Secrets Of Tax Lien Investing

Secrets Of Tax Lien Investing - Learn the secrets of tax lien investing today! High risk and toxic tax liens can cost money. Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. We help you start investing in tax deeds and tax liens with as little as $500. Knowing what to look for will help you from investing into a tax lien that is high risk.

Knowing what to look for will help you from investing into a tax lien that is high risk. High risk and toxic tax liens can cost money. We help you start investing in tax deeds and tax liens with as little as $500. Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. Learn the secrets of tax lien investing today!

Knowing what to look for will help you from investing into a tax lien that is high risk. Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. Learn the secrets of tax lien investing today! High risk and toxic tax liens can cost money. We help you start investing in tax deeds and tax liens with as little as $500.

TAX LIENS & TAX DEEDS EXPLAINED! Each year Florida has 254 counties

Learn the secrets of tax lien investing today! High risk and toxic tax liens can cost money. We help you start investing in tax deeds and tax liens with as little as $500. Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. Knowing what to look for will help you from investing.

What are Tax Lien Investing Benefits? Finance.Gov.Capital

We help you start investing in tax deeds and tax liens with as little as $500. High risk and toxic tax liens can cost money. Knowing what to look for will help you from investing into a tax lien that is high risk. Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs..

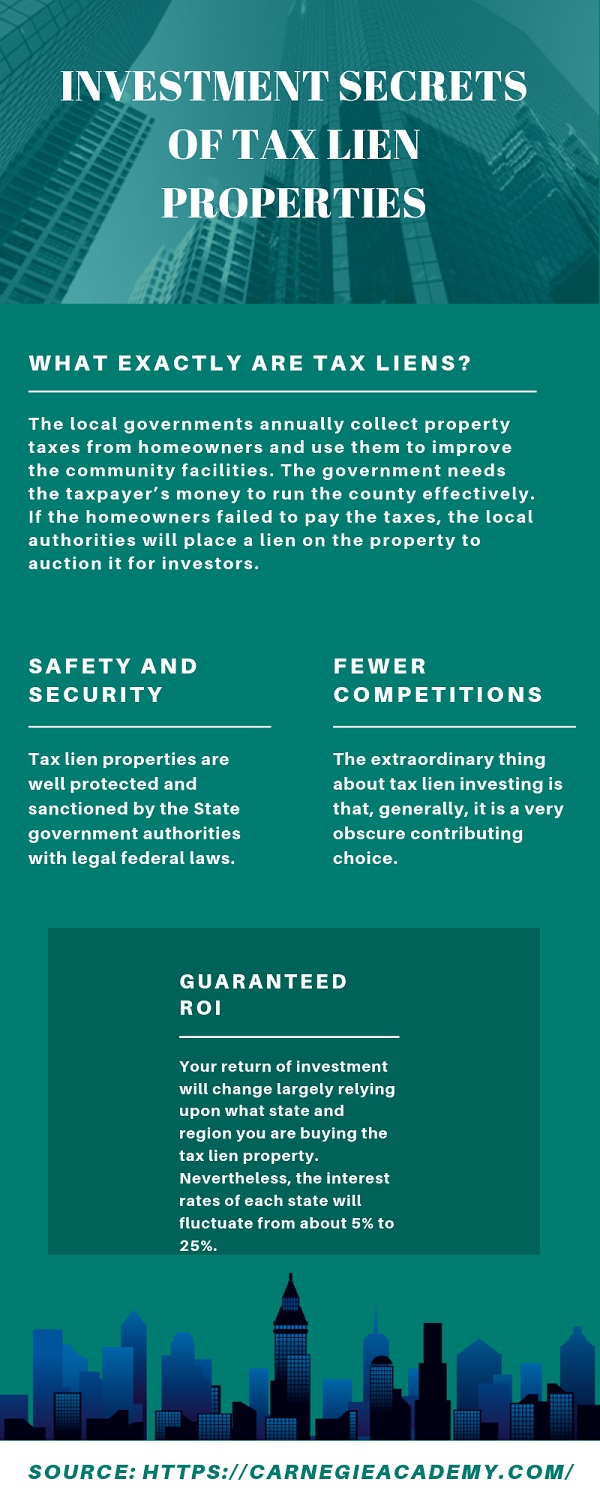

Investment Secrets of Tax Lien Properties Latest Infographics

Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. Knowing what to look for will help you from investing into a tax lien that is high risk. We help you start investing in tax deeds and tax liens with as little as $500. High risk and toxic tax liens can cost money..

Secrets of Tax Lien Investing Pleasant Grove UT

We help you start investing in tax deeds and tax liens with as little as $500. Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. Knowing what to look for will help you from investing into a tax lien that is high risk. Learn the secrets of tax lien investing today! High.

Tax Lien Investing What is Tax Lien Investing?

We help you start investing in tax deeds and tax liens with as little as $500. Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. Knowing what to look for will help you from investing into a tax lien that is high risk. Learn the secrets of tax lien investing today! High.

How Tax Lien Investing Works — LowCost Exposure to Real Estate

Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. We help you start investing in tax deeds and tax liens with as little as $500. Knowing what to look for will help you from investing into a tax lien that is high risk. Learn the secrets of tax lien investing today! High.

Secrets of Tax Lien Investing

High risk and toxic tax liens can cost money. Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. We help you start investing in tax deeds and tax liens with as little as $500. Knowing what to look for will help you from investing into a tax lien that is high risk..

Why Tax Lien Investing A Good Business? Tax Lien Certificate School

Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. We help you start investing in tax deeds and tax liens with as little as $500. Knowing what to look for will help you from investing into a tax lien that is high risk. Learn the secrets of tax lien investing today! High.

Tax Lien Investing A Beginner's Guide FortuneBuilders

High risk and toxic tax liens can cost money. Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. Knowing what to look for will help you from investing into a tax lien that is high risk. Learn the secrets of tax lien investing today! We help you start investing in tax deeds.

Secrets of Tax Lien Investing

Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. We help you start investing in tax deeds and tax liens with as little as $500. Learn the secrets of tax lien investing today! Knowing what to look for will help you from investing into a tax lien that is high risk. High.

High Risk And Toxic Tax Liens Can Cost Money.

Learn how to buy tax liens, earn high interest rates, and potentially acquire properties at low costs. Learn the secrets of tax lien investing today! Knowing what to look for will help you from investing into a tax lien that is high risk. We help you start investing in tax deeds and tax liens with as little as $500.