What Is 15 In Gratuity Calculation Formula

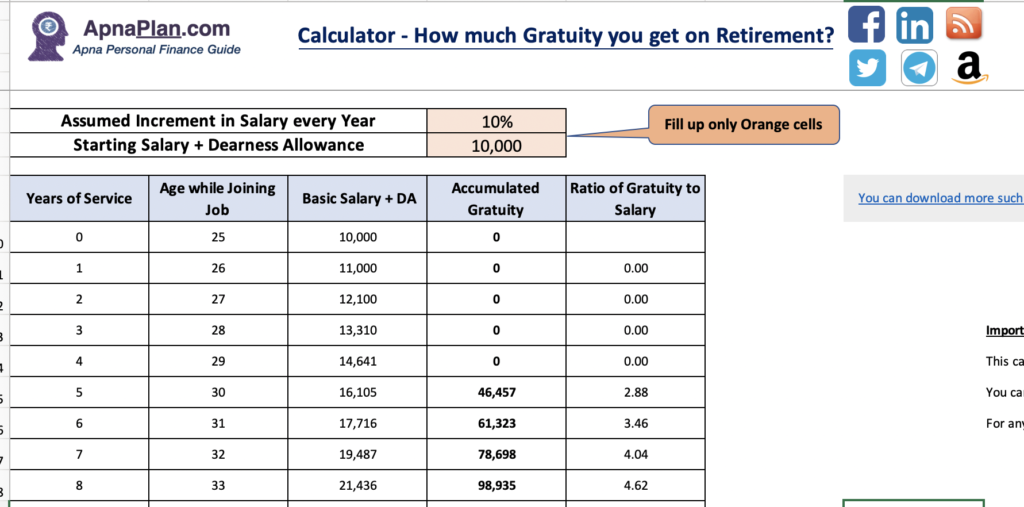

What Is 15 In Gratuity Calculation Formula - G = 2000 * 9 * 15 / 26. The gratuity amount is calculated based on three key factors: The employee's tenure of service, the last drawn. Gratuity = 15 x last drawn salary x the working tenure / 26. In this case, you can calculate gratuity using the following formula: Gratuity = (15 * your last drawn salary * tenure of working) / 26.

G = 2000 * 9 * 15 / 26. In this case, you can calculate gratuity using the following formula: The gratuity amount is calculated based on three key factors: Gratuity = 15 x last drawn salary x the working tenure / 26. Gratuity = (15 * your last drawn salary * tenure of working) / 26. The employee's tenure of service, the last drawn.

Gratuity = (15 * your last drawn salary * tenure of working) / 26. The gratuity amount is calculated based on three key factors: G = 2000 * 9 * 15 / 26. In this case, you can calculate gratuity using the following formula: Gratuity = 15 x last drawn salary x the working tenure / 26. The employee's tenure of service, the last drawn.

Gratuity Meaning, eligibility, calculation formula, taxation

G = 2000 * 9 * 15 / 26. The employee's tenure of service, the last drawn. Gratuity = 15 x last drawn salary x the working tenure / 26. The gratuity amount is calculated based on three key factors: Gratuity = (15 * your last drawn salary * tenure of working) / 26.

What is Gratuity Meaning, Calculation, and Formula

The employee's tenure of service, the last drawn. Gratuity = (15 * your last drawn salary * tenure of working) / 26. Gratuity = 15 x last drawn salary x the working tenure / 26. In this case, you can calculate gratuity using the following formula: G = 2000 * 9 * 15 / 26.

UAE Gratuity Calculation Formula and Eligibility Guide 2024

G = 2000 * 9 * 15 / 26. In this case, you can calculate gratuity using the following formula: The gratuity amount is calculated based on three key factors: Gratuity = 15 x last drawn salary x the working tenure / 26. The employee's tenure of service, the last drawn.

PPT Gratuity Calculation Formula Gratuity Calculation in India

The employee's tenure of service, the last drawn. In this case, you can calculate gratuity using the following formula: The gratuity amount is calculated based on three key factors: Gratuity = 15 x last drawn salary x the working tenure / 26. Gratuity = (15 * your last drawn salary * tenure of working) / 26.

Gratuity Calculator ★ Know The Calculation & Gratuity Formula

Gratuity = (15 * your last drawn salary * tenure of working) / 26. Gratuity = 15 x last drawn salary x the working tenure / 26. G = 2000 * 9 * 15 / 26. In this case, you can calculate gratuity using the following formula: The gratuity amount is calculated based on three key factors:

What is Gratuity Meaning, Eligibility, Gratuity Formula & Calculation

The gratuity amount is calculated based on three key factors: In this case, you can calculate gratuity using the following formula: Gratuity = 15 x last drawn salary x the working tenure / 26. G = 2000 * 9 * 15 / 26. Gratuity = (15 * your last drawn salary * tenure of working) / 26.

Gratuity Calculation And Tax Benefits GoSaveTax

The employee's tenure of service, the last drawn. Gratuity = (15 * your last drawn salary * tenure of working) / 26. In this case, you can calculate gratuity using the following formula: The gratuity amount is calculated based on three key factors: Gratuity = 15 x last drawn salary x the working tenure / 26.

Gratuity Calculation Formula HR IGNITE

Gratuity = (15 * your last drawn salary * tenure of working) / 26. The employee's tenure of service, the last drawn. The gratuity amount is calculated based on three key factors: G = 2000 * 9 * 15 / 26. Gratuity = 15 x last drawn salary x the working tenure / 26.

Gratuity Calculation Formula Step by Step Guide with Example

Gratuity = 15 x last drawn salary x the working tenure / 26. G = 2000 * 9 * 15 / 26. The employee's tenure of service, the last drawn. In this case, you can calculate gratuity using the following formula: The gratuity amount is calculated based on three key factors:

Gratuity Eligibility And Calculation »

The employee's tenure of service, the last drawn. Gratuity = 15 x last drawn salary x the working tenure / 26. The gratuity amount is calculated based on three key factors: G = 2000 * 9 * 15 / 26. In this case, you can calculate gratuity using the following formula:

Gratuity = 15 X Last Drawn Salary X The Working Tenure / 26.

In this case, you can calculate gratuity using the following formula: Gratuity = (15 * your last drawn salary * tenure of working) / 26. The gratuity amount is calculated based on three key factors: G = 2000 * 9 * 15 / 26.