Where To Report Inheritance On 1040

Where To Report Inheritance On 1040 - When a taxpayer receives a. The irs also receives a copy. Use schedule d on form 1040 to calculate the amount of your capital gain for your federal income tax return. Report the sale on schedule d (form 1040) and on form 8949, as described above. Do you get a 1099 for inheritance? Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. Part i of the form is.

Report the sale on schedule d (form 1040) and on form 8949, as described above. Use schedule d on form 1040 to calculate the amount of your capital gain for your federal income tax return. The irs also receives a copy. Do you get a 1099 for inheritance? Part i of the form is. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. When a taxpayer receives a. Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets:

Do you get a 1099 for inheritance? Use schedule d on form 1040 to calculate the amount of your capital gain for your federal income tax return. Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: The irs also receives a copy. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. When a taxpayer receives a. Report the sale on schedule d (form 1040) and on form 8949, as described above. Part i of the form is.

Free 1040 eic worksheet, Download Free 1040 eic worksheet png images

The irs also receives a copy. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. When a taxpayer receives a. Part i of the form is. Do you get a 1099 for inheritance?

1040 Impact Human Trafficking Rescue

Part i of the form is. Do you get a 1099 for inheritance? The irs also receives a copy. Use schedule d on form 1040 to calculate the amount of your capital gain for your federal income tax return. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return.

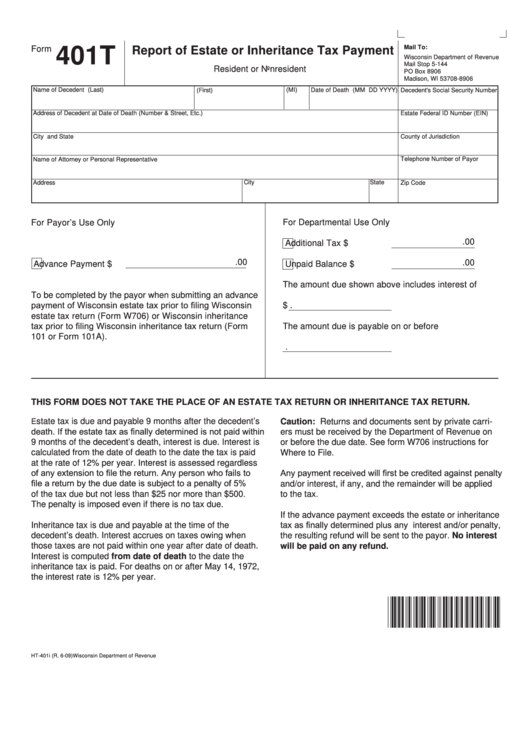

Inheritance Tax Estate Report Form

Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: Do you get a 1099 for inheritance? Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. The irs also receives a copy. Use schedule d on.

Form 1040 U.

The irs also receives a copy. When a taxpayer receives a. Do you get a 1099 for inheritance? Report the sale on schedule d (form 1040) and on form 8949, as described above. Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets:

Can I Sell My Inheritance? Inheritance Funding

Part i of the form is. The irs also receives a copy. Report the sale on schedule d (form 1040) and on form 8949, as described above. When a taxpayer receives a. Use schedule d on form 1040 to calculate the amount of your capital gain for your federal income tax return.

IRSFormular 1040 ausfüllen Infos zum IRSFormular 1040ES

Do you get a 1099 for inheritance? When a taxpayer receives a. Use schedule d on form 1040 to calculate the amount of your capital gain for your federal income tax return. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. Part i of the form is.

104012OC04 Form 1040 Official U.S. Individual Tax Return

Use schedule d on form 1040 to calculate the amount of your capital gain for your federal income tax return. Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: Do you get a 1099 for inheritance? When a taxpayer receives a. Generally, inherited property (including cash,.

Form 1040 AOTM

When a taxpayer receives a. Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: The irs also receives a copy. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. Report the sale on schedule d.

Create any 1040 Form Online Instantly ThePayStubs Worksheets Library

When a taxpayer receives a. Report the sale on schedule d (form 1040) and on form 8949, as described above. Do you get a 1099 for inheritance? Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return. Report the sale on schedule d (form 1040), capital gains and losses and.

A1O04 Form 1040 Schedule A Itemized Deductions

Do you get a 1099 for inheritance? Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: Report the sale on schedule d (form 1040) and on form 8949, as described above. Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on.

When A Taxpayer Receives A.

Do you get a 1099 for inheritance? Part i of the form is. The irs also receives a copy. Report the sale on schedule d (form 1040) and on form 8949, as described above.

Use Schedule D On Form 1040 To Calculate The Amount Of Your Capital Gain For Your Federal Income Tax Return.

Report the sale on schedule d (form 1040), capital gains and losses and on form 8949, sales and other dispositions of capital assets: Generally, inherited property (including cash, stocks, and real estate) is not taxable or reportable on a personal 1040 federal return.