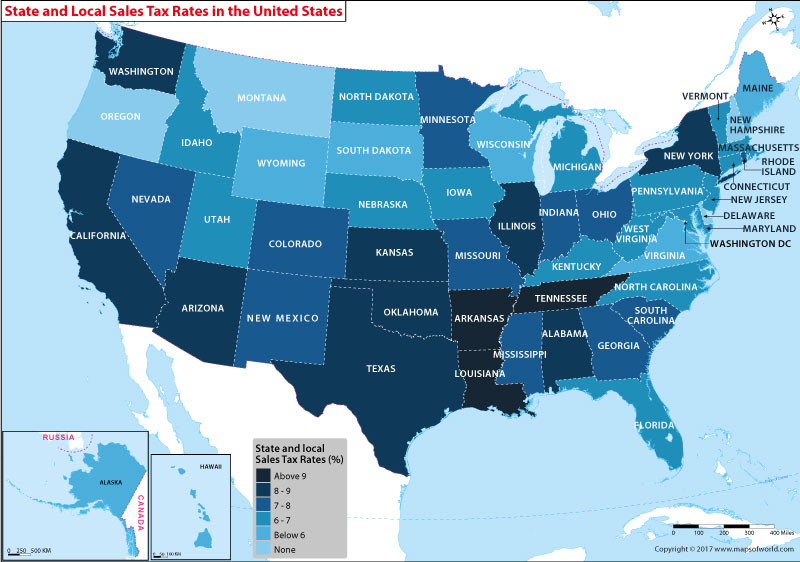

Washington State Local Tax Rates

Washington State Local Tax Rates - This page contains data on city and county populations, assessed valuations, property tax levies, sales tax distributions, and sales tax. Local sales tax rates, components, and distributions. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. You’ll find rates for sales and use tax, motor. Local sales tax rates can vary significantly depending on which local sales tax. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%.

You’ll find rates for sales and use tax, motor. Local sales tax rates, components, and distributions. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. This page contains data on city and county populations, assessed valuations, property tax levies, sales tax distributions, and sales tax. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. Local sales tax rates can vary significantly depending on which local sales tax.

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Local sales tax rates, components, and distributions. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. You’ll find rates for sales and use tax, motor. Local sales tax rates can vary significantly depending on which local sales tax. This page contains data on city and county populations, assessed valuations, property tax levies, sales tax distributions, and sales tax.

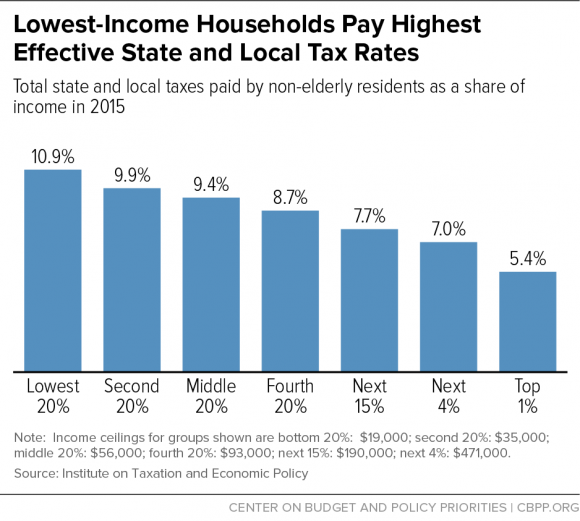

Households Pay Highest Effective State & Local Tax Rates

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a.

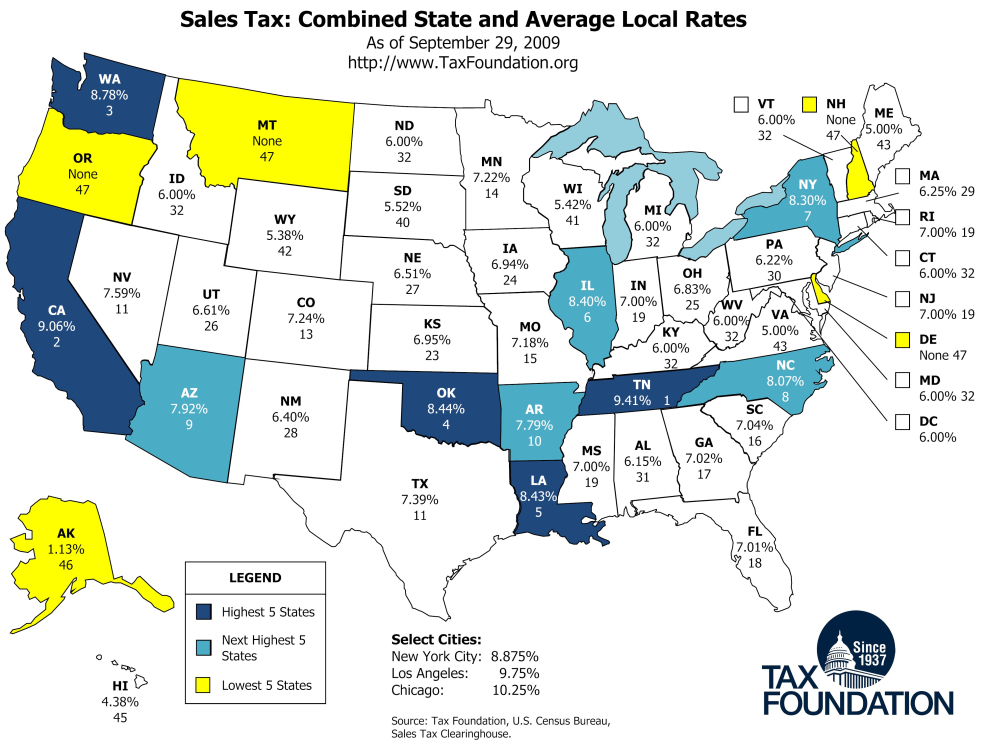

COMBINED STATE AND LOCAL GENERAL SALES TAX RATES Download Table

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales.

Monday Map State and Local Sales Tax Rates, 2011

This page contains data on city and county populations, assessed valuations, property tax levies, sales tax distributions, and sales tax. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. Local sales tax rates can vary significantly depending on which local sales tax. 536 rows washington has state sales.

State and Local Sales Tax Rates, Midyear 2020 Tax Foundation

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Local sales tax rates, components, and distributions. Local sales tax rates can vary significantly depending on which local sales tax. You’ll find rates for sales and use tax, motor. Updates and tax rate liability for technical questions.

Monday Map Combined State and Local Sales Tax Rates

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. You’ll find rates for sales and use tax, motor. Local sales tax rates can vary significantly depending on which local sales tax. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis.

Monday Map Sales Tax Combined State and Average Local Rates

This page contains data on city and county populations, assessed valuations, property tax levies, sales tax distributions, and sales tax. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Local sales tax rates can vary significantly depending on which local sales tax. Local sales tax rates, components, and distributions. Lists of.

State Tax Rates and Brackets, 2021 Tax Foundation

Local sales tax rates, components, and distributions. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Use our tax rate lookup tool to find tax rates and location codes for any location in washington. Local sales tax rates can vary significantly depending on which local sales.

Combined State and Average Local Sales Tax Rates Tax Foundation

536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Local sales tax rates, components, and distributions. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. You’ll find rates for sales and.

CT Effective State & Local Tax Rates Continue To Climb Report

Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team. Local sales tax rates, components, and distributions. Local sales tax rates can vary significantly depending on which local sales tax. This page contains data on city and county populations, assessed valuations, property tax levies, sales tax distributions, and sales.

The State and Local Sales Tax Rates in The US states Our World

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. You’ll find rates for sales and use tax, motor. Local sales tax rates can vary significantly depending on which local sales tax. This page contains data on city and county populations, assessed valuations, property tax levies, sales tax distributions, and sales tax..

Local Sales Tax Rates Can Vary Significantly Depending On Which Local Sales Tax.

Use our tax rate lookup tool to find tax rates and location codes for any location in washington. You’ll find rates for sales and use tax, motor. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Local sales tax rates, components, and distributions.

Lists Of Local Sales & Use Tax Rates And Changes, As Well As Information For Lodging Sales, Motor Vehicles Sales Or Leases, And.

This page contains data on city and county populations, assessed valuations, property tax levies, sales tax distributions, and sales tax. Updates and tax rate liability for technical questions about searching for your address or improving the results, contact the gis team.

.png)

.png)