Kentucky Property Lien Laws

Kentucky Property Lien Laws - An attorney's lien is levied against a property for unpaid legal fees. A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. A lien is a legal claim. Understanding the legal framework surrounding property liens in kentucky is essential for property owners. Kentucky law recognizes 23 different types of liens. .005 personal judgment in action to enforce. For general laws governing construction of statutes, see krs chapter 446. For general laws governing construction of statutes, see krs chapter 446.

Kentucky law recognizes 23 different types of liens. A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. .005 personal judgment in action to enforce. For general laws governing construction of statutes, see krs chapter 446. A lien is a legal claim. An attorney's lien is levied against a property for unpaid legal fees. Understanding the legal framework surrounding property liens in kentucky is essential for property owners. For general laws governing construction of statutes, see krs chapter 446.

For general laws governing construction of statutes, see krs chapter 446. An attorney's lien is levied against a property for unpaid legal fees. A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. Understanding the legal framework surrounding property liens in kentucky is essential for property owners. For general laws governing construction of statutes, see krs chapter 446. .005 personal judgment in action to enforce. A lien is a legal claim. Kentucky law recognizes 23 different types of liens.

Is It Bad To Have A Lien On Your Property? NeededInTheHome

Understanding the legal framework surrounding property liens in kentucky is essential for property owners. An attorney's lien is levied against a property for unpaid legal fees. A lien is a legal claim. Kentucky law recognizes 23 different types of liens. .005 personal judgment in action to enforce.

Property Lien Facts Law Offices of Mark Weinstein, PC

Understanding the legal framework surrounding property liens in kentucky is essential for property owners. For general laws governing construction of statutes, see krs chapter 446. .005 personal judgment in action to enforce. Kentucky law recognizes 23 different types of liens. A lien is a legal claim.

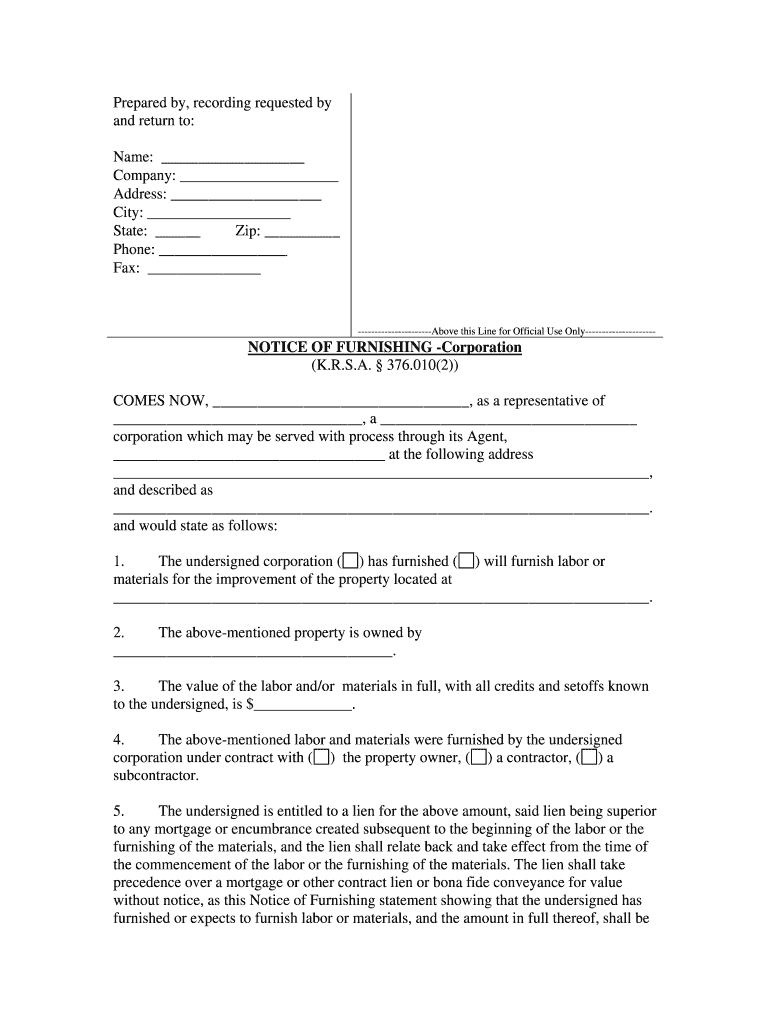

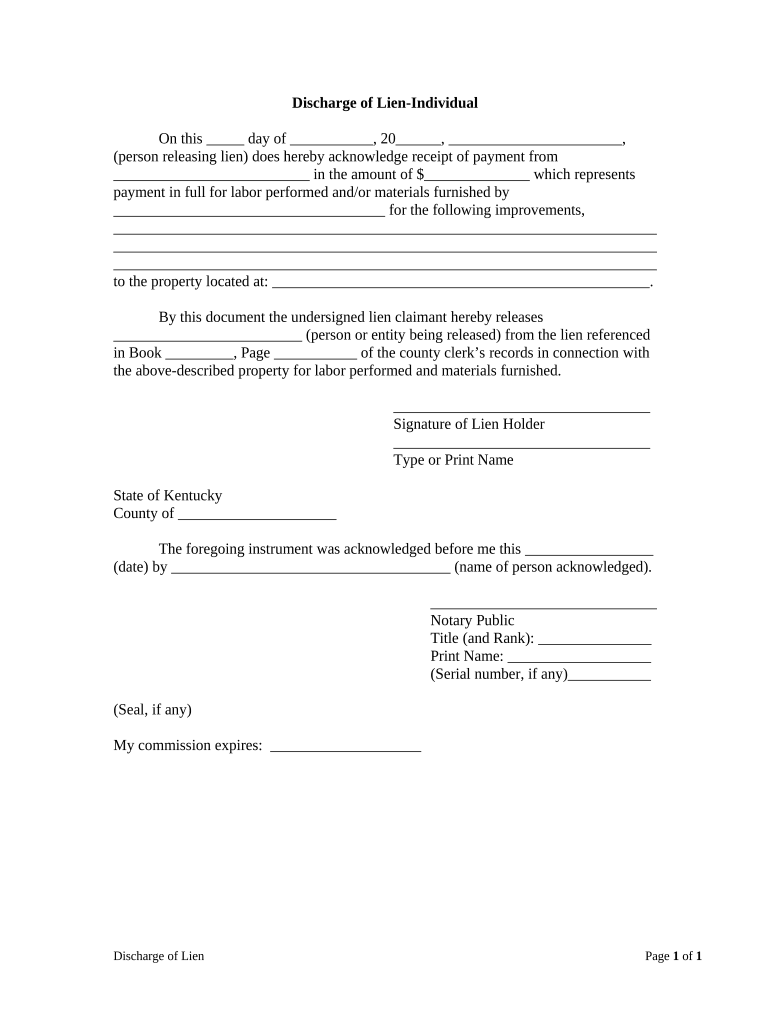

Lien Samples Kentucky Fill and Sign Printable Template Online US

A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. Understanding the legal framework surrounding property liens in kentucky is essential for property owners. A lien is a legal claim. For general laws governing construction of statutes, see krs chapter 446. For.

Kentucky mechanics lien form Fill out & sign online DocHub

An attorney's lien is levied against a property for unpaid legal fees. A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. For general laws governing construction of statutes, see krs chapter 446. .005 personal judgment in action to enforce. Kentucky law.

Fillable Online Title Lien Release Form Kentucky. Title Lien Release

A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. For general laws governing construction of statutes, see krs chapter 446. Kentucky law recognizes 23 different types of liens. Understanding the legal framework surrounding property liens in kentucky is essential for property.

What are the recent changes to the Texas property lien laws? Texas

An attorney's lien is levied against a property for unpaid legal fees. A lien is a legal claim. For general laws governing construction of statutes, see krs chapter 446. For general laws governing construction of statutes, see krs chapter 446. .005 personal judgment in action to enforce.

Kentucky Construction or Mechanics Lien Package Individual Kentucky

For general laws governing construction of statutes, see krs chapter 446. A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and. A lien is a legal claim. An attorney's lien is levied against a property for unpaid legal fees. Kentucky law recognizes.

kentucky lien Doc Template pdfFiller

An attorney's lien is levied against a property for unpaid legal fees. Understanding the legal framework surrounding property liens in kentucky is essential for property owners. For general laws governing construction of statutes, see krs chapter 446. A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time.

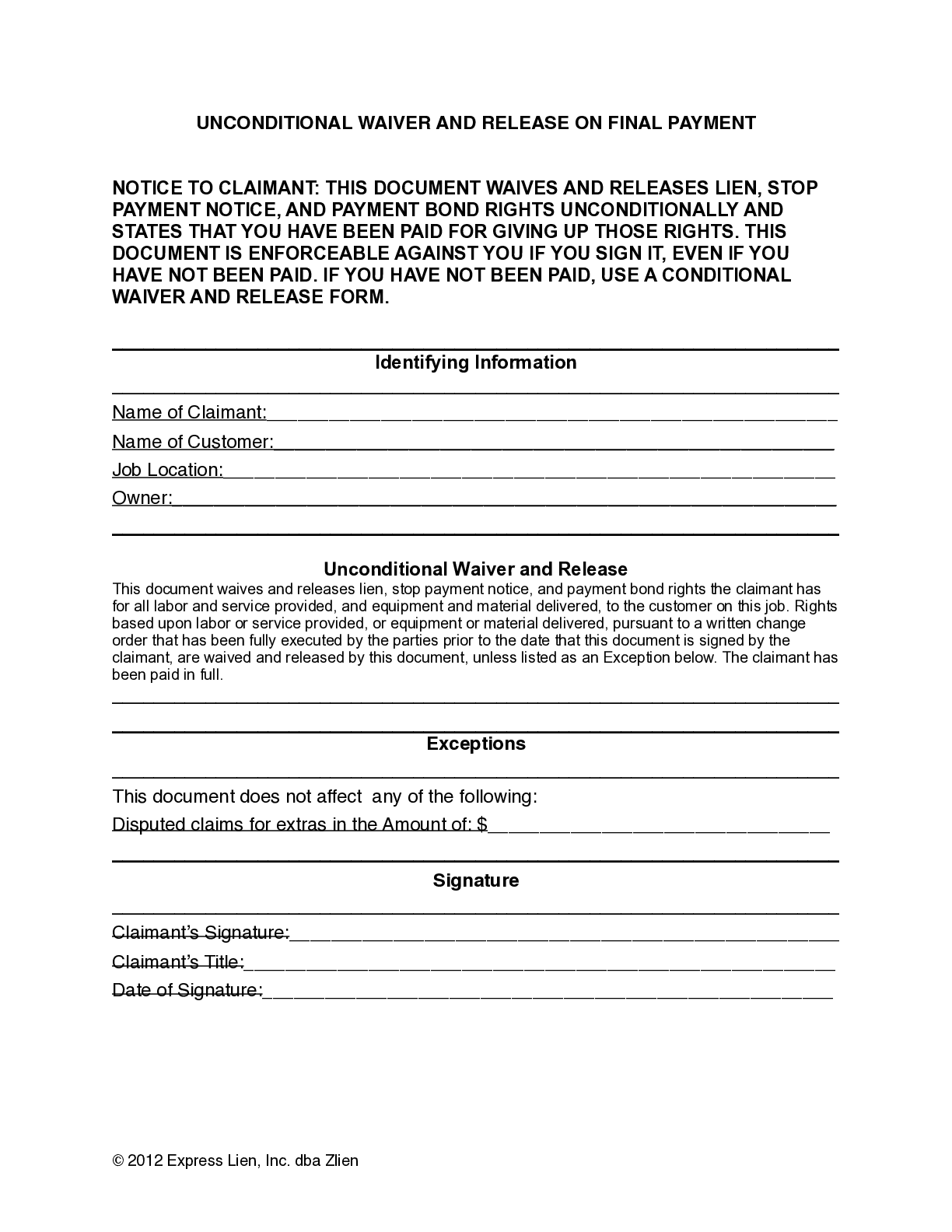

Kentucky Mechanics Lien Forms

Understanding the legal framework surrounding property liens in kentucky is essential for property owners. .005 personal judgment in action to enforce. For general laws governing construction of statutes, see krs chapter 446. For general laws governing construction of statutes, see krs chapter 446. A lien is a legal claim.

Kentucky Final Unconditional Lien Waiver Form Free

Understanding the legal framework surrounding property liens in kentucky is essential for property owners. For general laws governing construction of statutes, see krs chapter 446. .005 personal judgment in action to enforce. For general laws governing construction of statutes, see krs chapter 446. Kentucky law recognizes 23 different types of liens.

Kentucky Law Recognizes 23 Different Types Of Liens.

An attorney's lien is levied against a property for unpaid legal fees. Understanding the legal framework surrounding property liens in kentucky is essential for property owners. .005 personal judgment in action to enforce. For general laws governing construction of statutes, see krs chapter 446.

A Lien Is A Legal Claim.

For general laws governing construction of statutes, see krs chapter 446. A notice of state tax lien is a public claim against a taxpayer's property or rights to property, both owned at the time the lien is filed and.