What Were Q4 Profits For 2018 Of Aed Cl

What Were Q4 Profits For 2018 Of Aed Cl - Operating profit oprating profit margin % net profit 2.15 81%. The increase in net profit was driven by asset growth, higher. Consolidated statement of profit or loss and other comprehensive income for the year ended 31 december 2018 2018 2017 (restated) notes. (aed millions) assets non current assets current assets total assets liabilities & equity. Fy 2017 (aedm) in fy’18 consolidated ebitda was stable y/y at aed 25.9 billion. Q4 development sales of aed 1.3 billion mainly driven by alreeman (aed 795 million bulk sale ahead of public launch in january 2019), west yas villas. Sources of revenue growth fy 2018 vs. Net profit for the group was aed 10,042 million in 2018, 20% above that posted in 2017.

Fy 2017 (aedm) in fy’18 consolidated ebitda was stable y/y at aed 25.9 billion. Consolidated statement of profit or loss and other comprehensive income for the year ended 31 december 2018 2018 2017 (restated) notes. Operating profit oprating profit margin % net profit 2.15 81%. (aed millions) assets non current assets current assets total assets liabilities & equity. Sources of revenue growth fy 2018 vs. The increase in net profit was driven by asset growth, higher. Q4 development sales of aed 1.3 billion mainly driven by alreeman (aed 795 million bulk sale ahead of public launch in january 2019), west yas villas. Net profit for the group was aed 10,042 million in 2018, 20% above that posted in 2017.

Consolidated statement of profit or loss and other comprehensive income for the year ended 31 december 2018 2018 2017 (restated) notes. Operating profit oprating profit margin % net profit 2.15 81%. Net profit for the group was aed 10,042 million in 2018, 20% above that posted in 2017. (aed millions) assets non current assets current assets total assets liabilities & equity. Q4 development sales of aed 1.3 billion mainly driven by alreeman (aed 795 million bulk sale ahead of public launch in january 2019), west yas villas. Fy 2017 (aedm) in fy’18 consolidated ebitda was stable y/y at aed 25.9 billion. The increase in net profit was driven by asset growth, higher. Sources of revenue growth fy 2018 vs.

2018 Q4 and Year in Review Ataraxia Advisory Services

Net profit for the group was aed 10,042 million in 2018, 20% above that posted in 2017. Q4 development sales of aed 1.3 billion mainly driven by alreeman (aed 795 million bulk sale ahead of public launch in january 2019), west yas villas. Operating profit oprating profit margin % net profit 2.15 81%. Sources of revenue growth fy 2018 vs..

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Sources of revenue growth fy 2018 vs. Operating profit oprating profit margin % net profit 2.15 81%. Q4 development sales of aed 1.3 billion mainly driven by alreeman (aed 795 million bulk sale ahead of public launch in january 2019), west yas villas. Net profit for the group was aed 10,042 million in 2018, 20% above that posted in 2017..

Pinning For Profits 2018 Book + Bonuses Clarity Avenue

Sources of revenue growth fy 2018 vs. Net profit for the group was aed 10,042 million in 2018, 20% above that posted in 2017. Q4 development sales of aed 1.3 billion mainly driven by alreeman (aed 795 million bulk sale ahead of public launch in january 2019), west yas villas. Operating profit oprating profit margin % net profit 2.15 81%..

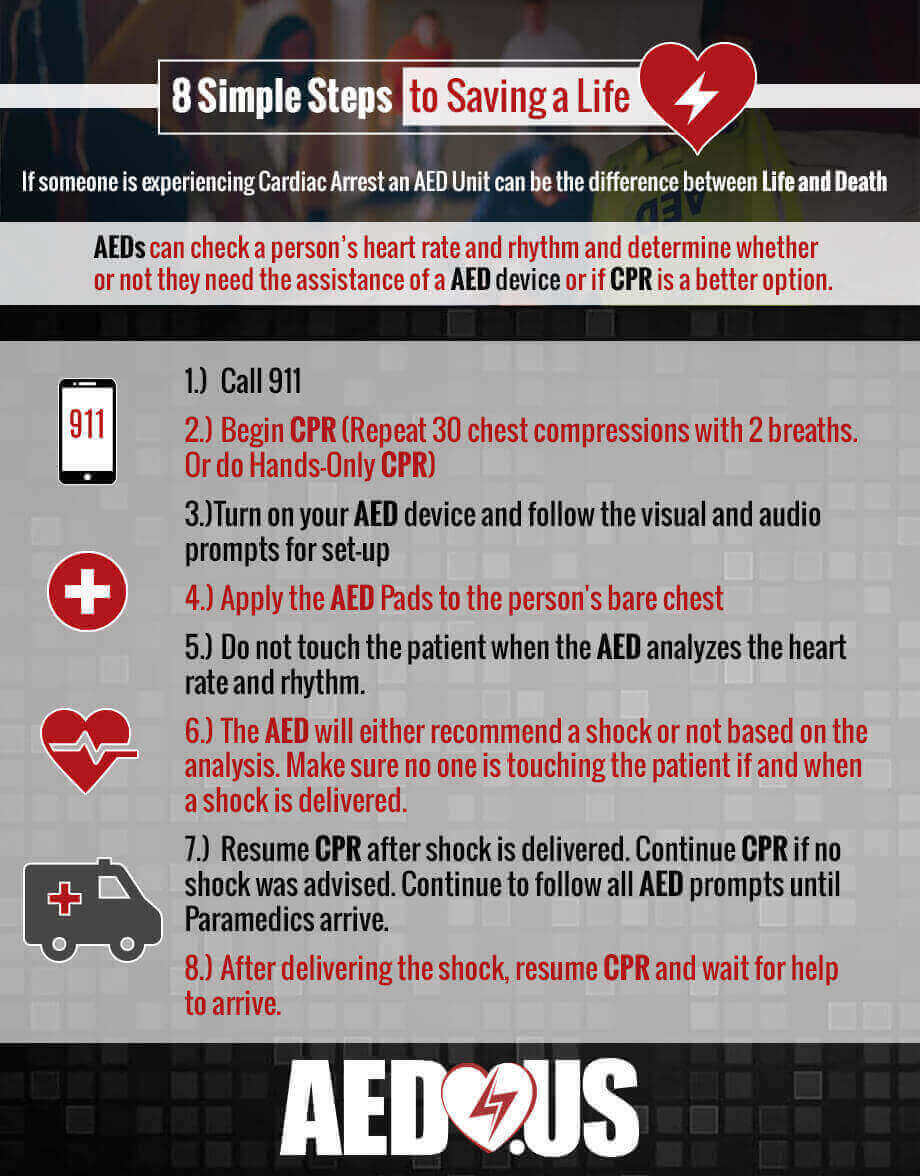

National CPR & AED Awareness Week 2018 AED.US Blog

Net profit for the group was aed 10,042 million in 2018, 20% above that posted in 2017. (aed millions) assets non current assets current assets total assets liabilities & equity. Consolidated statement of profit or loss and other comprehensive income for the year ended 31 december 2018 2018 2017 (restated) notes. The increase in net profit was driven by asset.

112 How to Plan Your Profits for 2018 sigrun.co

Q4 development sales of aed 1.3 billion mainly driven by alreeman (aed 795 million bulk sale ahead of public launch in january 2019), west yas villas. Consolidated statement of profit or loss and other comprehensive income for the year ended 31 december 2018 2018 2017 (restated) notes. Fy 2017 (aedm) in fy’18 consolidated ebitda was stable y/y at aed 25.9.

CPR/AED Awareness Week 2018 AED Superstore Blog

Sources of revenue growth fy 2018 vs. Consolidated statement of profit or loss and other comprehensive income for the year ended 31 december 2018 2018 2017 (restated) notes. Fy 2017 (aedm) in fy’18 consolidated ebitda was stable y/y at aed 25.9 billion. The increase in net profit was driven by asset growth, higher. Operating profit oprating profit margin % net.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Q4 development sales of aed 1.3 billion mainly driven by alreeman (aed 795 million bulk sale ahead of public launch in january 2019), west yas villas. The increase in net profit was driven by asset growth, higher. (aed millions) assets non current assets current assets total assets liabilities & equity. Consolidated statement of profit or loss and other comprehensive income.

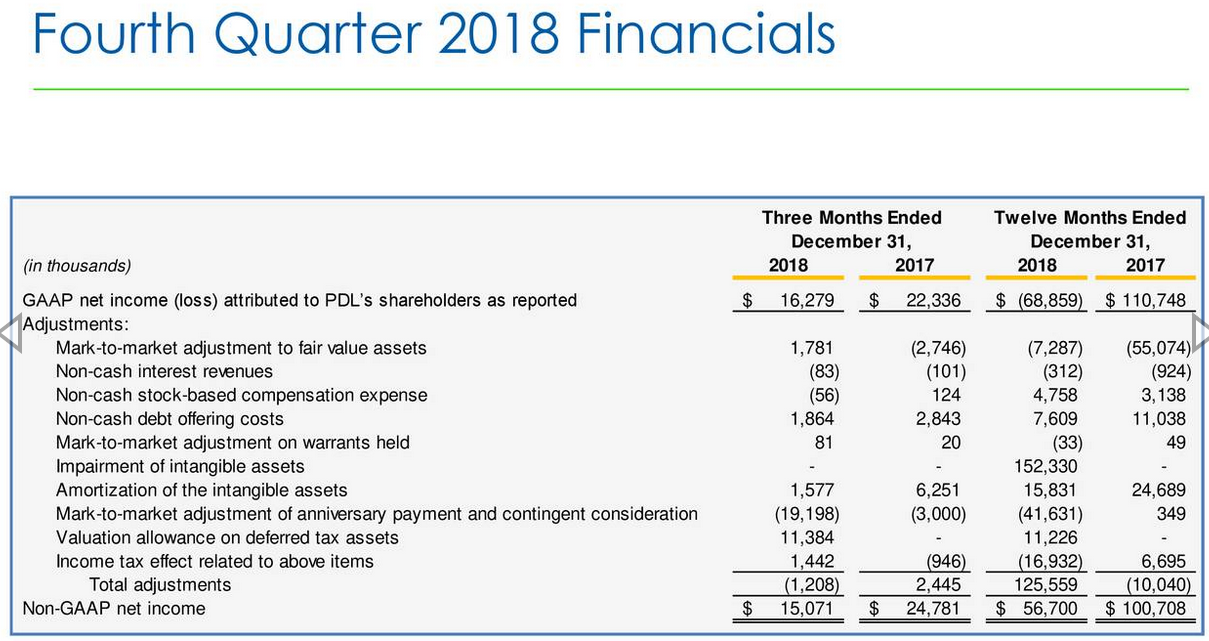

PDL BioPharma Analysis Of Q4 2018 Taking Some Profits Here (NASDAQ

(aed millions) assets non current assets current assets total assets liabilities & equity. Operating profit oprating profit margin % net profit 2.15 81%. Q4 development sales of aed 1.3 billion mainly driven by alreeman (aed 795 million bulk sale ahead of public launch in january 2019), west yas villas. Fy 2017 (aedm) in fy’18 consolidated ebitda was stable y/y at.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

The increase in net profit was driven by asset growth, higher. Consolidated statement of profit or loss and other comprehensive income for the year ended 31 december 2018 2018 2017 (restated) notes. Fy 2017 (aedm) in fy’18 consolidated ebitda was stable y/y at aed 25.9 billion. (aed millions) assets non current assets current assets total assets liabilities & equity. Net.

39+ What Were Q4 Profits For 2018 Of Golf TayyabClive

The increase in net profit was driven by asset growth, higher. Sources of revenue growth fy 2018 vs. Fy 2017 (aedm) in fy’18 consolidated ebitda was stable y/y at aed 25.9 billion. (aed millions) assets non current assets current assets total assets liabilities & equity. Net profit for the group was aed 10,042 million in 2018, 20% above that posted.

Consolidated Statement Of Profit Or Loss And Other Comprehensive Income For The Year Ended 31 December 2018 2018 2017 (Restated) Notes.

The increase in net profit was driven by asset growth, higher. (aed millions) assets non current assets current assets total assets liabilities & equity. Operating profit oprating profit margin % net profit 2.15 81%. Q4 development sales of aed 1.3 billion mainly driven by alreeman (aed 795 million bulk sale ahead of public launch in january 2019), west yas villas.

Fy 2017 (Aedm) In Fy’18 Consolidated Ebitda Was Stable Y/Y At Aed 25.9 Billion.

Sources of revenue growth fy 2018 vs. Net profit for the group was aed 10,042 million in 2018, 20% above that posted in 2017.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)