State Local Sales Tax Deduction

State Local Sales Tax Deduction - Determine the amount of state and local general sales tax you can claim when you itemize deductions on schedule a (forms 1040. Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year or the state and. A sales tax deduction lets you lower your tax bill by subtracting the sales tax you’ve paid throughout the year. Taxpayers can utilize two tables to calculate their alternative sales tax deduction. It’s part of the state and. Answer a few questions about yourself and large purchases you made in the year of the tax. Estimate your state and local sales tax deduction. Using your income and the number of exemptions you are.

Taxpayers can utilize two tables to calculate their alternative sales tax deduction. Determine the amount of state and local general sales tax you can claim when you itemize deductions on schedule a (forms 1040. Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year or the state and. A sales tax deduction lets you lower your tax bill by subtracting the sales tax you’ve paid throughout the year. It’s part of the state and. Estimate your state and local sales tax deduction. Using your income and the number of exemptions you are. Answer a few questions about yourself and large purchases you made in the year of the tax.

Determine the amount of state and local general sales tax you can claim when you itemize deductions on schedule a (forms 1040. Taxpayers can utilize two tables to calculate their alternative sales tax deduction. Answer a few questions about yourself and large purchases you made in the year of the tax. Using your income and the number of exemptions you are. A sales tax deduction lets you lower your tax bill by subtracting the sales tax you’ve paid throughout the year. Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year or the state and. It’s part of the state and. Estimate your state and local sales tax deduction.

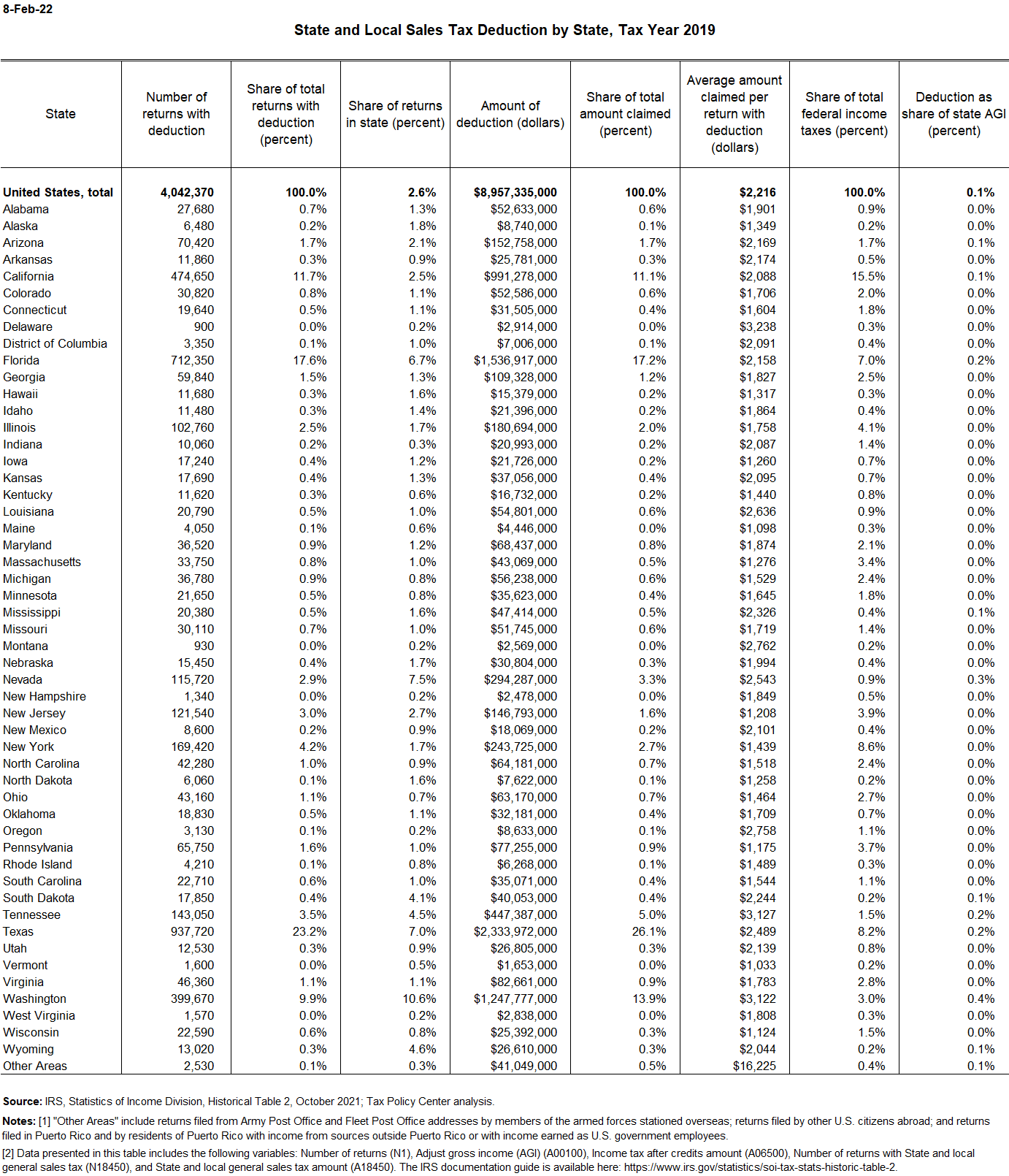

State and Local Sales Tax Deduction By State Tax Policy Center

Using your income and the number of exemptions you are. Estimate your state and local sales tax deduction. Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year or the state and. Answer a few questions about yourself and large purchases you made in the year of the tax..

State and Local Sales Tax Deduction By State Tax Policy Center

Taxpayers can utilize two tables to calculate their alternative sales tax deduction. It’s part of the state and. Using your income and the number of exemptions you are. Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year or the state and. Estimate your state and local sales tax.

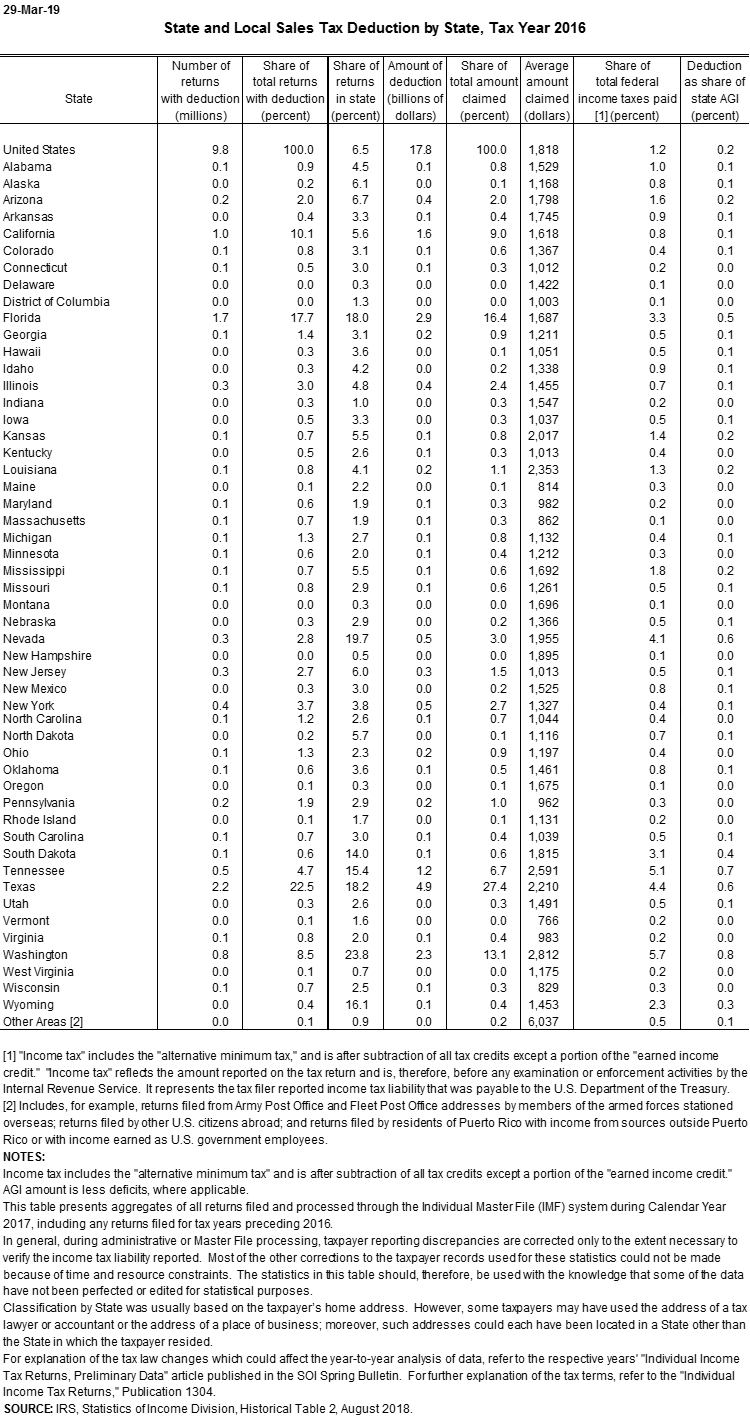

State and Local Tax Deduction by State Tax Policy Center

Estimate your state and local sales tax deduction. Using your income and the number of exemptions you are. Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year or the state and. Answer a few questions about yourself and large purchases you made in the year of the tax..

The State and Local Tax Deduction A Primer Tax Foundation

Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year or the state and. Taxpayers can utilize two tables to calculate their alternative sales tax deduction. Using your income and the number of exemptions you are. Determine the amount of state and local general sales tax you can claim.

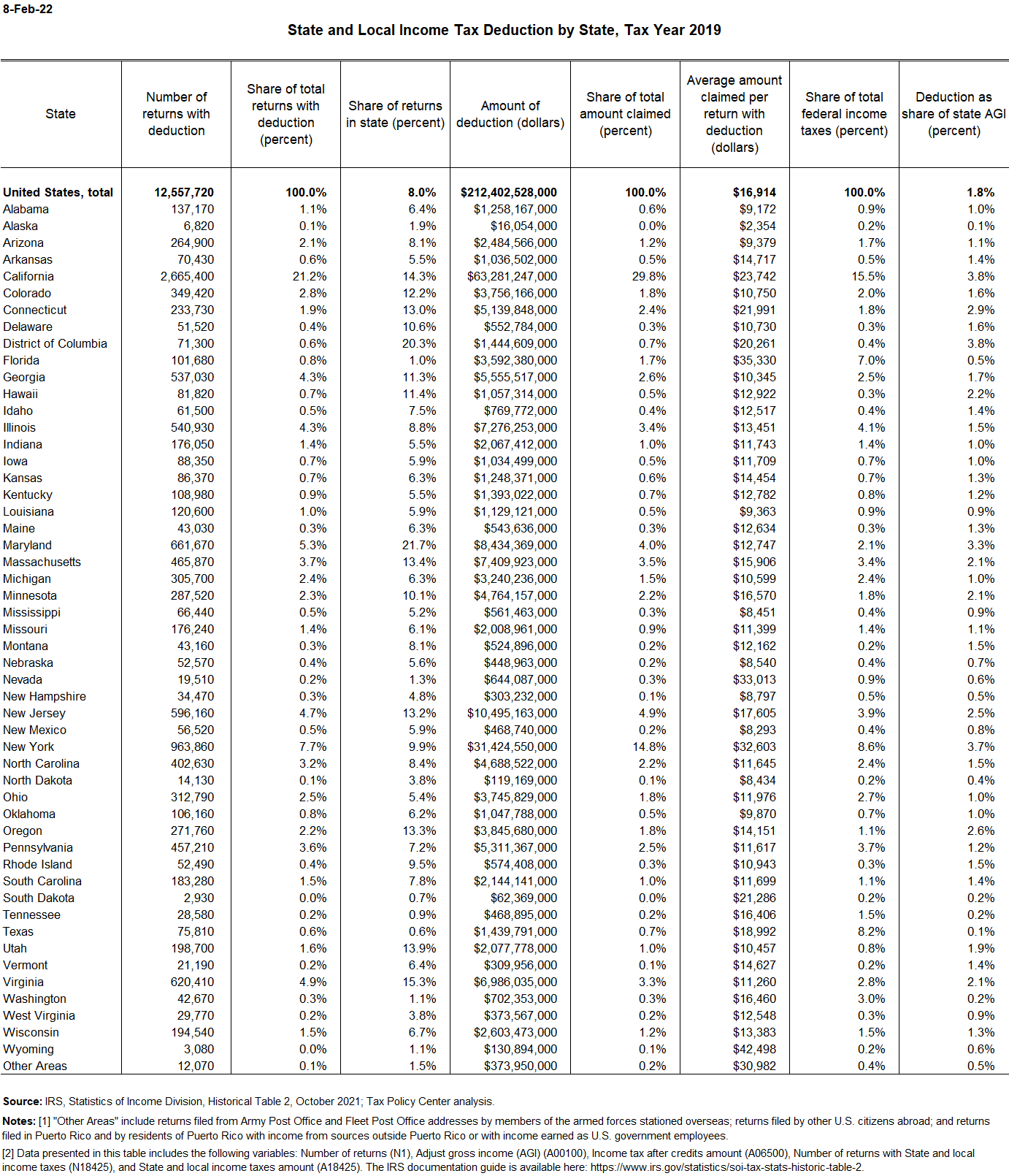

State and Local Sales Tax Deduction By State and AGI Tax Policy Center

A sales tax deduction lets you lower your tax bill by subtracting the sales tax you’ve paid throughout the year. It’s part of the state and. Using your income and the number of exemptions you are. Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year or the state.

SALT (State and Local Tax) Deduction 2024

Determine the amount of state and local general sales tax you can claim when you itemize deductions on schedule a (forms 1040. Answer a few questions about yourself and large purchases you made in the year of the tax. Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year.

How Does the State and Local Tax Deduction Work? Ramsey

Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year or the state and. Using your income and the number of exemptions you are. A sales tax deduction lets you lower your tax bill by subtracting the sales tax you’ve paid throughout the year. Taxpayers can utilize two tables.

What is the State and Local Sales Tax Deduction? The TurboTax Blog

It’s part of the state and. Determine the amount of state and local general sales tax you can claim when you itemize deductions on schedule a (forms 1040. A sales tax deduction lets you lower your tax bill by subtracting the sales tax you’ve paid throughout the year. Estimate your state and local sales tax deduction. Taxpayers can utilize two.

7 Situations State and Local Tax Deduction Not Allowed On Federal Tax

Taxpayers can utilize two tables to calculate their alternative sales tax deduction. Using your income and the number of exemptions you are. Answer a few questions about yourself and large purchases you made in the year of the tax. Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year.

State and Local Sales Tax Deduction By State and AGI Tax Policy Center

Estimate your state and local sales tax deduction. Determine the amount of state and local general sales tax you can claim when you itemize deductions on schedule a (forms 1040. Using your income and the number of exemptions you are. Taxpayers can utilize two tables to calculate their alternative sales tax deduction. Here's some help on how to choose whether.

A Sales Tax Deduction Lets You Lower Your Tax Bill By Subtracting The Sales Tax You’ve Paid Throughout The Year.

It’s part of the state and. Taxpayers can utilize two tables to calculate their alternative sales tax deduction. Here's some help on how to choose whether to deduct the state and local income taxes you paid for the year or the state and. Determine the amount of state and local general sales tax you can claim when you itemize deductions on schedule a (forms 1040.

Answer A Few Questions About Yourself And Large Purchases You Made In The Year Of The Tax.

Estimate your state and local sales tax deduction. Using your income and the number of exemptions you are.