works differently in different states. In states where home loans are secured by a mortgage, the process tends to take the judicial route, whereas states where they are secured by a deed of trust follow a nonjudicial process. A judicial foreclosure involves the court. In some states, foreclosures are exclusively judicial. In others, it can foreclose without going through.

"Judicial Vs. Nonjudicial Foreclosure" Key Differences Explained

A judicial sale is the result of a lawsuit and a court order, while a nonjudicial sale. Foreclosure works differently in different states. In others, the lender can proceed using either a judicial or nonjudicial process. In some states, the lender will use a judicial procedure. A judicial foreclosure involves the court.

Extra Judicial Foreclosure As Amended PDF Foreclosure Mortgage Law

A judicial foreclosure involves the court. In states where home loans are secured by a mortgage, the process tends to take the judicial route, whereas states where they are secured by a deed of trust follow a nonjudicial process. In others, the lender can proceed using either a judicial or nonjudicial process. In these states, lenders usually select the nonjudicial.

A Judicial Foreclosure Involves The Court.

In some states, the lender will use a judicial procedure. Depending on your state’s laws and the terms of your mortgage, your lender may have the option to pursue a nonjudicial foreclosure or a judicial foreclosure. Foreclosure works differently in different states. In others, the lender can proceed using either a judicial or nonjudicial process.

In Others, It Can Foreclose Without Going Through The Court System, Using A Nonjudicial Foreclosure.

In some states, foreclosures are exclusively judicial. A judicial sale is the result of a lawsuit and a court order, while a nonjudicial sale. In states where home loans are secured by a mortgage, the process tends to take the judicial route, whereas states where they are secured by a deed of trust follow a nonjudicial process. In these states, lenders usually select the nonjudicial process because it's faster and cheaper than.