Name 3 Ways The Local Government Uses Tax Dollars

Name 3 Ways The Local Government Uses Tax Dollars - Name three ways the local government uses your tax money. Local governments use tax revenue to provide services such as police and. Property taxes are the dominant tax revenue source for local governments, generating approximately three in four local tax dollars. School district tax to help fund educational programs. Study with quizlet and memorize flashcards containing terms like name 3 ways the state government uses tax. Local governments use tax dollars for services such as road maintenance, public safety, and parks and recreation. Three ways they use these funds include: What does a tax deduction do? Government uses taxes for education, healthcare and transportation among other things

Local governments use tax revenue to provide services such as police and. What does a tax deduction do? Property taxes are the dominant tax revenue source for local governments, generating approximately three in four local tax dollars. Name three ways the local government uses your tax money. Three ways they use these funds include: Local governments use tax dollars for services such as road maintenance, public safety, and parks and recreation. Study with quizlet and memorize flashcards containing terms like name 3 ways the state government uses tax. School district tax to help fund educational programs. Government uses taxes for education, healthcare and transportation among other things

Local governments use tax dollars for services such as road maintenance, public safety, and parks and recreation. Local governments use tax revenue to provide services such as police and. Government uses taxes for education, healthcare and transportation among other things Property taxes are the dominant tax revenue source for local governments, generating approximately three in four local tax dollars. Study with quizlet and memorize flashcards containing terms like name 3 ways the state government uses tax. Three ways they use these funds include: School district tax to help fund educational programs. Name three ways the local government uses your tax money. What does a tax deduction do?

How do you want your local tax dollars spent? THE AMHERST CURRENT

Local governments use tax dollars for services such as road maintenance, public safety, and parks and recreation. Local governments use tax revenue to provide services such as police and. Three ways they use these funds include: Name three ways the local government uses your tax money. School district tax to help fund educational programs.

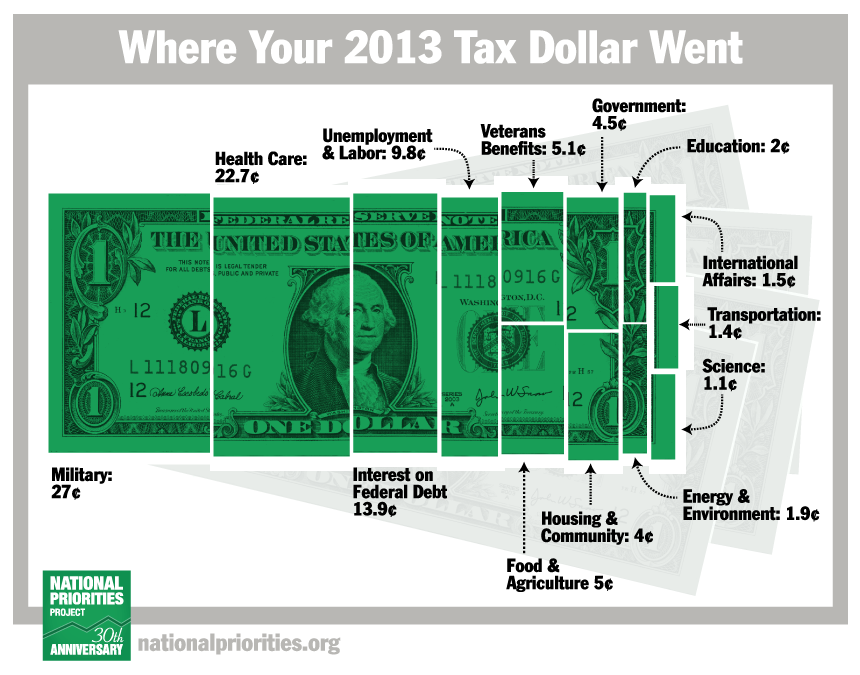

Where Did Your Tax Dollars Go? SavvyRoo

What does a tax deduction do? Local governments use tax revenue to provide services such as police and. Government uses taxes for education, healthcare and transportation among other things Three ways they use these funds include: Local governments use tax dollars for services such as road maintenance, public safety, and parks and recreation.

How the U.S. Government Really Spends Your Tax Dollars Reader's Digest

School district tax to help fund educational programs. Three ways they use these funds include: Property taxes are the dominant tax revenue source for local governments, generating approximately three in four local tax dollars. Government uses taxes for education, healthcare and transportation among other things Study with quizlet and memorize flashcards containing terms like name 3 ways the state government.

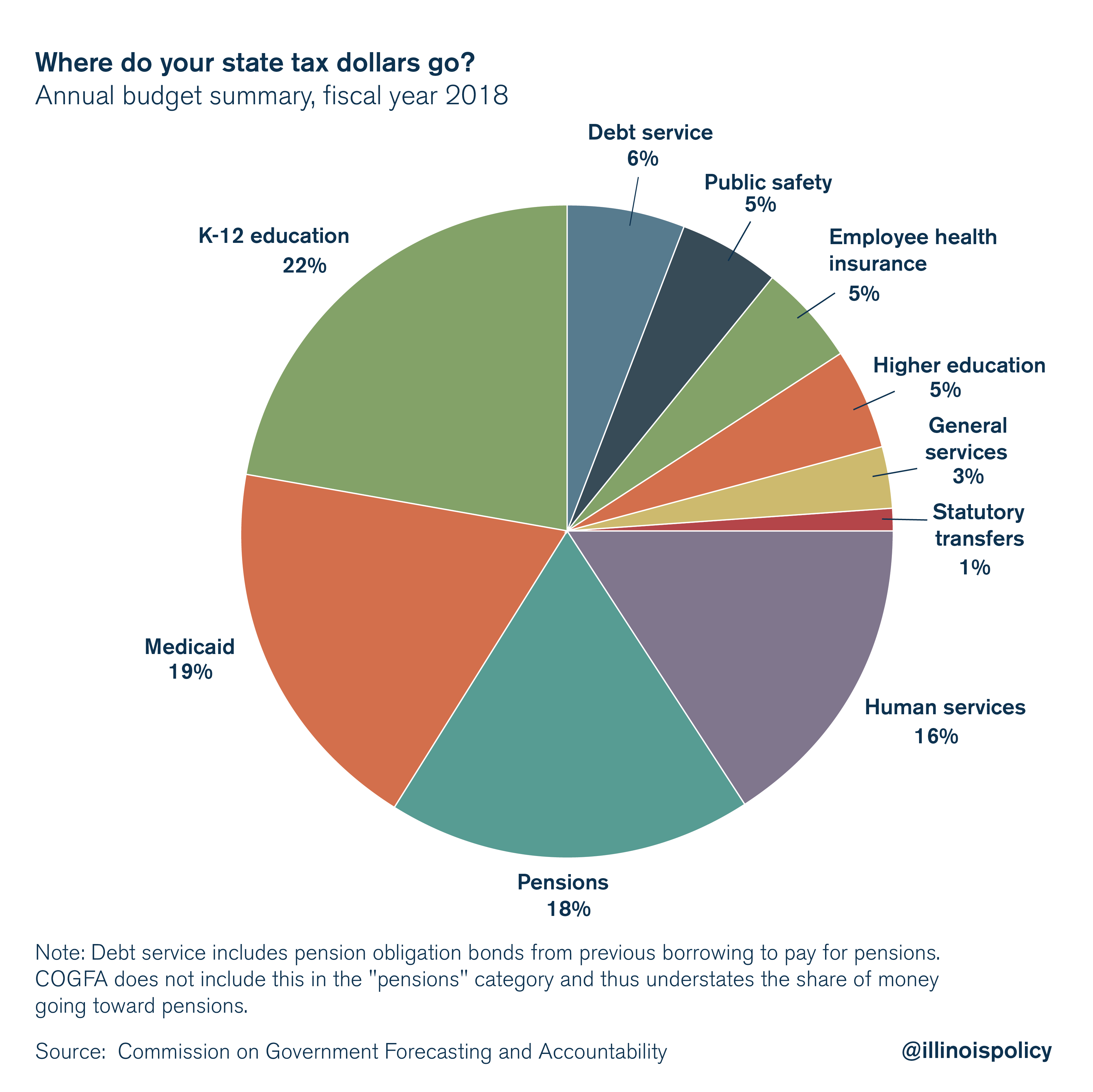

Tax Day Where do Illinoisans’ state tax dollars go?

Name three ways the local government uses your tax money. Local governments use tax dollars for services such as road maintenance, public safety, and parks and recreation. Property taxes are the dominant tax revenue source for local governments, generating approximately three in four local tax dollars. School district tax to help fund educational programs. Local governments use tax revenue to.

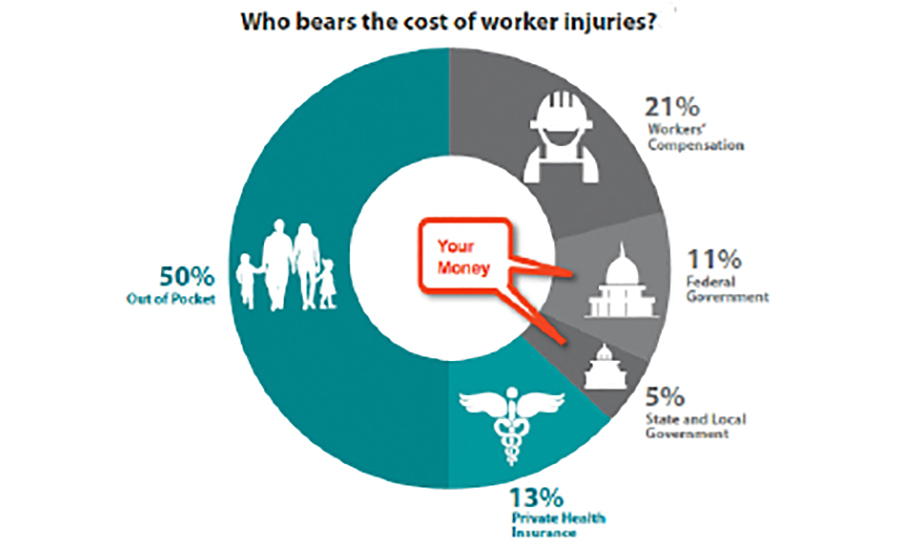

Better ways to spend our tax dollars 20150901 ISHN

Local governments use tax revenue to provide services such as police and. Property taxes are the dominant tax revenue source for local governments, generating approximately three in four local tax dollars. What does a tax deduction do? Government uses taxes for education, healthcare and transportation among other things Local governments use tax dollars for services such as road maintenance, public.

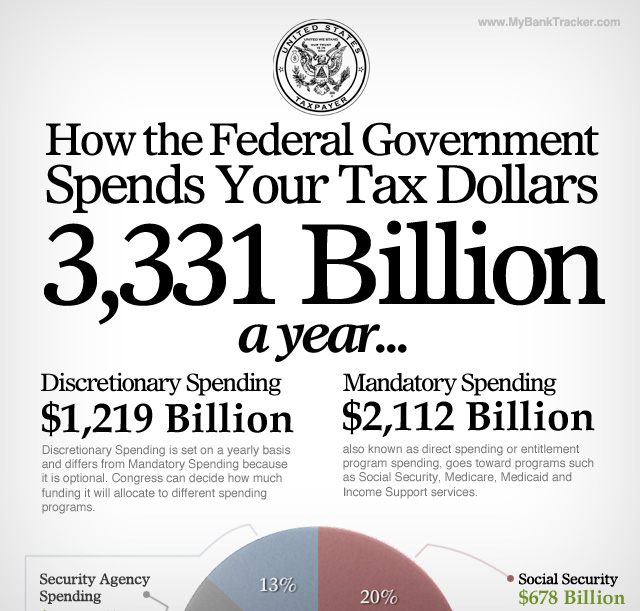

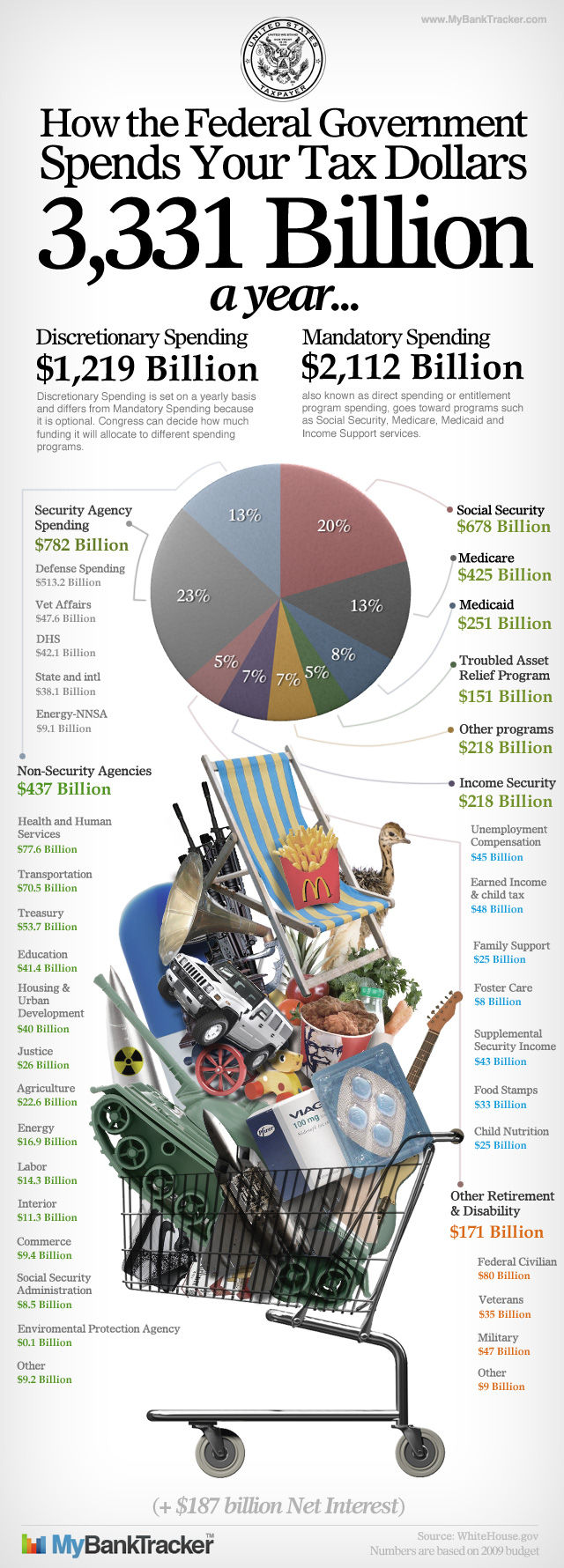

How the Federal Government Spends Your Tax Dollars Infograph

Government uses taxes for education, healthcare and transportation among other things Local governments use tax revenue to provide services such as police and. Local governments use tax dollars for services such as road maintenance, public safety, and parks and recreation. What does a tax deduction do? Property taxes are the dominant tax revenue source for local governments, generating approximately three.

How the Federal Government Spends Your Tax Dollars Infograph

Three ways they use these funds include: Local governments use tax dollars for services such as road maintenance, public safety, and parks and recreation. School district tax to help fund educational programs. Study with quizlet and memorize flashcards containing terms like name 3 ways the state government uses tax. What does a tax deduction do?

Where Do Your Tax Dollars Go?

What does a tax deduction do? Three ways they use these funds include: School district tax to help fund educational programs. Local governments use tax revenue to provide services such as police and. Government uses taxes for education, healthcare and transportation among other things

How the Government Spends Your Tax Dollars Tax Foundation

Three ways they use these funds include: Name three ways the local government uses your tax money. School district tax to help fund educational programs. Property taxes are the dominant tax revenue source for local governments, generating approximately three in four local tax dollars. What does a tax deduction do?

How the Government Spends Your Tax Dollars Tax Foundation

Local governments use tax dollars for services such as road maintenance, public safety, and parks and recreation. What does a tax deduction do? Local governments use tax revenue to provide services such as police and. Name three ways the local government uses your tax money. School district tax to help fund educational programs.

What Does A Tax Deduction Do?

School district tax to help fund educational programs. Study with quizlet and memorize flashcards containing terms like name 3 ways the state government uses tax. Local governments use tax revenue to provide services such as police and. Property taxes are the dominant tax revenue source for local governments, generating approximately three in four local tax dollars.

Government Uses Taxes For Education, Healthcare And Transportation Among Other Things

Name three ways the local government uses your tax money. Three ways they use these funds include: Local governments use tax dollars for services such as road maintenance, public safety, and parks and recreation.

.png)