Local Option Tax

Local Option Tax - The proposed tsplost will supplement the existing transportation funding through an additional 1% sales tax. Local option sales tax (lost) special purpose local option sales tax (splost) taxes; If you are doing business in or delivering products to a municipality with a 1% local option tax, you must also collect and. Tsplost stands for transportation special purpose local option sales tax. This additional sales tax generates revenue to fund. Local option tax is calculated as 1% of the taxable (net) sales for each town. A transaction is subject to local option tax if it is subject to the vermont.

Local option sales tax (lost) special purpose local option sales tax (splost) taxes; If you are doing business in or delivering products to a municipality with a 1% local option tax, you must also collect and. The proposed tsplost will supplement the existing transportation funding through an additional 1% sales tax. This additional sales tax generates revenue to fund. Tsplost stands for transportation special purpose local option sales tax. Local option tax is calculated as 1% of the taxable (net) sales for each town. A transaction is subject to local option tax if it is subject to the vermont.

A transaction is subject to local option tax if it is subject to the vermont. This additional sales tax generates revenue to fund. Local option tax is calculated as 1% of the taxable (net) sales for each town. The proposed tsplost will supplement the existing transportation funding through an additional 1% sales tax. Local option sales tax (lost) special purpose local option sales tax (splost) taxes; If you are doing business in or delivering products to a municipality with a 1% local option tax, you must also collect and. Tsplost stands for transportation special purpose local option sales tax.

Local Option Tax City of Crouch

This additional sales tax generates revenue to fund. Tsplost stands for transportation special purpose local option sales tax. A transaction is subject to local option tax if it is subject to the vermont. If you are doing business in or delivering products to a municipality with a 1% local option tax, you must also collect and. The proposed tsplost will.

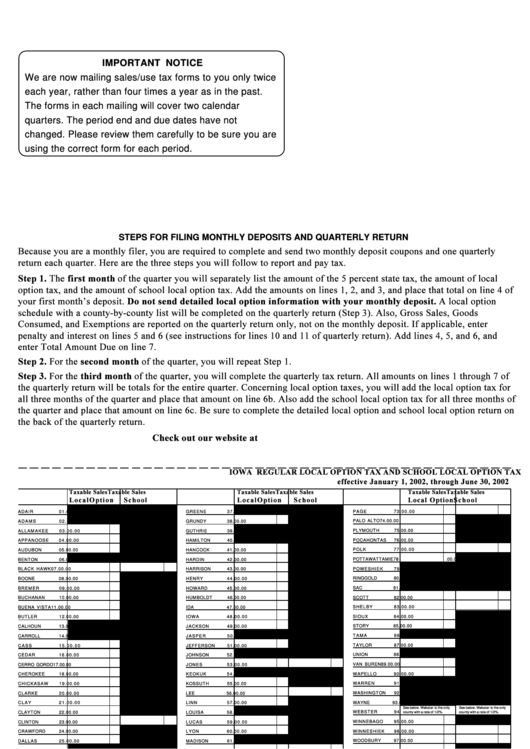

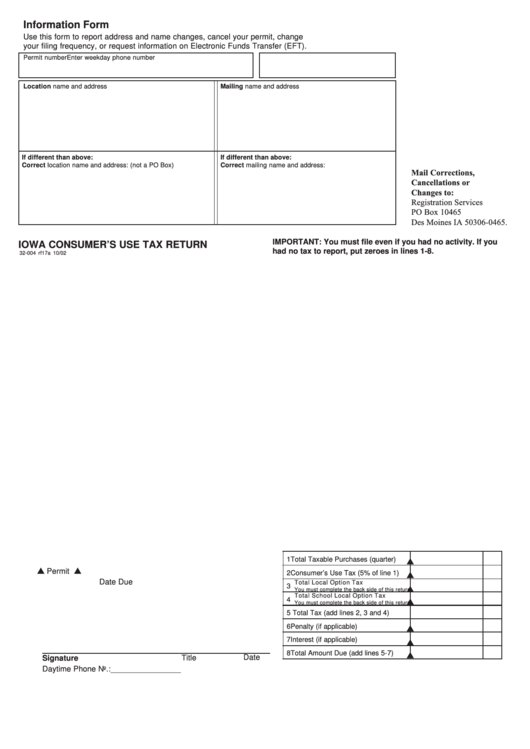

Form 31089 Iowa Regular Local Option Tax And School Local Option Tax

This additional sales tax generates revenue to fund. If you are doing business in or delivering products to a municipality with a 1% local option tax, you must also collect and. A transaction is subject to local option tax if it is subject to the vermont. Tsplost stands for transportation special purpose local option sales tax. The proposed tsplost will.

Local Option Sales Tax Monticello, MN

Tsplost stands for transportation special purpose local option sales tax. A transaction is subject to local option tax if it is subject to the vermont. Local option sales tax (lost) special purpose local option sales tax (splost) taxes; If you are doing business in or delivering products to a municipality with a 1% local option tax, you must also collect.

Updated State and Local Option Sales Tax Tax Foundation

A transaction is subject to local option tax if it is subject to the vermont. This additional sales tax generates revenue to fund. The proposed tsplost will supplement the existing transportation funding through an additional 1% sales tax. If you are doing business in or delivering products to a municipality with a 1% local option tax, you must also collect.

Local Option Sales Tax Monticello, MN

Local option sales tax (lost) special purpose local option sales tax (splost) taxes; Local option tax is calculated as 1% of the taxable (net) sales for each town. The proposed tsplost will supplement the existing transportation funding through an additional 1% sales tax. Tsplost stands for transportation special purpose local option sales tax. A transaction is subject to local option.

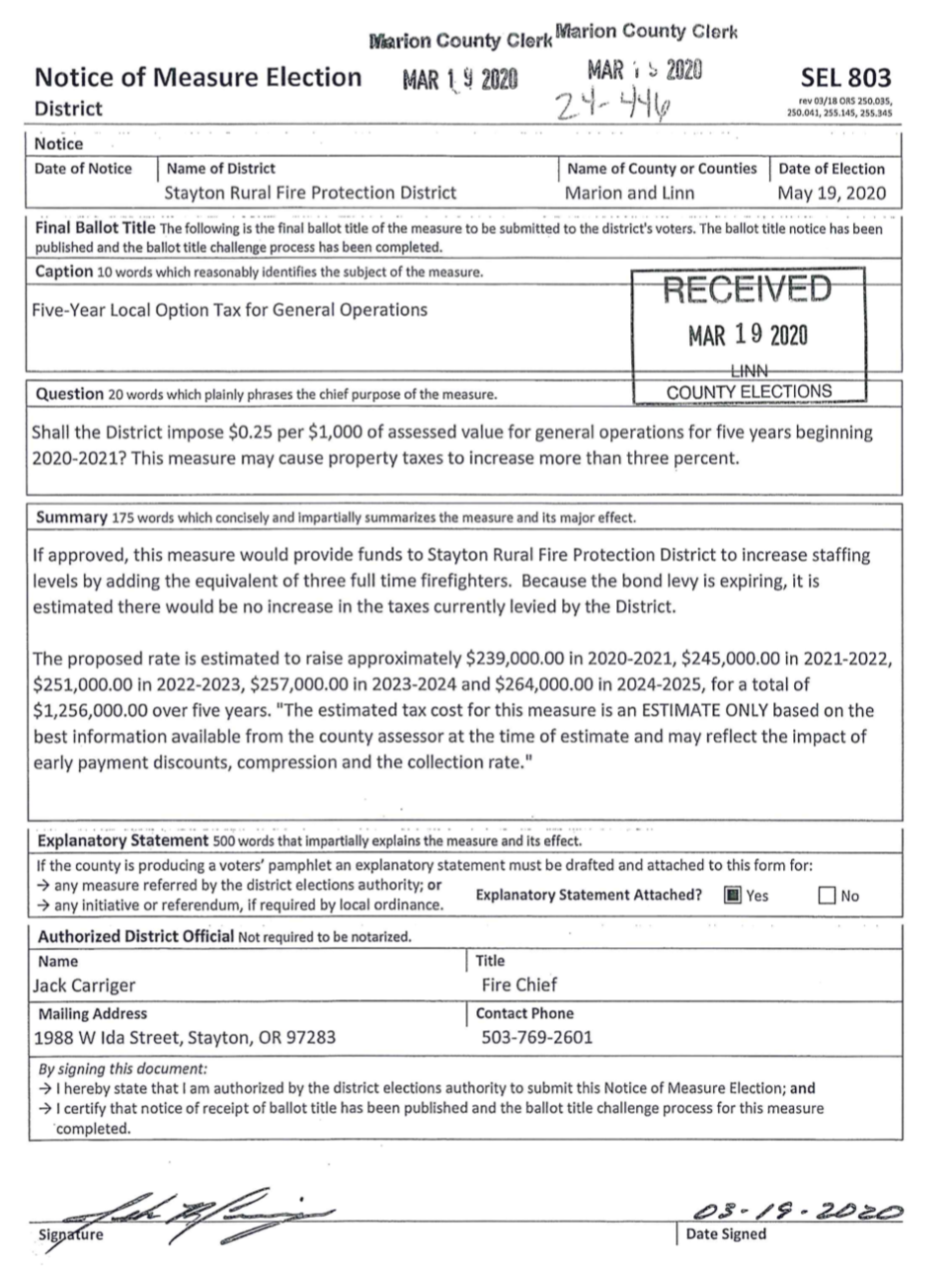

Stayton Rural Fire Protection District Local Option Tax LINN COUNTY

Local option sales tax (lost) special purpose local option sales tax (splost) taxes; Tsplost stands for transportation special purpose local option sales tax. The proposed tsplost will supplement the existing transportation funding through an additional 1% sales tax. Local option tax is calculated as 1% of the taxable (net) sales for each town. If you are doing business in or.

TAX Consultancy Firm Gurugram

Tsplost stands for transportation special purpose local option sales tax. Local option sales tax (lost) special purpose local option sales tax (splost) taxes; The proposed tsplost will supplement the existing transportation funding through an additional 1% sales tax. A transaction is subject to local option tax if it is subject to the vermont. This additional sales tax generates revenue to.

Iowa Regular Local Option Tax And School Local Option Tax Form 2004

Tsplost stands for transportation special purpose local option sales tax. If you are doing business in or delivering products to a municipality with a 1% local option tax, you must also collect and. Local option tax is calculated as 1% of the taxable (net) sales for each town. This additional sales tax generates revenue to fund. Local option sales tax.

Local Option Sales Tax (LOST) Projects Mille Lacs County, MN

Tsplost stands for transportation special purpose local option sales tax. If you are doing business in or delivering products to a municipality with a 1% local option tax, you must also collect and. Local option sales tax (lost) special purpose local option sales tax (splost) taxes; This additional sales tax generates revenue to fund. A transaction is subject to local.

Tax Preparation Business Startup

Local option sales tax (lost) special purpose local option sales tax (splost) taxes; Tsplost stands for transportation special purpose local option sales tax. If you are doing business in or delivering products to a municipality with a 1% local option tax, you must also collect and. Local option tax is calculated as 1% of the taxable (net) sales for each.

This Additional Sales Tax Generates Revenue To Fund.

Local option sales tax (lost) special purpose local option sales tax (splost) taxes; If you are doing business in or delivering products to a municipality with a 1% local option tax, you must also collect and. The proposed tsplost will supplement the existing transportation funding through an additional 1% sales tax. Tsplost stands for transportation special purpose local option sales tax.

A Transaction Is Subject To Local Option Tax If It Is Subject To The Vermont.

Local option tax is calculated as 1% of the taxable (net) sales for each town.