Tax Consequences Deed In Lieu Of Foreclosure

Tax Consequences Deed In Lieu Of Foreclosure - When it comes to a deed in lieu of foreclosure, one of the most significant tax implications that many people face is the. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the. (1) the amount the lender. (1) this audit technique guide discusses the tax consequences for real estate property that is disposed of through foreclosure, short sale,.

(1) the amount the lender. (1) this audit technique guide discusses the tax consequences for real estate property that is disposed of through foreclosure, short sale,. When it comes to a deed in lieu of foreclosure, one of the most significant tax implications that many people face is the. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the.

Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. When it comes to a deed in lieu of foreclosure, one of the most significant tax implications that many people face is the. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the. (1) this audit technique guide discusses the tax consequences for real estate property that is disposed of through foreclosure, short sale,. (1) the amount the lender.

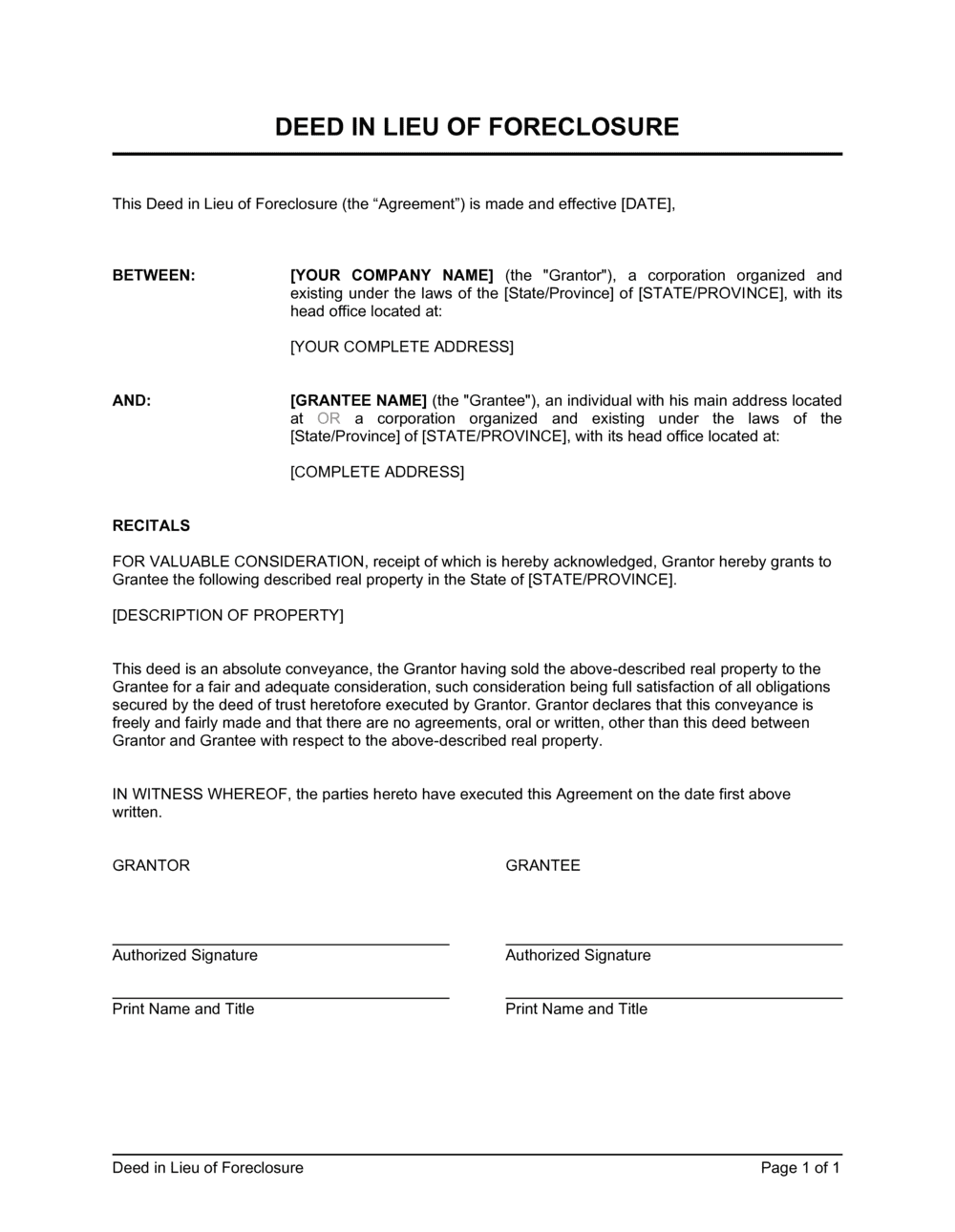

Deed In Lieu of Foreclosure Template by BusinessinaBox™

When it comes to a deed in lieu of foreclosure, one of the most significant tax implications that many people face is the. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in.

What is a Deed in Lieu of Foreclosure?

(1) this audit technique guide discusses the tax consequences for real estate property that is disposed of through foreclosure, short sale,. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. Real property foreclosures can produce various tax consequences depending on the type of.

Client Q&A What is a deedinlieu of foreclosure? first tuesday Journal

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. (1) this audit technique guide discusses the tax consequences for real estate property that is disposed of through foreclosure, short sale,. (1) the amount the lender. Fortunately, at least through 2025, most people who.

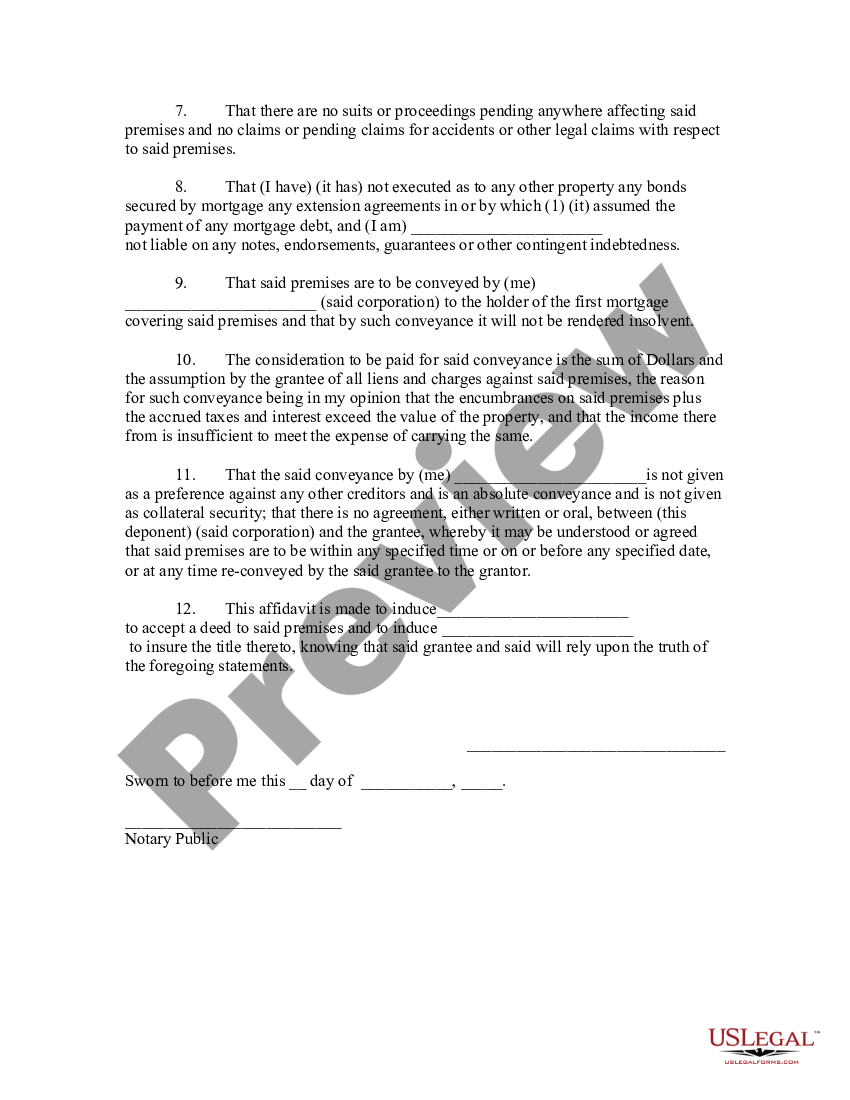

New York Affidavit for Deed in Lieu of Foreclosure Ny Deed US Legal

When it comes to a deed in lieu of foreclosure, one of the most significant tax implications that many people face is the. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the. (1) this audit technique guide discusses the tax consequences for real estate property that is disposed of through foreclosure,.

Deed In Lieu Of Foreclosure Form US Legal Forms

(1) this audit technique guide discusses the tax consequences for real estate property that is disposed of through foreclosure, short sale,. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the. When it comes to a deed in lieu of foreclosure, one of the most significant tax implications that many people face.

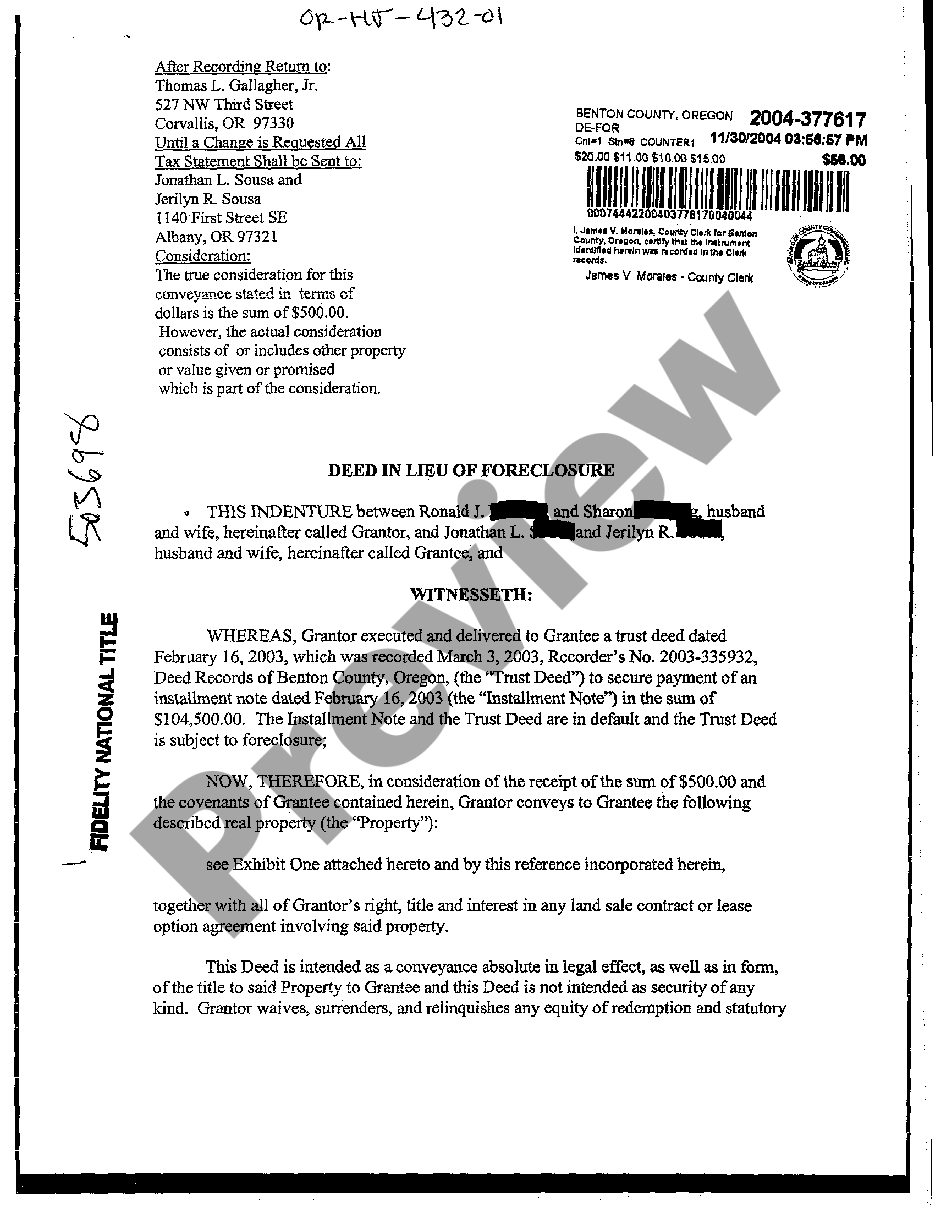

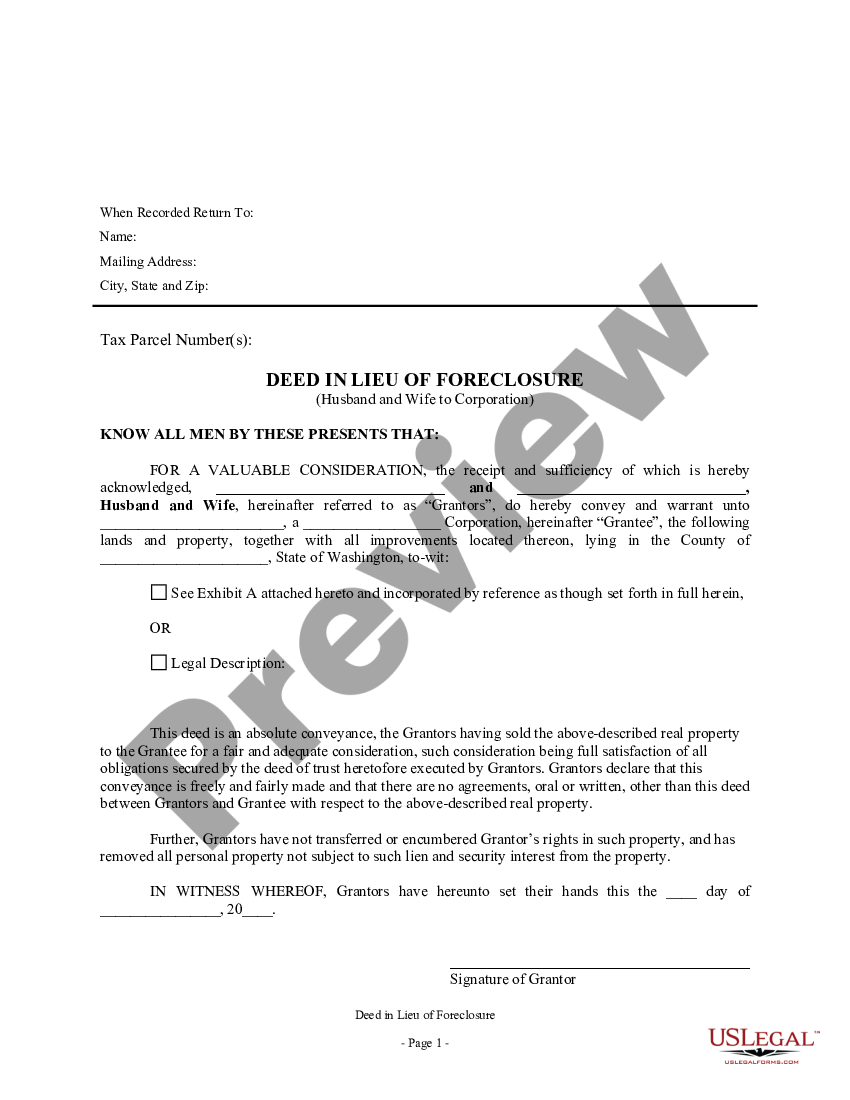

Washington Deed in Lieu of Foreclosure Deed In Lieu Of Foreclosure

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. (1) the amount the lender. When it comes to a deed in lieu of foreclosure, one of the most significant tax implications that many people face is the. Real property foreclosures can produce various.

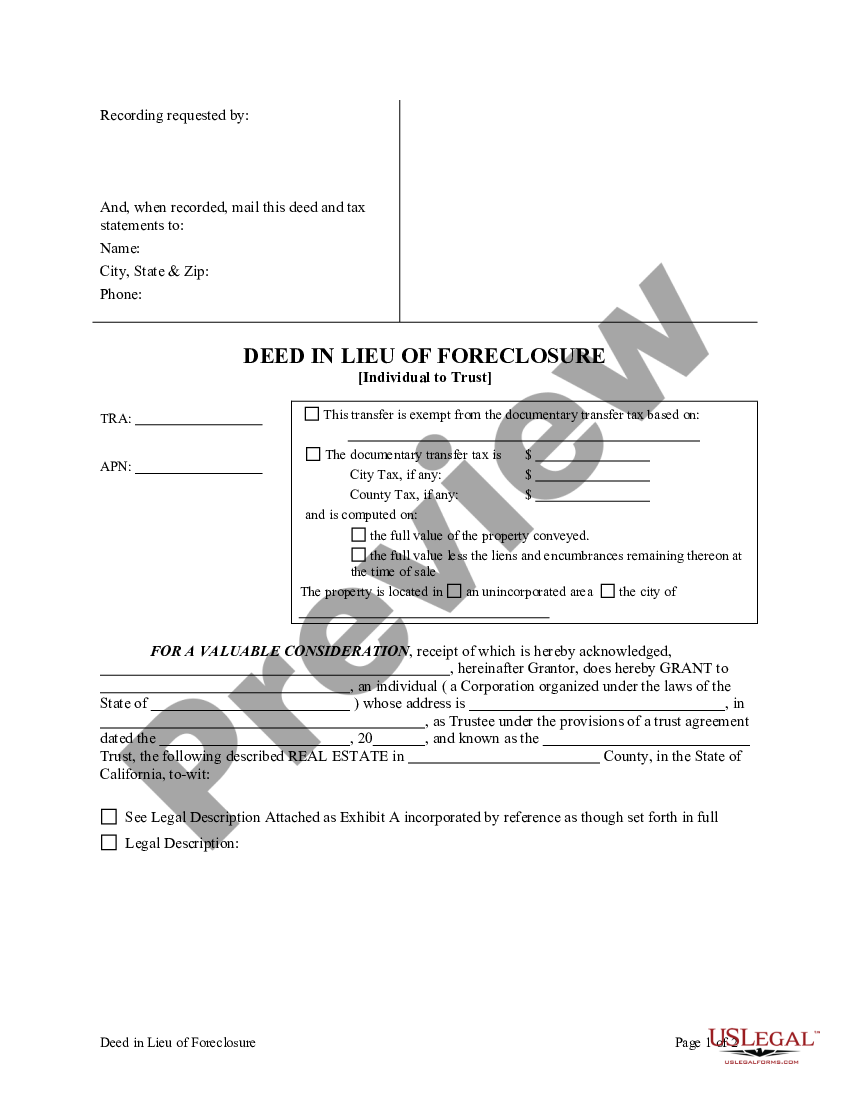

California Deed in Lieu of Foreclosure Make Adeed In Lieu Of

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. (1) this audit technique guide discusses the tax consequences for.

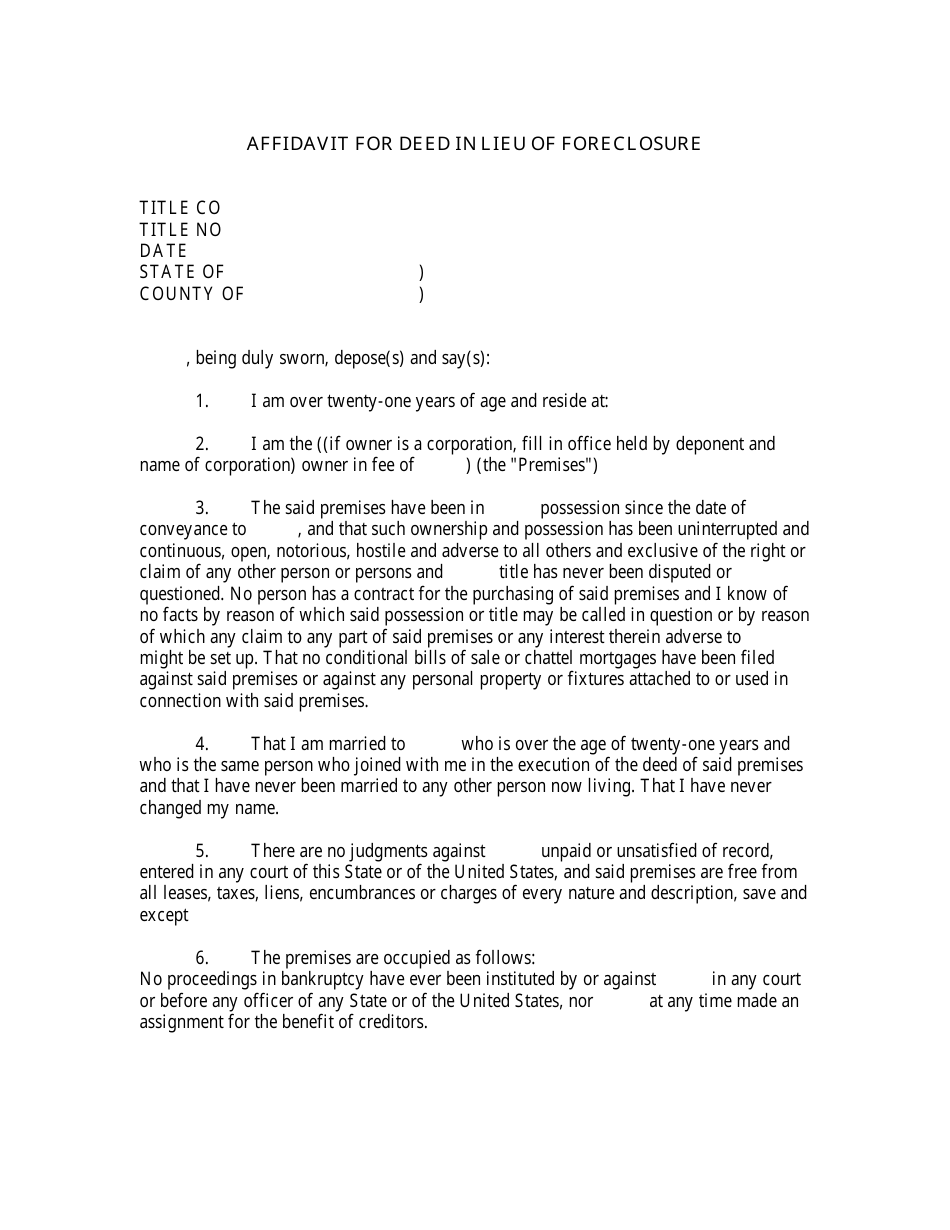

Affidavit for Deed in Lieu of Foreclosure Fill Out, Sign Online and

When it comes to a deed in lieu of foreclosure, one of the most significant tax implications that many people face is the. (1) the amount the lender. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. Real property foreclosures can produce various.

Deed In Lieu Of Foreclosure Sample With No Experience US Legal Forms

(1) this audit technique guide discusses the tax consequences for real estate property that is disposed of through foreclosure, short sale,. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. If your lender agrees to a short sale or to accept a deed in lieu.

Quiz & Worksheet Deed in Lieu of Foreclosure

(1) this audit technique guide discusses the tax consequences for real estate property that is disposed of through foreclosure, short sale,. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. When it comes to a deed in lieu of foreclosure, one of the most significant.

When It Comes To A Deed In Lieu Of Foreclosure, One Of The Most Significant Tax Implications That Many People Face Is The.

(1) this audit technique guide discusses the tax consequences for real estate property that is disposed of through foreclosure, short sale,. If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven. Real property foreclosures can produce various tax consequences depending on the type of debt (recourse or nonrecourse), the. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face.