Tax Lien Foreclosure

Tax Lien Foreclosure - If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Investors can earn attractive returns through. Tax lien foreclosure is a legal process triggered by unpaid property taxes.

Investors can earn attractive returns through. Tax lien foreclosure is a legal process triggered by unpaid property taxes. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific.

Investors can earn attractive returns through. Tax lien foreclosure is a legal process triggered by unpaid property taxes. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific.

Sample Foreclosure Answer Download Free PDF Foreclosure Complaint

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Investors can earn attractive returns through. Tax lien foreclosure is a legal process triggered by unpaid property taxes.

Washington DC Property Tax Lien Attorney Zaharevich Law Office

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Investors can earn attractive returns through. Tax lien foreclosure is a legal process triggered by unpaid property taxes.

Understanding NJ Tax Lien Foreclosure Westmarq

Tax lien foreclosure is a legal process triggered by unpaid property taxes. Investors can earn attractive returns through. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific.

Tax Lien Foreclosure What You Need To Know Crixeo

Investors can earn attractive returns through. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Tax lien foreclosure is a legal process triggered by unpaid property taxes.

Tax Lien Foreclosure What You Need To Know Crixeo

Investors can earn attractive returns through. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Tax lien foreclosure is a legal process triggered by unpaid property taxes.

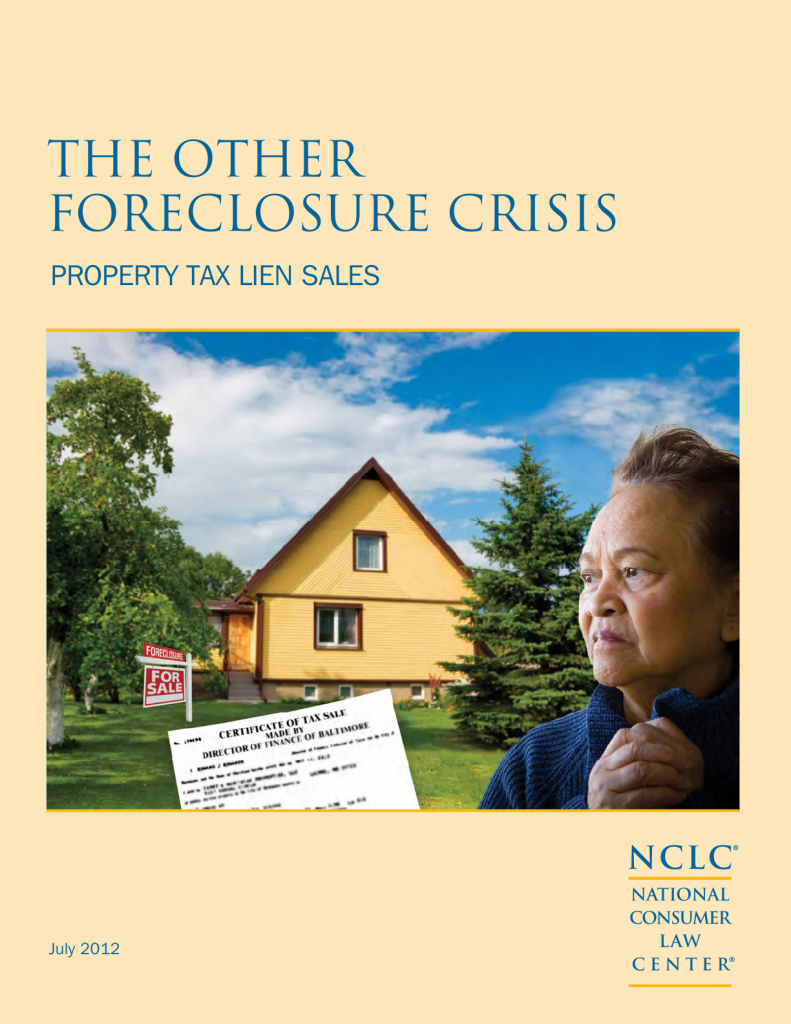

The Other Foreclosure Crisis Property Tax Lien Sales FORECLOSURE FRAUD

Investors can earn attractive returns through. Tax lien foreclosure is a legal process triggered by unpaid property taxes. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific.

Tax Lien Foreclosure Attorney Scottsdale Arizona Hall Law Group

If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Investors can earn attractive returns through. Tax lien foreclosure is a legal process triggered by unpaid property taxes.

Tax Lien Foreclosure Update Levitt & Slafkes, P.C.

Investors can earn attractive returns through. Tax lien foreclosure is a legal process triggered by unpaid property taxes. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific.

Tax Lien Foreclosure Attorney In Ohio?

Investors can earn attractive returns through. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Tax lien foreclosure is a legal process triggered by unpaid property taxes.

What is a property Tax Lien? Real Estate Articles by

Investors can earn attractive returns through. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific. Tax lien foreclosure is a legal process triggered by unpaid property taxes.

Tax Lien Foreclosure Is A Legal Process Triggered By Unpaid Property Taxes.

Investors can earn attractive returns through. If the delinquent taxes aren't paid by a certain date, the purchaser of the lien generally has a right to foreclose the lien or take specific.