Tax Lien Certificate Florida

Tax Lien Certificate Florida - All procedures of this tax sale are in accordance. A tax certificate is a lien against real estate (not the owner) and. A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. It does not convey title to the land. Tax deed application processing is now available online at www.lienhub.com. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. A tax certificate represents a first priority tax lien on real property; 28 rows the tax/lien certificate transfer endorsement document can be found under the forms page on this website or click here. The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes.

It does not convey title to the land. Tax deed application processing is now available online at www.lienhub.com. 28 rows the tax/lien certificate transfer endorsement document can be found under the forms page on this website or click here. A tax certificate represents a first priority tax lien on real property; The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. A tax certificate is a lien against real estate (not the owner) and. A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. All procedures of this tax sale are in accordance.

Tax deed application processing is now available online at www.lienhub.com. The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. 28 rows the tax/lien certificate transfer endorsement document can be found under the forms page on this website or click here. A tax certificate is a lien against real estate (not the owner) and. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. All procedures of this tax sale are in accordance. A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. A tax certificate represents a first priority tax lien on real property; It does not convey title to the land.

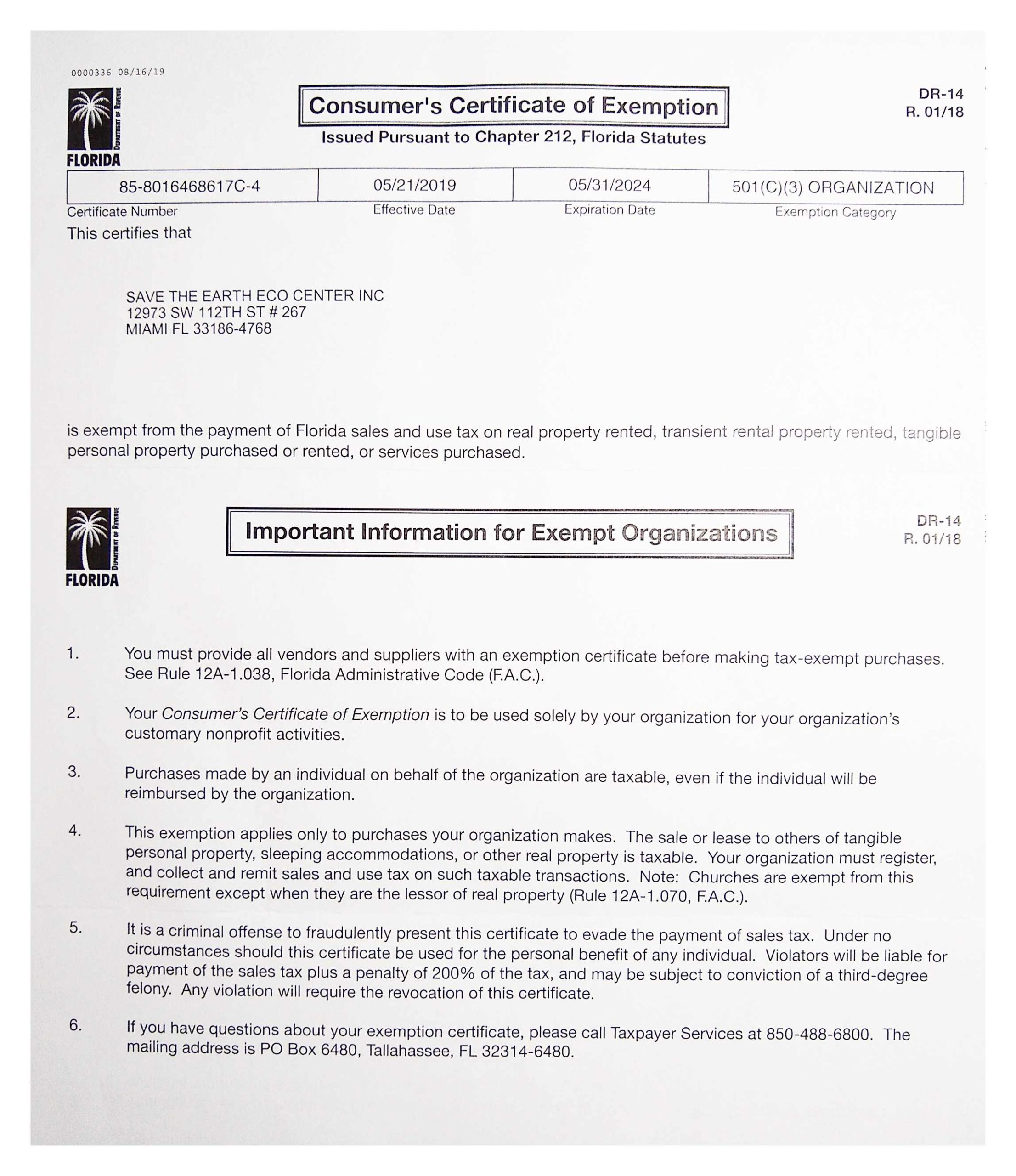

Florida Sales And Use Tax Certificate Of Exemption Form

28 rows the tax/lien certificate transfer endorsement document can be found under the forms page on this website or click here. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. All procedures of this tax sale are in accordance. The annual tax certificate sale is a.

tax lien PDF Free Download

A tax certificate is a lien against real estate (not the owner) and. 28 rows the tax/lien certificate transfer endorsement document can be found under the forms page on this website or click here. A tax certificate represents a first priority tax lien on real property; Tax deed application processing is now available online at www.lienhub.com. The annual tax certificate.

Florida County Held Tax Lien Certificates PDF Tax Lien Foreclosure

On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. A tax certificate represents a first priority tax lien on real property; The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. Tax deed application processing is now available online.

Investing In Florida Tax Lien Certificate School

It does not convey title to the land. A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. A tax certificate is a lien against real estate (not the owner) and. On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property..

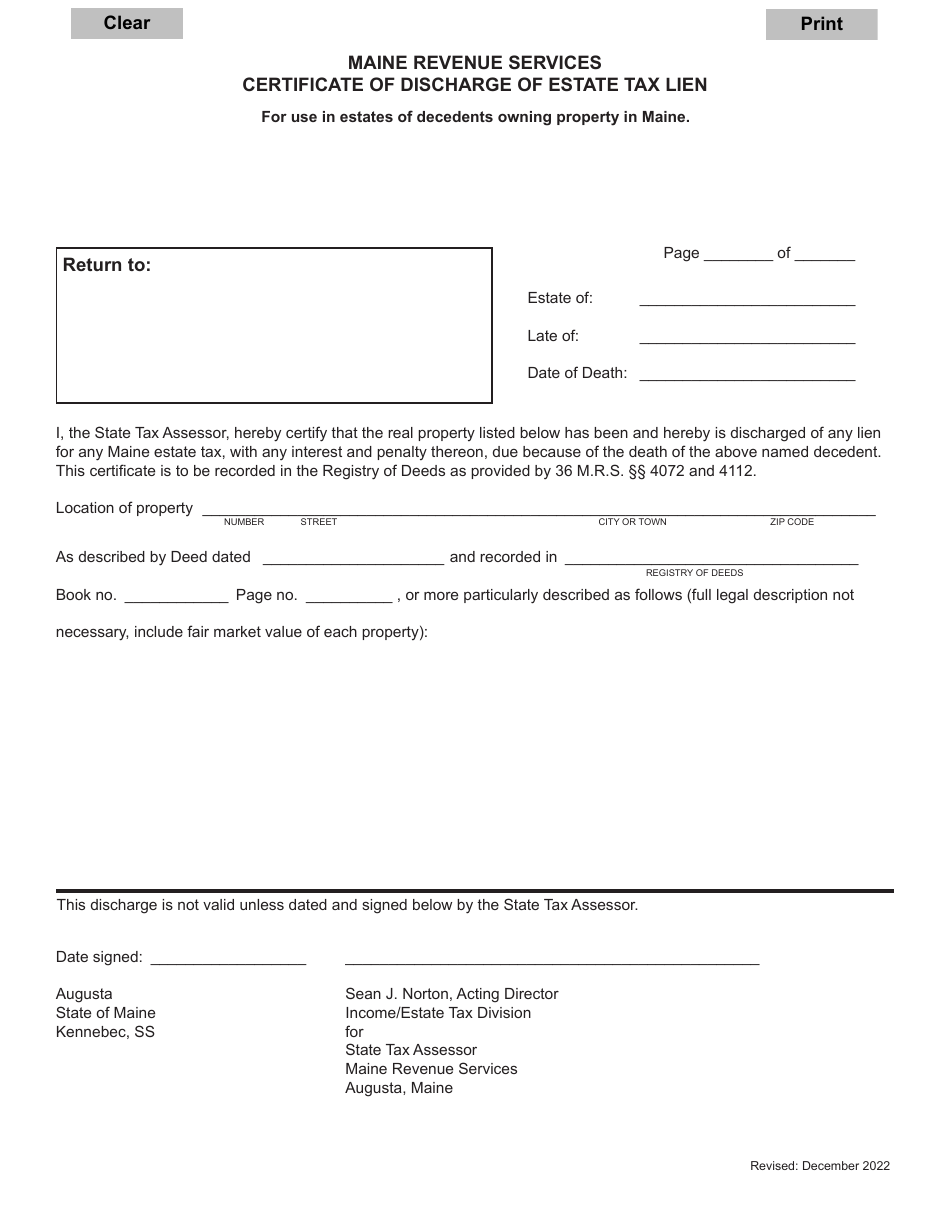

Maine Certificate of Discharge of Estate Tax Lien Fill Out, Sign

A tax certificate represents a first priority tax lien on real property; It does not convey title to the land. All procedures of this tax sale are in accordance. A tax certificate is a lien against real estate (not the owner) and. A tax certificate is an enforceable first lien against a property for unpaid real estate taxes.

Property Tax Lien Certificates Florida PRORFETY

On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. All procedures of this tax sale are in accordance. A tax certificate represents a first priority tax lien on real property; A tax certificate is an enforceable first lien against a property for unpaid real estate taxes..

tax lien certificate

28 rows the tax/lien certificate transfer endorsement document can be found under the forms page on this website or click here. A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. A tax certificate represents a first priority tax lien on real property; All procedures of this tax sale are in accordance. On or.

What is a Tax Lien Certificate United Tax Liens

A tax certificate represents a first priority tax lien on real property; The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. 28 rows the tax/lien certificate transfer endorsement document can be found under the forms page on this website or click here. A tax certificate is an enforceable first lien against a.

Complete Guide to Tax Lien Certificates Tax Lien Code

It does not convey title to the land. The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. Tax deed application processing is now available online at www.lienhub.com. 28 rows the tax/lien certificate transfer endorsement document can be found under the forms page on this website or click here. A tax certificate is.

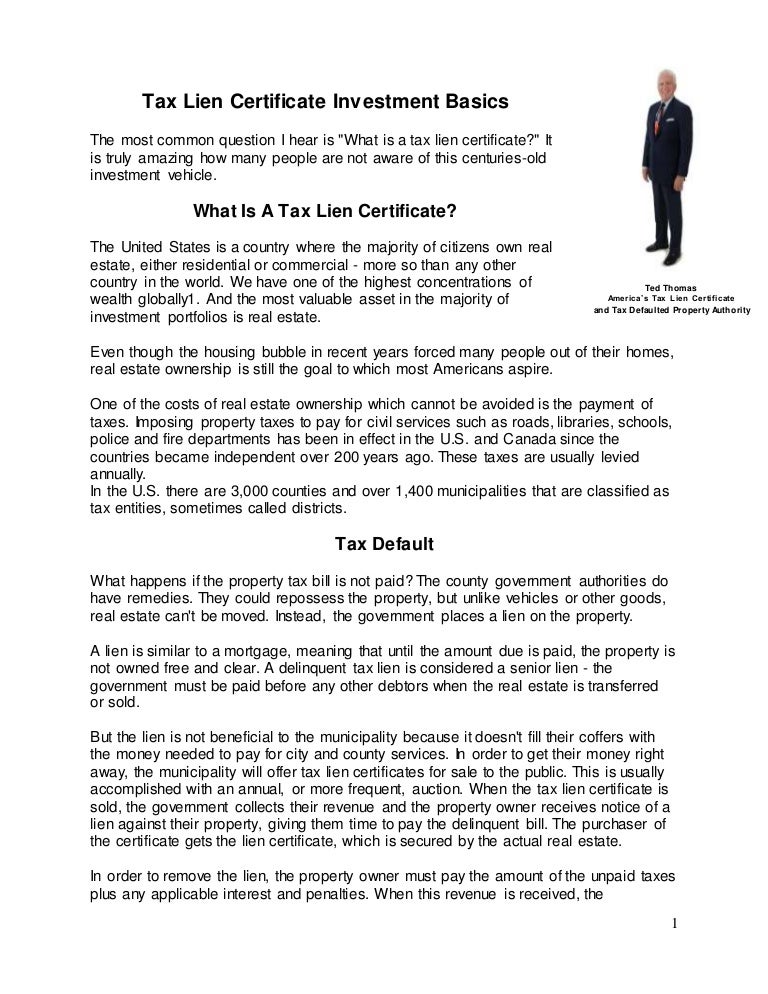

Tax Lien Certificate Investment Basics

A tax certificate represents a first priority tax lien on real property; A tax certificate is an enforceable first lien against a property for unpaid real estate taxes. Tax deed application processing is now available online at www.lienhub.com. All procedures of this tax sale are in accordance. 28 rows the tax/lien certificate transfer endorsement document can be found under the.

A Tax Certificate Is A Lien Against Real Estate (Not The Owner) And.

Tax deed application processing is now available online at www.lienhub.com. A tax certificate represents a first priority tax lien on real property; On or before june 1, the tax collector must conduct a tax certificate sale of the unpaid taxes on each parcel of property. It does not convey title to the land.

28 Rows The Tax/Lien Certificate Transfer Endorsement Document Can Be Found Under The Forms Page On This Website Or Click Here.

All procedures of this tax sale are in accordance. The annual tax certificate sale is a public sale of tax liens on delinquent real property taxes. A tax certificate is an enforceable first lien against a property for unpaid real estate taxes.