Oregon State Tax Lien

Oregon State Tax Lien - Oregon revised statutes title 29, revenue and. A state tax lien is the government’s legal claim. However, the statute of 10 years limitation on. To be removed from the list, a taxpayer must. (a) all ad valorem property taxes. Taxes on personal property shall be a lien:

A state tax lien is the government’s legal claim. Oregon revised statutes title 29, revenue and. (a) all ad valorem property taxes. To be removed from the list, a taxpayer must. However, the statute of 10 years limitation on. Taxes on personal property shall be a lien:

To be removed from the list, a taxpayer must. A state tax lien is the government’s legal claim. (a) all ad valorem property taxes. Oregon revised statutes title 29, revenue and. Taxes on personal property shall be a lien: However, the statute of 10 years limitation on.

Tax Lien Tax Lien Washington State

Oregon revised statutes title 29, revenue and. A state tax lien is the government’s legal claim. (a) all ad valorem property taxes. Taxes on personal property shall be a lien: However, the statute of 10 years limitation on.

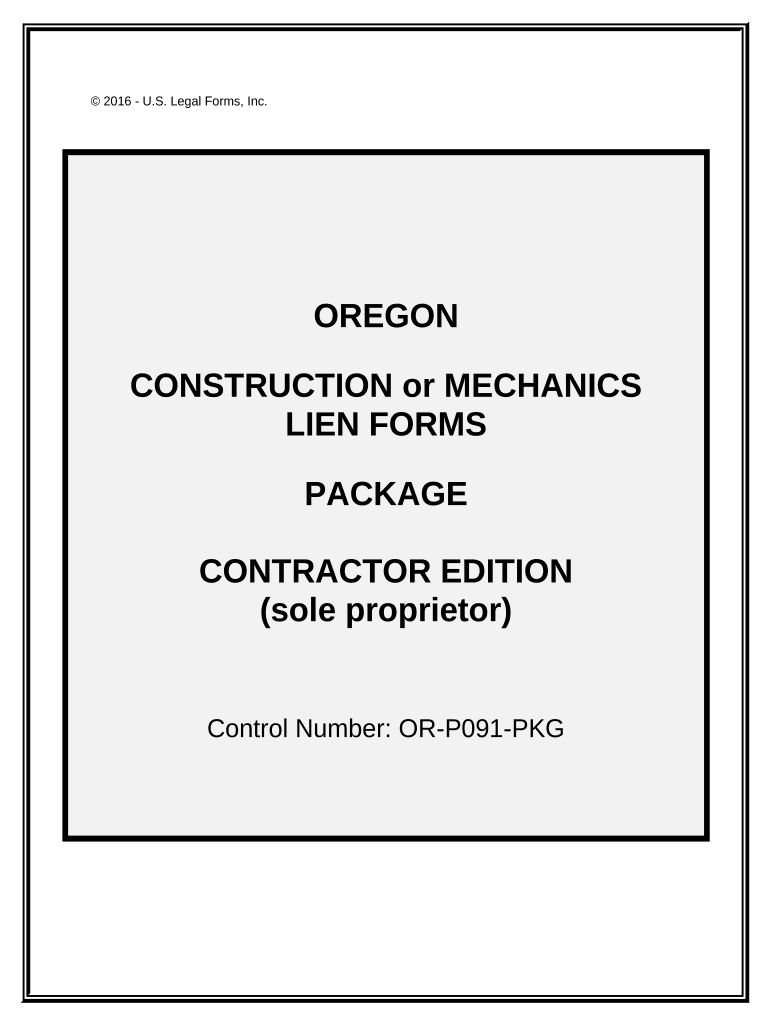

Mechanics lien oregon Fill out & sign online DocHub

However, the statute of 10 years limitation on. Taxes on personal property shall be a lien: To be removed from the list, a taxpayer must. (a) all ad valorem property taxes. A state tax lien is the government’s legal claim.

tax lien PDF Free Download

However, the statute of 10 years limitation on. To be removed from the list, a taxpayer must. (a) all ad valorem property taxes. Taxes on personal property shall be a lien: Oregon revised statutes title 29, revenue and.

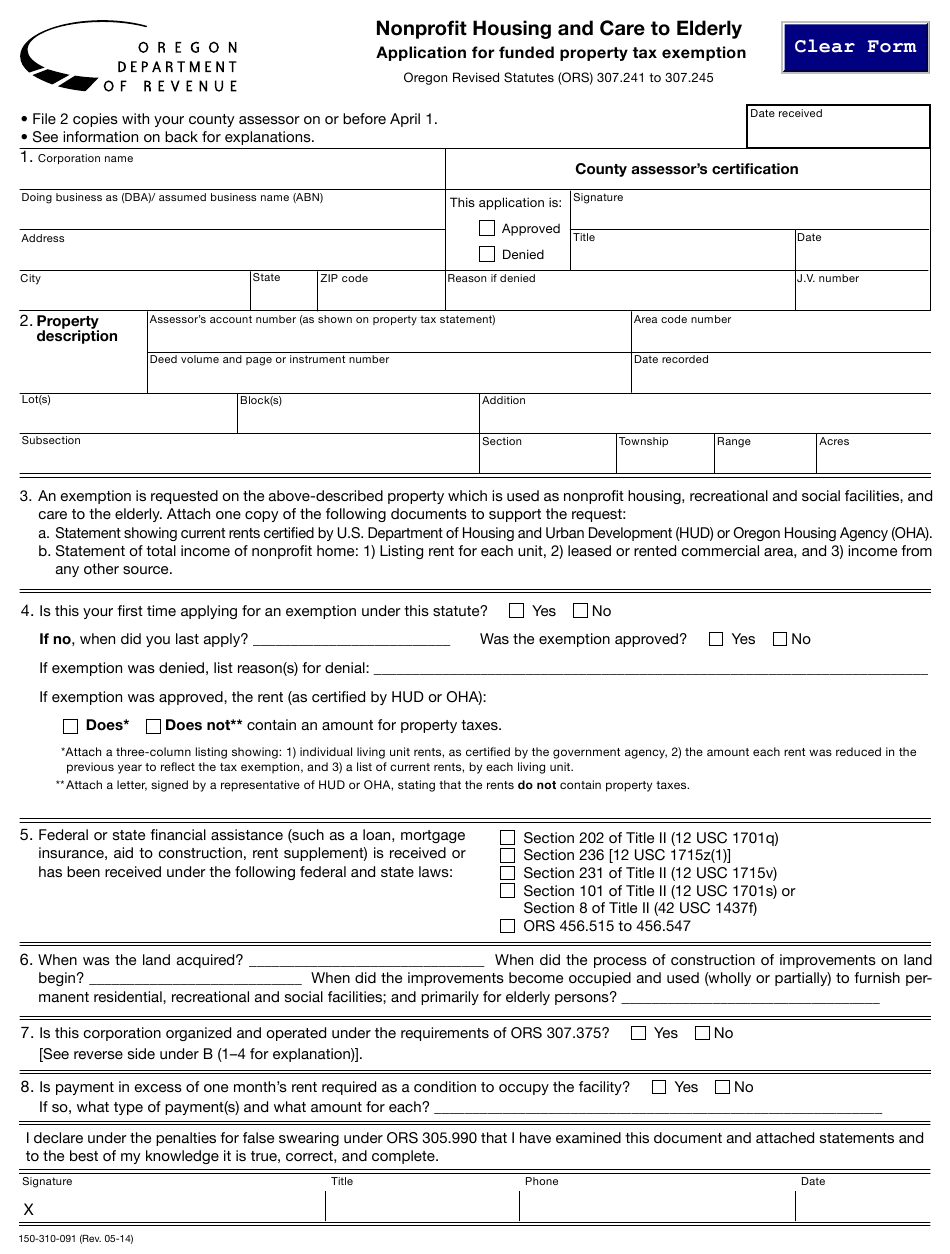

State Tax Exemption Form Oregon

(a) all ad valorem property taxes. Oregon revised statutes title 29, revenue and. A state tax lien is the government’s legal claim. Taxes on personal property shall be a lien: However, the statute of 10 years limitation on.

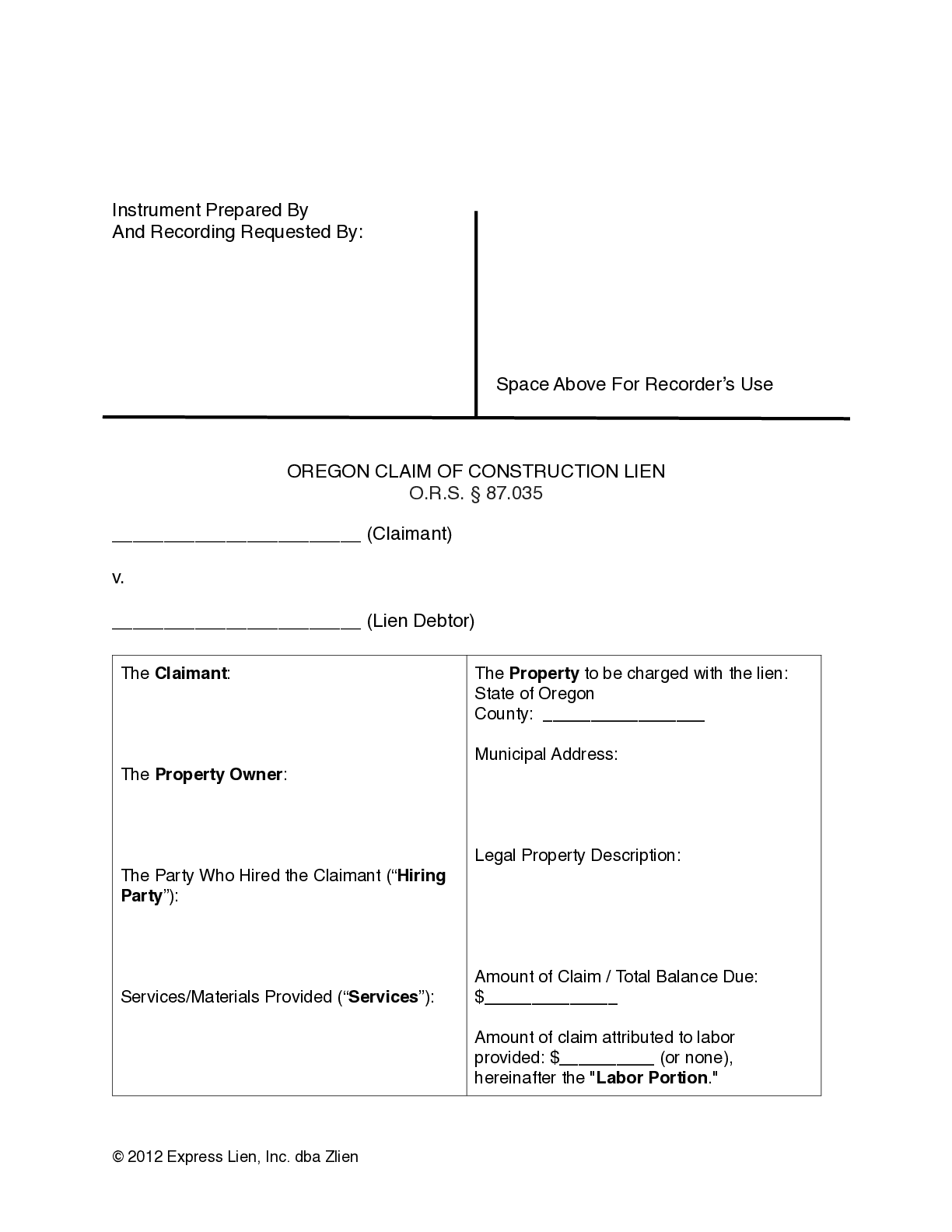

Oregon Claim of Construction Lien Form Free Template

Taxes on personal property shall be a lien: (a) all ad valorem property taxes. To be removed from the list, a taxpayer must. A state tax lien is the government’s legal claim. However, the statute of 10 years limitation on.

Guide On How To Start A Tax Lien Business Side Hustle

A state tax lien is the government’s legal claim. Oregon revised statutes title 29, revenue and. Taxes on personal property shall be a lien: To be removed from the list, a taxpayer must. However, the statute of 10 years limitation on.

Oregon Notice of Right to Lien Form Download Free With Fact Sheet

To be removed from the list, a taxpayer must. However, the statute of 10 years limitation on. Oregon revised statutes title 29, revenue and. A state tax lien is the government’s legal claim. (a) all ad valorem property taxes.

Tax Lien Sale Download Free PDF Tax Lien Taxes

Oregon revised statutes title 29, revenue and. A state tax lien is the government’s legal claim. Taxes on personal property shall be a lien: However, the statute of 10 years limitation on. To be removed from the list, a taxpayer must.

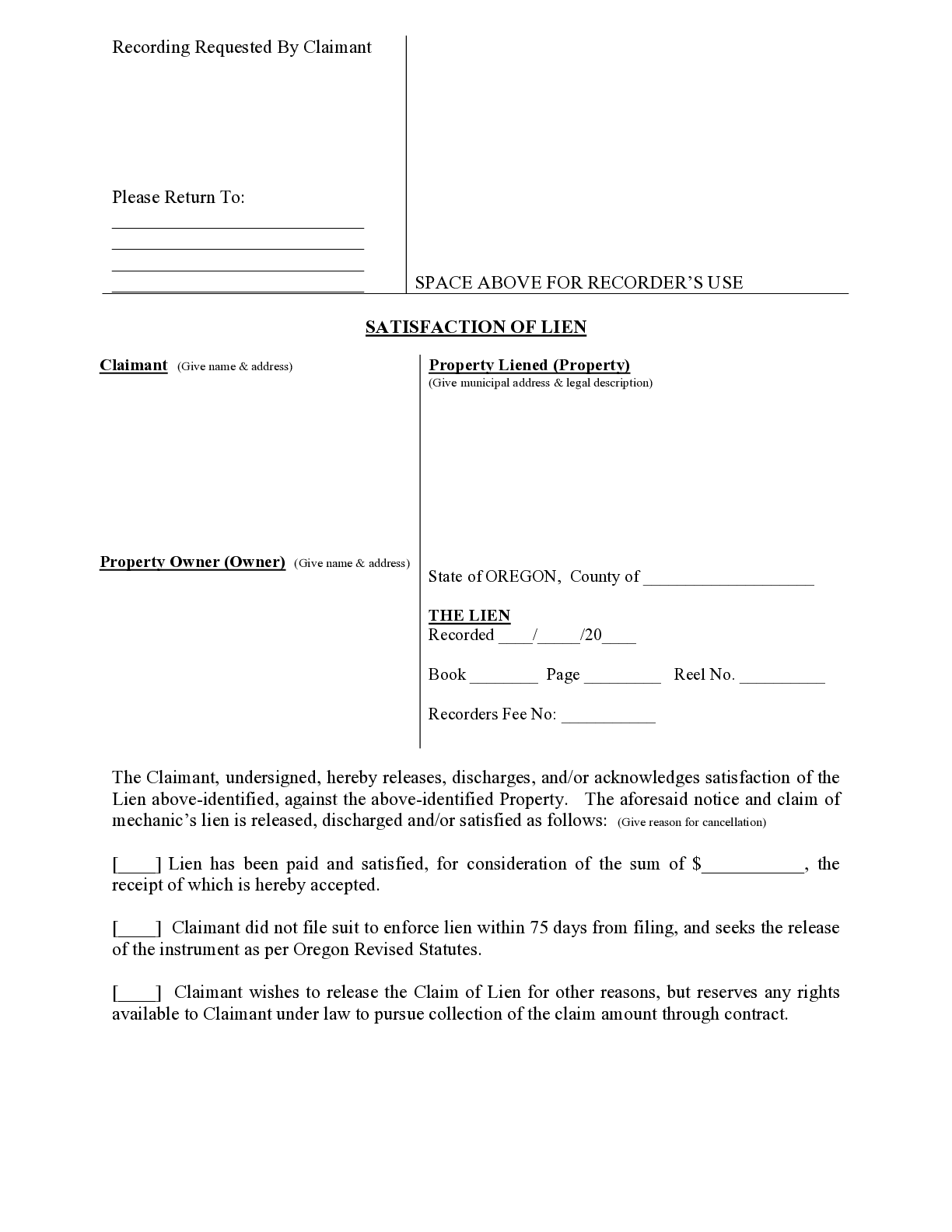

Oregon Satisfaction of Lien Form Free Template

A state tax lien is the government’s legal claim. However, the statute of 10 years limitation on. To be removed from the list, a taxpayer must. (a) all ad valorem property taxes. Taxes on personal property shall be a lien:

A State Tax Lien Is The Government’s Legal Claim.

To be removed from the list, a taxpayer must. However, the statute of 10 years limitation on. (a) all ad valorem property taxes. Taxes on personal property shall be a lien: