Local Tax Forms Pennsylvania

Local Tax Forms Pennsylvania - The department of revenue administers the tax laws and other revenue programs of the commonwealth of. Employers with worksites located in pennsylvania are required to withhold and remit the local. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15,. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. Where's my income tax refund? Find out how to withhold and remit the local eit and lst for your employees working in pa. Access psd codes, eit rates, tax forms, faqs,. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Local income tax requirements for employers.

Employers with worksites located in pennsylvania are required to withhold and remit the local. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Find out how to withhold and remit the local eit and lst for your employees working in pa. Where's my income tax refund? The department of revenue administers the tax laws and other revenue programs of the commonwealth of. Access psd codes, eit rates, tax forms, faqs,. Local income tax requirements for employers. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15,. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of.

Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Local income tax requirements for employers. The department of revenue administers the tax laws and other revenue programs of the commonwealth of. Employers with worksites located in pennsylvania are required to withhold and remit the local. Find out how to withhold and remit the local eit and lst for your employees working in pa. Access psd codes, eit rates, tax forms, faqs,. Where's my income tax refund? Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15,. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of.

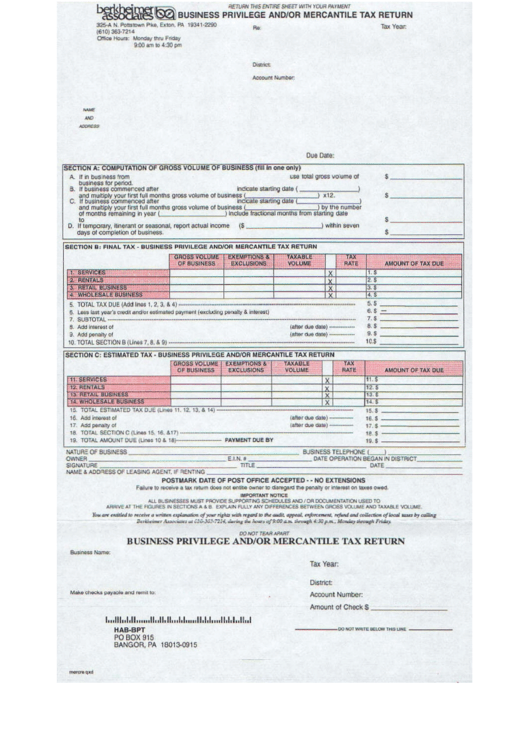

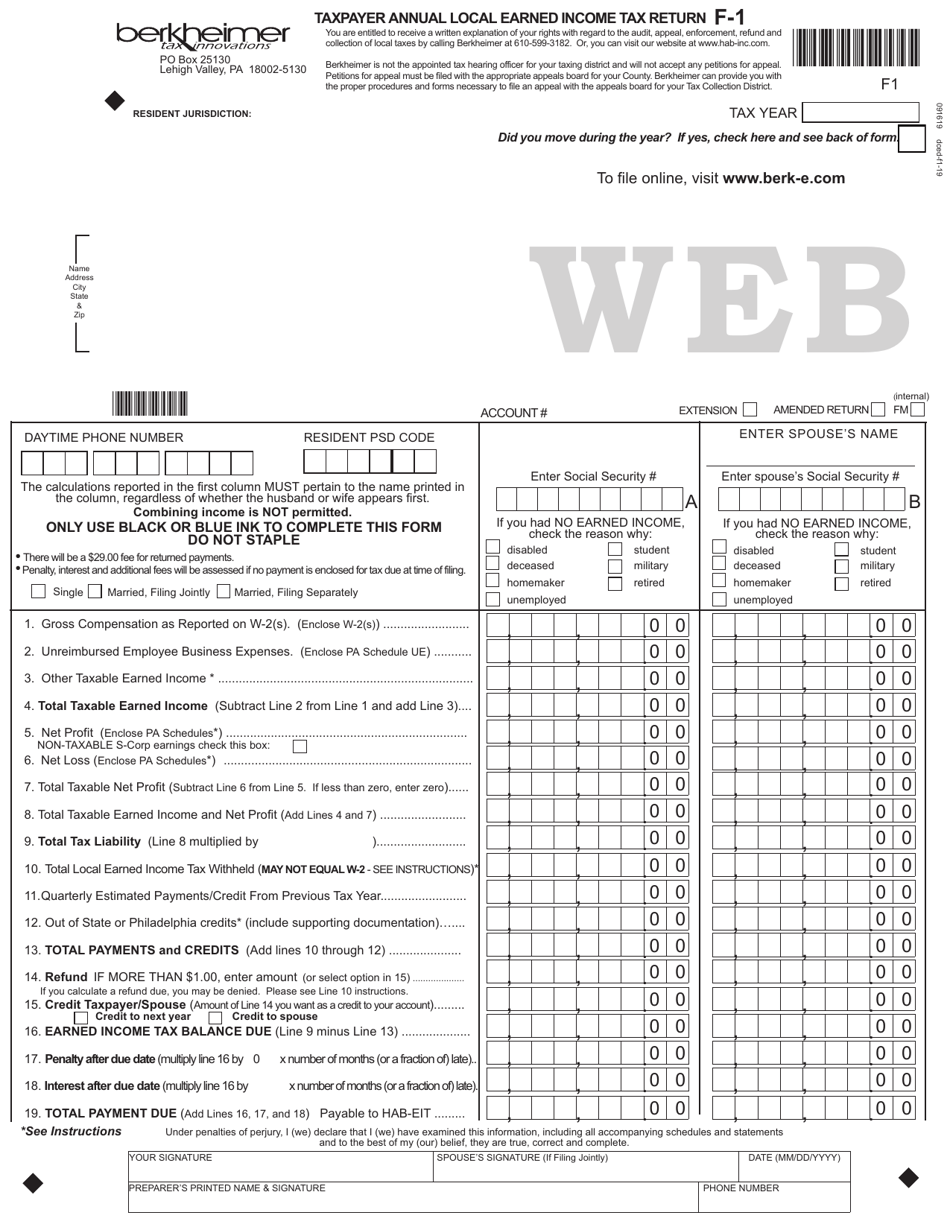

Top 21 Berkheimer Tax Forms And Templates free to download in PDF format

Find out how to withhold and remit the local eit and lst for your employees working in pa. The department of revenue administers the tax laws and other revenue programs of the commonwealth of. Employers with worksites located in pennsylvania are required to withhold and remit the local. Pennsylvania residents with earned income or net profits must file a local.

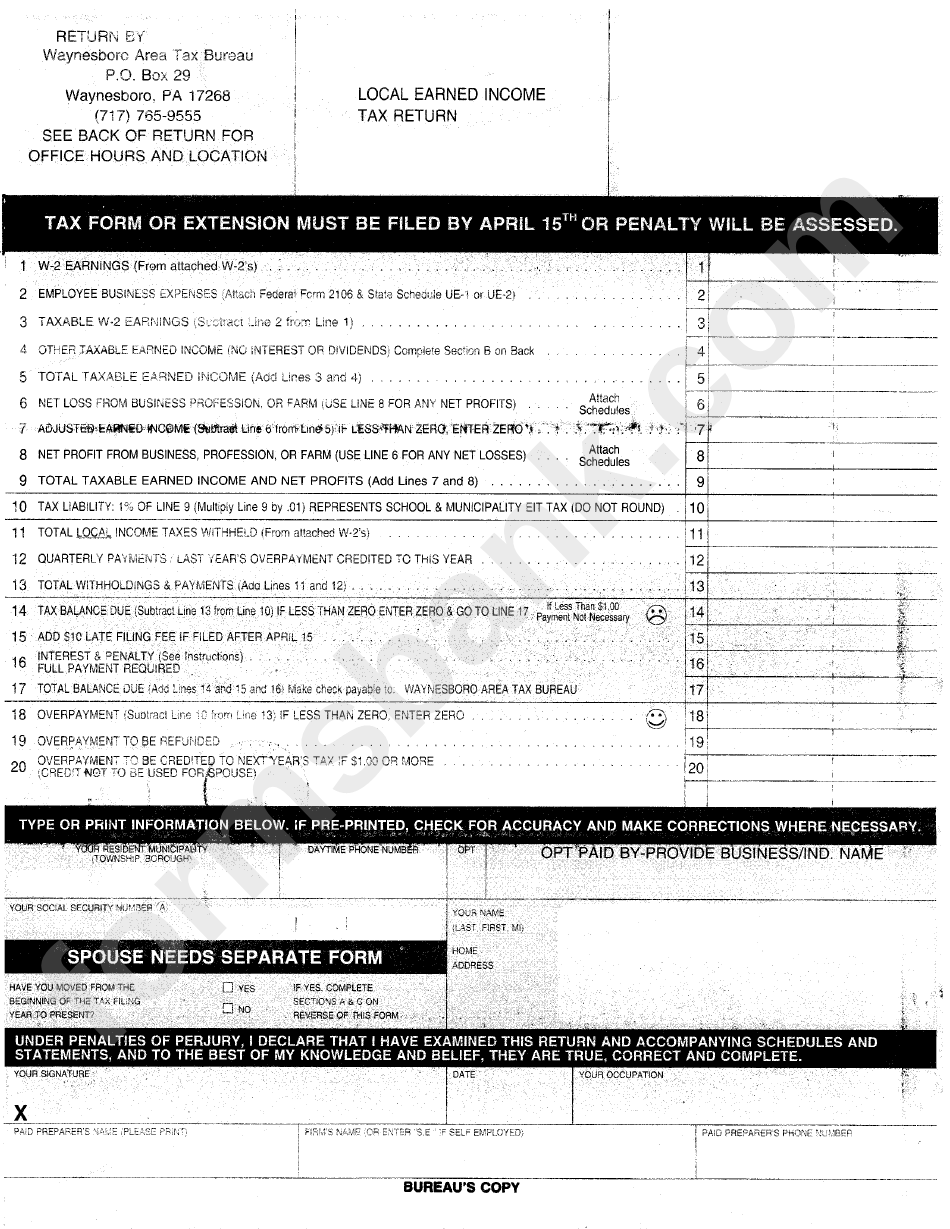

Local Earned Tax Return Form printable pdf download

Local income tax requirements for employers. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Where's my income tax refund? Pennsylvania residents with earned income.

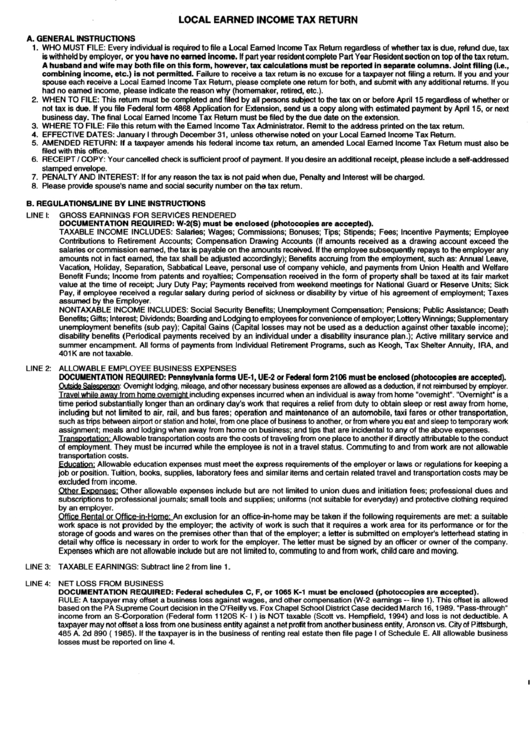

Instructions For Local Earned Tax Return Form Pennsylvania

Where's my income tax refund? Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15,. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. The pennsylvania local income tax exchange (palite) system allows.

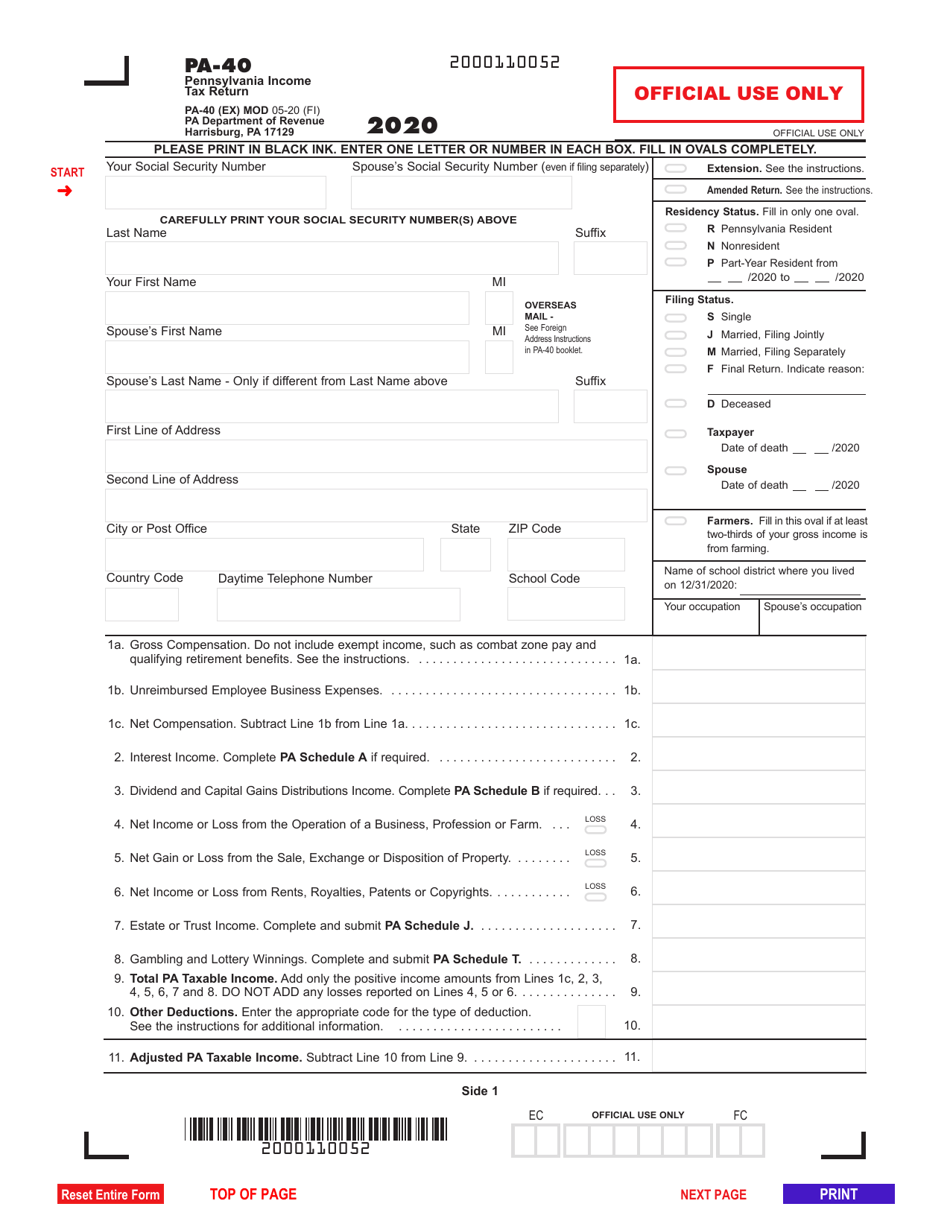

Pennsylvania State Fillable Tax Forms Printable Forms Free Online

Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare.

2023 Pa Tax Exempt Form Printable Forms Free Online

Where's my income tax refund? Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Pennsylvania residents with earned income or net profits must file a local.

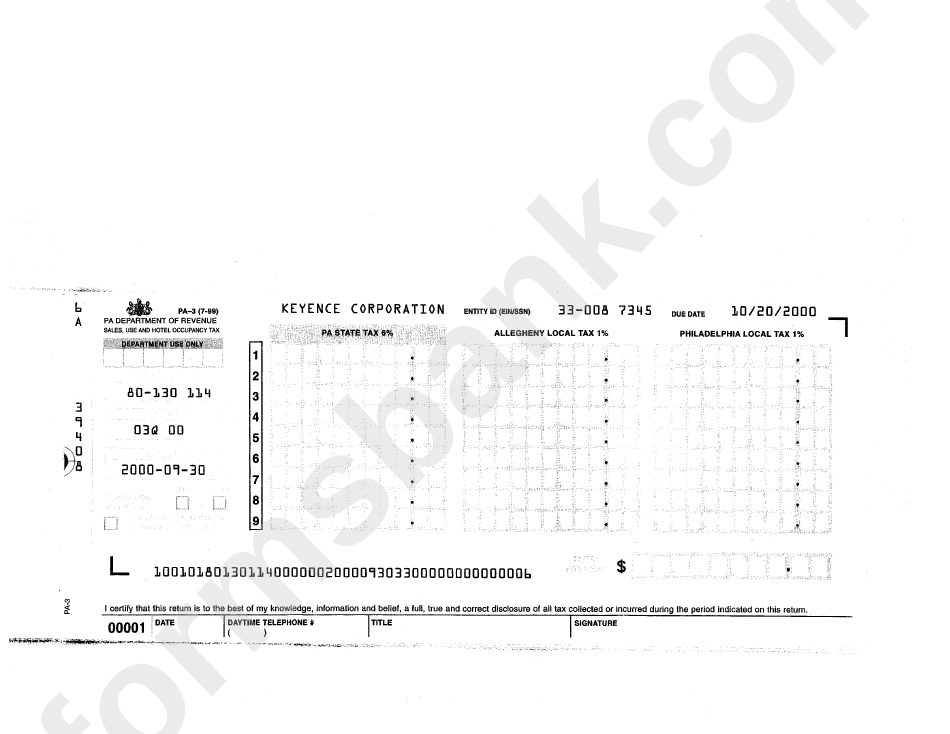

Form Pa3 Sales, Use And Hotel Occupancy Tax printable pdf download

Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Access psd codes, eit rates, tax forms, faqs,. Local income tax requirements for employers. Where's my income tax refund? Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00.

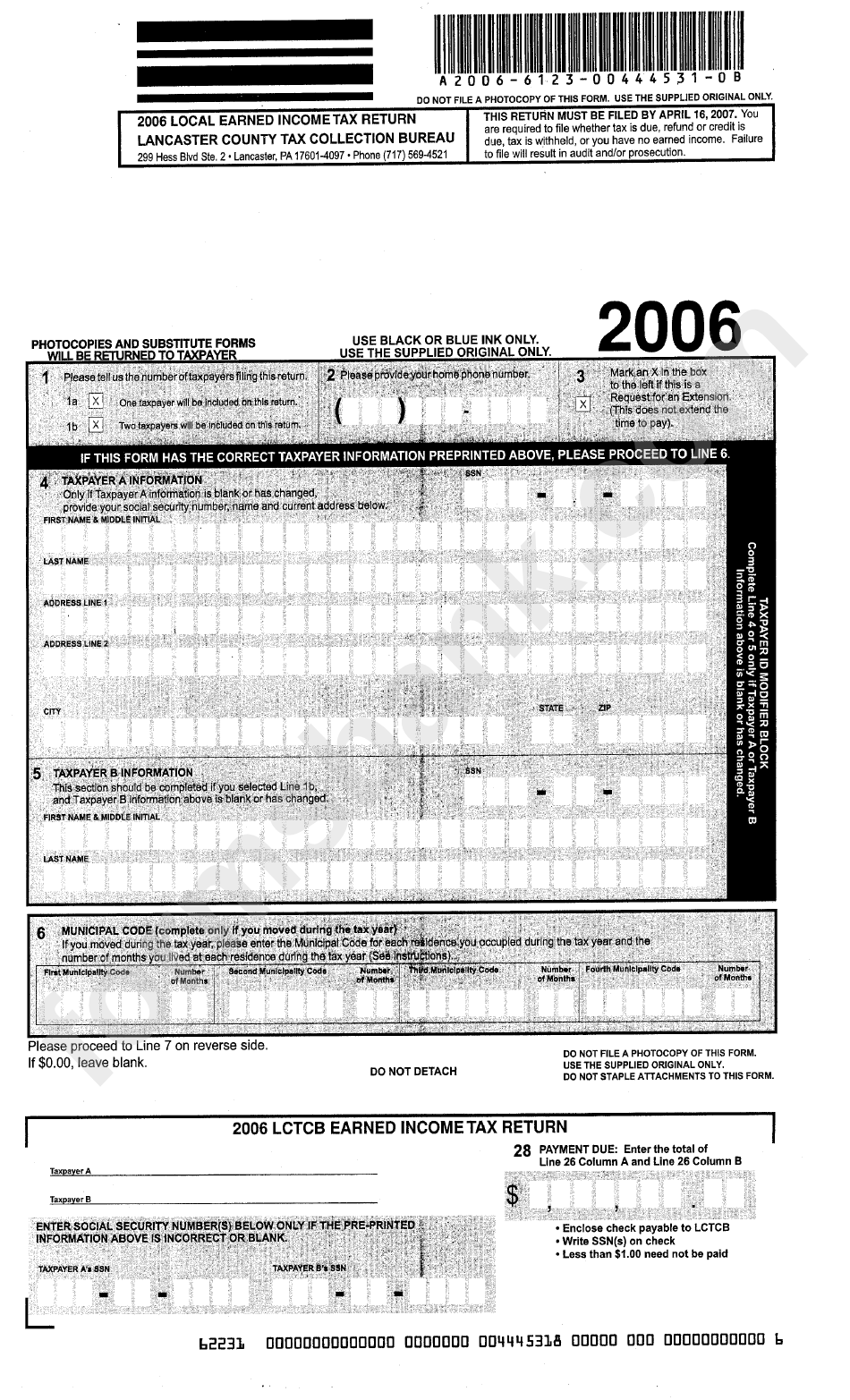

Local Earned Tax Return Form 2006 Lancaster County Tax

The department of revenue administers the tax laws and other revenue programs of the commonwealth of. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Local income tax requirements for employers. Where's my income tax refund? Assuming the current pennsylvania state tax rate is 3.07% for the tax year.

Fillable Local Earned Tax Form Pa Printable Forms Free Online

The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Local income tax requirements for employers. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. Employers with worksites located in pennsylvania are required to withhold.

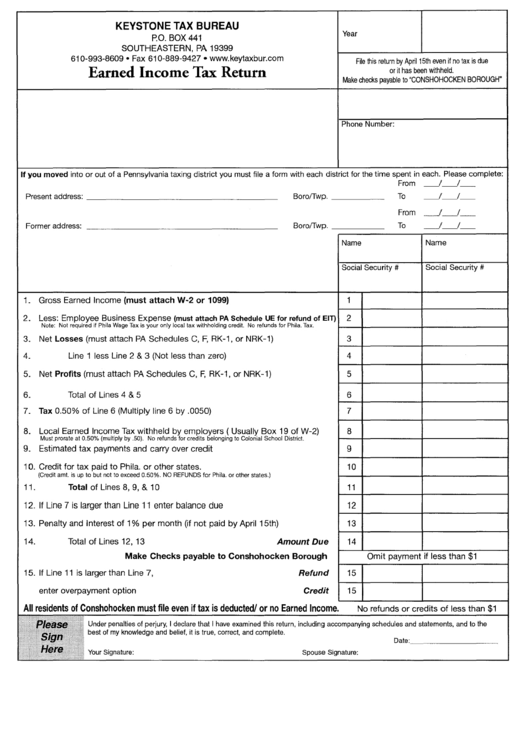

Earned Tax Return Form Pennsylvania printable pdf download

Local income tax requirements for employers. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Access psd codes, eit rates, tax forms, faqs,. Pennsylvania residents.

Printable Pennsylvania State Tax Forms Printable Forms Free Online

Find out how to withhold and remit the local eit and lst for your employees working in pa. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of. Employers with worksites located in pennsylvania are required to withhold and remit the local. Where's my income tax.

Find Out How To Withhold And Remit The Local Eit And Lst For Your Employees Working In Pa.

Where's my income tax refund? Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers. Access psd codes, eit rates, tax forms, faqs,.

Pennsylvania Residents With Earned Income Or Net Profits Must File A Local Earned Income Tax Return Online Or By Mail By April 15,.

The department of revenue administers the tax laws and other revenue programs of the commonwealth of. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Assuming the current pennsylvania state tax rate is 3.07% for the tax year in question, since the $317.00 exceeds 3.07% (pa tax) amount of.