Vermont Local Option Tax

Vermont Local Option Tax - Now, the town of woodstock will. A municipality may vote to levy the. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. See attached vermont general guidelines on. More than two dozen cities and towns across vermont have implemented a local 1% sales tax. Local option tax is a way for municipalities in vermont to raise additional revenue. Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. A local option sales tax applies only to sales of items that are subject to the vermont sales tax.

See attached vermont general guidelines on. A local option sales tax applies only to sales of items that are subject to the vermont sales tax. Local option tax is a way for municipalities in vermont to raise additional revenue. A municipality may vote to levy the. A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. Now, the town of woodstock will. More than two dozen cities and towns across vermont have implemented a local 1% sales tax. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax.

A municipality may vote to levy the. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. More than two dozen cities and towns across vermont have implemented a local 1% sales tax. Now, the town of woodstock will. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. A local option sales tax applies only to sales of items that are subject to the vermont sales tax. Local option tax is a way for municipalities in vermont to raise additional revenue. A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. See attached vermont general guidelines on.

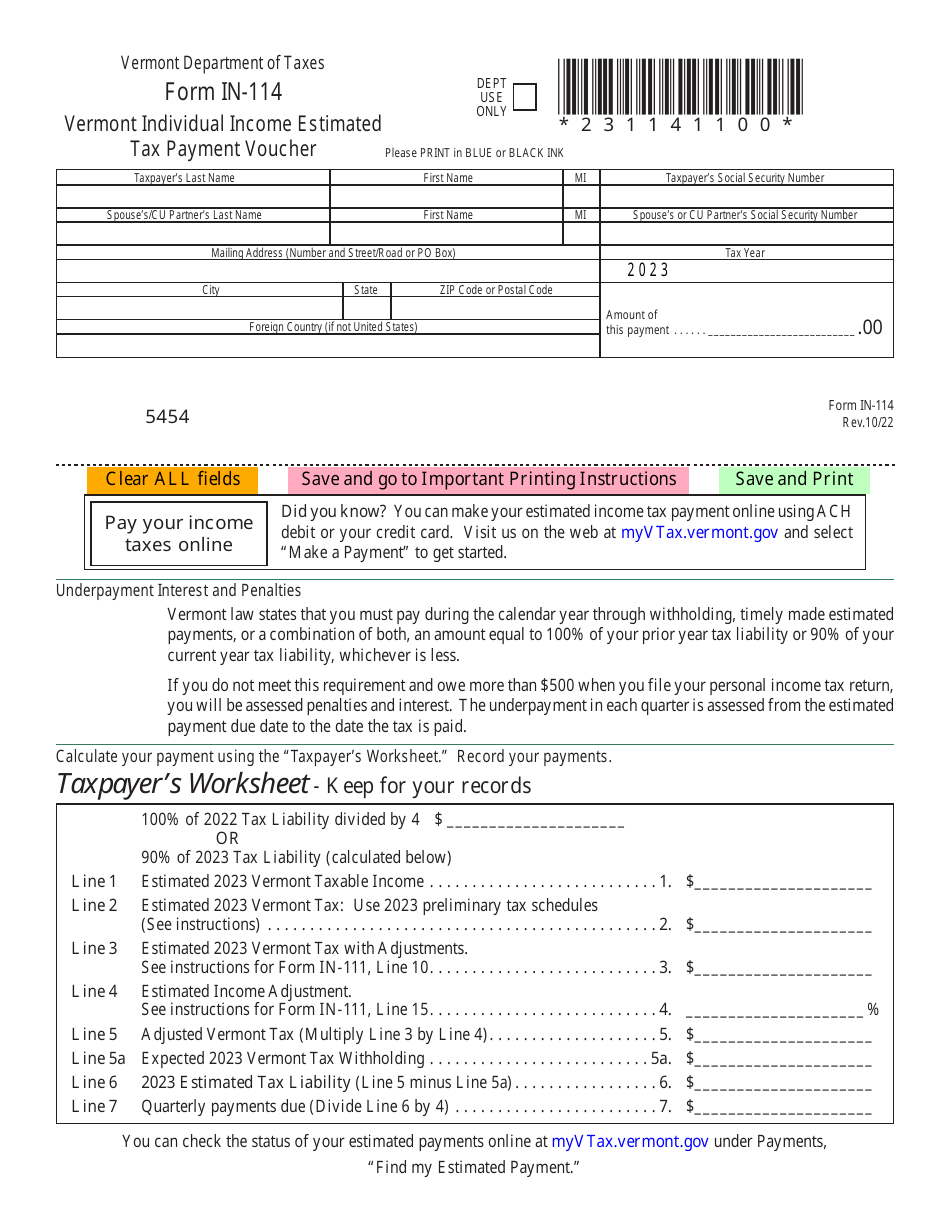

Form IN114 Download Fillable PDF or Fill Online Vermont Individual

A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. A local option sales tax applies only to sales of items that are subject.

Ketchum sees loss in local option tax revenue amid COVID19 pandemic

See attached vermont general guidelines on. A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. Local option tax is.

Vermont Tax Information — Town of Craftsbury

A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. See attached vermont general guidelines on. A municipality may vote to levy the. Local option tax is a way for municipalities in vermont to raise additional revenue. Now, the town of woodstock will.

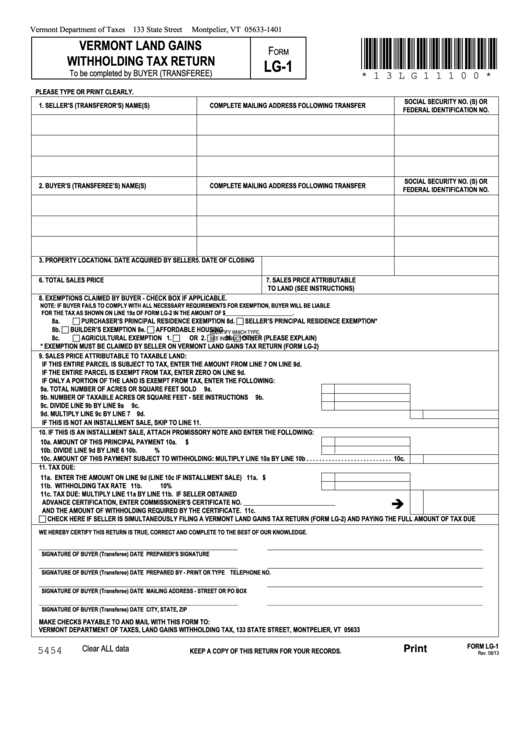

Fillable Form Lg1 Vermont Land Gains Withholding Tax Return

A municipality may vote to levy the. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. Local option tax is a way for municipalities in vermont to raise additional revenue. Use the local option tax finder tool to search for a specific address or town to determine.

Buy Vermont Local

More than two dozen cities and towns across vermont have implemented a local 1% sales tax. See attached vermont general guidelines on. Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. A local option sales tax applies only to sales of items that are subject.

Updated State and Local Option Sales Tax

More than two dozen cities and towns across vermont have implemented a local 1% sales tax. A local option sales tax applies only to sales of items that are subject to the vermont sales tax. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. See attached vermont general.

Barre City Considers Local Option Tax (Again) Vermont Public Radio

A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. A municipality may vote to levy the. A local option sales tax.

Vermont Property Tax Rates Highlights 2024

See attached vermont general guidelines on. More than two dozen cities and towns across vermont have implemented a local 1% sales tax. Local option tax is a way for municipalities in vermont to raise additional revenue. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. A municipality may.

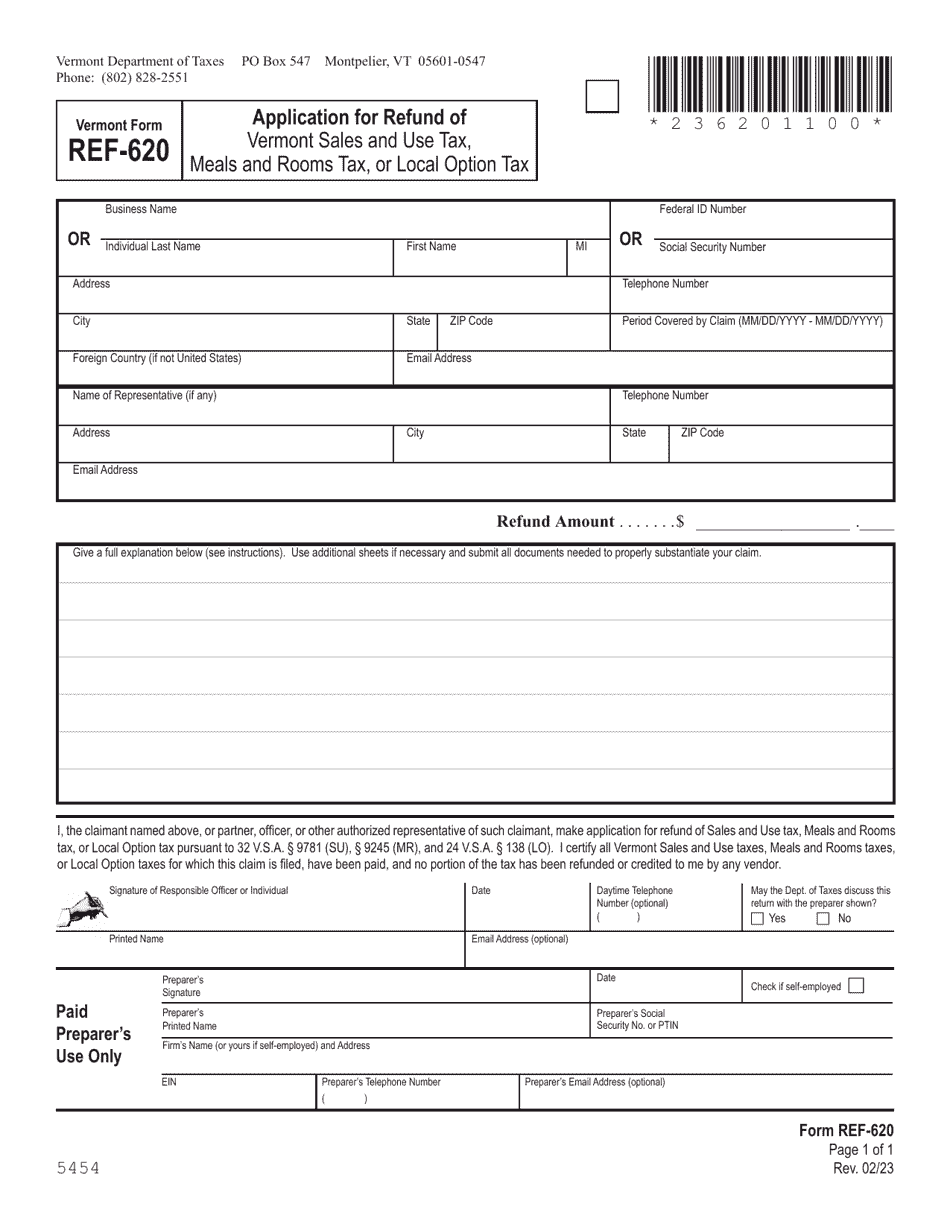

Form REF620 Fill Out, Sign Online and Download Printable PDF

A local option sales tax applies only to sales of items that are subject to the vermont sales tax. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic.

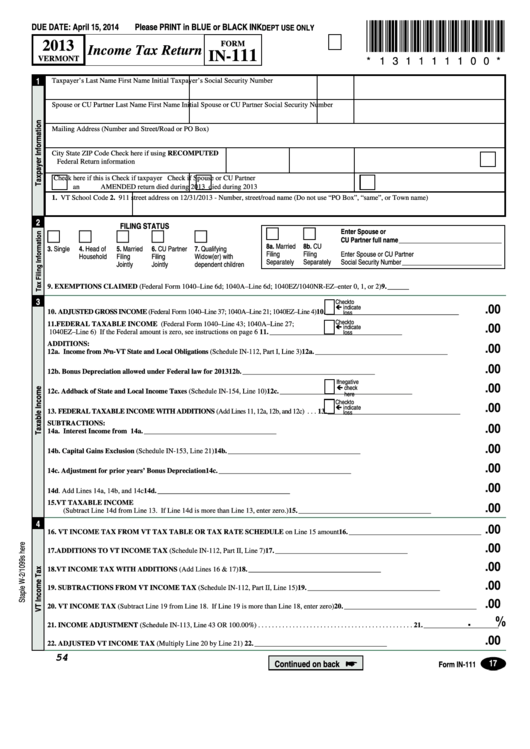

Fillable Form In111 Vermont Tax Return 2013 printable pdf

More than two dozen cities and towns across vermont have implemented a local 1% sales tax. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method. A local option sales tax applies only to sales of items that are subject to the vermont sales tax. A municipality may vote.

Local Option Tax Is A Way For Municipalities In Vermont To Raise Additional Revenue.

A municipality may vote to levy the. A transaction is subject to local option tax if it is subject to the vermont sales, meals, rooms, or alcoholic beverage tax. A local option sales tax applies only to sales of items that are subject to the vermont sales tax. A local option tax is a way for municipalities in vermont to raise revenue by assessing a 1% tax in addition to certain state tax types.

Now, The Town Of Woodstock Will.

Use the local option tax finder tool to search for a specific address or town to determine if a local option tax is levied. See attached vermont general guidelines on. More than two dozen cities and towns across vermont have implemented a local 1% sales tax. Local option taxes (a) local option taxes are authorized under this section for the purpose of affording municipalities an alternative method.