Local Business Tax Receipt Orange County Florida

Local Business Tax Receipt Orange County Florida - If you would like to. Business tax receipt payments are due on october 1st of each year. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. All businesses must have both city and county business tax receipts. If you would like to search for business tax receipts in orange county, please use the following search options. You can only search for one. Get an orange county business tax receipt. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. Taxes not paid by that date will be subject to penalties. To find your business, enter a business tax receipt id number or search by name, address, city, or zip.

To find your business, enter a business tax receipt id number or search by name, address, city, or zip. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. If you would like to search for business tax receipts in orange county, please use the following search options. Business tax receipt payments are due on october 1st of each year. If you would like to. All businesses must have both city and county business tax receipts. Taxes not paid by that date will be subject to penalties. Get an orange county business tax receipt. You can only search for one.

If you would like to. If you would like to search for business tax receipts in orange county, please use the following search options. All businesses must have both city and county business tax receipts. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. To find your business, enter a business tax receipt id number or search by name, address, city, or zip. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. Taxes not paid by that date will be subject to penalties. Business tax receipt payments are due on october 1st of each year. You can only search for one. Get an orange county business tax receipt.

Miami Dade County Business Tax Receipt Master of Documents

All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. Get an orange county business tax receipt. If you would like to. Business tax receipt payments are due on october 1st of each year. Taxes not paid by that date will be subject to penalties.

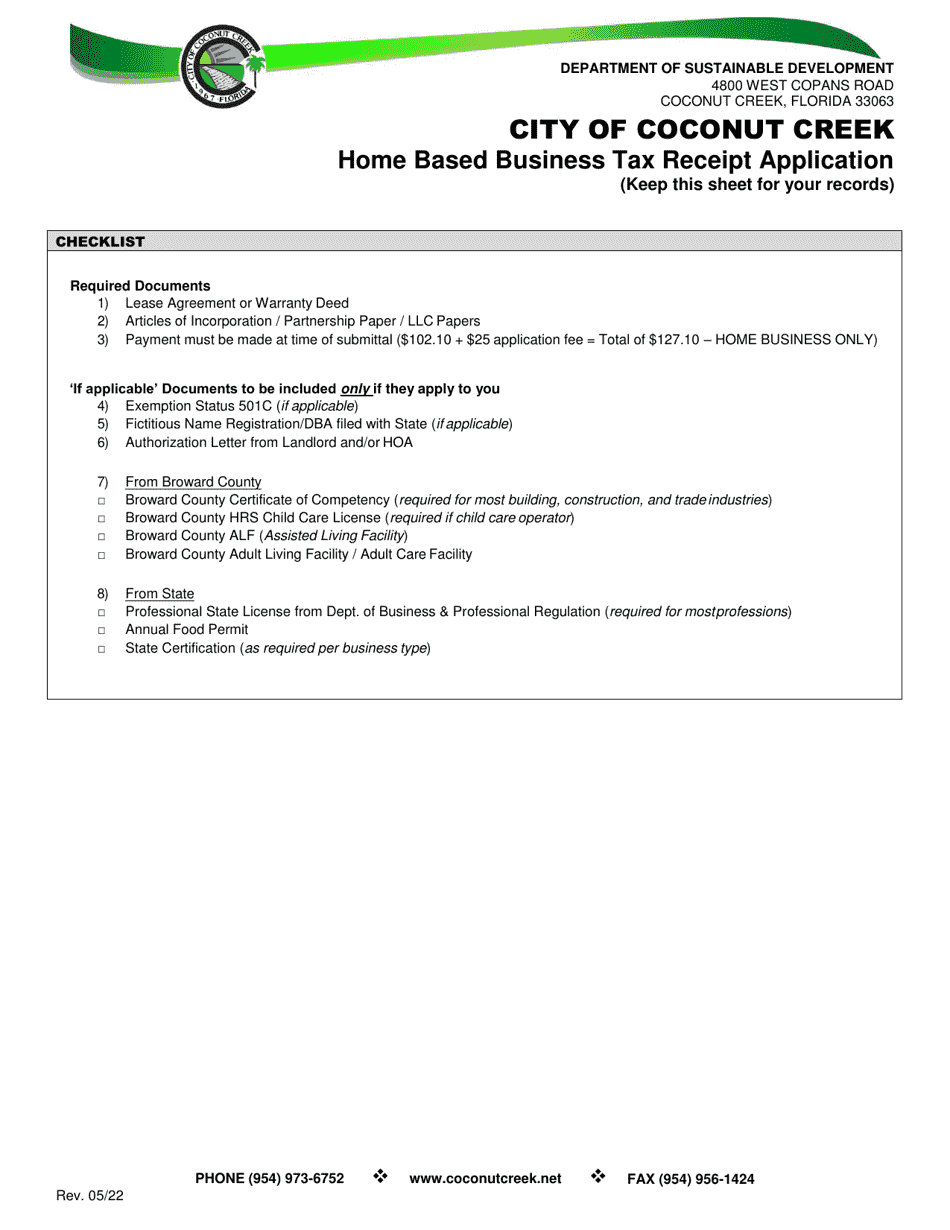

City of Coconut Creek, Florida Home Based Business Tax Receipt

This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. To find your business, enter a business tax receipt id number or search by name, address, city,.

Tax Receipt Template

You can only search for one. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. All businesses must have both city and county business tax receipts. Business tax receipt payments are due on october 1st of each year. If you would like to.

broward county business tax receipt form Johnie Suggs

You can only search for one. If you would like to. To find your business, enter a business tax receipt id number or search by name, address, city, or zip. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. Taxes not paid by that date will be subject.

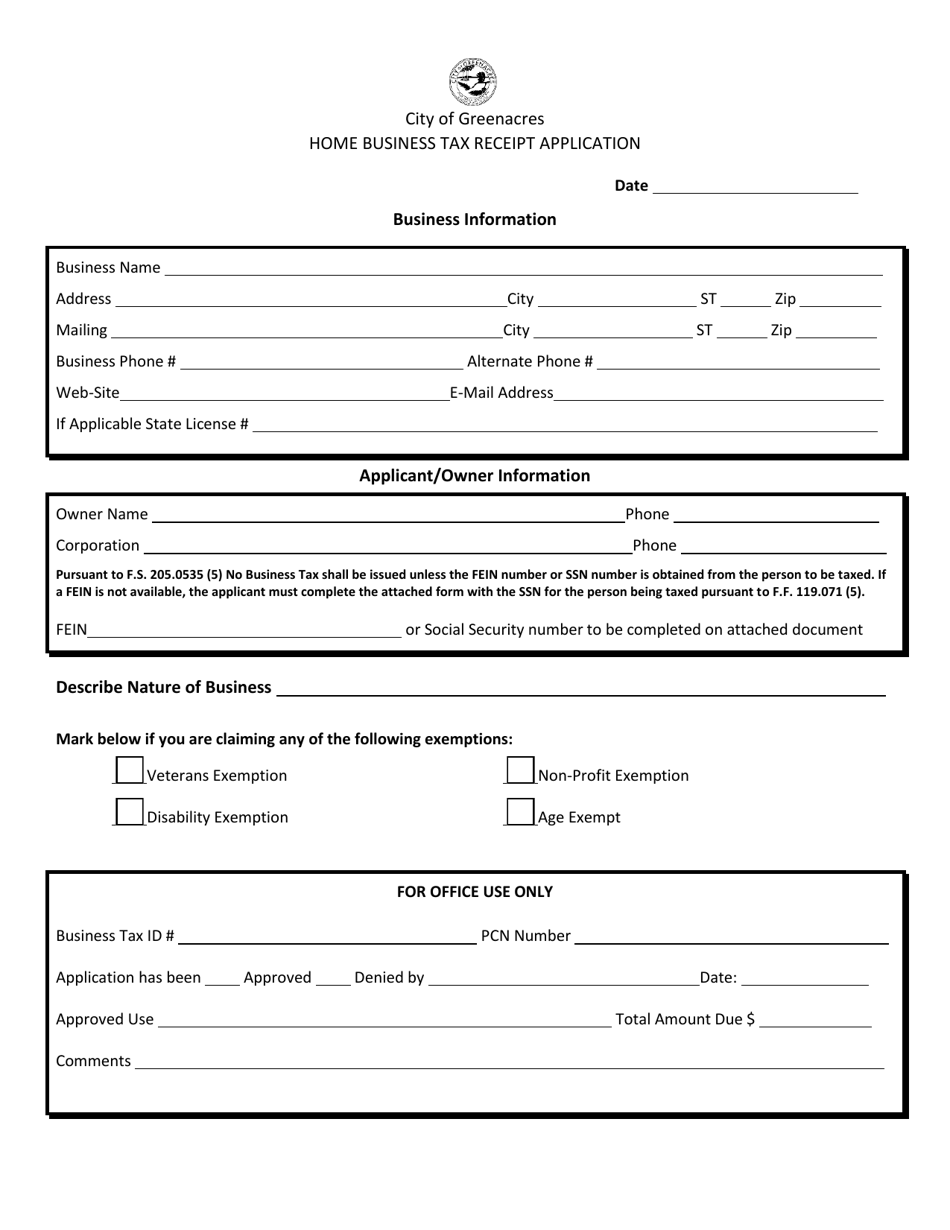

City of Greenacres, Florida Home Business Tax Receipt Application

All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. If you would like to search for business tax receipts in orange county, please use the following search options. Business tax receipt payments are due on october 1st of each year. All businesses must have both city and county.

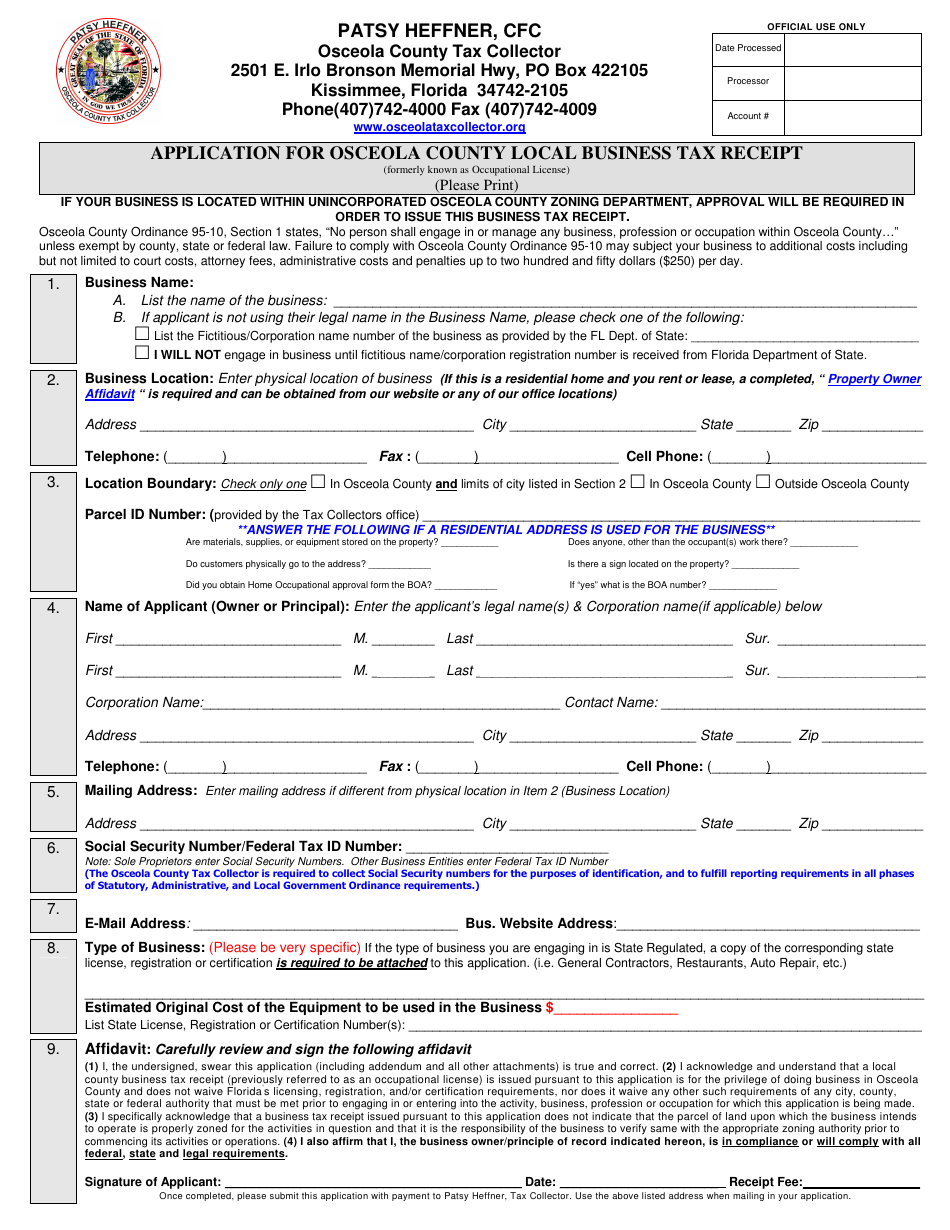

Osceola County, Florida Application for Osceola County Local Business

To find your business, enter a business tax receipt id number or search by name, address, city, or zip. All businesses must have both city and county business tax receipts. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. If you would like to search for business tax.

Orange County Probate Form Acknowledgment Of Receipt

All businesses must have both city and county business tax receipts. Get an orange county business tax receipt. Taxes not paid by that date will be subject to penalties. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. If you would like to.

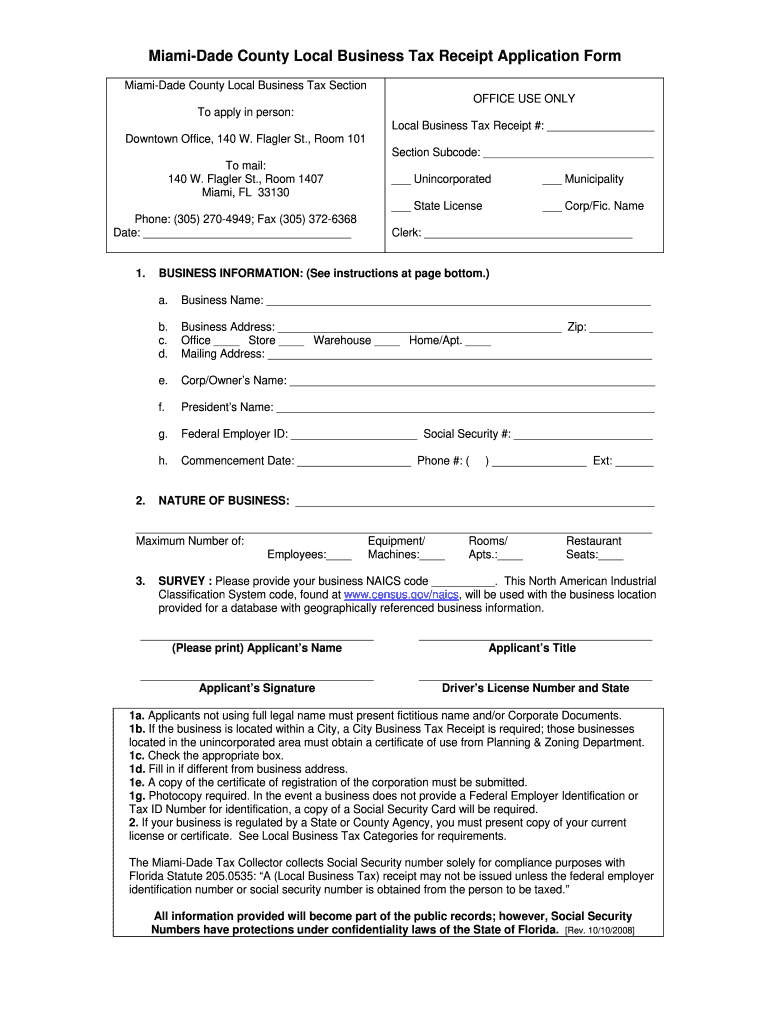

2008 FL Local Business Tax Receipt Application Form MiamiDade County

All businesses must have both city and county business tax receipts. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. Business tax receipt payments are due.

broward county business tax receipt search Hardesty

This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. If you would like to. Get an orange county business tax receipt. Business tax receipt payments are due on october 1st of each year. If you would like to search for business tax receipts in orange county, please.

If You Would Like To.

If you would like to search for business tax receipts in orange county, please use the following search options. All businesses must have both city and county business tax receipts. This page explains the process of obtaining a business tax receipt for the purpose of operating a business in orange county, florida. Taxes not paid by that date will be subject to penalties.

You Can Only Search For One.

Get an orange county business tax receipt. To find your business, enter a business tax receipt id number or search by name, address, city, or zip. All businesses operating in these municipalities must obtain a local business tax receipt prior to obtaining an orange county business tax. Business tax receipt payments are due on october 1st of each year.