What Is The Expected Return On Andre S Stock Portfolio

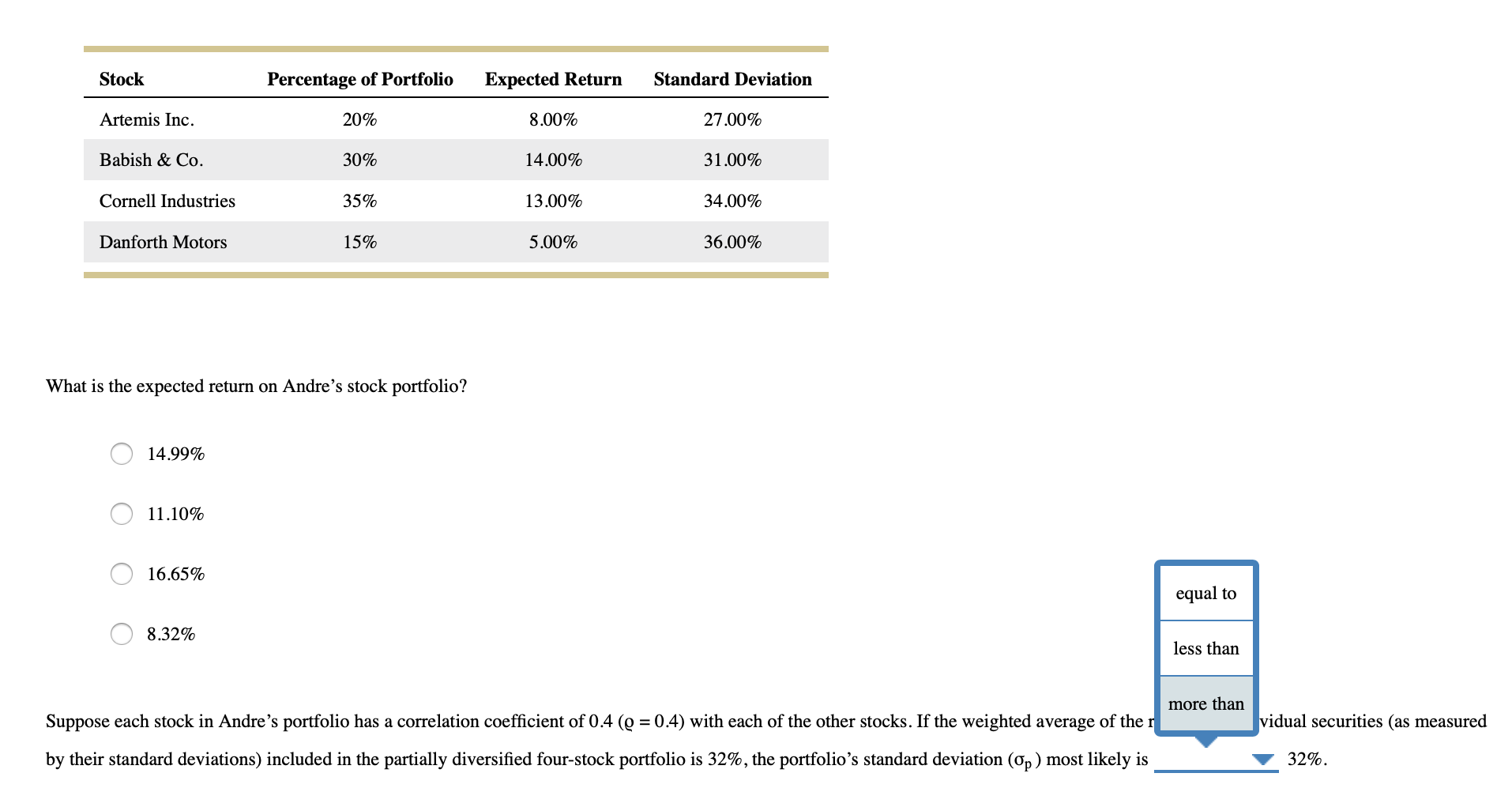

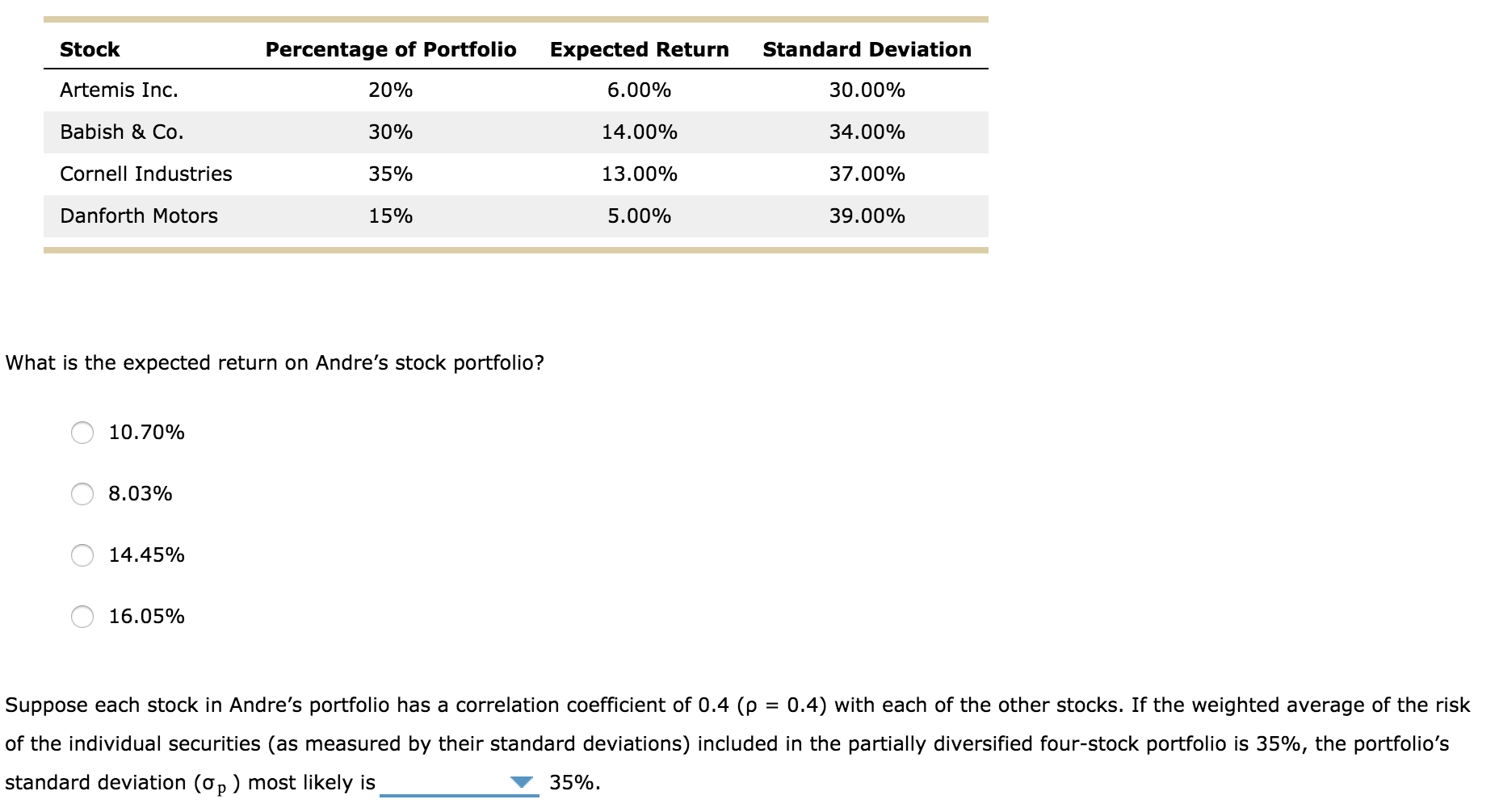

What Is The Expected Return On Andre S Stock Portfolio - The expected return of a portfolio is the weighted average of the expected returns of each component stock. Suppose each stock in andre’s portfolio has a correlation coefficient of 0.4 (ρ = 0.4) with. Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified. What is the expected return on andre’s stock portfolio? Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio.

If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified. Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. What is the expected return on andre’s stock portfolio? The expected return of a portfolio is the weighted average of the expected returns of each component stock. Suppose each stock in andre’s portfolio has a correlation coefficient of 0.4 (ρ = 0.4) with.

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. The expected return of a portfolio is the weighted average of the expected returns of each component stock. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified. Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. Suppose each stock in andre’s portfolio has a correlation coefficient of 0.4 (ρ = 0.4) with. What is the expected return on andre’s stock portfolio?

Portfolio Expected Return Meaning, Formula, Example, & Limitations

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified. What is the expected return on andre’s stock portfolio? The.

Solved What is the expected return of Andre's stock

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. The expected return of a portfolio is the weighted average of the expected returns of each component stock. Suppose each stock in andre’s portfolio has a correlation coefficient of 0.4 (ρ = 0.4) with. If the weighted average of the risk of the individual securities (as.

Expected Return of Portfolio Formula Quant RL

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified. Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. What is the expected return on andre’s stock portfolio? Suppose.

Expected Return (ER) of a Portfolio Calculation Finance Strategists

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified. The expected return of a portfolio is the weighted average of the expected returns of each component stock. Analyzing portfolio risk and return involves.

10+ Portfolio Expected Return Calculator SophinaMayble

The expected return of a portfolio is the weighted average of the expected returns of each component stock. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified. What is the expected return on andre’s stock portfolio? Analyzing portfolio risk and return involves the understanding of expected returns.

Solved Stock Percentage of Portfolio Expected Return

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. The expected return of a portfolio is the weighted average of the expected returns of each component stock. Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. What is the expected return on andre’s stock portfolio? Suppose each stock in andre’s.

Portfolio Expected Return Formula KaydenaxChen

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. The expected return of a portfolio is the weighted average of the expected returns of each component stock. If the weighted average of the risk of the individual securities (as measured by.

Solved Portfolio Expected Return You have 10,000 to invest

What is the expected return on andre’s stock portfolio? Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified. Suppose each stock in andre’s portfolio has a correlation coefficient of 0.4 (ρ = 0.4).

Portfolio Expected Return Formula HayleyminBowen

Suppose each stock in andre’s portfolio has a correlation coefficient of 0.4 (ρ = 0.4) with. Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified. What is the expected return on andre’s stock.

Solved Stock Percentage of Portfolio Expected Return

Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified. Suppose each stock in andre’s portfolio has a correlation coefficient of 0.4 (ρ = 0.4) with. Analyzing portfolio risk and return involves the understanding.

If The Weighted Average Of The Risk Of The Individual Securities (As Measured By Their Standard Deviations) Included In The Partially Diversified.

What is the expected return on andre’s stock portfolio? Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. Suppose each stock in andre’s portfolio has a correlation coefficient of 0.4 (ρ = 0.4) with.

/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)