Rhode Island Tax Lien

Rhode Island Tax Lien - View information and requirements about the town of bristol. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. View monthly rhode island tax lien list recorded with appropriate city or town. Tax titles on real estate. In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. (a) taxes assessed against any person in any city or town for either personal property or real estate shall. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. Tax sale information for bidders. Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment.

View information and requirements about the town of bristol. (a) taxes assessed against any person in any city or town for either personal property or real estate shall. Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. Tax titles on real estate. In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. View monthly rhode island tax lien list recorded with appropriate city or town. Tax sale information for bidders.

(a) taxes assessed against any person in any city or town for either personal property or real estate shall. View monthly rhode island tax lien list recorded with appropriate city or town. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. Tax titles on real estate. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. Tax sale information for bidders. View information and requirements about the town of bristol. In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment.

The Complete Guide to Rhode Island Lien & Notice Deadlines National

View information and requirements about the town of bristol. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. Tax sale information for bidders. (a) taxes assessed against any person in any city or town for either personal property or real estate shall. Tax titles on real estate.

Rhode Island Division of Taxation May 2020

Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. Tax titles on real estate. View information and requirements about the town of bristol. View monthly rhode island.

Rhode Island Mechanics Liens Everything You Need to Know to Get Paid

Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. Tax sale information for bidders. View information and requirements about the town of bristol. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. Tax titles on real estate.

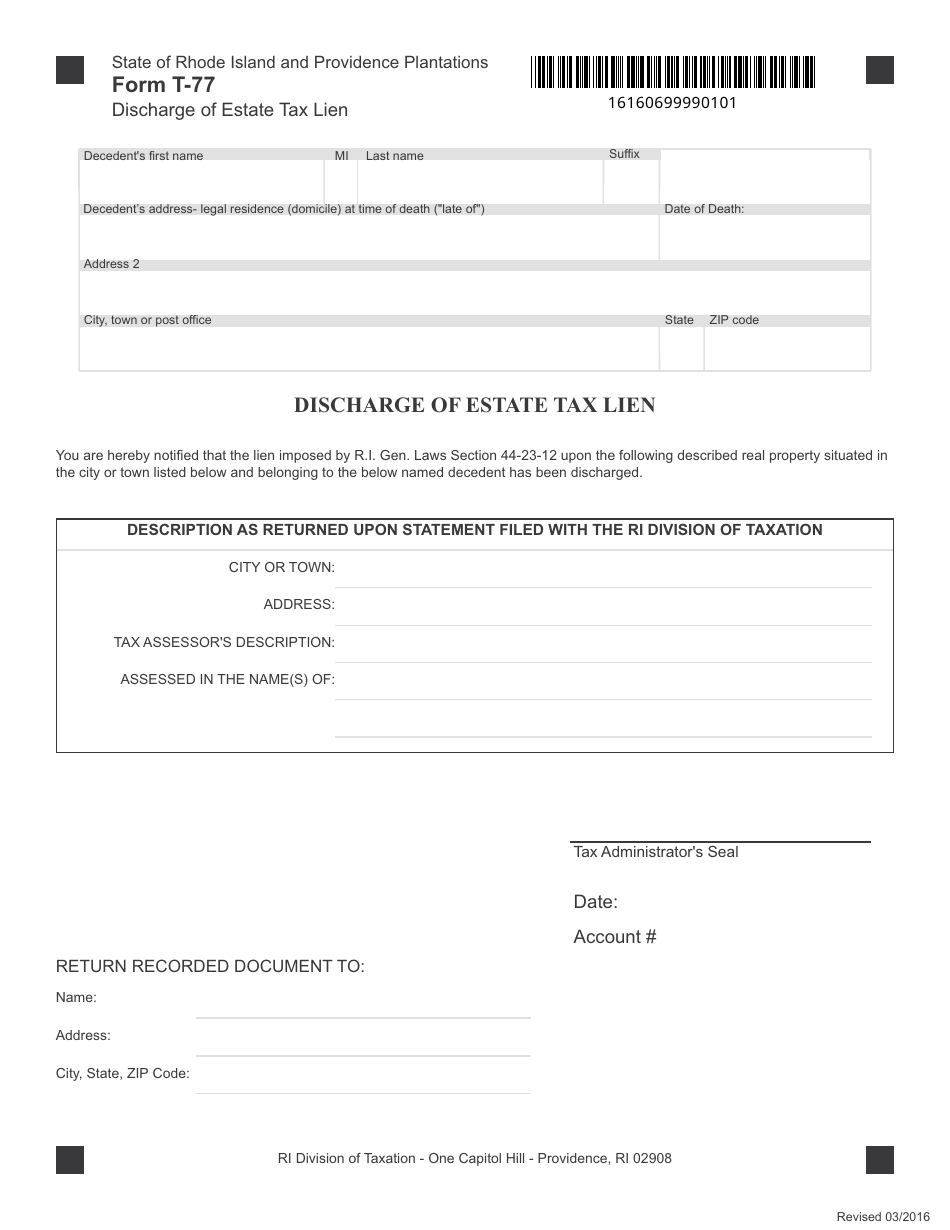

Form T77 Fill Out, Sign Online and Download Fillable PDF, Rhode

View monthly rhode island tax lien list recorded with appropriate city or town. View information and requirements about the town of bristol. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. Tax sale information for bidders. (a) taxes assessed against any person in any city or town for either.

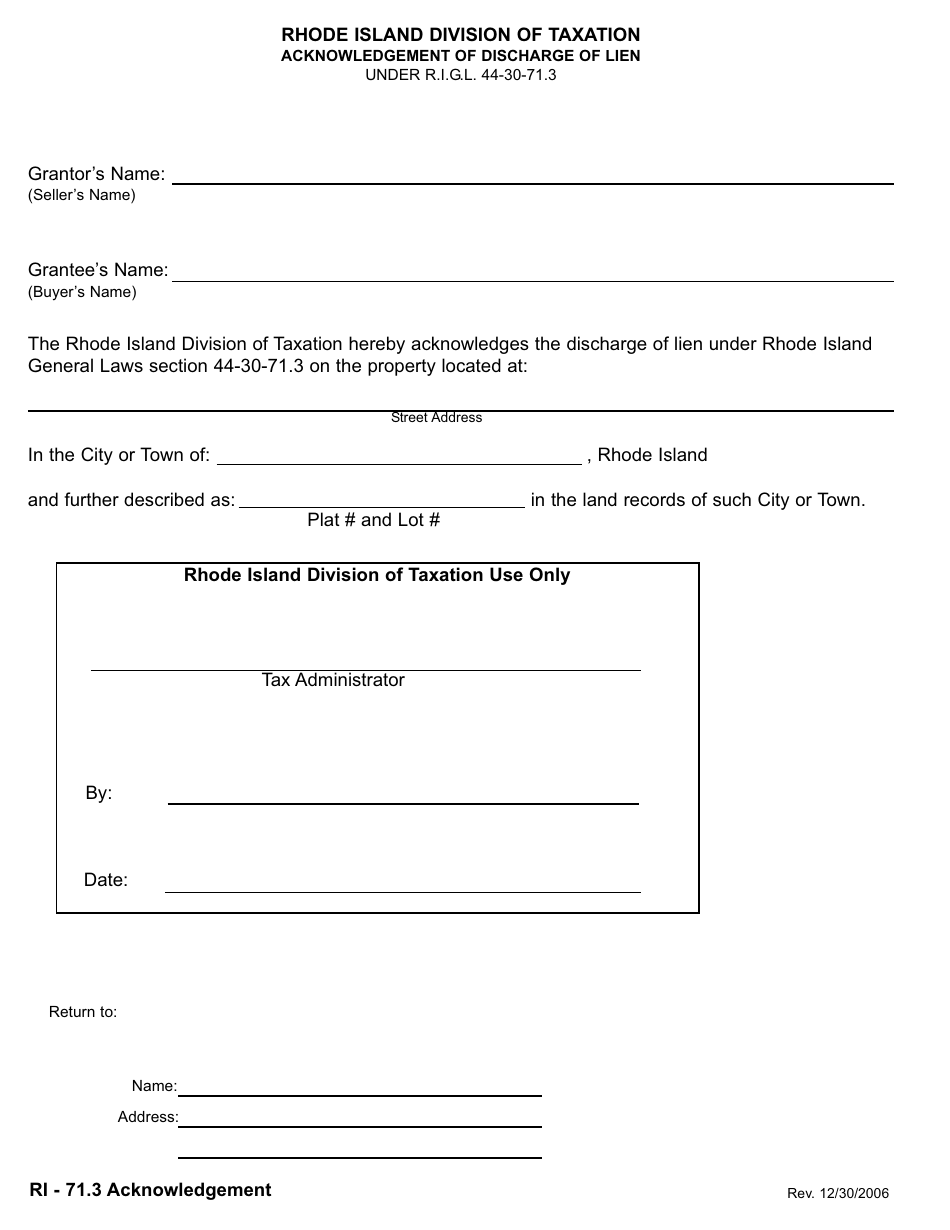

Rhode Island Acknowledgement of Discharge of Lien Fill Out, Sign

(a) taxes assessed against any person in any city or town for either personal property or real estate shall. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. View monthly rhode island tax lien list recorded with appropriate city or town. Tax titles on real estate. In rhode island,.

Rhode Island State Taxes Taxed Right

(a) taxes assessed against any person in any city or town for either personal property or real estate shall. In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. Tax sale.

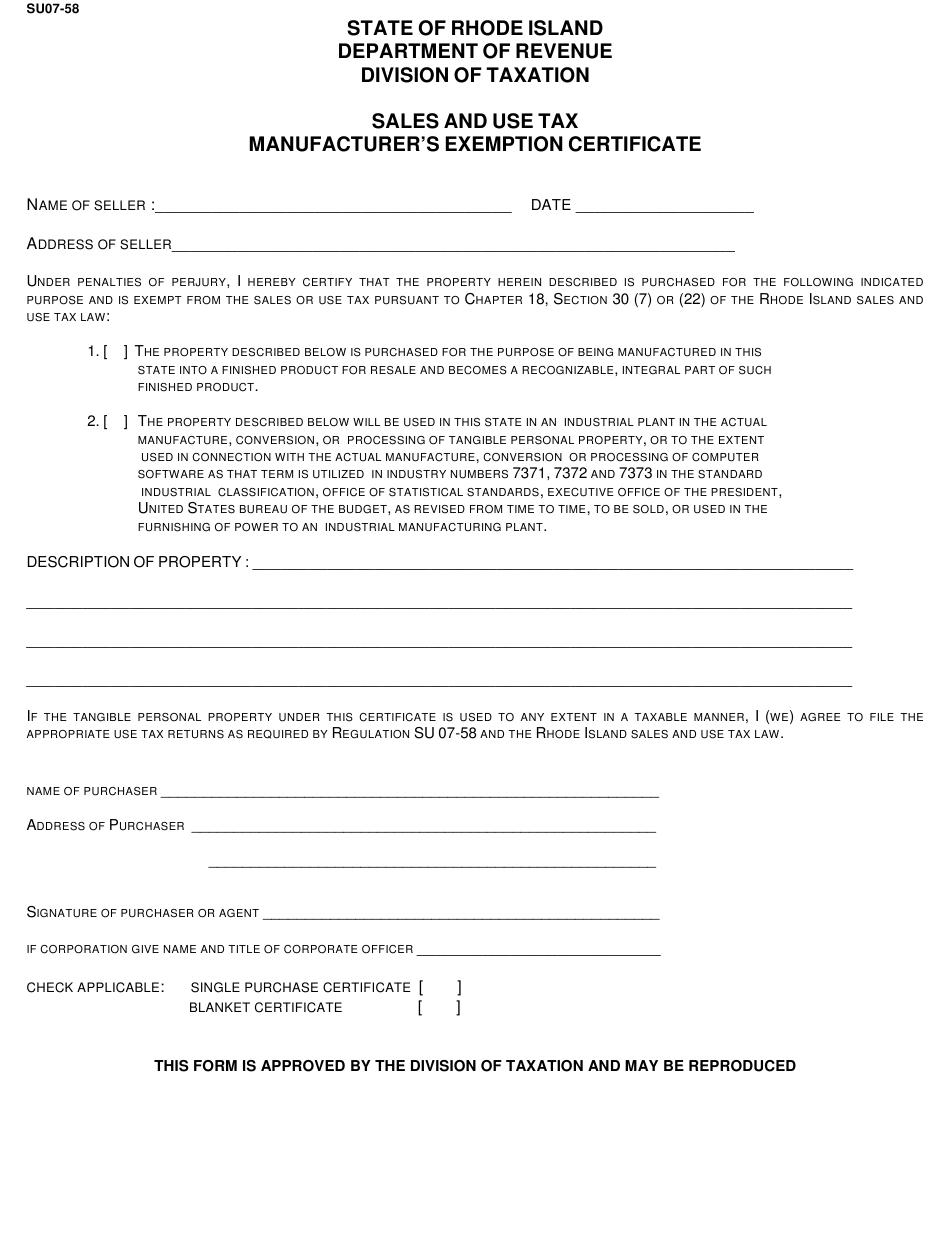

Rhode Island Tax Exempt Form

(a) taxes assessed against any person in any city or town for either personal property or real estate shall. View monthly rhode island tax lien list recorded with appropriate city or town. Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. Tax sale information for bidders. When.

rhode island tax rates 2020 Russ

When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. Tax sale information for bidders. (a) taxes assessed against any person in any city or town for either personal property or real estate shall. Legally, a tax is a lien in favor of the city that arises by operation of.

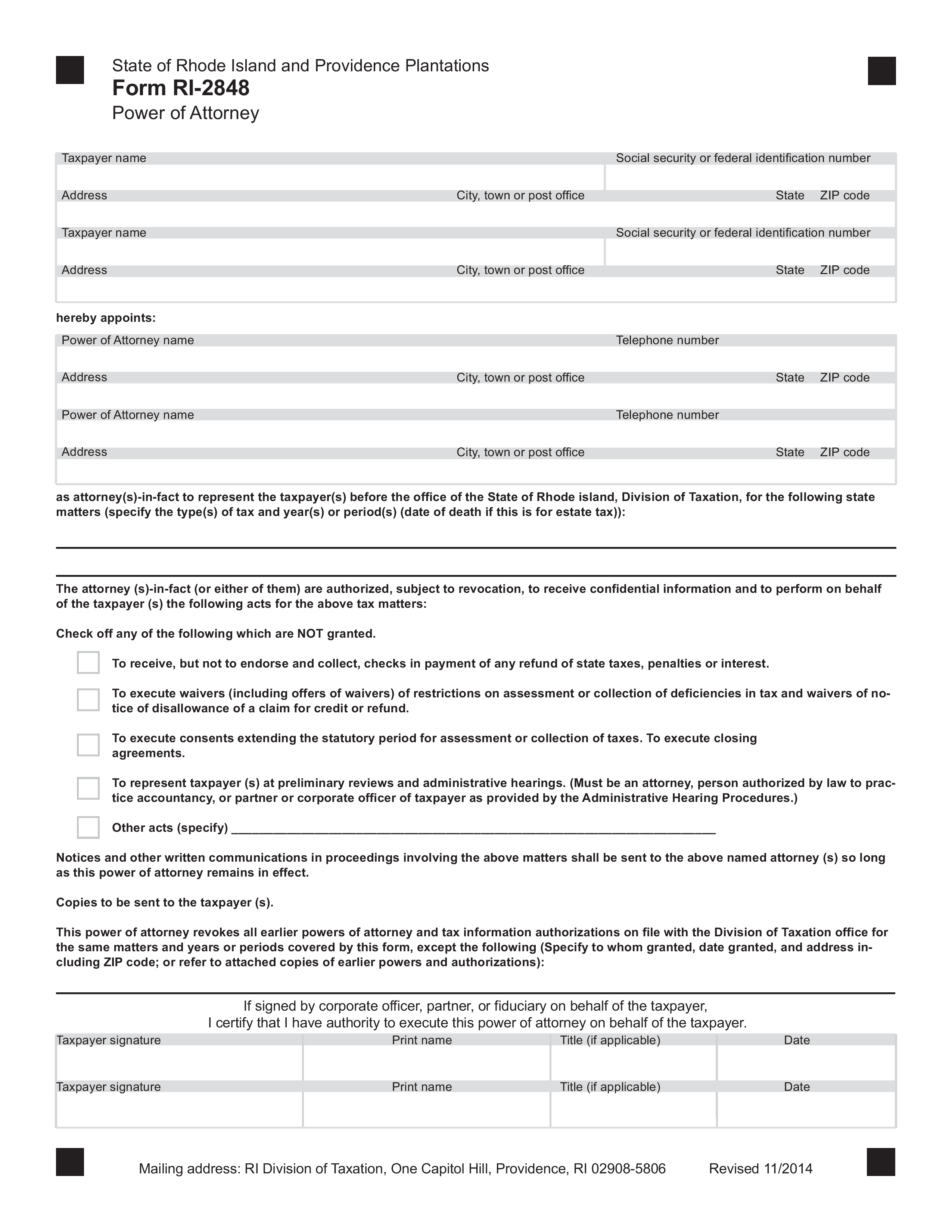

Free Rhode Island Tax Power of Attorney Form (Form RI2848)

Tax sale information for bidders. Tax titles on real estate. In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. View monthly rhode island tax lien list recorded with appropriate city or town. View information and requirements about the town of bristol.

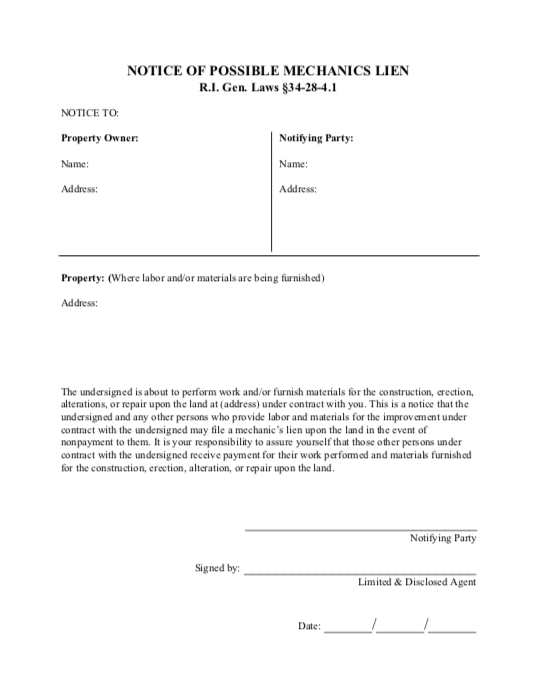

Rhode Island Notice of Possible Mechanics Lien Form Levelset

When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at. In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. Tax sale information for bidders. Using the best available information, the rhode island division of taxation has sent formal notice, by.

Tax Sale Information For Bidders.

View information and requirements about the town of bristol. Using the best available information, the rhode island division of taxation has sent formal notice, by regular and certified. In rhode island, municipal real estate tax sales are a crucial mechanism used by local governments to collect delinquent. View monthly rhode island tax lien list recorded with appropriate city or town.

Tax Titles On Real Estate.

(a) taxes assessed against any person in any city or town for either personal property or real estate shall. Legally, a tax is a lien in favor of the city that arises by operation of law upon the date of assessment. When an owner of real estate becomes delinquent in the payment of their real estate taxes, the municipal government at.