Kentucky Local Income Tax Withholding

Kentucky Local Income Tax Withholding - We have information on the local income tax rates in 218 localities in kentucky. You can click on any city or county for more details, including the. Divide the annual kentucky city income tax withholding calculated in step 2 by the number of pay dates in the tax year to obtain. To determine the annual kentucky county income tax withholding, multiply the gross annual wages by the appropriate county income. The income tax withholding for boone county and kenton county, kentucky, includes the following changes:

The income tax withholding for boone county and kenton county, kentucky, includes the following changes: Divide the annual kentucky city income tax withholding calculated in step 2 by the number of pay dates in the tax year to obtain. You can click on any city or county for more details, including the. We have information on the local income tax rates in 218 localities in kentucky. To determine the annual kentucky county income tax withholding, multiply the gross annual wages by the appropriate county income.

You can click on any city or county for more details, including the. We have information on the local income tax rates in 218 localities in kentucky. Divide the annual kentucky city income tax withholding calculated in step 2 by the number of pay dates in the tax year to obtain. The income tax withholding for boone county and kenton county, kentucky, includes the following changes: To determine the annual kentucky county income tax withholding, multiply the gross annual wages by the appropriate county income.

Kentucky tax one step closer to being eliminated WBONTV Local

Divide the annual kentucky city income tax withholding calculated in step 2 by the number of pay dates in the tax year to obtain. The income tax withholding for boone county and kenton county, kentucky, includes the following changes: You can click on any city or county for more details, including the. To determine the annual kentucky county income tax.

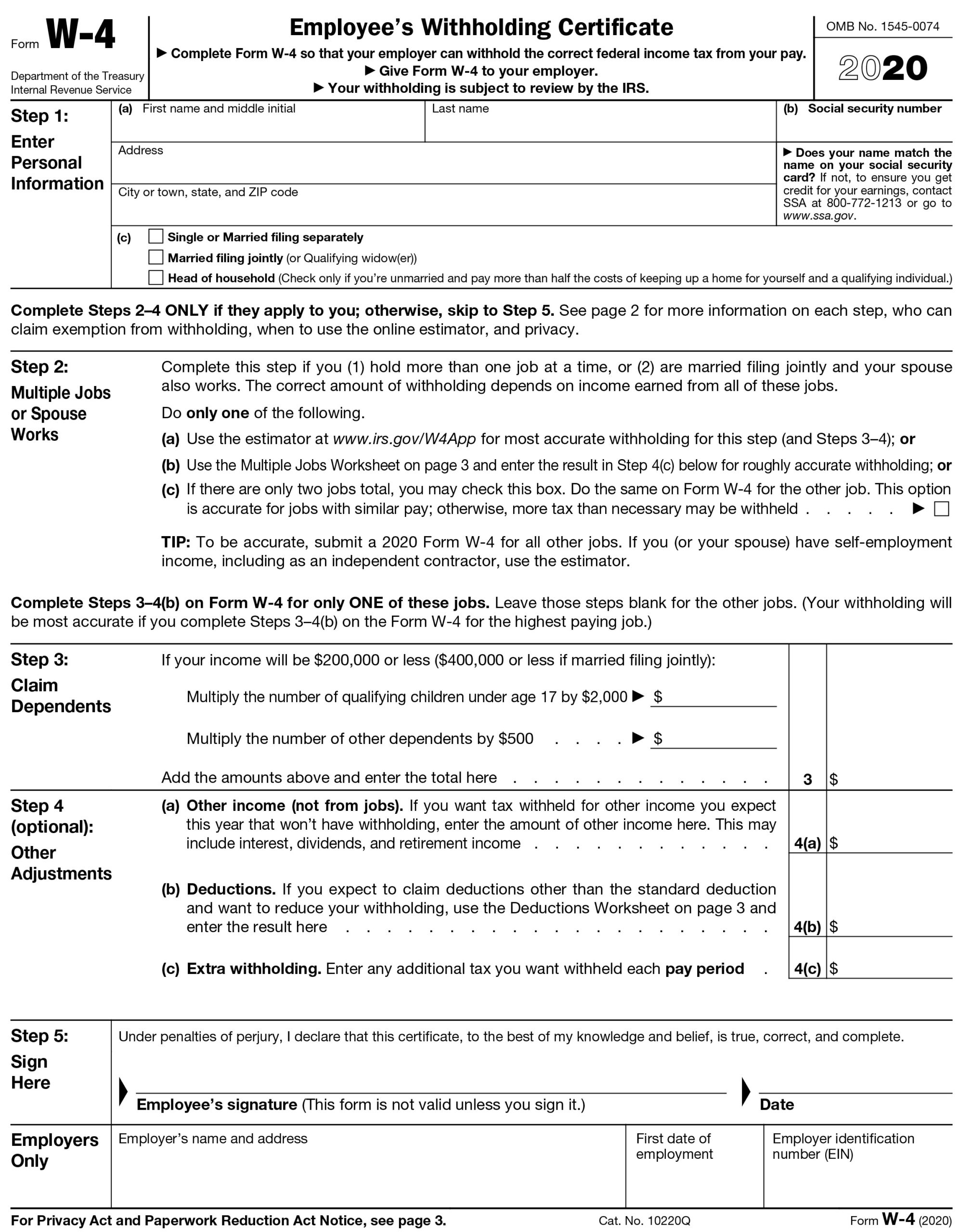

Kentucky Employee Withholding Form 2022

The income tax withholding for boone county and kenton county, kentucky, includes the following changes: We have information on the local income tax rates in 218 localities in kentucky. To determine the annual kentucky county income tax withholding, multiply the gross annual wages by the appropriate county income. Divide the annual kentucky city income tax withholding calculated in step 2.

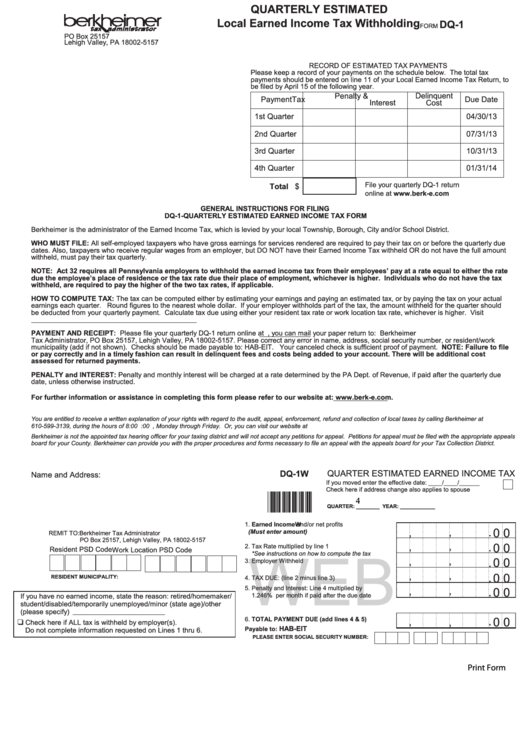

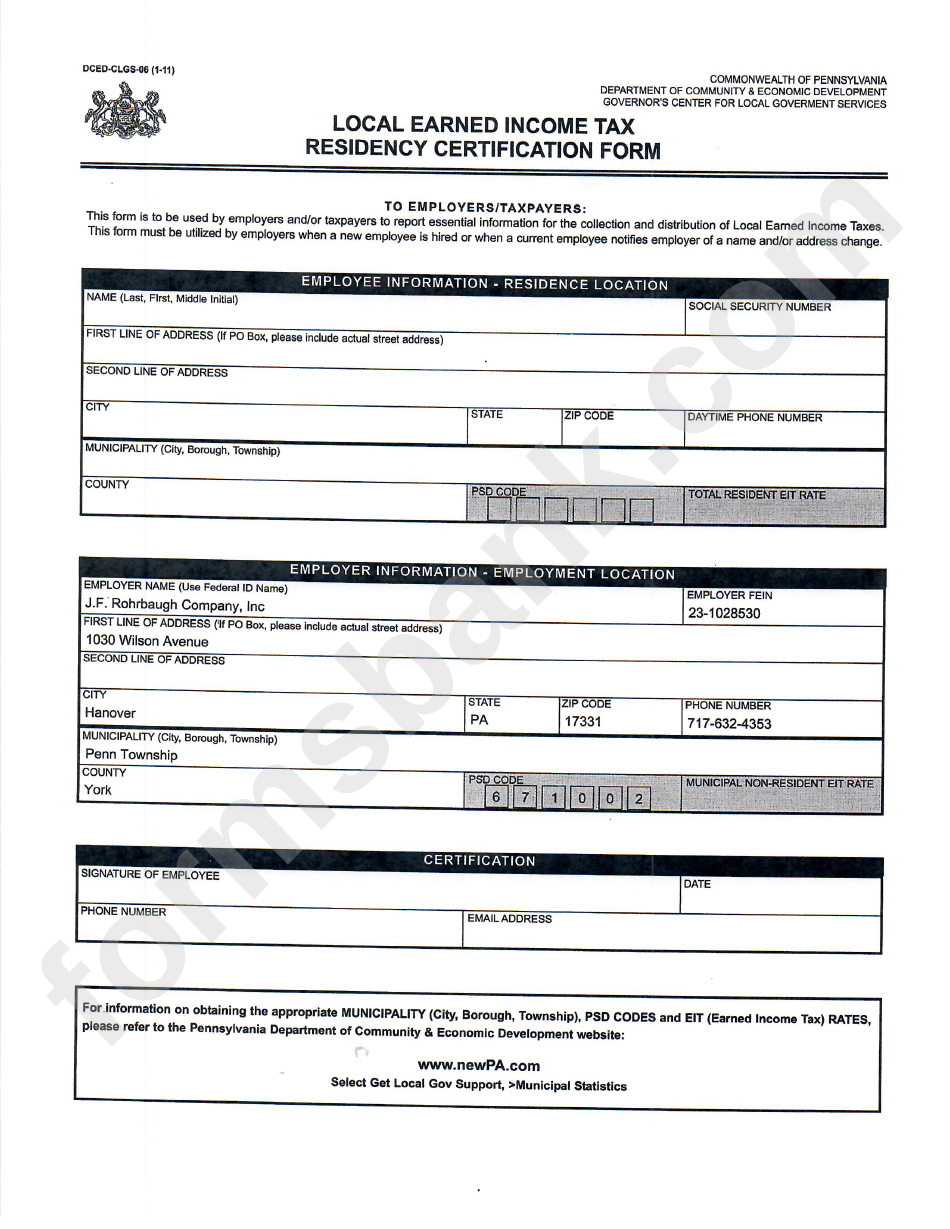

Pennsylvania Local Earned Tax Withholding Form

To determine the annual kentucky county income tax withholding, multiply the gross annual wages by the appropriate county income. The income tax withholding for boone county and kenton county, kentucky, includes the following changes: Divide the annual kentucky city income tax withholding calculated in step 2 by the number of pay dates in the tax year to obtain. We have.

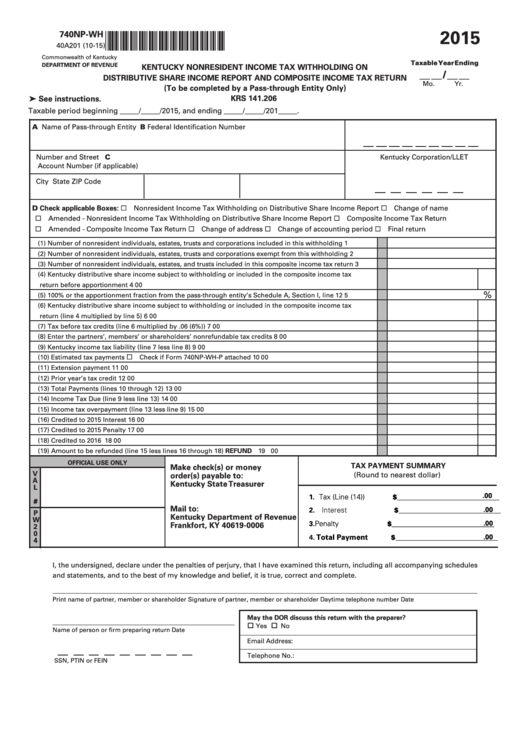

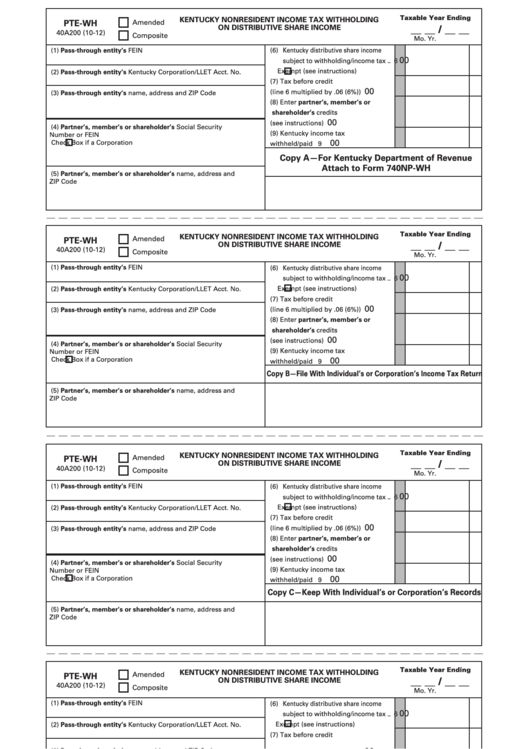

Form 740npWh Kentucky Nonresident Tax Withholding On

We have information on the local income tax rates in 218 localities in kentucky. The income tax withholding for boone county and kenton county, kentucky, includes the following changes: You can click on any city or county for more details, including the. To determine the annual kentucky county income tax withholding, multiply the gross annual wages by the appropriate county.

Kentucky Enacts Personal Tax Rate Reduction Harding, Shymanski

To determine the annual kentucky county income tax withholding, multiply the gross annual wages by the appropriate county income. You can click on any city or county for more details, including the. The income tax withholding for boone county and kenton county, kentucky, includes the following changes: We have information on the local income tax rates in 218 localities in.

Tax Withholding Tables 2024 Cammy Jordain

To determine the annual kentucky county income tax withholding, multiply the gross annual wages by the appropriate county income. We have information on the local income tax rates in 218 localities in kentucky. The income tax withholding for boone county and kenton county, kentucky, includes the following changes: Divide the annual kentucky city income tax withholding calculated in step 2.

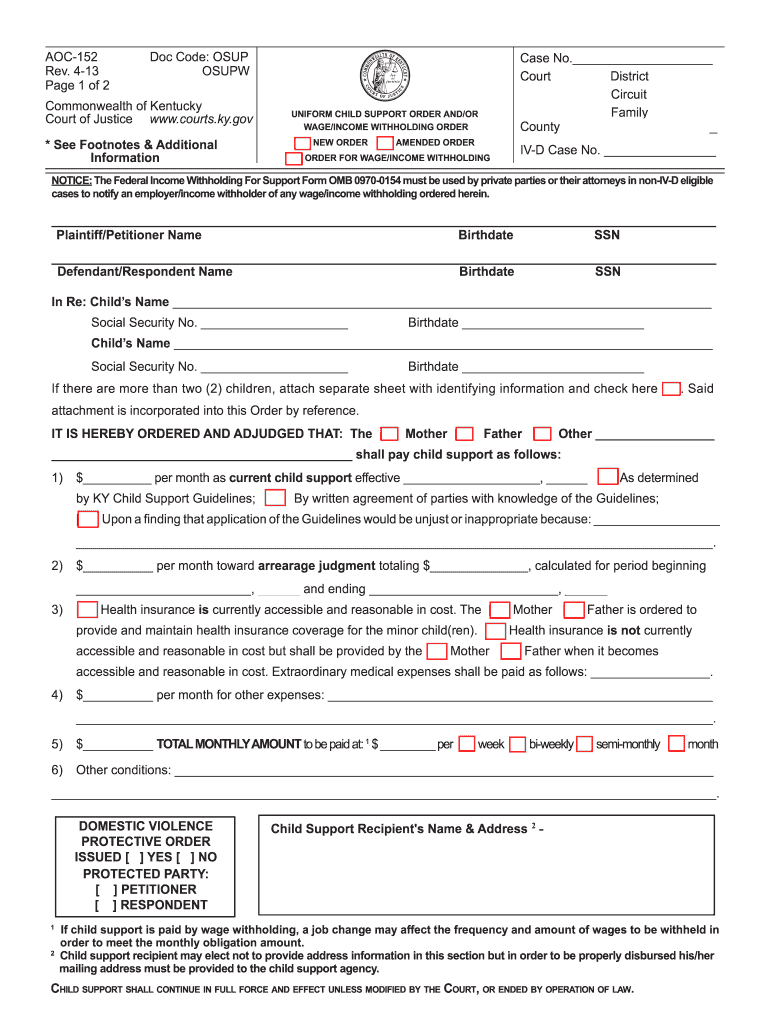

Kentucky Withholding Tax Registration Form

We have information on the local income tax rates in 218 localities in kentucky. Divide the annual kentucky city income tax withholding calculated in step 2 by the number of pay dates in the tax year to obtain. To determine the annual kentucky county income tax withholding, multiply the gross annual wages by the appropriate county income. You can click.

Fillable Local Earned Tax Form Pa Printable Forms Free Online

The income tax withholding for boone county and kenton county, kentucky, includes the following changes: We have information on the local income tax rates in 218 localities in kentucky. You can click on any city or county for more details, including the. Divide the annual kentucky city income tax withholding calculated in step 2 by the number of pay dates.

Kentucky Tax Calculator 2024 2025

We have information on the local income tax rates in 218 localities in kentucky. To determine the annual kentucky county income tax withholding, multiply the gross annual wages by the appropriate county income. You can click on any city or county for more details, including the. The income tax withholding for boone county and kenton county, kentucky, includes the following.

Form PteWh Kentucky Nonresident Tax Withholding On

You can click on any city or county for more details, including the. The income tax withholding for boone county and kenton county, kentucky, includes the following changes: Divide the annual kentucky city income tax withholding calculated in step 2 by the number of pay dates in the tax year to obtain. To determine the annual kentucky county income tax.

The Income Tax Withholding For Boone County And Kenton County, Kentucky, Includes The Following Changes:

You can click on any city or county for more details, including the. Divide the annual kentucky city income tax withholding calculated in step 2 by the number of pay dates in the tax year to obtain. We have information on the local income tax rates in 218 localities in kentucky. To determine the annual kentucky county income tax withholding, multiply the gross annual wages by the appropriate county income.