What Is Irs Code 766

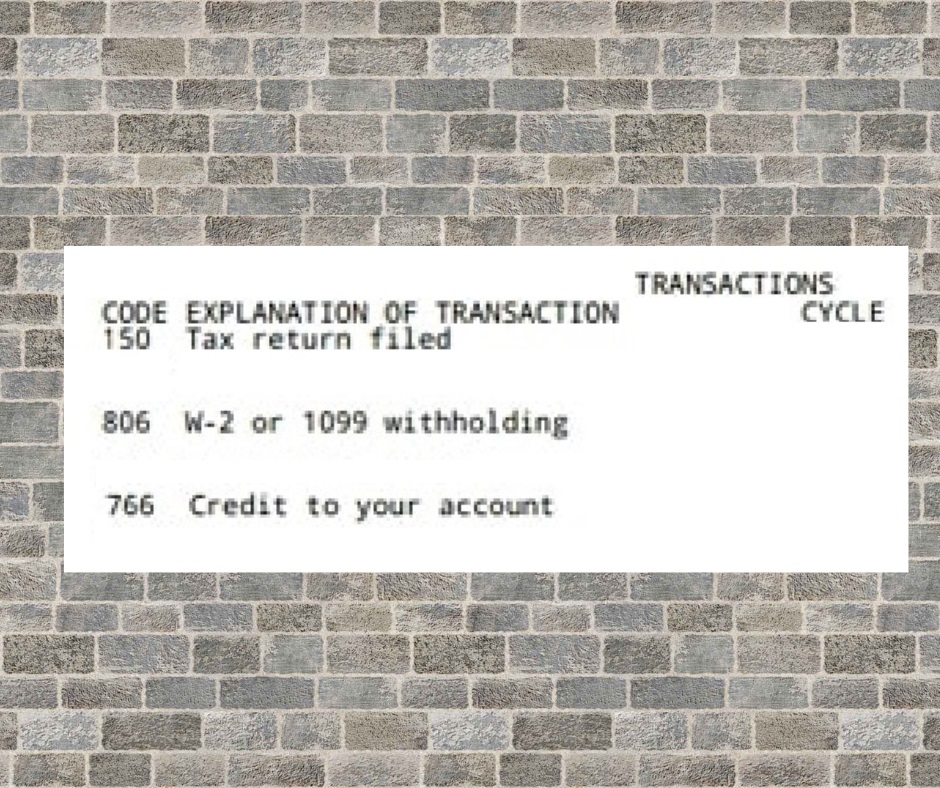

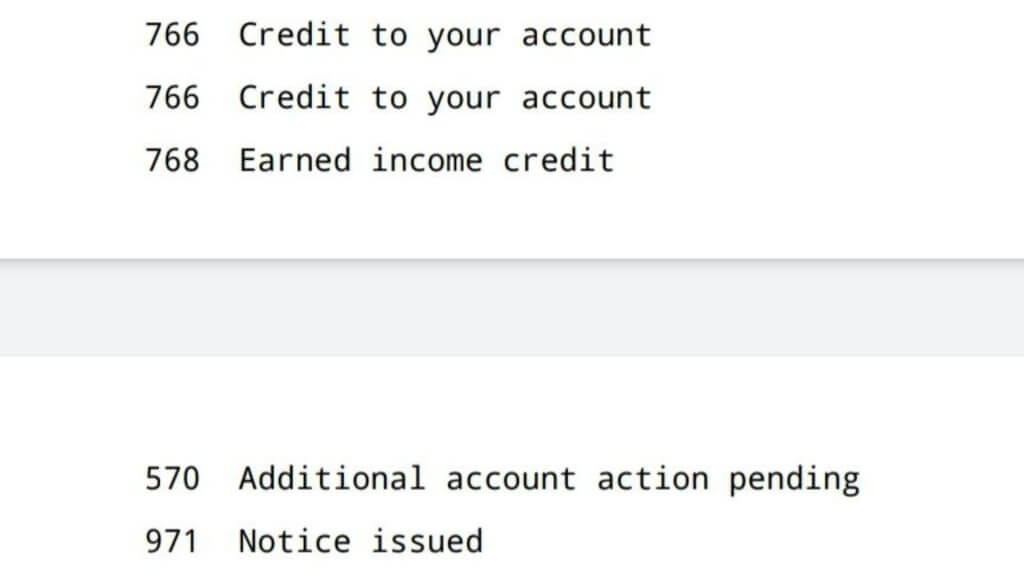

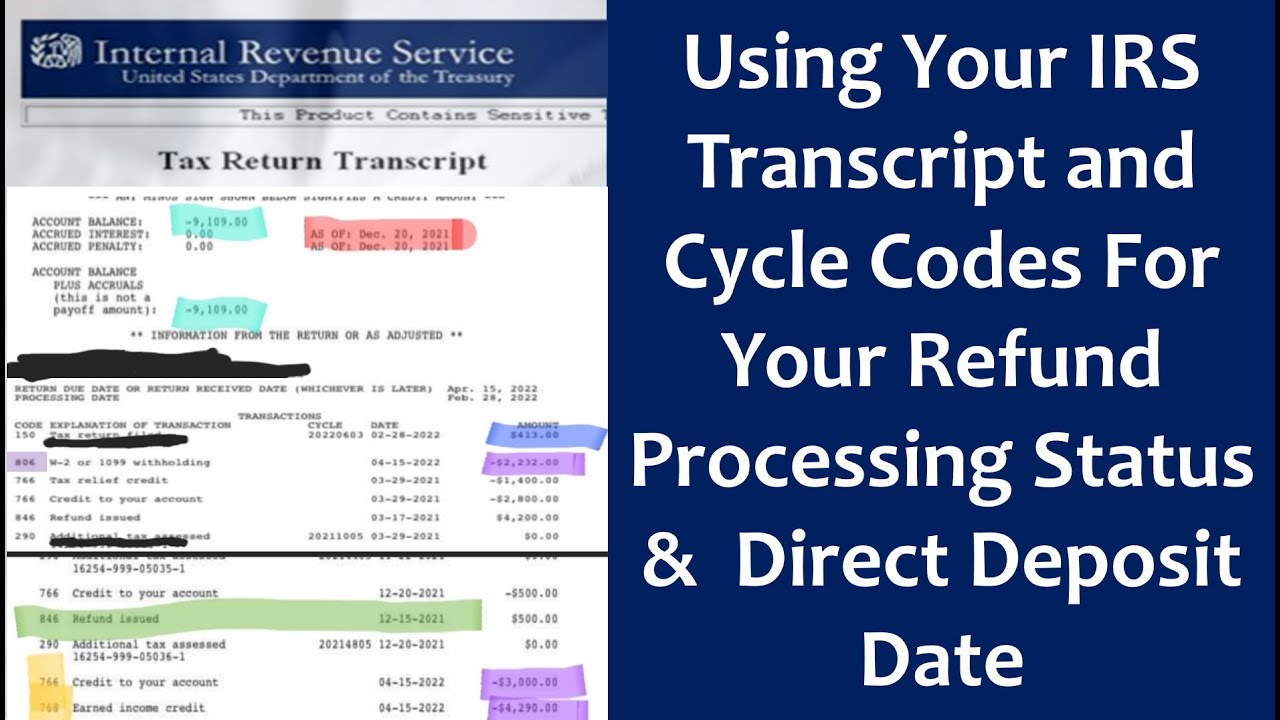

What Is Irs Code 766 - This usually means the irs has applied a refundable credit. What is irs code 766? When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. An irs code 766 on your account means that you have received a credit on your account from the irs. Irs transaction code 766 on your tax transcript signifies a credit to your account.

When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. Irs transaction code 766 on your tax transcript signifies a credit to your account. An irs code 766 on your account means that you have received a credit on your account from the irs. This usually means the irs has applied a refundable credit. What is irs code 766?

When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. What is irs code 766? An irs code 766 on your account means that you have received a credit on your account from the irs. Irs transaction code 766 on your tax transcript signifies a credit to your account. This usually means the irs has applied a refundable credit.

What Is Code 766 on an IRS Transcript?

Irs transaction code 766 on your tax transcript signifies a credit to your account. This usually means the irs has applied a refundable credit. An irs code 766 on your account means that you have received a credit on your account from the irs. What is irs code 766? When an irs code 766 appears on your 2021 or 2022.

What Does Code 766 and 768 Mean on IRS Transcript? Calm CFO

This usually means the irs has applied a refundable credit. When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. Irs transaction code 766 on your tax transcript signifies a credit to your account. What is irs code 766? An irs.

Help! Code 766, 767, 290, 971!! r/IRS

An irs code 766 on your account means that you have received a credit on your account from the irs. What is irs code 766? Irs transaction code 766 on your tax transcript signifies a credit to your account. This usually means the irs has applied a refundable credit. When an irs code 766 appears on your 2021 or 2022.

What does code 766 mean on IRS transcript?

When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. An irs code 766 on your account means that you have received a credit on your account from the irs. What is irs code 766? This usually means the irs has.

The IRS Code 766 What Does it Mean on IRS Transcript?

What is irs code 766? This usually means the irs has applied a refundable credit. Irs transaction code 766 on your tax transcript signifies a credit to your account. When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. An irs.

IRS Transcript Code 766 Understanding the Credit to Your Account ⋆

Irs transaction code 766 on your tax transcript signifies a credit to your account. An irs code 766 on your account means that you have received a credit on your account from the irs. This usually means the irs has applied a refundable credit. What is irs code 766? When an irs code 766 appears on your 2021 or 2022.

IRS Code 766 All You Need to Know in 2024 + FAQs

When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. What is irs code 766? An irs code 766 on your account means that you have received a credit on your account from the irs. This usually means the irs has.

IRS Code 766

An irs code 766 on your account means that you have received a credit on your account from the irs. This usually means the irs has applied a refundable credit. What is irs code 766? Irs transaction code 766 on your tax transcript signifies a credit to your account. When an irs code 766 appears on your 2021 or 2022.

What does IRS Code 766 credit to your account mean? Leia aqui What

When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. This usually means the irs has applied a refundable credit. An irs code 766 on your account means that you have received a credit on your account from the irs. What.

What Does IRS Code 766 Mean?

Irs transaction code 766 on your tax transcript signifies a credit to your account. When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. An irs code 766 on your account means that you have received a credit on your account.

This Usually Means The Irs Has Applied A Refundable Credit.

Irs transaction code 766 on your tax transcript signifies a credit to your account. What is irs code 766? When an irs code 766 appears on your 2021 or 2022 tax transcript, that means there is a tax credit on your account from the irs, which is good. An irs code 766 on your account means that you have received a credit on your account from the irs.