Texas Sales Tax Lien

Texas Sales Tax Lien - Sales results by month are posted on the delinquent tax sales link at the bottom of this page. As required by the texas property tax code section 34.011, a bidder must register with the county tax assessor collector in order to. Bidding starts at taxes due plus interest and penalties and other expenses incurred in making the sale. The lien on the property then passes. If you are past due in the payment of your taxes, please. Tax liability secured by lien. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Please be aware that a tax lien could have a negative impact on your credit rating. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Cause numbers are noted as.

Bidding starts at taxes due plus interest and penalties and other expenses incurred in making the sale. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Please be aware that a tax lien could have a negative impact on your credit rating. Cause numbers are noted as. If you are past due in the payment of your taxes, please. As required by the texas property tax code section 34.011, a bidder must register with the county tax assessor collector in order to. Tax liability secured by lien. The lien on the property then passes. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Sales results by month are posted on the delinquent tax sales link at the bottom of this page.

The lien on the property then passes. Tax liability secured by lien. As required by the texas property tax code section 34.011, a bidder must register with the county tax assessor collector in order to. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Please be aware that a tax lien could have a negative impact on your credit rating. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. If you are past due in the payment of your taxes, please. Bidding starts at taxes due plus interest and penalties and other expenses incurred in making the sale. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Cause numbers are noted as.

Tax Review PDF Taxes Tax Lien

A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Tax liability secured by lien. As required by the texas property tax code section 34.011, a bidder must register with the county tax assessor collector in order to. The lien.

Pursuant to the Tax Lien, Tax May be Collected from Estate Property in

A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Cause numbers are noted as. As required by.

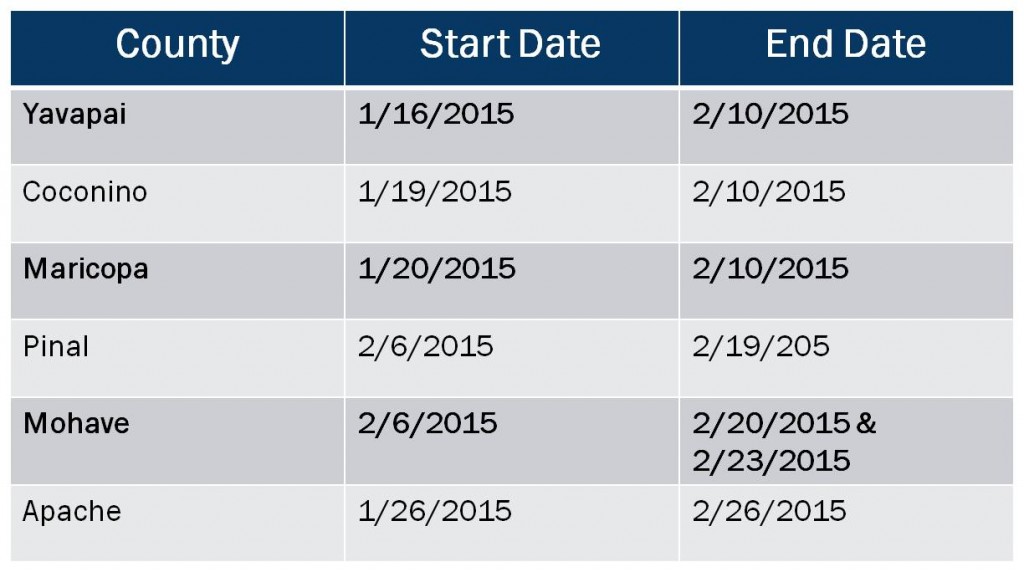

Arizona Tax Lien Sales Tax Lien Investing Tips

Please be aware that a tax lien could have a negative impact on your credit rating. The lien on the property then passes. Bidding starts at taxes due plus interest and penalties and other expenses incurred in making the sale. Cause numbers are noted as. Tax liability secured by lien.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

Please be aware that a tax lien could have a negative impact on your credit rating. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. The lien on the property then passes. Sales results by month are posted on the delinquent tax sales link at the bottom.

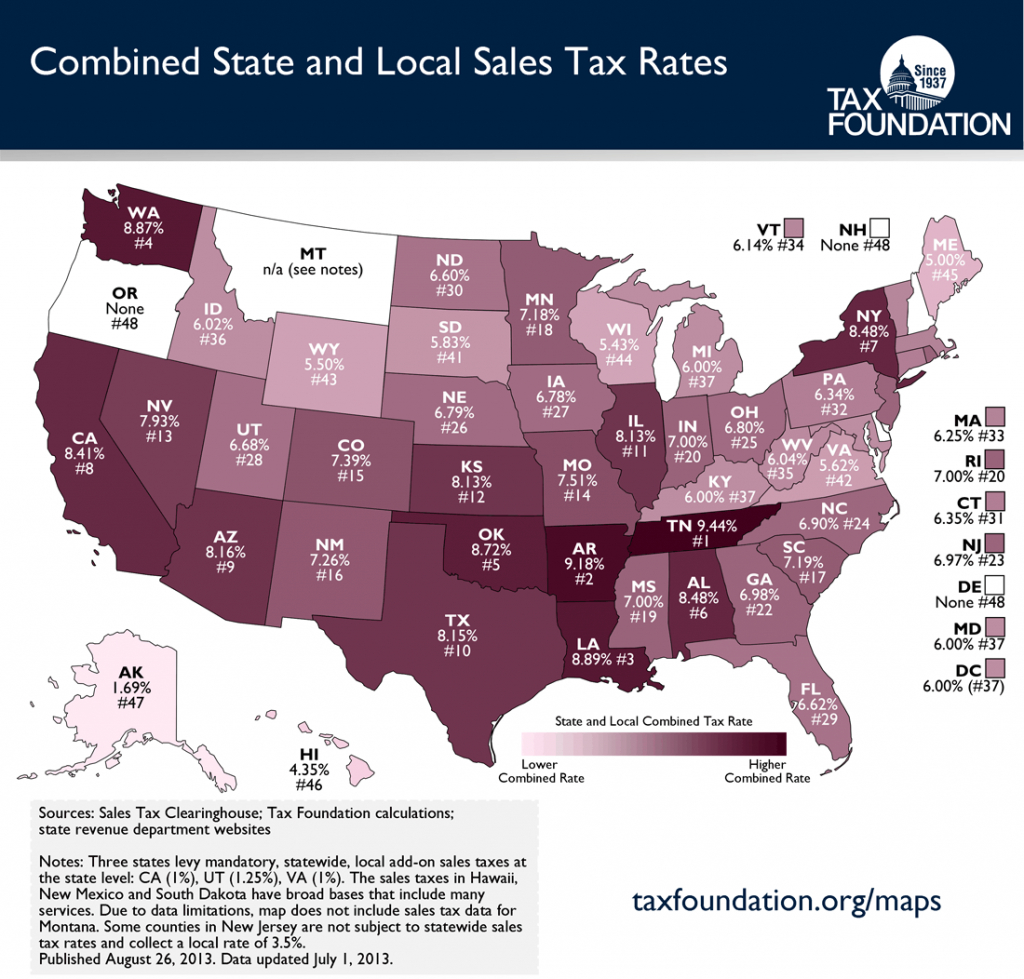

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

Tax liability secured by lien. Cause numbers are noted as. If you are past due in the payment of your taxes, please. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Bidding starts at taxes due plus interest and penalties and other expenses incurred in making the.

Tax Lien Investing Tips Which States have tax sales in the next 30

Bidding starts at taxes due plus interest and penalties and other expenses incurred in making the sale. If you are past due in the payment of your taxes, please. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Tax liability secured by lien. (a) all taxes, fines, interest, and penalties due.

What Are Tax Lien Sales Understanding PastDue Property Taxes United

Sales results by month are posted on the delinquent tax sales link at the bottom of this page. As required by the texas property tax code section 34.011, a bidder must register with the county tax assessor collector in order to. The lien on the property then passes. Please be aware that a tax lien could have a negative impact.

Sales Tax Institute

As required by the texas property tax code section 34.011, a bidder must register with the county tax assessor collector in order to. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Tax liability secured by lien. The lien.

Tax Lien Sale PDF Tax Lien Taxes

A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. Cause numbers are noted as. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. If you are past due in the.

Ultimate Texas Sales Tax Guide Zamp

Cause numbers are noted as. Please be aware that a tax lien could have a negative impact on your credit rating. A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. The lien on the property then passes. If you.

Sales Results By Month Are Posted On The Delinquent Tax Sales Link At The Bottom Of This Page.

A person conducting a sale for the foreclosure of a tax lien under rule 736 of the texas rules of civil procedure shall, within 10 days of the sale, pay. As required by the texas property tax code section 34.011, a bidder must register with the county tax assessor collector in order to. Tax liability secured by lien. The lien on the property then passes.

Cause Numbers Are Noted As.

If you are past due in the payment of your taxes, please. Please be aware that a tax lien could have a negative impact on your credit rating. Bidding starts at taxes due plus interest and penalties and other expenses incurred in making the sale. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien.