Tax Lien Certificates Ohio

Tax Lien Certificates Ohio - Tax certificate sales are usually held around the 2 nd week of october. If you don’t redeem during the one. For more information on purchasing tax liens, contact the treasurer’s. After the tax lien sale, you get one year to pay off all lien charges and interest property. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. This page details the ohio revised code that. Details of the ohio revised code that pertains to the tax lien process and gives ways to pay liens.

After the tax lien sale, you get one year to pay off all lien charges and interest property. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. Tax certificate sales are usually held around the 2 nd week of october. For more information on purchasing tax liens, contact the treasurer’s. This page details the ohio revised code that. Details of the ohio revised code that pertains to the tax lien process and gives ways to pay liens. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. If you don’t redeem during the one.

For more information on purchasing tax liens, contact the treasurer’s. If you don’t redeem during the one. After the tax lien sale, you get one year to pay off all lien charges and interest property. This page details the ohio revised code that. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. Tax certificate sales are usually held around the 2 nd week of october. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. Details of the ohio revised code that pertains to the tax lien process and gives ways to pay liens.

Ohio Property Tax Lien Sales

For more information on purchasing tax liens, contact the treasurer’s. Tax certificate sales are usually held around the 2 nd week of october. If you don’t redeem during the one. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. Details of the ohio revised code that pertains to the tax lien process and gives.

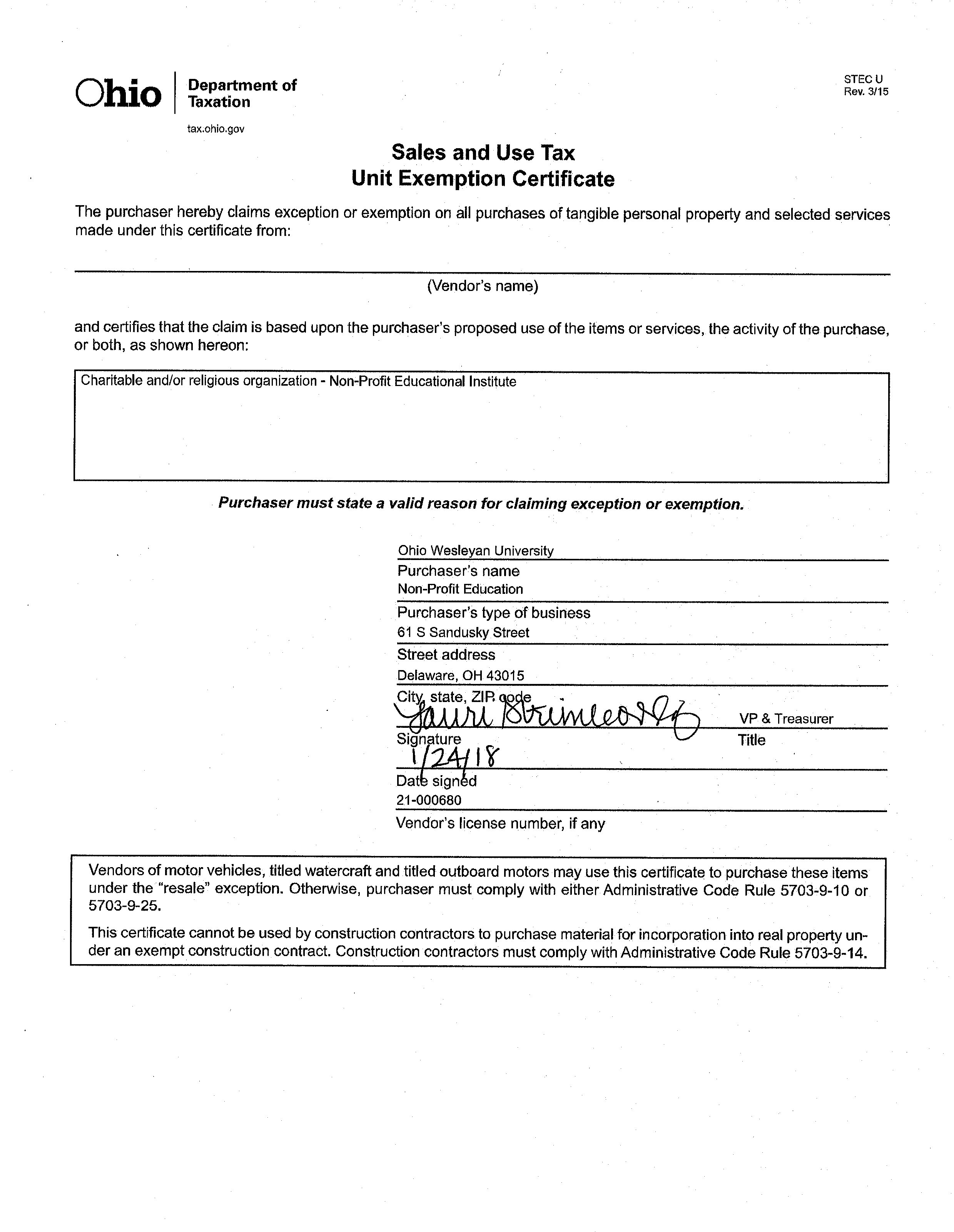

Ohio Sales And Use Tax Blanket Exemption Certificate Instructions

Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. If you don’t redeem during the one. This page details the ohio revised code that. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. Tax certificate.

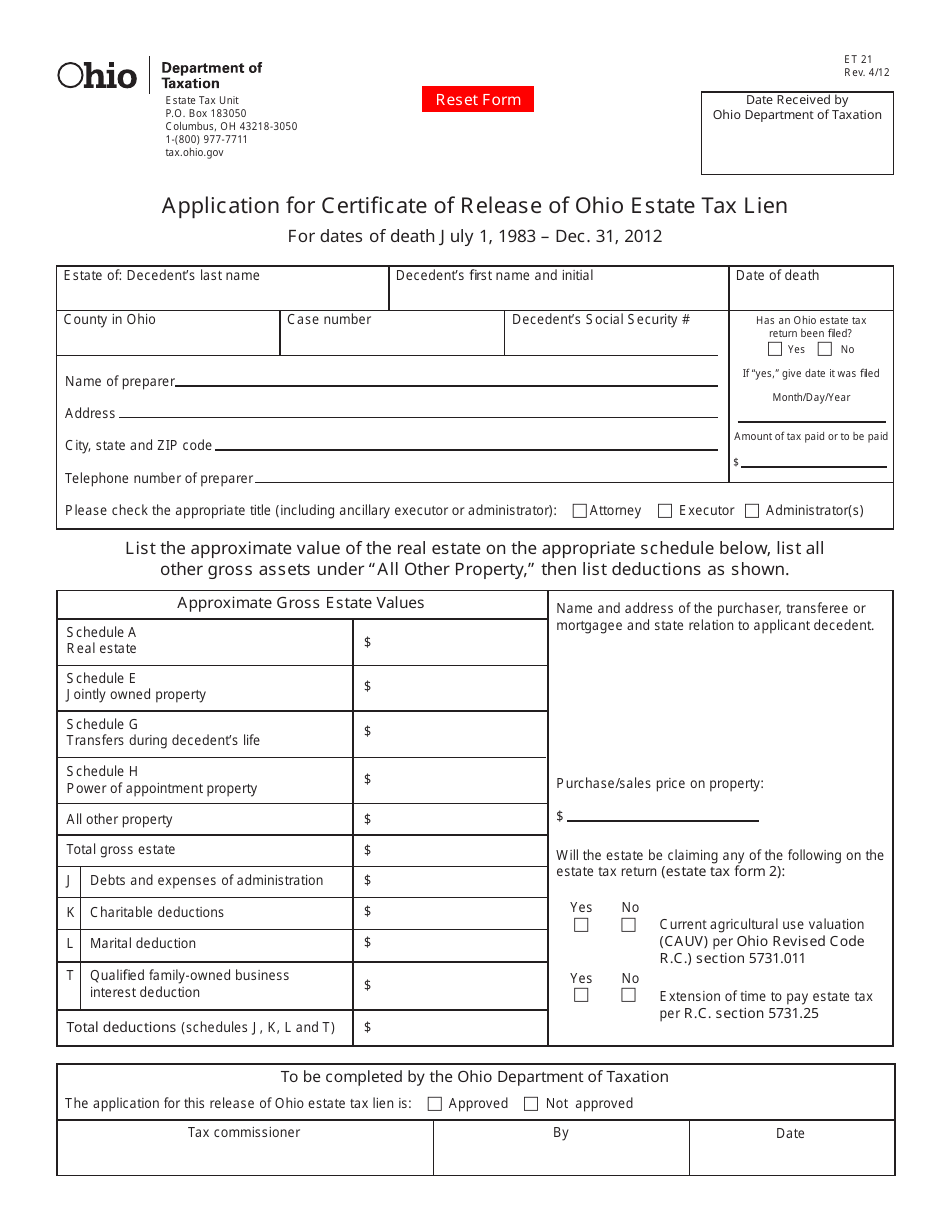

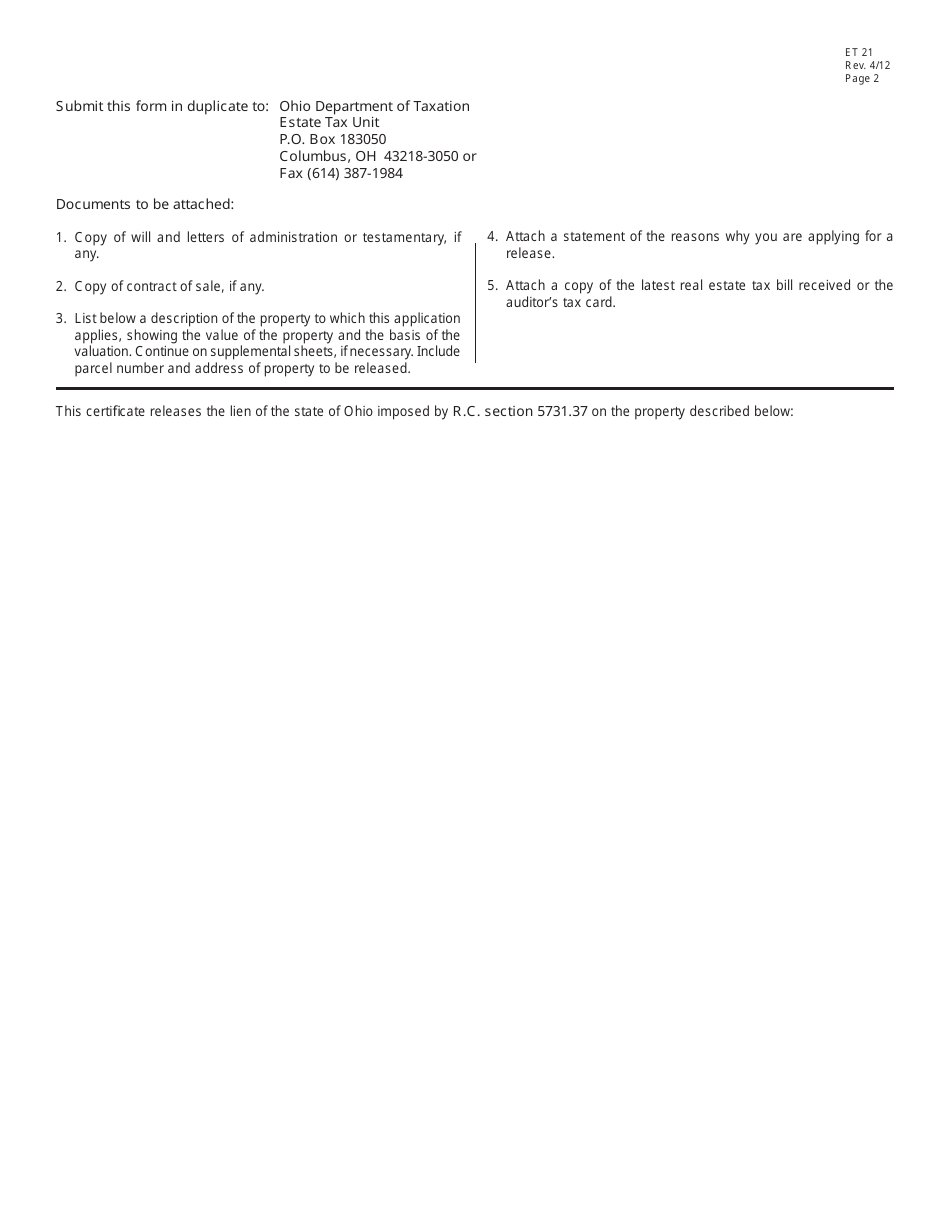

Form ET21 Fill Out, Sign Online and Download Fillable PDF, Ohio

After the tax lien sale, you get one year to pay off all lien charges and interest property. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. This page details the ohio revised code that. For more information on purchasing tax.

Tax Lien Ohio State Tax Lien

After the tax lien sale, you get one year to pay off all lien charges and interest property. If you don’t redeem during the one. Tax certificate sales are usually held around the 2 nd week of october. Details of the ohio revised code that pertains to the tax lien process and gives ways to pay liens. Cuyahoga county is.

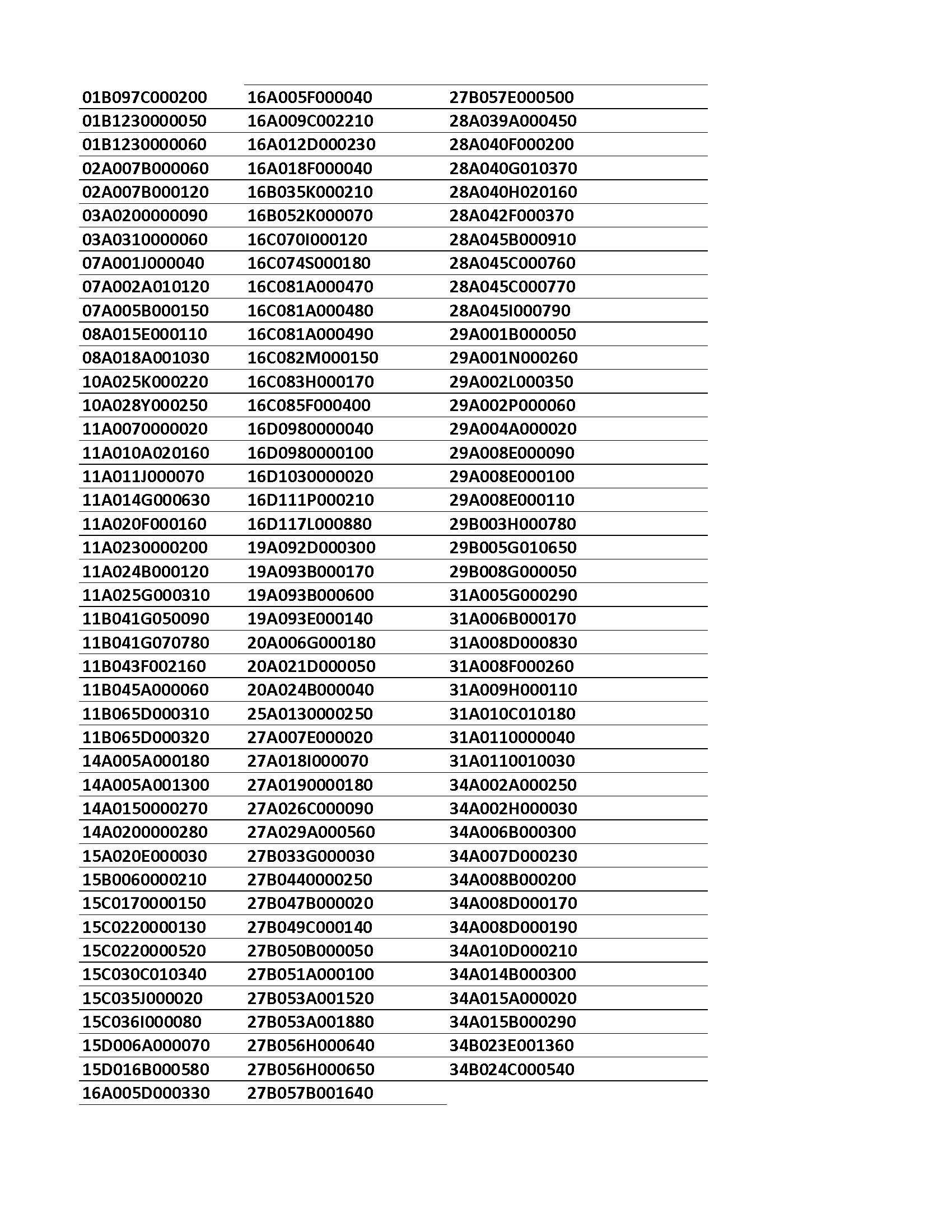

TAX LIENS PENDING CERTIFICATE FILING Treasurer

For more information on purchasing tax liens, contact the treasurer’s. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes. Details of the ohio revised code that pertains to the tax lien process and gives ways to pay liens. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you.

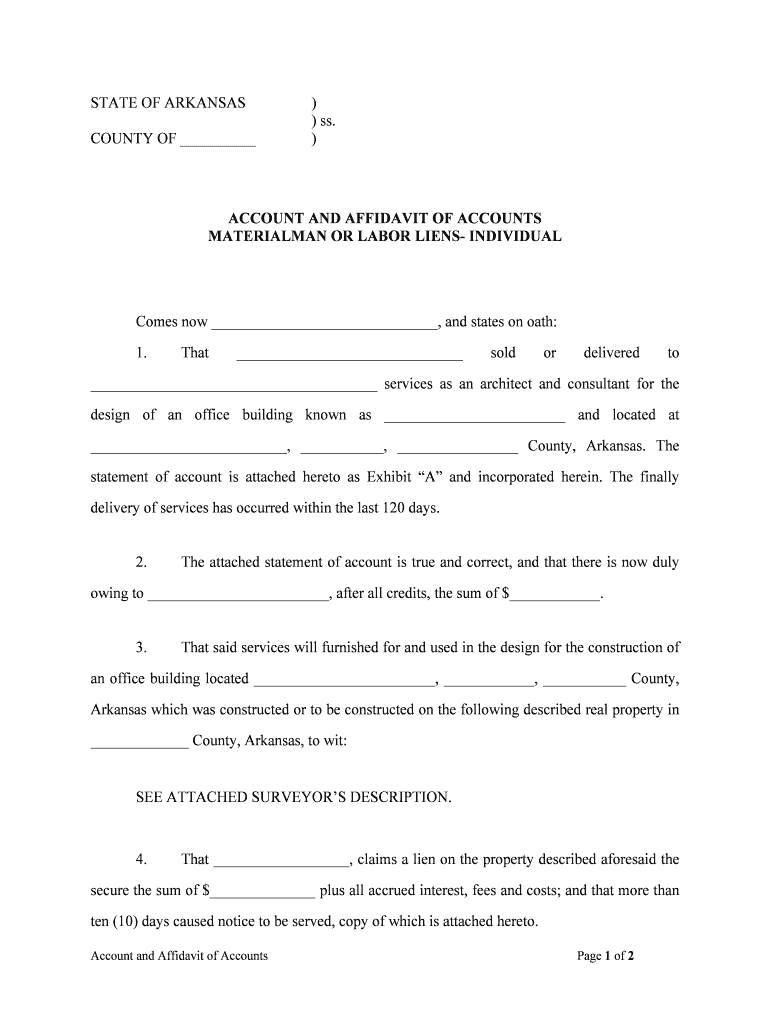

OHIO Lien Laws by State Form Fill Out and Sign Printable PDF Template

Details of the ohio revised code that pertains to the tax lien process and gives ways to pay liens. If you don’t redeem during the one. Tax certificate sales are usually held around the 2 nd week of october. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in.

FAQs Tax Ease Ohio

Tax certificate sales are usually held around the 2 nd week of october. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. This page details the ohio revised code that. If you don’t redeem during the one. Details of the ohio.

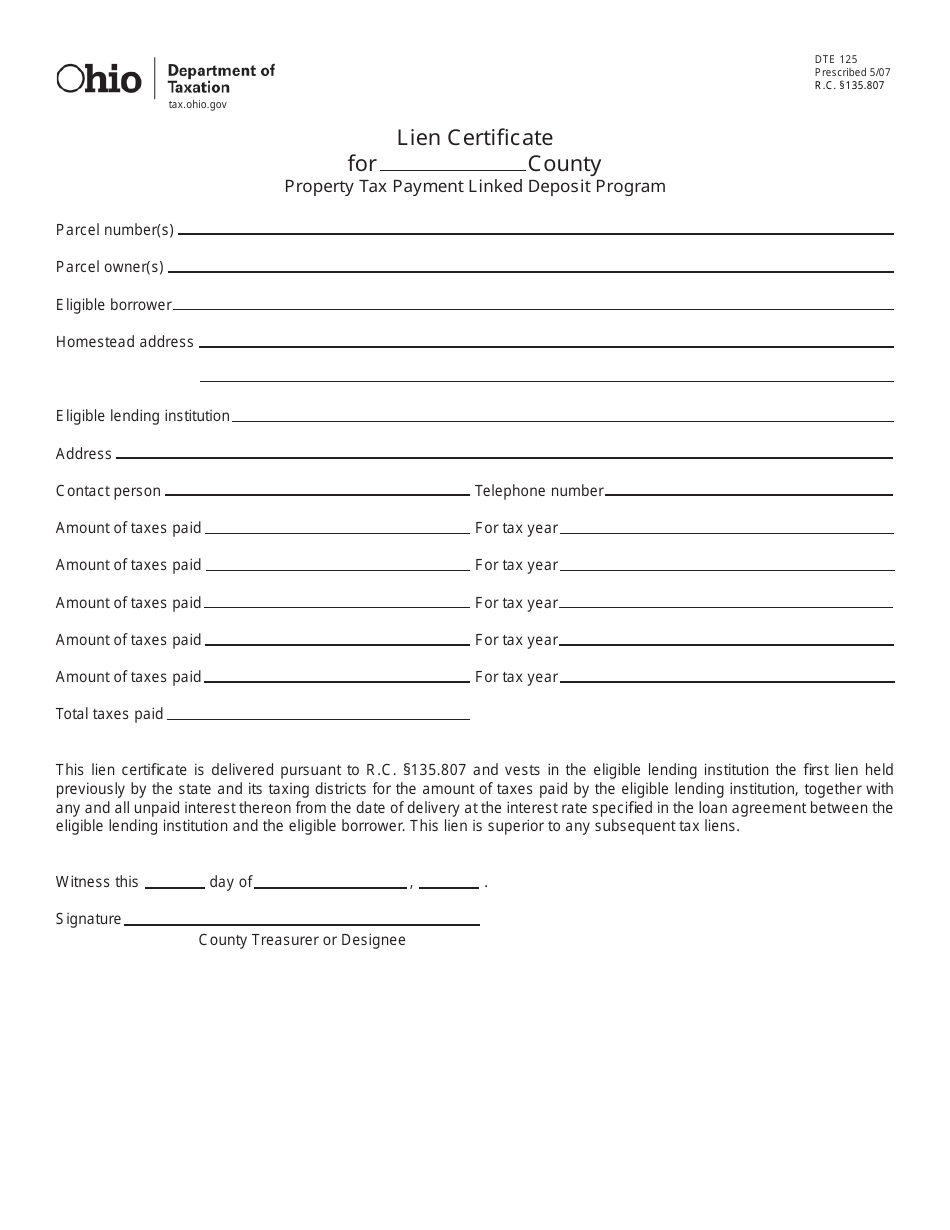

Form DTE125 Fill Out, Sign Online and Download Printable PDF, Ohio

Tax certificate sales are usually held around the 2 nd week of october. For more information on purchasing tax liens, contact the treasurer’s. Details of the ohio revised code that pertains to the tax lien process and gives ways to pay liens. Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay.

Tax Lien What Is A State Tax Lien Ohio

Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. If you don’t redeem during the one. For more information on purchasing tax liens, contact the treasurer’s. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes..

Form ET21 Fill Out, Sign Online and Download Fillable PDF, Ohio

Tax certificate liens to avoid the sale of a tax certificate lien on your property, you must pay your taxes in full or enter into a payment plan. Details of the ohio revised code that pertains to the tax lien process and gives ways to pay liens. Tax certificate sales are usually held around the 2 nd week of october..

Tax Certificate Liens To Avoid The Sale Of A Tax Certificate Lien On Your Property, You Must Pay Your Taxes In Full Or Enter Into A Payment Plan.

Details of the ohio revised code that pertains to the tax lien process and gives ways to pay liens. If you don’t redeem during the one. Tax certificate sales are usually held around the 2 nd week of october. For more information on purchasing tax liens, contact the treasurer’s.

After The Tax Lien Sale, You Get One Year To Pay Off All Lien Charges And Interest Property.

This page details the ohio revised code that. Cuyahoga county is permitted to sell tax lien certificates on parcels that have delinquent taxes.