Tax Liens Baltimore City

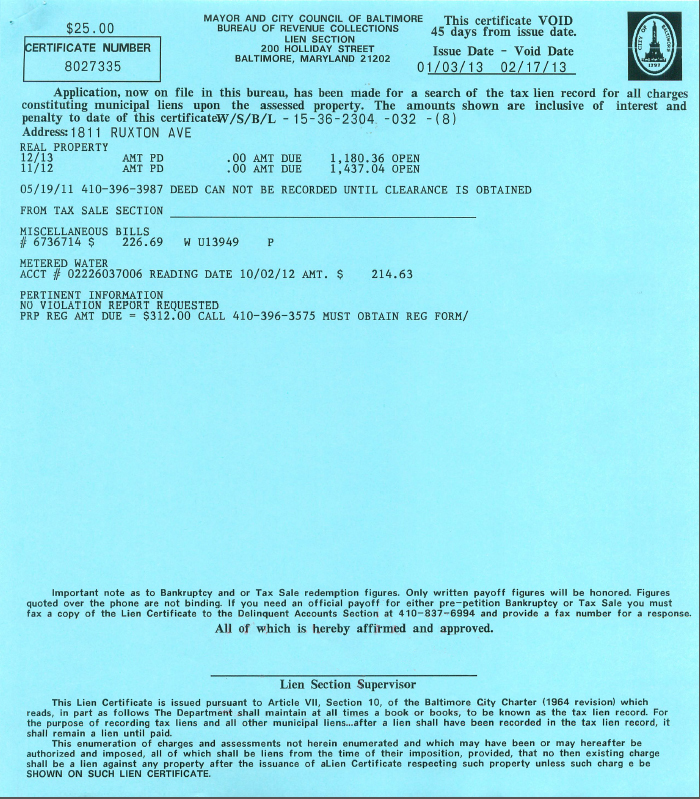

Tax Liens Baltimore City - Each year, baltimore city sells homeowners’ unpaid city bills (liens) to outside bidders who then charge interest and fees, allowable under. The tax sale is used to collect delinquent real property taxes and other unpaid. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax. You must pay for the lien certificate after applying online. The city of baltimore holds an annual tax lien certificate sale. There are several types of bills and municipal charges. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of.

There are several types of bills and municipal charges. Each year, baltimore city sells homeowners’ unpaid city bills (liens) to outside bidders who then charge interest and fees, allowable under. The tax sale is used to collect delinquent real property taxes and other unpaid. The city of baltimore holds an annual tax lien certificate sale. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of. You must pay for the lien certificate after applying online. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax.

Each year, baltimore city sells homeowners’ unpaid city bills (liens) to outside bidders who then charge interest and fees, allowable under. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of. There are several types of bills and municipal charges. You must pay for the lien certificate after applying online. The tax sale is used to collect delinquent real property taxes and other unpaid. The city of baltimore holds an annual tax lien certificate sale.

City discusses tax delinquencies and tax liens Fig City News

The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of. You must pay for the lien certificate after applying online. The tax sale is used to collect delinquent real property taxes and other unpaid. There are several types of bills and municipal charges..

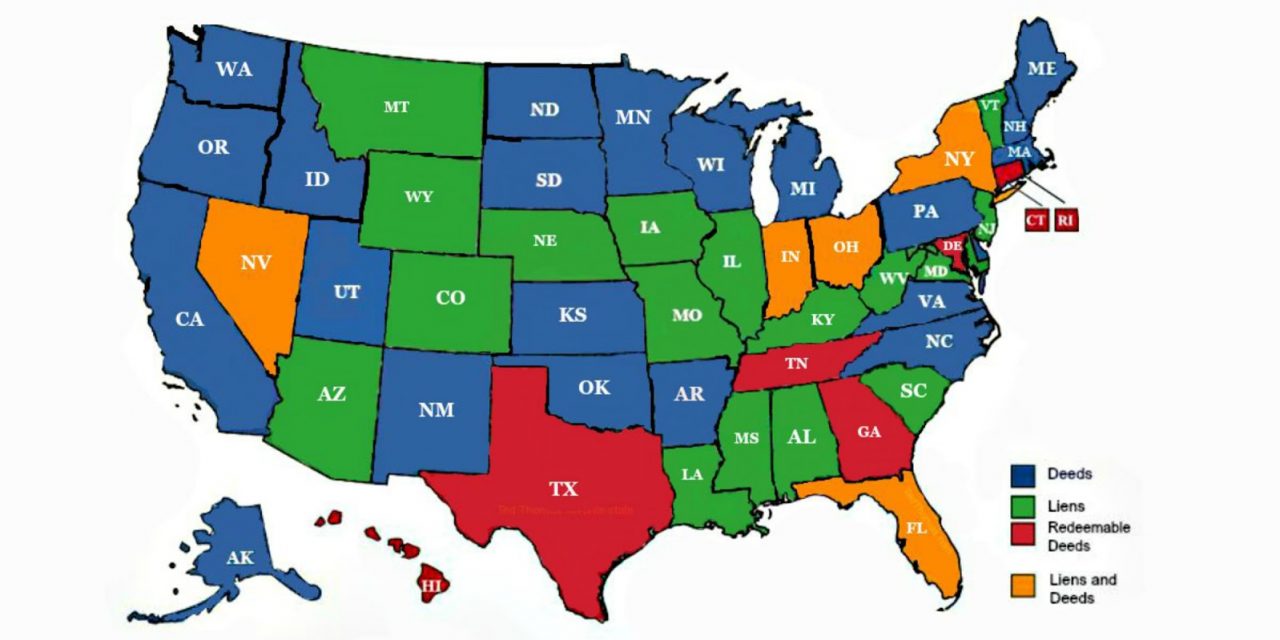

What Is A Tax Lien? Atlanta Tax Lawyer Alyssa Maloof Whatley

This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax. Each year, baltimore city sells homeowners’ unpaid city bills (liens) to outside bidders who then charge interest and fees, allowable under. The annual tax sale process begins in the first week of february when the city mails a.

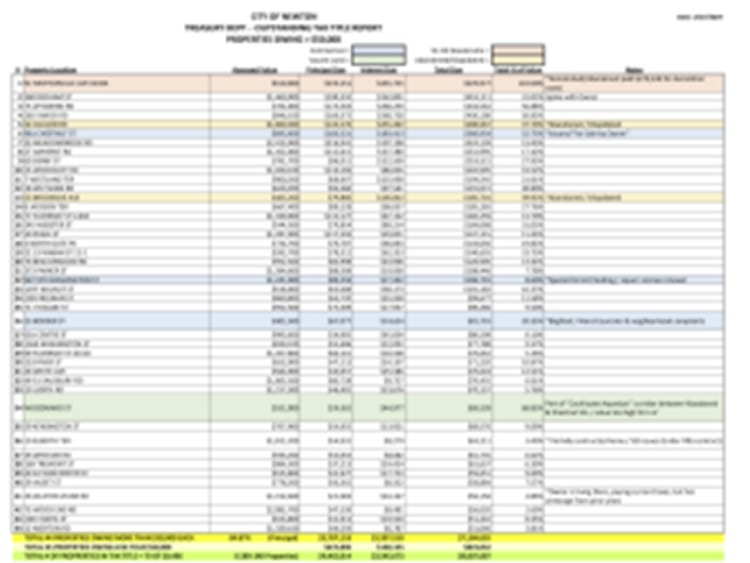

City of Baltimore, tax sale list.Source From City of Baltimore 2018

This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax. You must pay for the lien certificate after applying online. The city of baltimore holds an annual tax lien certificate sale. The annual tax sale process begins in the first week of february when the city mails a.

Tax Liens An Overview CheckBook IRA LLC

This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax. Each year, baltimore city sells homeowners’ unpaid city bills (liens) to outside bidders who then charge interest and fees, allowable under. There are several types of bills and municipal charges. The city of baltimore holds an annual tax.

Baltimore City Tax Lien List 2024 Karee Marjory

The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of. The city of baltimore holds an annual tax lien certificate sale. You must pay for the lien certificate after applying online. The tax sale is used to collect delinquent real property taxes and.

Baltimore Mayor Announces Removal Of New OwnerOccupied Tax Liens From

The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of. You must pay for the lien certificate after applying online. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax. The.

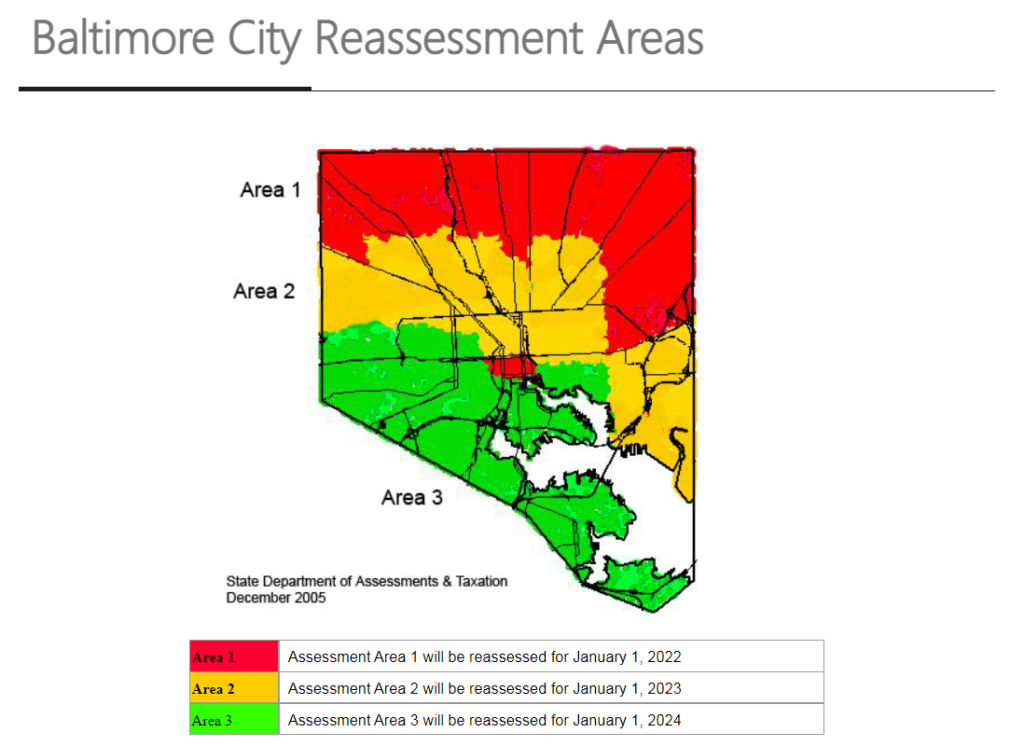

Baltimore City Tax Assessments Overview for Rental Property Investors

The tax sale is used to collect delinquent real property taxes and other unpaid. You must pay for the lien certificate after applying online. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax. The annual tax sale process begins in the first week of february when the.

Baltimore homeowners with tax liens get reprieve as mayor postpones auction

Each year, baltimore city sells homeowners’ unpaid city bills (liens) to outside bidders who then charge interest and fees, allowable under. You must pay for the lien certificate after applying online. The tax sale is used to collect delinquent real property taxes and other unpaid. The annual tax sale process begins in the first week of february when the city.

Baltimore City Tax Lien List 2024 Karee Marjory

Each year, baltimore city sells homeowners’ unpaid city bills (liens) to outside bidders who then charge interest and fees, allowable under. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax. The city of baltimore holds an annual tax lien certificate sale. You must pay for the lien.

6 key takeaways from The Baltimore Banner’s tax sale investigation

The city of baltimore holds an annual tax lien certificate sale. The annual tax sale process begins in the first week of february when the city mails a final bill and legal notice to the property owner of. There are several types of bills and municipal charges. The tax sale is used to collect delinquent real property taxes and other.

The Annual Tax Sale Process Begins In The First Week Of February When The City Mails A Final Bill And Legal Notice To The Property Owner Of.

The city of baltimore holds an annual tax lien certificate sale. The tax sale is used to collect delinquent real property taxes and other unpaid. There are several types of bills and municipal charges. This listing includes properties with delinquent taxes and municipal liens, located in baltimore city, that are scheduled for the sealed bid tax.

You Must Pay For The Lien Certificate After Applying Online.

Each year, baltimore city sells homeowners’ unpaid city bills (liens) to outside bidders who then charge interest and fees, allowable under.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/baltimorebanner/EXX67DZ43NDEPKABJVD2ZMIE24.jpg)