Tax Lien Certificate California

Tax Lien Certificate California - For more information regarding a specific county’s public auction sale, please view the county tax collector's website for the most accurate and. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). If you have paid your bill in full and have not received. Ftb may record a lien against taxpayers when their tax debts are overdue. We will issue a tax lien release once your unsecured property tax bill is paid in full. Ftb notifies taxpayers 30 days before recording the lien. On file in the office of the tax collector of (county) county, state of california, is a certificate of redemption, dated (date), attesting to the.

Ftb may record a lien against taxpayers when their tax debts are overdue. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). On file in the office of the tax collector of (county) county, state of california, is a certificate of redemption, dated (date), attesting to the. For more information regarding a specific county’s public auction sale, please view the county tax collector's website for the most accurate and. We will issue a tax lien release once your unsecured property tax bill is paid in full. Ftb notifies taxpayers 30 days before recording the lien. If you have paid your bill in full and have not received.

Ftb may record a lien against taxpayers when their tax debts are overdue. Ftb notifies taxpayers 30 days before recording the lien. For more information regarding a specific county’s public auction sale, please view the county tax collector's website for the most accurate and. We will issue a tax lien release once your unsecured property tax bill is paid in full. If you have paid your bill in full and have not received. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). On file in the office of the tax collector of (county) county, state of california, is a certificate of redemption, dated (date), attesting to the.

Searching for what is a Tax Lien Certificate? Latest Infographics

We will issue a tax lien release once your unsecured property tax bill is paid in full. Ftb notifies taxpayers 30 days before recording the lien. Ftb may record a lien against taxpayers when their tax debts are overdue. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien.

Everything to know about tax lien certificate Latest Infographics

We will issue a tax lien release once your unsecured property tax bill is paid in full. Ftb notifies taxpayers 30 days before recording the lien. If you have paid your bill in full and have not received. On file in the office of the tax collector of (county) county, state of california, is a certificate of redemption, dated (date),.

Tax Lien Certificate Definition

For more information regarding a specific county’s public auction sale, please view the county tax collector's website for the most accurate and. Ftb notifies taxpayers 30 days before recording the lien. We will issue a tax lien release once your unsecured property tax bill is paid in full. Under california law, priority between state and federal tax liens is determined.

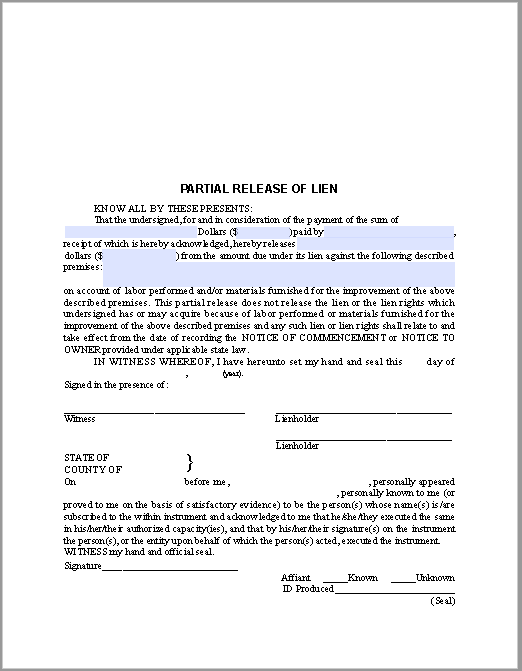

Lien Certificate Examples Archives Free Fillable PDF Forms

We will issue a tax lien release once your unsecured property tax bill is paid in full. On file in the office of the tax collector of (county) county, state of california, is a certificate of redemption, dated (date), attesting to the. Under california law, priority between state and federal tax liens is determined when each liability was first created.

Unlocking the Mystery How to Get a Tax Lien Certificate?

We will issue a tax lien release once your unsecured property tax bill is paid in full. If you have paid your bill in full and have not received. Ftb may record a lien against taxpayers when their tax debts are overdue. Under california law, priority between state and federal tax liens is determined when each liability was first created.

What is a tax lien certificate? Ray Seaman, eXp Realty

If you have paid your bill in full and have not received. We will issue a tax lien release once your unsecured property tax bill is paid in full. For more information regarding a specific county’s public auction sale, please view the county tax collector's website for the most accurate and. Ftb notifies taxpayers 30 days before recording the lien..

How to Buy a Tax Lien Certificate 15 Steps (with Pictures)

On file in the office of the tax collector of (county) county, state of california, is a certificate of redemption, dated (date), attesting to the. Ftb notifies taxpayers 30 days before recording the lien. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). We will issue a.

tax lien certificate

If you have paid your bill in full and have not received. For more information regarding a specific county’s public auction sale, please view the county tax collector's website for the most accurate and. On file in the office of the tax collector of (county) county, state of california, is a certificate of redemption, dated (date), attesting to the. Under.

Tax Lien Certificate Investor's wiki

If you have paid your bill in full and have not received. Ftb notifies taxpayers 30 days before recording the lien. We will issue a tax lien release once your unsecured property tax bill is paid in full. For more information regarding a specific county’s public auction sale, please view the county tax collector's website for the most accurate and..

ABCs of Tax Lien and Deed Investing Special 90 Off Tax Lien

Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). We will issue a tax lien release once your unsecured property tax bill is paid in full. For more information regarding a specific county’s public auction sale, please view the county tax collector's website for the most accurate.

Ftb May Record A Lien Against Taxpayers When Their Tax Debts Are Overdue.

We will issue a tax lien release once your unsecured property tax bill is paid in full. Ftb notifies taxpayers 30 days before recording the lien. If you have paid your bill in full and have not received. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date).

For More Information Regarding A Specific County’s Public Auction Sale, Please View The County Tax Collector's Website For The Most Accurate And.

On file in the office of the tax collector of (county) county, state of california, is a certificate of redemption, dated (date), attesting to the.

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)