Local Tax Withholding In Pennsylvania

Local Tax Withholding In Pennsylvania - Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. Employers with worksites located in pennsylvania are required. Local income tax requirements for employers. Local, state, and federal government websites often end in.gov. Employers with worksites located in pennsylvania are required to withhold and remit the local. Dced local government services act 32: You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Commonwealth of pennsylvania government websites and email systems use.

Local, state, and federal government websites often end in.gov. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Employers with worksites located in pennsylvania are required to withhold and remit the local. Commonwealth of pennsylvania government websites and email systems use. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Employers with worksites located in pennsylvania are required. Dced local government services act 32: Local income tax requirements for employers.

Employers with worksites located in pennsylvania are required to withhold and remit the local. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Employers with worksites located in pennsylvania are required. Local, state, and federal government websites often end in.gov. Commonwealth of pennsylvania government websites and email systems use. Dced local government services act 32: Local income tax requirements for employers.

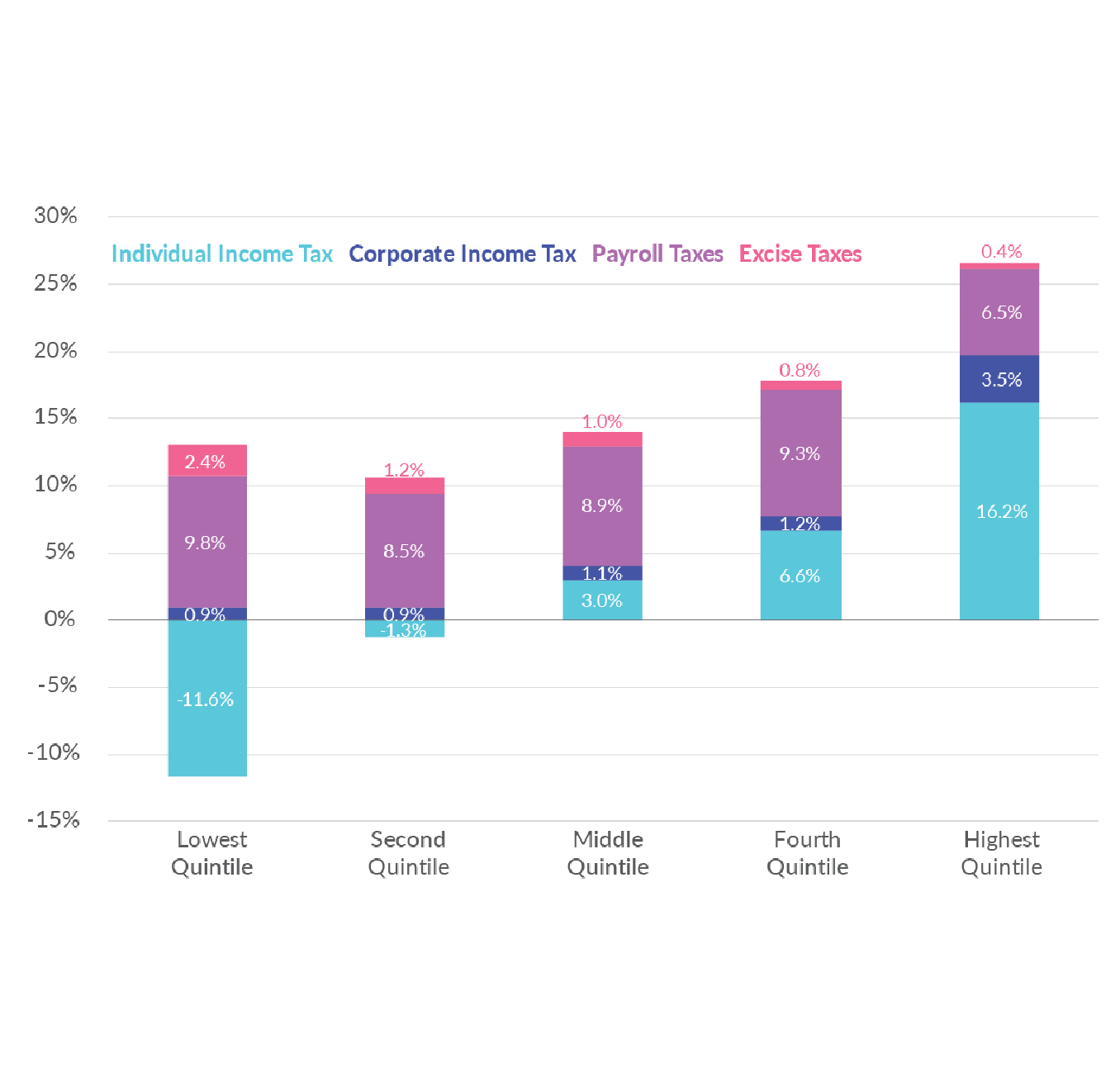

Federal Tax Rates by Group and Tax Source

Employers with worksites located in pennsylvania are required to withhold and remit the local. Local, state, and federal government websites often end in.gov. Local income tax requirements for employers. Employers with worksites located in pennsylvania are required. Commonwealth of pennsylvania government websites and email systems use.

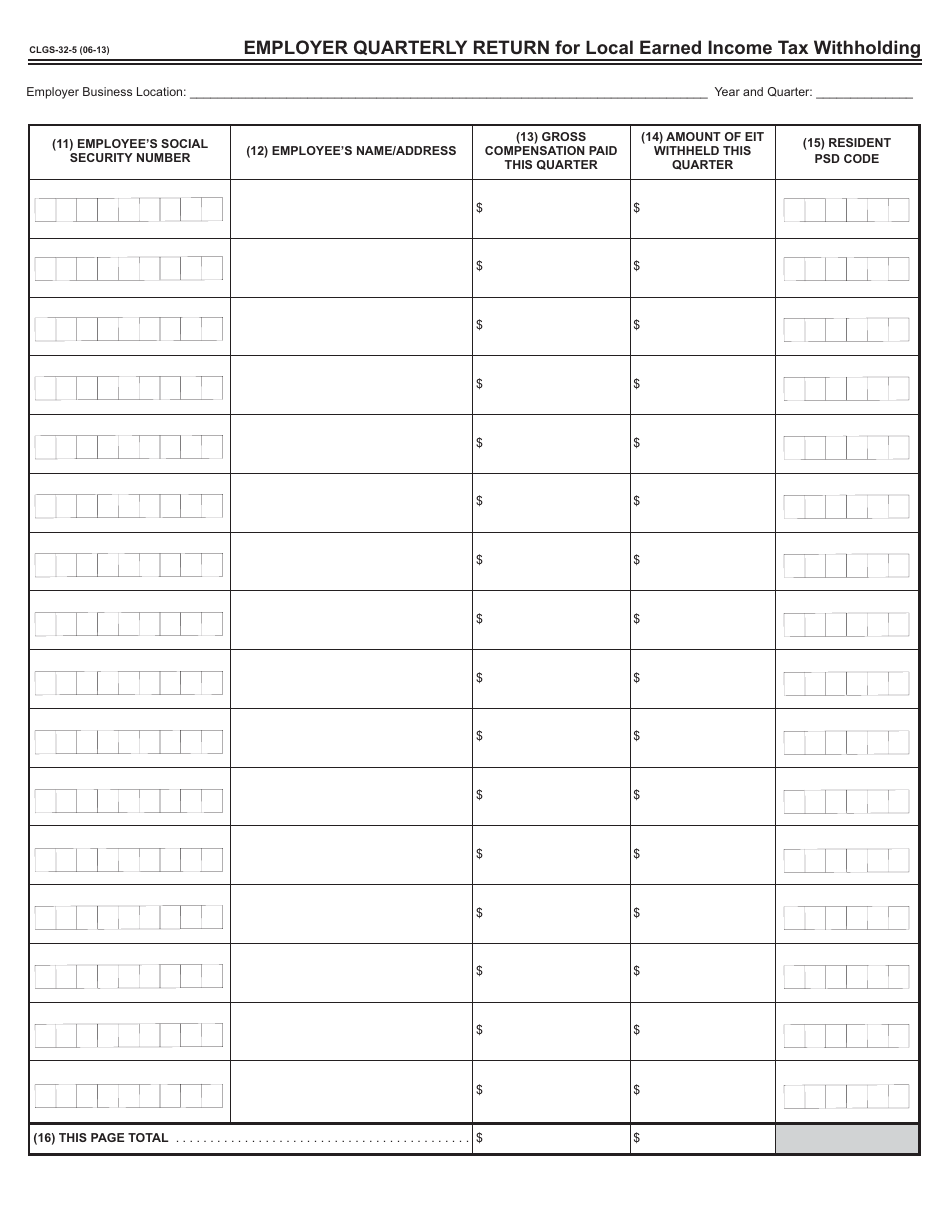

Form CLGS325 Fill Out, Sign Online and Download Fillable PDF

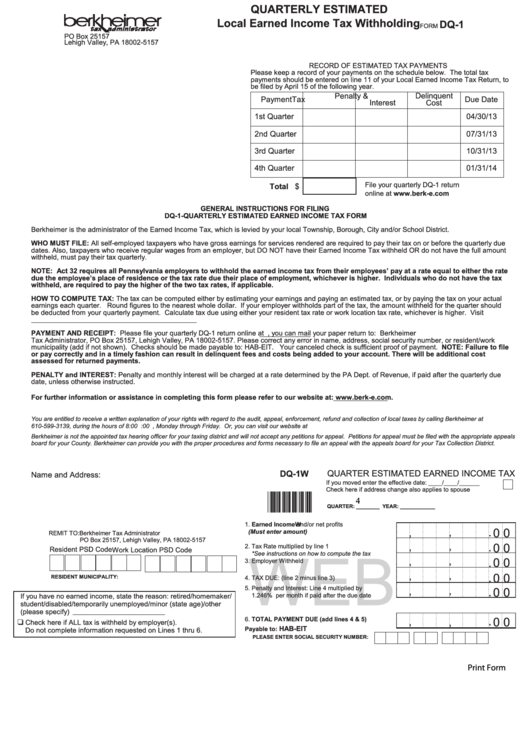

Local income tax requirements for employers. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Employers with worksites located in pennsylvania are required to withhold and.

SOLUTION Withholding tax and value added tax Studypool

Pennsylvania department of community & economic development governor's center for local government services 400 north street,. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Commonwealth of pennsylvania government websites and email systems use. Local income tax requirements for employers. Dced local.

Understanding State And Local Taxes Phoenix Tax Consultants

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Local income tax requirements for employers. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Local, state, and federal government websites often end in.gov. Employers with.

Elevated Tax & Accounting ETA always on time Tax & Accounting

Employers with worksites located in pennsylvania are required. Local income tax requirements for employers. Local, state, and federal government websites often end in.gov. Employers with worksites located in pennsylvania are required to withhold and remit the local. Commonwealth of pennsylvania government websites and email systems use.

Pennsylvania Local Earned Tax Withholding Form

Pennsylvania department of community & economic development governor's center for local government services 400 north street,. Employers with worksites located in pennsylvania are required to withhold and remit the local. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Local, state, and.

Tax Withholding is a Set Amount of Tax that an Employer

Employers with worksites located in pennsylvania are required to withhold and remit the local. Local, state, and federal government websites often end in.gov. Dced local government services act 32: Pennsylvania department of community & economic development governor's center for local government services 400 north street,. Commonwealth of pennsylvania government websites and email systems use.

BIR Imposes 1 Withholding Tax on Online Merchants

Employers with worksites located in pennsylvania are required to withhold and remit the local. Employers with worksites located in pennsylvania are required. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make.

7 Situations State and Local Tax Deduction Not Allowed On Federal Tax

You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Employers with worksites located in pennsylvania are required to withhold and remit the local. Pennsylvania department of community & economic development governor's center for local government services 400 north street,. Local income tax.

The Harms of Retaliatory Tax and Trade Policies Tax Foundation

Commonwealth of pennsylvania government websites and email systems use. Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Dced local government services act 32: Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers.

Employers With Worksites Located In Pennsylvania Are Required.

Dced local government services act 32: You are required to withhold the higher of the two eit rates, as well as the local services tax (lst), and make remittances to the local tax. Employers with worksites located in pennsylvania are required to withhold and remit the local. Local, state, and federal government websites often end in.gov.

Local Income Tax Requirements For Employers.

Pennsylvania law requires employers to withhold pennsylvania personal income tax from employees’ compensation in two common. Commonwealth of pennsylvania government websites and email systems use. Pennsylvania department of community & economic development governor's center for local government services 400 north street,.