Ohio State Tax Lien Search

Ohio State Tax Lien Search - The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. You may obtain the questionnaire by searching tax forms at tax.ohio.gov. It makes assessments, prepares tax forms, provides. An official state of ohio site. The ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including but not. For income tax and school district delinquencies if you were not a. You may be charged penalties and interest. The ohio department of taxation administers most state and several local taxes.

It makes assessments, prepares tax forms, provides. The ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including but not. The ohio department of taxation administers most state and several local taxes. You may obtain the questionnaire by searching tax forms at tax.ohio.gov. You may be charged penalties and interest. For income tax and school district delinquencies if you were not a. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. An official state of ohio site.

You may be charged penalties and interest. It makes assessments, prepares tax forms, provides. You may obtain the questionnaire by searching tax forms at tax.ohio.gov. The ohio department of taxation administers most state and several local taxes. The ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including but not. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. An official state of ohio site. For income tax and school district delinquencies if you were not a.

Tax Lien Ohio State Tax Lien

It makes assessments, prepares tax forms, provides. The ohio department of taxation administers most state and several local taxes. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. You may obtain the questionnaire by searching tax forms at tax.ohio.gov. You may be charged penalties and interest.

Tax Lien What Is A State Tax Lien Ohio

The ohio department of taxation administers most state and several local taxes. The ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including but not. You may be charged penalties and interest. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund..

FAQ On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat

For income tax and school district delinquencies if you were not a. An official state of ohio site. It makes assessments, prepares tax forms, provides. The ohio department of taxation administers most state and several local taxes. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund.

Online Ohio State Tax Withholding Form

The ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including but not. The ohio department of taxation administers most state and several local taxes. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. You may obtain the questionnaire by searching.

How Do I Get a Tax Lien Removed From My Credit Report?

It makes assessments, prepares tax forms, provides. The ohio department of taxation administers most state and several local taxes. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. You may be charged penalties and interest. You may obtain the questionnaire by searching tax forms at tax.ohio.gov.

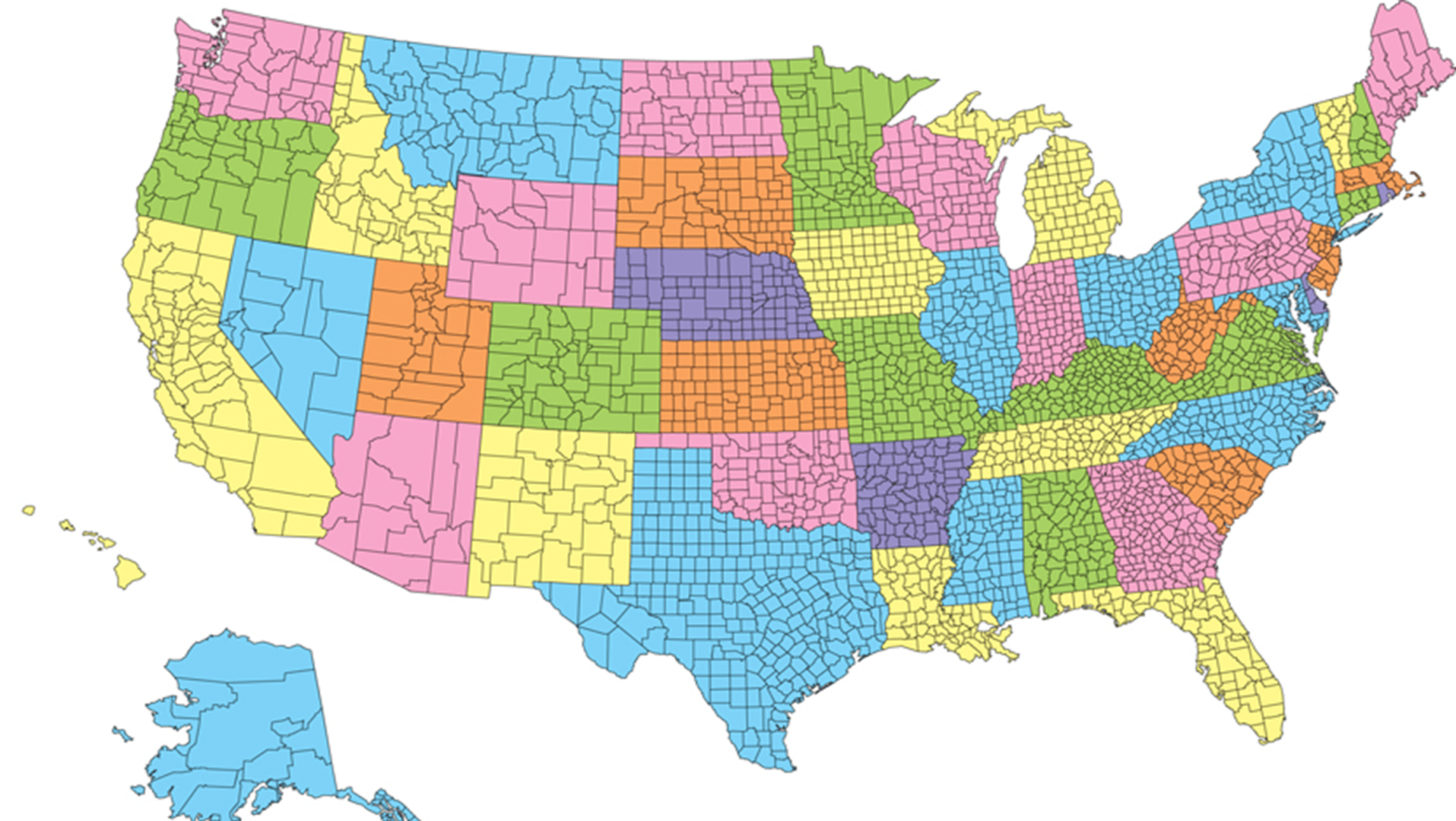

The Essential List Of Tax Lien Certificate States Tax Lien

The ohio department of taxation administers most state and several local taxes. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. An official state of ohio site. It makes assessments, prepares tax forms, provides. The ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a.

How To Find Out About A Tax Lien Engineercontest30

The ohio department of taxation administers most state and several local taxes. The ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including but not. It makes assessments, prepares tax forms, provides. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund..

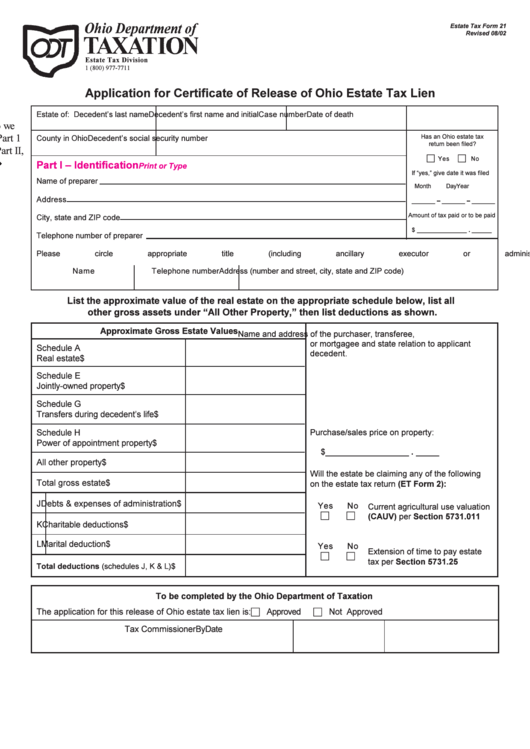

Estate Tax Form 21 Application For Certificate Of Release Of Ohio

The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. You may be charged penalties and interest. You may obtain the questionnaire by searching tax forms at tax.ohio.gov. The ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including but not. An.

Tax Lien Texas State Tax Lien

You may be charged penalties and interest. It makes assessments, prepares tax forms, provides. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. An official state of ohio site. The ohio department of taxation administers most state and several local taxes.

Property Tax Lien Sales Ohio Investor's Guide to Success

An official state of ohio site. For income tax and school district delinquencies if you were not a. The ohio department of taxation administers most state and several local taxes. It makes assessments, prepares tax forms, provides. You may be charged penalties and interest.

You May Obtain The Questionnaire By Searching Tax Forms At Tax.ohio.gov.

The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. You may be charged penalties and interest. The ohio department of taxation files judgment liens in the clerk of courts office to recover revenue for a variety of taxes, including but not. It makes assessments, prepares tax forms, provides.

An Official State Of Ohio Site.

For income tax and school district delinquencies if you were not a. The ohio department of taxation administers most state and several local taxes.