Missouri State Tax Lien

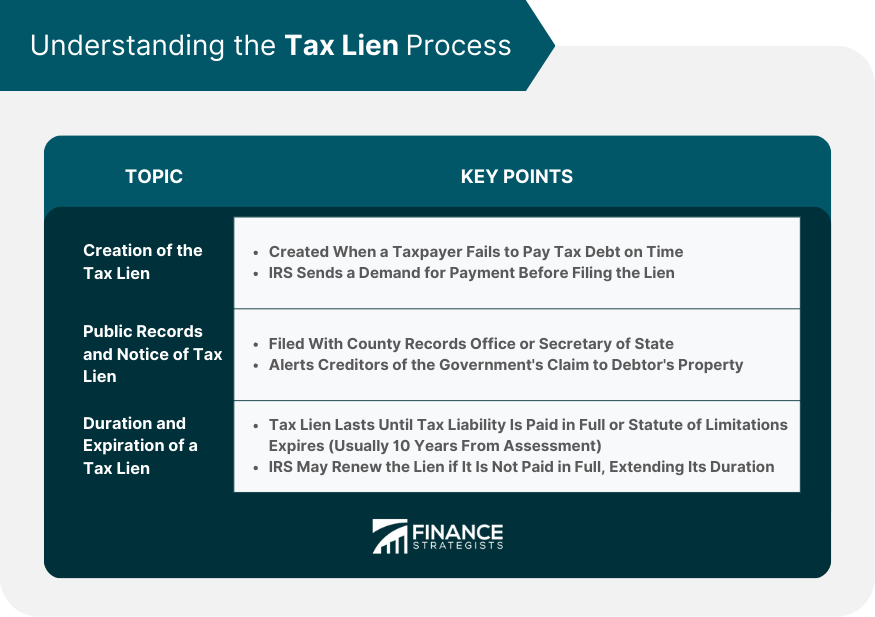

Missouri State Tax Lien - If the taxpayer does not reside, have a place of business or own property in the state of missouri, the director may file for record a certificate of. The department of revenue is responsible for taking steps to ensure individuals and businesses pay their tax liability. A tax lien is the certificate of tax lien filed in the county’s recorder of deeds office and attaches to all real and personal property owned by the. Each county collector is responsible for publishing information on the properties to be. Where can i get a list of delinquent property tax sales? Missouri tax liens expire after 10 years, but may be renewed one time prior to expiring for an additional 10 years (20 years. Delinquent taxes with penalty, interest, and sales costs may be paid to the county collector at any time prior to the. With the case number search, you may use either the. To search for a certificate of tax lien, you may search by case number or debtor name. A suit for the foreclosure of the tax liens herein provided for shall be instituted by filing in the appropriate office of the circuit clerk a petition,.

A suit for the foreclosure of the tax liens herein provided for shall be instituted by filing in the appropriate office of the circuit clerk a petition,. A tax lien is the certificate of tax lien filed in the county’s recorder of deeds office and attaches to all real and personal property owned by the. Where can i get a list of delinquent property tax sales? Missouri tax liens expire after 10 years, but may be renewed one time prior to expiring for an additional 10 years (20 years. To search for a certificate of tax lien, you may search by case number or debtor name. Each county collector is responsible for publishing information on the properties to be. With the case number search, you may use either the. Delinquent taxes with penalty, interest, and sales costs may be paid to the county collector at any time prior to the. The department of revenue is responsible for taking steps to ensure individuals and businesses pay their tax liability. If the taxpayer does not reside, have a place of business or own property in the state of missouri, the director may file for record a certificate of.

A suit for the foreclosure of the tax liens herein provided for shall be instituted by filing in the appropriate office of the circuit clerk a petition,. Where can i get a list of delinquent property tax sales? With the case number search, you may use either the. To search for a certificate of tax lien, you may search by case number or debtor name. Missouri tax liens expire after 10 years, but may be renewed one time prior to expiring for an additional 10 years (20 years. Delinquent taxes with penalty, interest, and sales costs may be paid to the county collector at any time prior to the. The department of revenue is responsible for taking steps to ensure individuals and businesses pay their tax liability. If the taxpayer does not reside, have a place of business or own property in the state of missouri, the director may file for record a certificate of. A tax lien is the certificate of tax lien filed in the county’s recorder of deeds office and attaches to all real and personal property owned by the. Each county collector is responsible for publishing information on the properties to be.

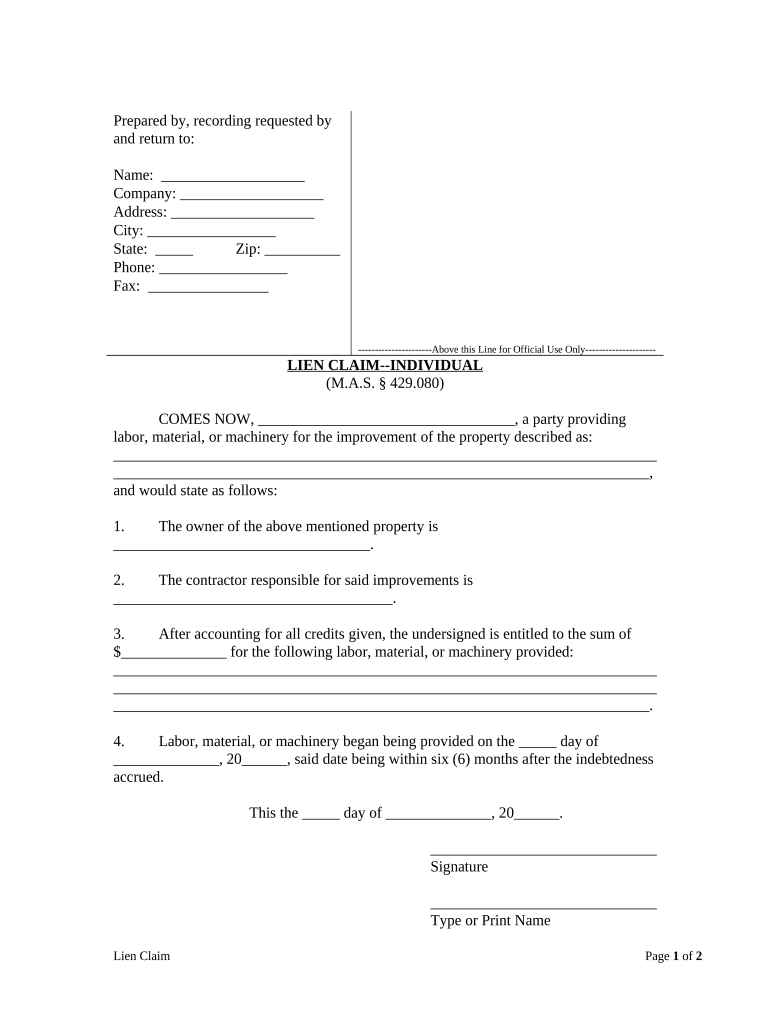

How to get a copy of a lien release in missouri online Fill out & sign

Missouri tax liens expire after 10 years, but may be renewed one time prior to expiring for an additional 10 years (20 years. A suit for the foreclosure of the tax liens herein provided for shall be instituted by filing in the appropriate office of the circuit clerk a petition,. To search for a certificate of tax lien, you may.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

Delinquent taxes with penalty, interest, and sales costs may be paid to the county collector at any time prior to the. To search for a certificate of tax lien, you may search by case number or debtor name. A suit for the foreclosure of the tax liens herein provided for shall be instituted by filing in the appropriate office of.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

If the taxpayer does not reside, have a place of business or own property in the state of missouri, the director may file for record a certificate of. A tax lien is the certificate of tax lien filed in the county’s recorder of deeds office and attaches to all real and personal property owned by the. A suit for the.

How to Tackle IRS Tax Lien or Levy Notice? Internal Revenue Code

Each county collector is responsible for publishing information on the properties to be. Delinquent taxes with penalty, interest, and sales costs may be paid to the county collector at any time prior to the. Where can i get a list of delinquent property tax sales? A suit for the foreclosure of the tax liens herein provided for shall be instituted.

How to Tackle IRS Tax Lien or Levy Notice? Internal Revenue Code

A suit for the foreclosure of the tax liens herein provided for shall be instituted by filing in the appropriate office of the circuit clerk a petition,. Missouri tax liens expire after 10 years, but may be renewed one time prior to expiring for an additional 10 years (20 years. The department of revenue is responsible for taking steps to.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

If the taxpayer does not reside, have a place of business or own property in the state of missouri, the director may file for record a certificate of. Delinquent taxes with penalty, interest, and sales costs may be paid to the county collector at any time prior to the. The department of revenue is responsible for taking steps to ensure.

Federal tax lien on foreclosed property laderdriver

Where can i get a list of delinquent property tax sales? Missouri tax liens expire after 10 years, but may be renewed one time prior to expiring for an additional 10 years (20 years. Each county collector is responsible for publishing information on the properties to be. To search for a certificate of tax lien, you may search by case.

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

Missouri tax liens expire after 10 years, but may be renewed one time prior to expiring for an additional 10 years (20 years. With the case number search, you may use either the. If the taxpayer does not reside, have a place of business or own property in the state of missouri, the director may file for record a certificate.

Tax Lien Sale PDF Tax Lien Taxes

A tax lien is the certificate of tax lien filed in the county’s recorder of deeds office and attaches to all real and personal property owned by the. To search for a certificate of tax lien, you may search by case number or debtor name. Missouri tax liens expire after 10 years, but may be renewed one time prior to.

Tax Lien Definition, Process, Consequences, How to Handle

Each county collector is responsible for publishing information on the properties to be. To search for a certificate of tax lien, you may search by case number or debtor name. A tax lien is the certificate of tax lien filed in the county’s recorder of deeds office and attaches to all real and personal property owned by the. Missouri tax.

Each County Collector Is Responsible For Publishing Information On The Properties To Be.

Where can i get a list of delinquent property tax sales? A suit for the foreclosure of the tax liens herein provided for shall be instituted by filing in the appropriate office of the circuit clerk a petition,. If the taxpayer does not reside, have a place of business or own property in the state of missouri, the director may file for record a certificate of. With the case number search, you may use either the.

To Search For A Certificate Of Tax Lien, You May Search By Case Number Or Debtor Name.

Missouri tax liens expire after 10 years, but may be renewed one time prior to expiring for an additional 10 years (20 years. The department of revenue is responsible for taking steps to ensure individuals and businesses pay their tax liability. Delinquent taxes with penalty, interest, and sales costs may be paid to the county collector at any time prior to the. A tax lien is the certificate of tax lien filed in the county’s recorder of deeds office and attaches to all real and personal property owned by the.