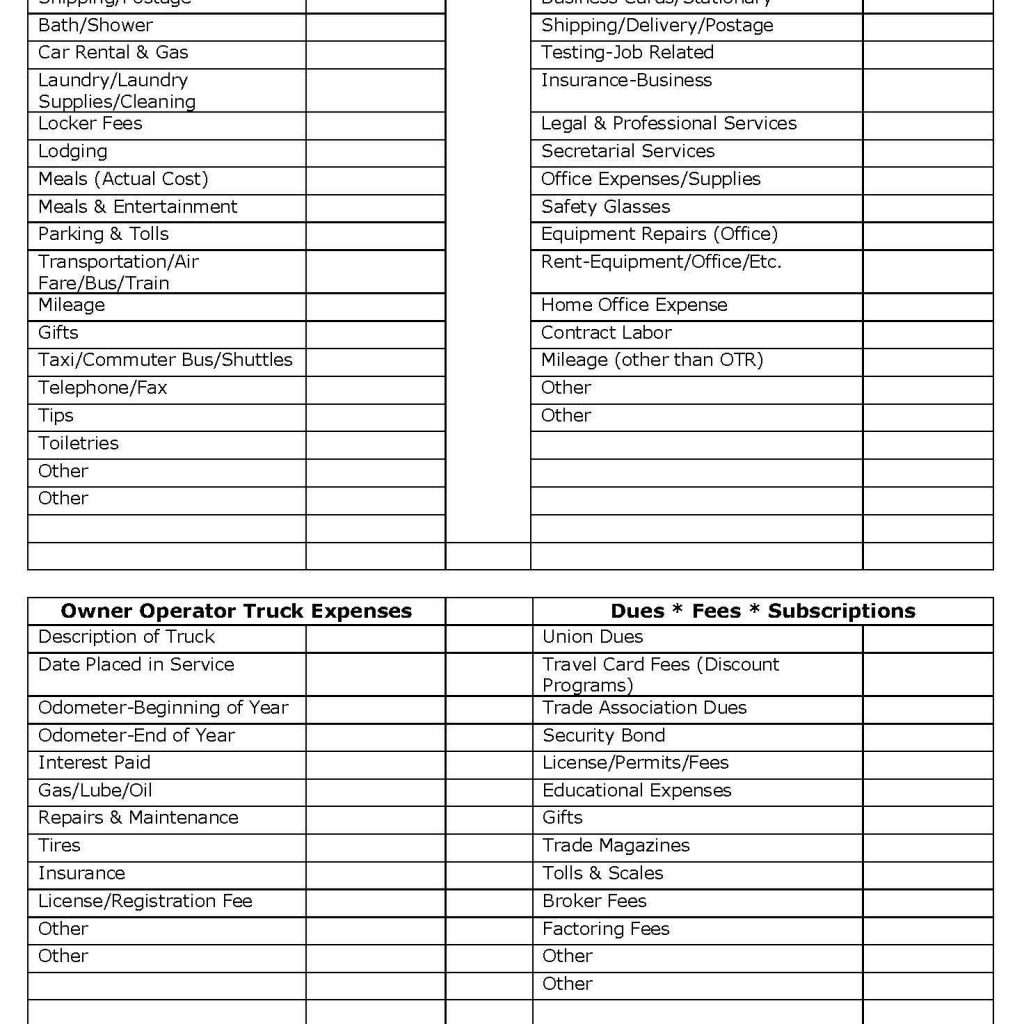

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

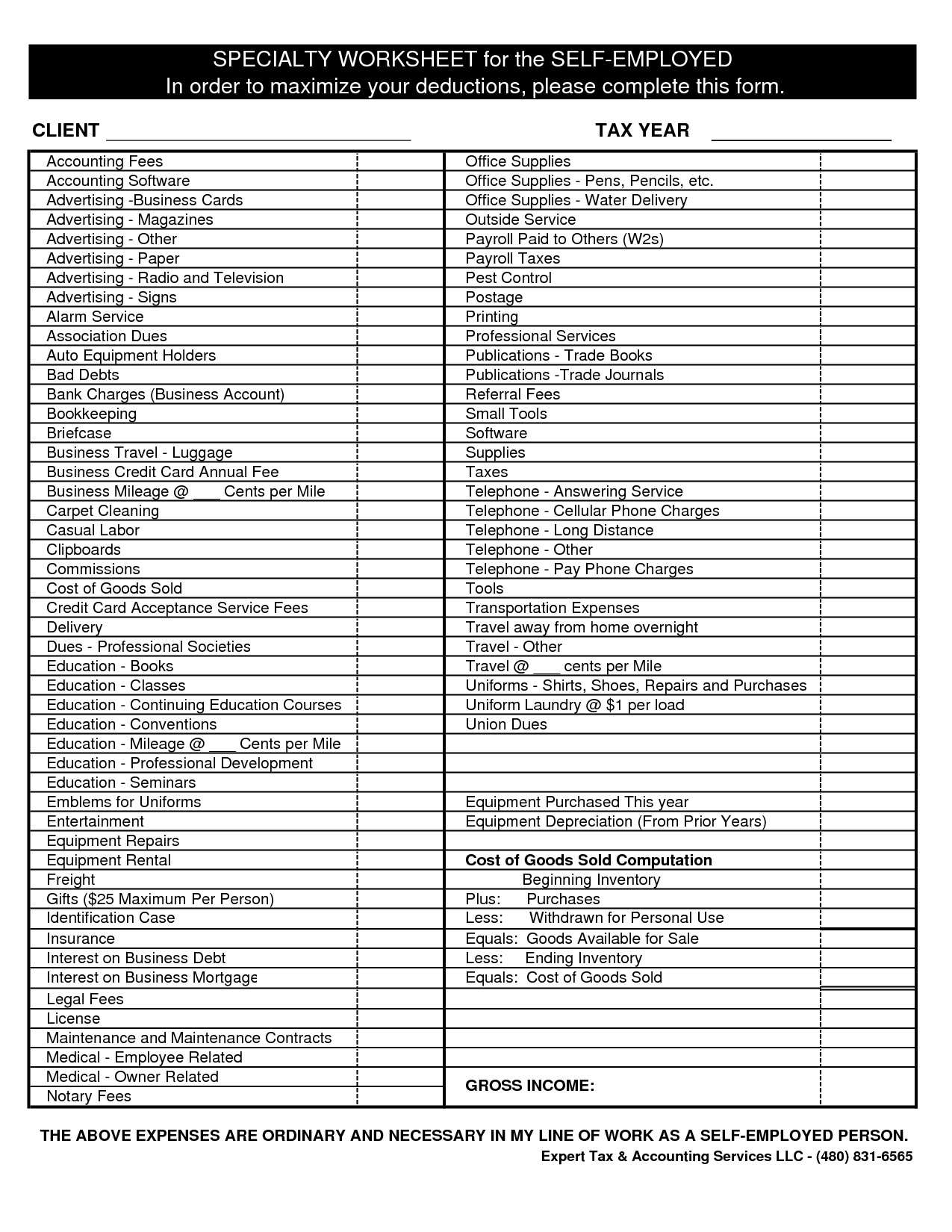

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet - In order for an expense to be deductible, it must be considered. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. You cannot legitimately deduct for downtime (with. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Shoeboxed is an expense & receipt.

Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Shoeboxed is an expense & receipt. In order for an expense to be deductible, it must be considered. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. You cannot legitimately deduct for downtime (with.

Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Shoeboxed is an expense & receipt. In order for an expense to be deductible, it must be considered. You cannot legitimately deduct for downtime (with. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses.

The OwnerOperator's Quick Guide to Taxes (2024)

Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. You cannot legitimately deduct for downtime (with. Shoeboxed is an expense & receipt. In order for an expense to be.

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Shoeboxed is an expense & receipt. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. You cannot legitimately deduct for downtime (with. In order for an expense to be deductible, it must be considered. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales,.

Printable Truck Driver Expense Owner Operator Tax Deductions

You cannot legitimately deduct for downtime (with. In order for an expense to be deductible, it must be considered. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Shoeboxed.

Printable Truck Driver Expense Owner Operator Tax Deductions

You cannot legitimately deduct for downtime (with. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must be considered. Shoeboxed.

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

In order for an expense to be deductible, it must be considered. You cannot legitimately deduct for downtime (with. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Shoeboxed is an expense & receipt. Truck driver tax deductions the purpose of this worksheet is to help you organize.

Free Owner Operator Expense Spreadsheet within Trucking Business

In order for an expense to be deductible, it must be considered. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Shoeboxed is an expense & receipt. You cannot.

Real Estate Agent Tax Deductions Worksheet 2022 Fill Online

Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. You cannot legitimately deduct for downtime (with. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must be considered. Shoeboxed.

Truck Driver Expense Spreadsheet —

Shoeboxed is an expense & receipt. You cannot legitimately deduct for downtime (with. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. In order for an expense to be.

Truck Driver Tax Deductions Worksheets

In order for an expense to be deductible, it must be considered. You cannot legitimately deduct for downtime (with. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Shoeboxed is an expense & receipt. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales,.

Printable Truck Driver Expense Owner Operator Tax Deductions

You cannot legitimately deduct for downtime (with. In order for an expense to be deductible, it must be considered. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Shoeboxed is an expense & receipt. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales,.

Truck Driver Tax Deductions The Purpose Of This Worksheet Is To Help You Organize Your Tax Deductible Business Expenses.

In order for an expense to be deductible, it must be considered. Shoeboxed is an expense & receipt. You cannot legitimately deduct for downtime (with. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible.